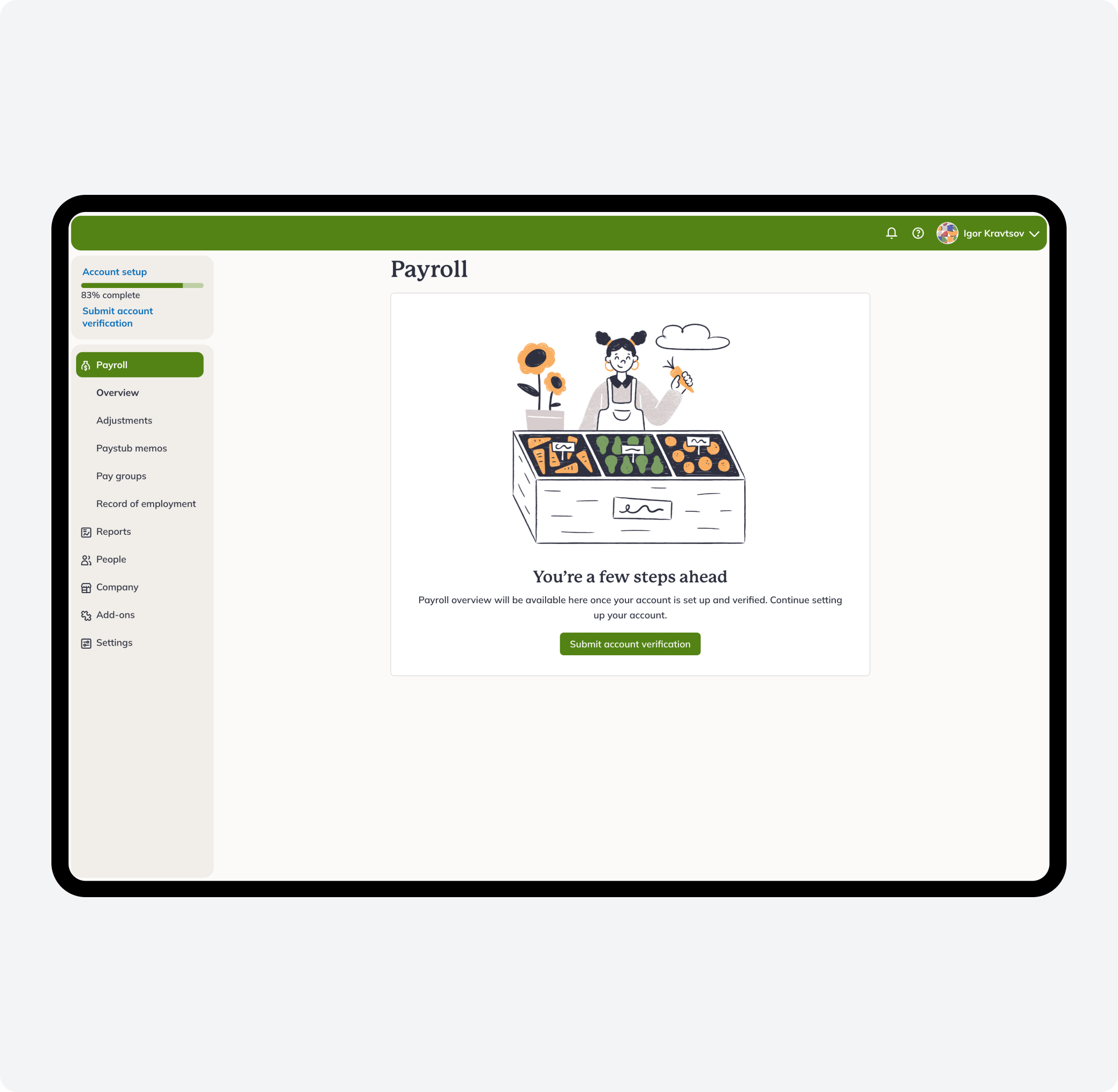

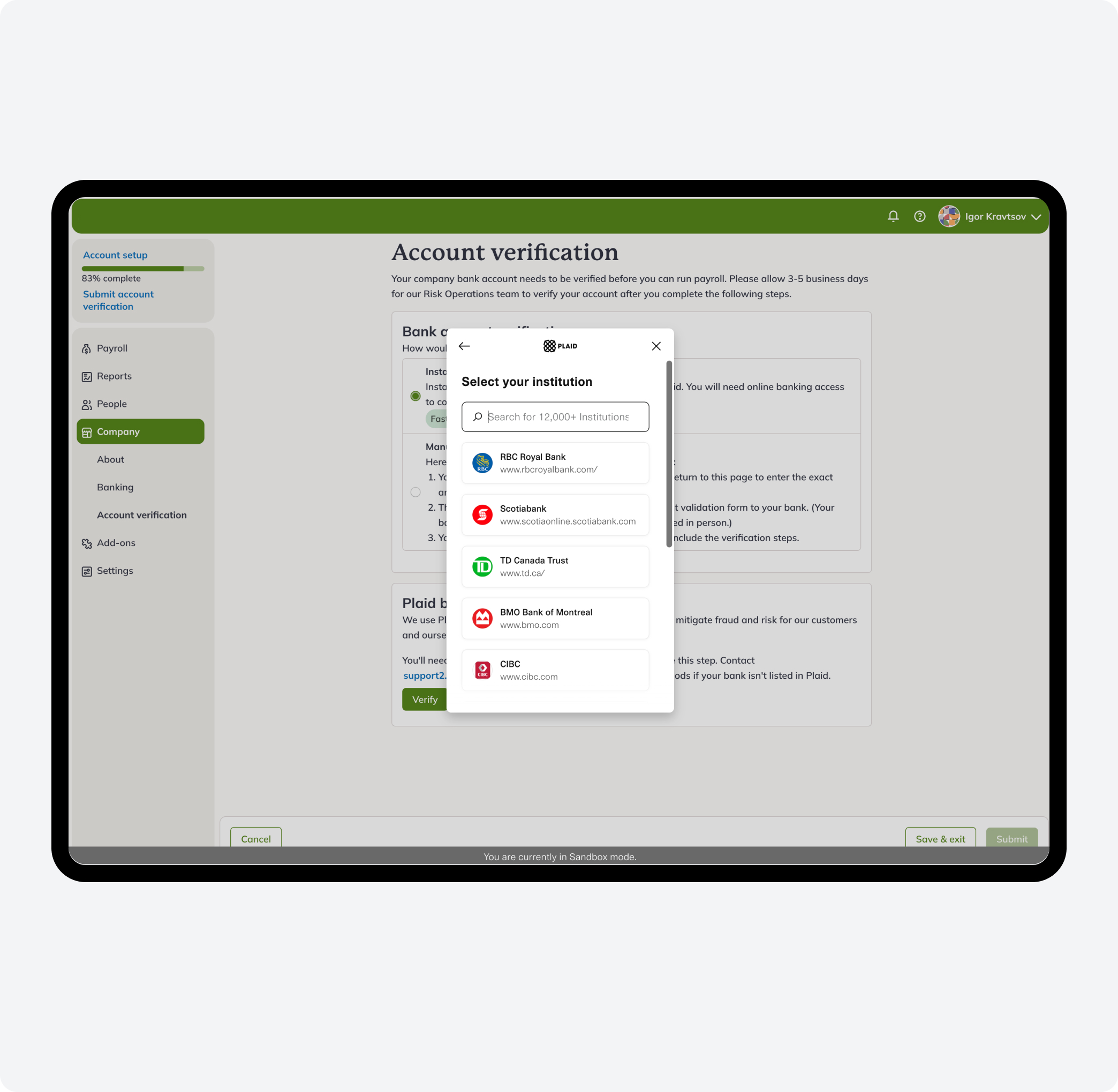

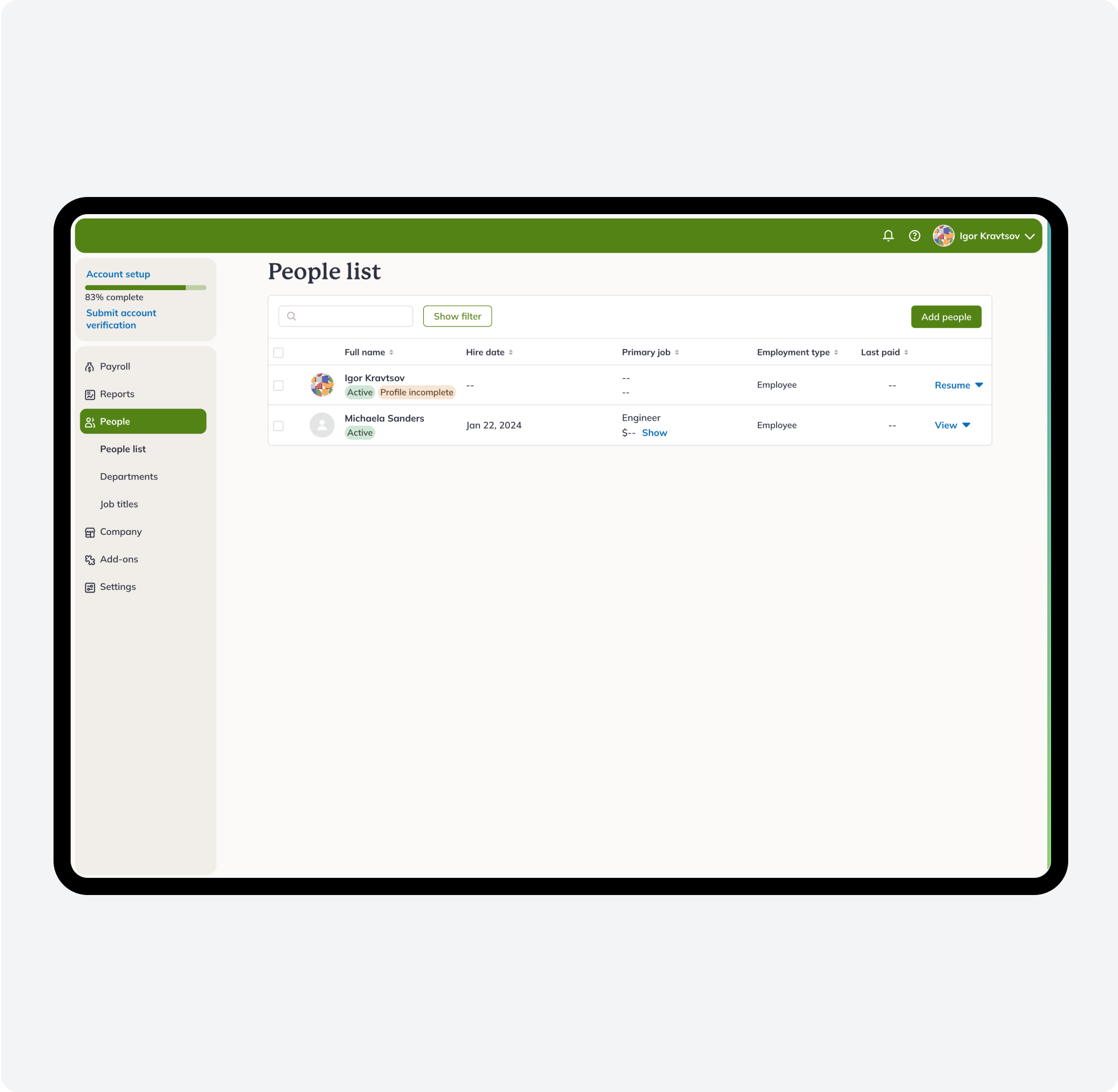

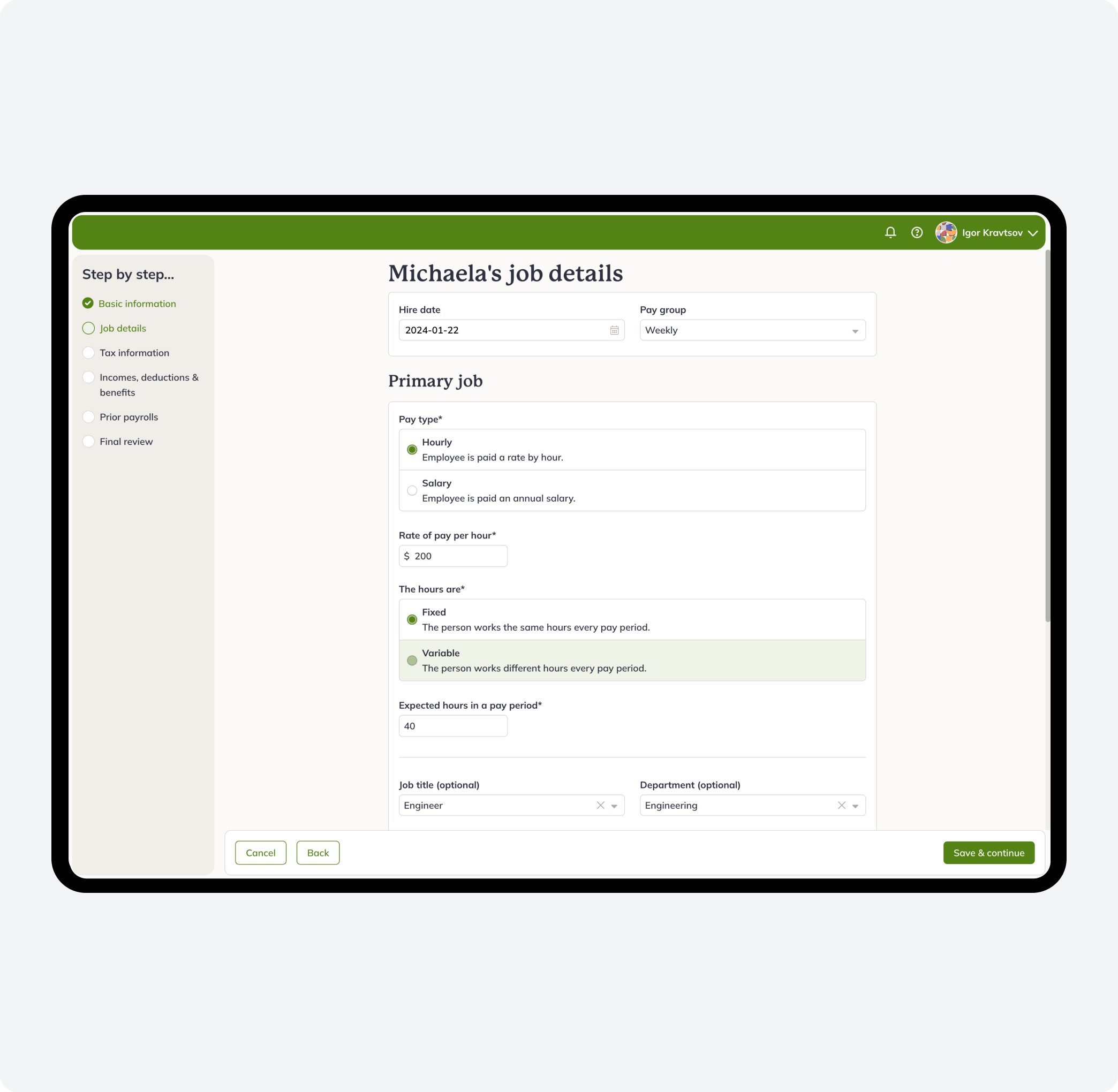

