What Customer’s Pain Does the Platform Solve?

About customer

The client, a well-funded startup with over 150 employees, is in a robust financial position with strong profitability.

He needed to urgently recruit a team of five senior engineers, indicating a significant expansion or a critical project in need of immediate expert attention.

So Spdload began to realize this task.

Now Let’s Take a Closer Look at the Key Deliveries

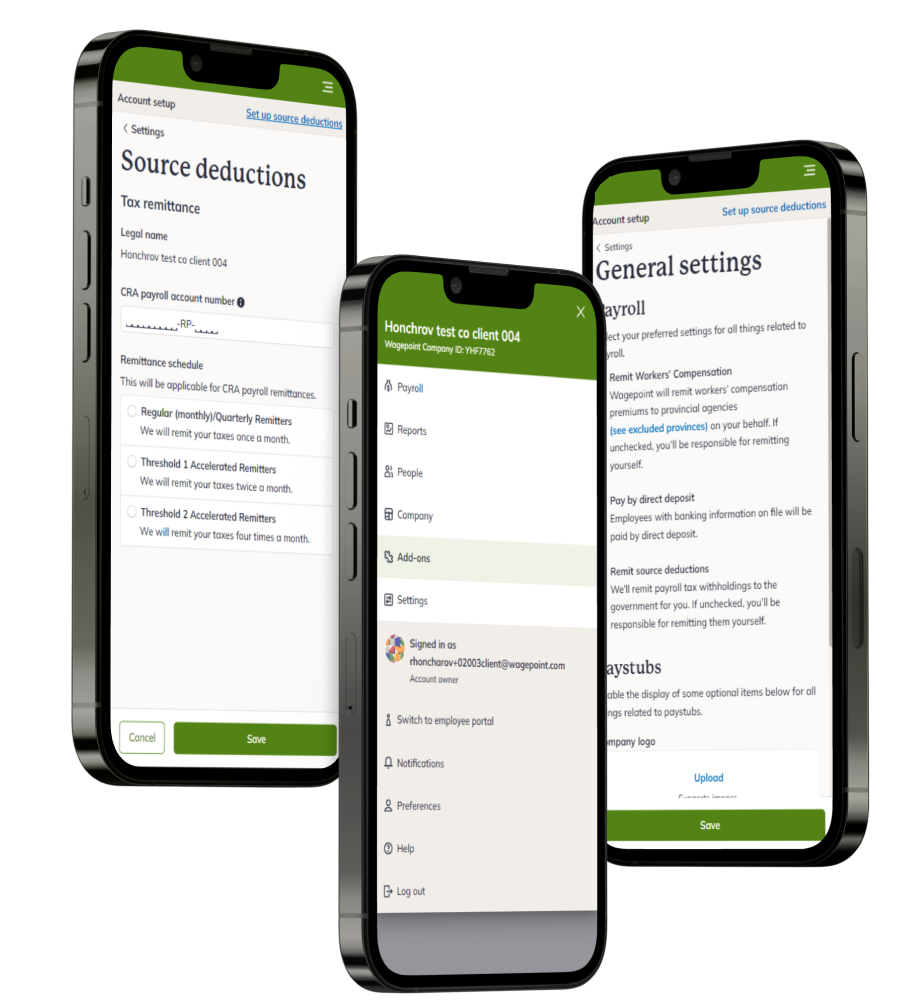

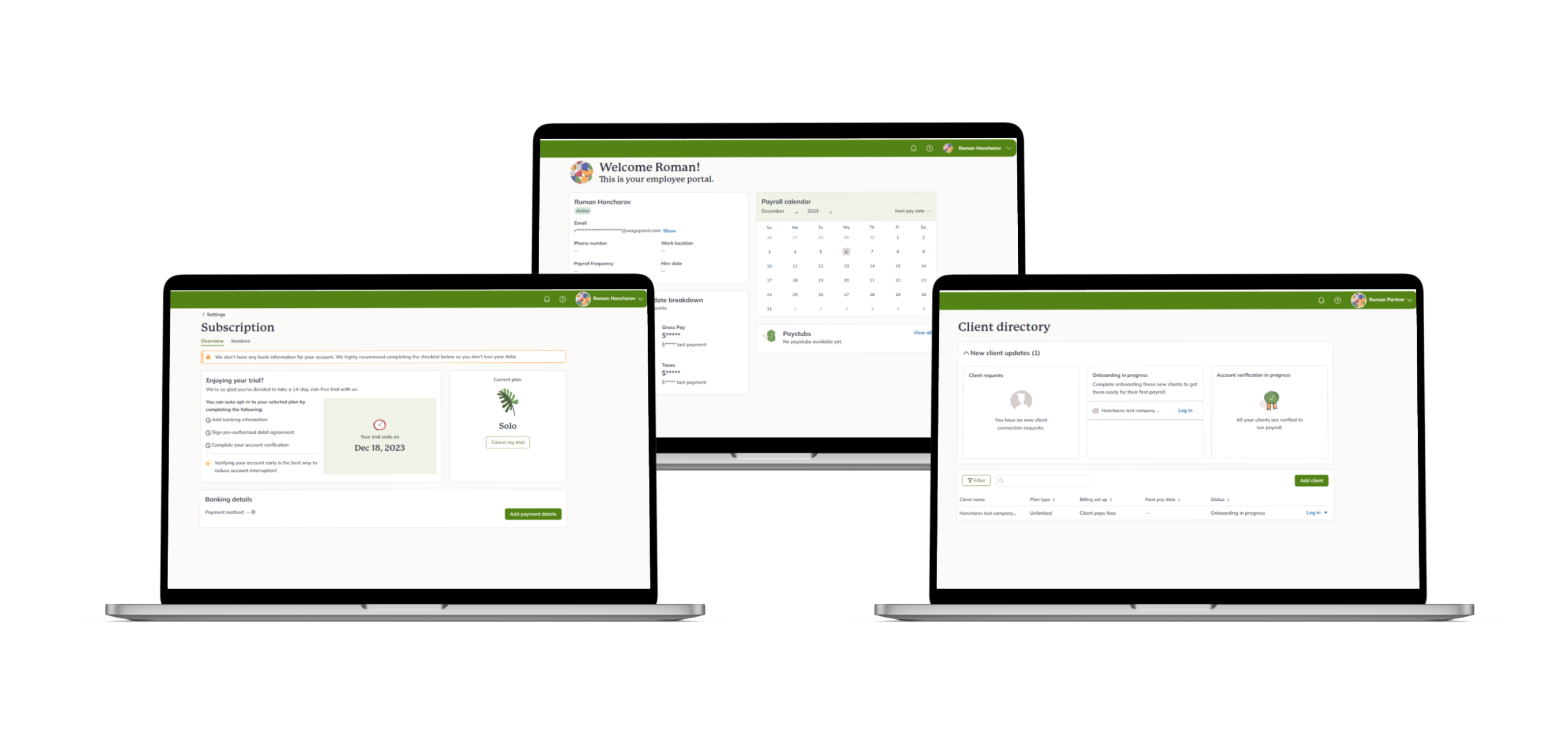

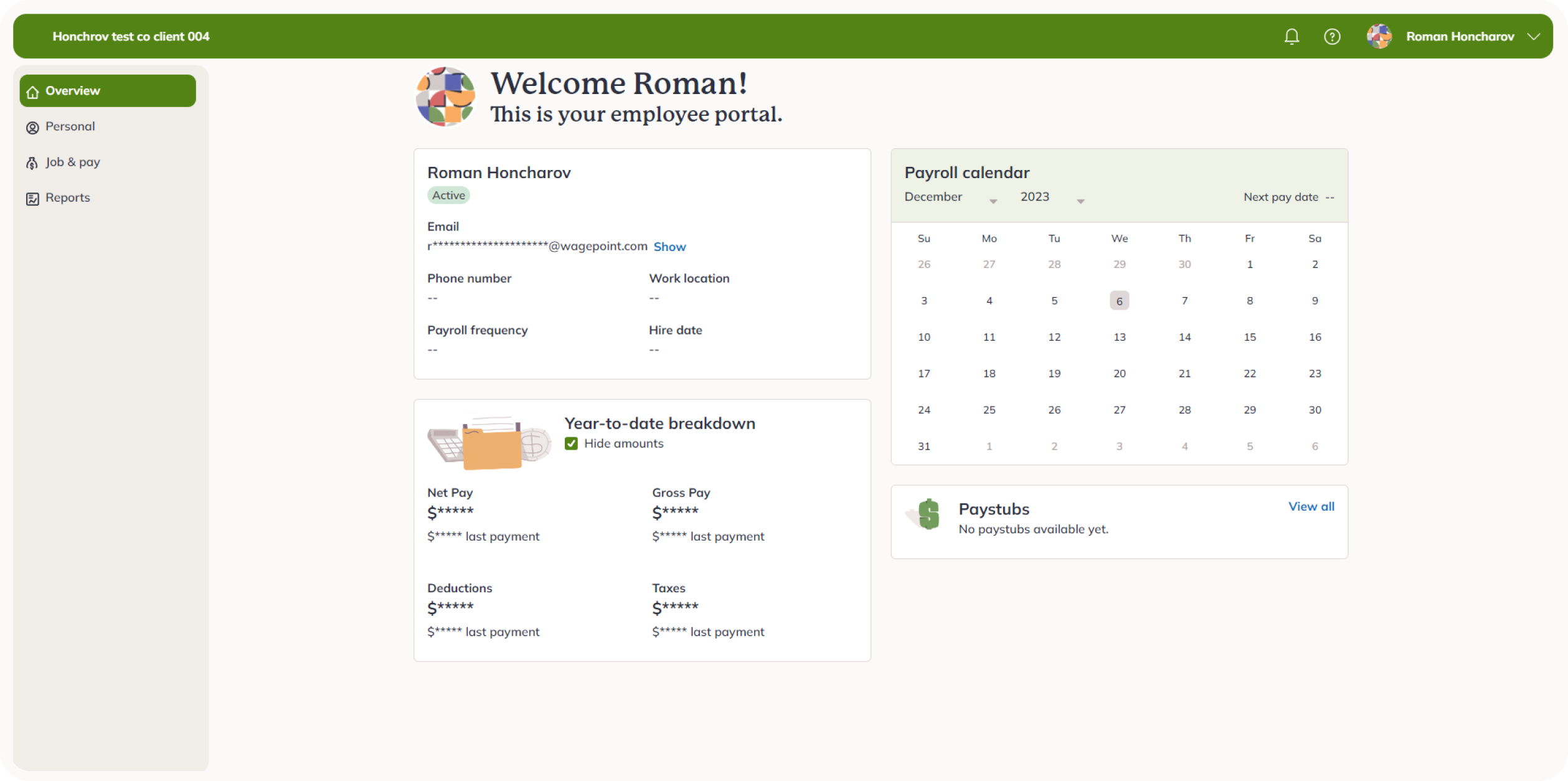

There are two main roles in the app: employee and business owner.

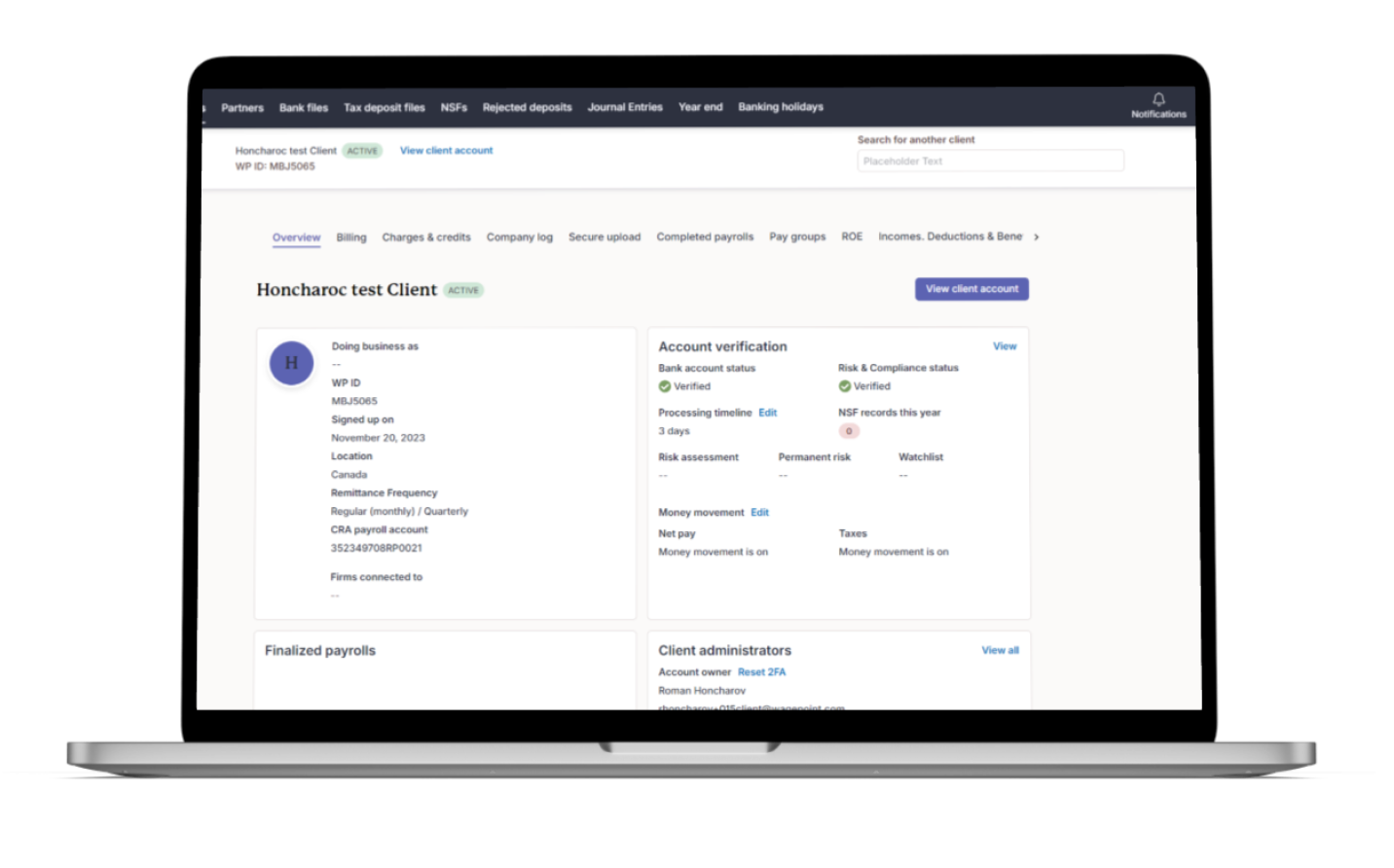

As a business owner, a client can add team members, and manage and control payroll and tax processes for their company and individual team members.

As an employee, the client can control all their own payroll and tax processes.

3. Tax Compliance

The platform automatically calculates federal, state, and local taxes, ensuring compliance with tax laws.

4 Direct Deposit and Pay Stubs

Employees are paid through direct deposit, and electronic pay stubs are generated, which they can access through an online portal.

5. Reporting

Platform provides a variety of payroll reports for employers, such as payroll summaries and tax reports, which can be used for accounting and compliance purposes.

What Technologies Did We Use?

Summary

We engaged 5 seniors who helped us implement several key features in the overall functionality of the system. We are currently working on improving and further developing the product.

Our team worked diligently to integrate advanced tax deduction algorithms and real-time pay stub generation functionalities, significantly streamlining the payroll management process.