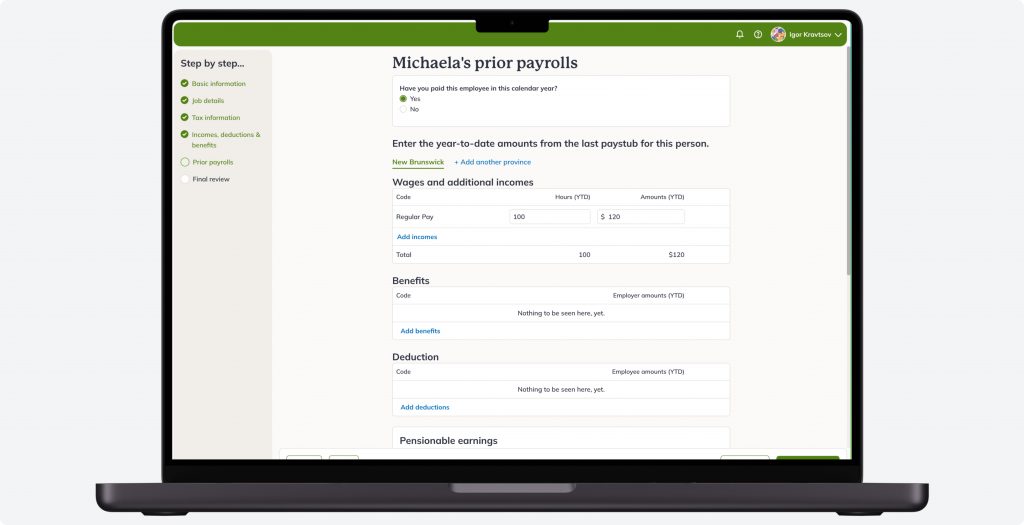

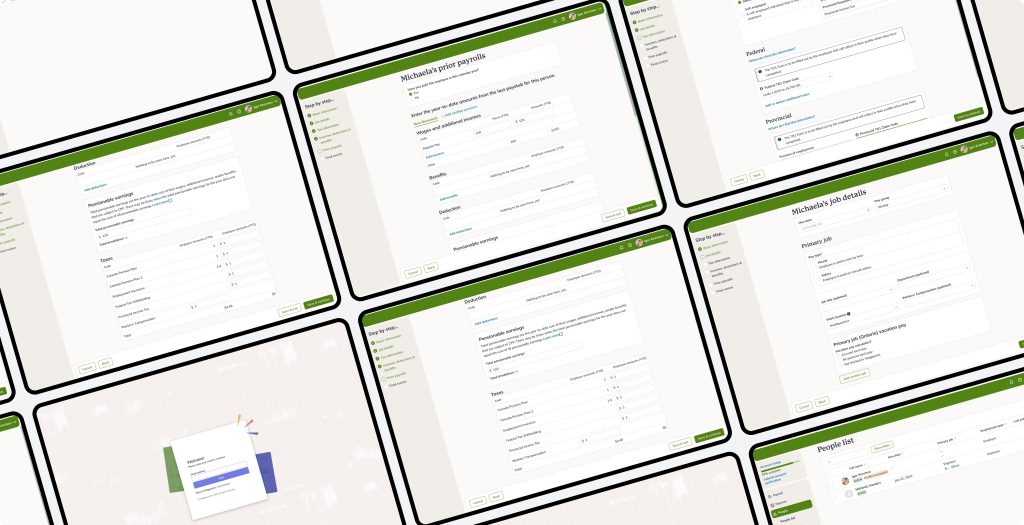

This is a Platform That Has Simple Payroll Software

The project marks a significant milestone in our commitment to delivering innovative custom payroll solutions.

It’s designed specifically for small businesses and customers in Canada and the US.

The client, a well-funded startup with over 150 employees, is in a robust financial position with strong profitability.

He urgently needed to recruit a team of five senior engineers, indicating a significant expansion or a critical project that required immediate expert attention.

So, SpdLoad began to work on this task.