15 Biggest & Oldest Insurance Companies in the US

- Updated: Nov 07, 2024

- 9 min

Life is full of uncertainties. From unexpected accidents to unpredictable health concerns, there are many instances where life can be disrupted. In such situations, insurance can provide a reliable safety net and pledge support during challenging times. It is quite beneficial, isn’t it?

However, the insurance sector is more than just protective services for worst-case scenarios. It’s a lucrative business model generating trillions of dollars annually.

Let’s explore the insurance world to understand the foundational components that enable these companies to prosper. Additionally, we will explore the top 15 largest insurance companies by market cap, market share, and revenues.

Looking to calculate annual recurring revenue? This ARR calculator provides a quick and accurate estimate.

Transform your ideas into reality with custom software tailored just for your business – contact us today!

Largest Insurance Companies by Segment

The country’s largest insurance companies have maintained dominance, especially in the top 10, with only slight changes in the rankings. These are the current leaders across these core segments based on NAIC’s and III’s latest data.

Property & Casualty

Property and casualty (P&C) insurers cover personal property like homes, cars, boats, and other vehicles. They also cover liability risks stemming from property damage or personal injury. This helps pay for lawsuit expenses or medical costs from such incidents.

The leading American property and casualty companies by direct premiums written are:

| Company | Direct Premiums Written | Market Share |

| State Farm Group | $78.6 billion | 9.06% |

| Berkshire Hathaway (BRK.A) | $56.0 billion | 6.45% |

| Progressive Insurance Group (PGR) | $52.3 billion | 6.03% |

| Allstate Insurance Group (ALL) | $45.5 billion | 5.24% |

| Liberty Mutual | $43.9 billion | 5.06% |

| Travelers Group (TRV) | $34.2 billion | 3.95% |

| Chubb (CB) | $29.4 billion | 3.39% |

| USAA Group | $26.8 billion | 3.09% |

| Farmers Insurance Group | $26.4 billion | 3.04% |

| Nationwide | $20.3 billion | 2.34% |

Life Insurance Companies

Life insurance companies promise to pay money to beneficiaries when the insured person passes away. They use math and statistics to calculate future payouts. But having lots of money now ensures they can pay claims and still make a profit.

The top US life insurers by direct premium written (the dollar value of new policies not re-insured) are:

| Company | Total Direct Premium | Market Share |

| New York Life Grp | $11.7 billion | 6.75% |

| Northwestern Mutual | $11.3 billion | 6.52% |

| Metropolitan Group (MET) | $10.5 billion | 6.05% |

| Prudential of America (PRU) | $10.1 billion | 5.80% |

| Lincoln National | $8.4 billion | 4.83% |

| MassMutual | $7.9 billion | 4.57% |

| State Farm | $5.0 billion | 2.87% |

| Aegon (AEG) | $4.9 billion | 2.80% |

| John Hancock | $4.7 billion | 2.73% |

| Minnesota Mutual Grp | $4.7 billion | 2.70% |

Health Insurance Companies

Health insurance companies sell plans to pay for medical care. People can buy plans on their own or through an employer. Technically, the U.S. government provides the most health coverage through Medicare, Medicaid, and other programs.

The top US private health insurers by total direct premium written are:

| Company | Total Direct Premium | Market Share |

| UnitedHealth Group (UNH) | $177 billion | 14.1% |

| Kaiser | $104 billion | 8.3% |

| Anthem | $77 billion | 6.2% |

| Centene Corp. | $75 billion | 6.0% |

| Humana | $74 billion | 5.9% |

| CVS Healthcare (CVS) | $69 billion | 5.5% |

| CIGNA Health | $32 billion | 2.5% |

| Molina Healthcare | $21 billion | 1.7% |

| Independence Health | $21 billion | 1.6% |

15 Inspiring Insurance Companies for 2025

After covering major insurance carriers, let’s highlight 15 companies making an impact. These innovators set positive examples by rethinking customer service, claims, products, and technology in the insurance industry.

When planning business strategy and customer outreach, this CLTV calculator gives companies a way to see the long-term revenue potential of their customer base, making it easier to plan ahead.

1. The Philadelphia Contributionship

Established in 1752 by Benjamin Franklin, it’s the oldest property insurance company in the United States. The very first coverage type they offered? Fire-related damages.

Its historical roots make it a foundational piece in the American insurance landscape.

Insurance products: Homeowners insurance, condo/renters insurance, and landlord property insurance.

What you can learn from this insurance company: The Philadelphia Contributionship is one of the most dependable insurance companies (started by a Founding Father). With over 250 years of experience under its belt, they’re as reliable and trustworthy as it gets.

2. GEICO

Did you know that GEICO stands for something? Yes. Government Employees Insurance Company is famous for its auto insurance and memorable ad campaigns.

In 1996, Berkshire Hathaway acquired GEICO under the leadership of renowned investor Warren Buffett. The acquisition made it a fully owned subsidiary of Berkshire Hathaway. And it boasts a significant market share.

With its direct-to-consumer model, it offers a wide range of policies nationwide and is one of the largest auto insurers in the US. GEICO provides online service 24/7 and 365 days a year.

Insurance products: Auto, homeowners, renters, motorcycle/ATV, boat, and business insurance.

What you can learn from this insurance company: Known for its memorable marketing campaigns, Geico has demonstrated the power of branding in the insurance industry.

You recognize the green gecko, right? His name is Martin.

For advertisers looking to maximize exposure, our CPM calculator helps manage costs while reaching more people.

Find the best TypeScript developers for your project.

3. State Farm

Founded in 1922, State Farm started as an auto insurance company for farmers but has since expanded its offerings.

Now, it provides various insurance products and financial services, known for its extensive network of agents. You know, Jake from State Farm.

Insurance products: Auto, renter, motorcycle, homeowner, condo owner, small business, life, medicare supplement, supplemental health, pet insurance.

What you can learn from this insurance company: It’s known for its comprehensive coverage and excellent customer service. Unsurprisingly, this insurance company is a household name with some of the best insurance agents.

And they have some funny TV commercials, too.

4. BriteCo

A newer entrant in the insurance world, BriteCo specializes in jewelry and watch insurance. They offer immediate appraisals and boast transparent, easy-to-understand engagement ring insurance policies for consumers.

The goal? To help their clients protect one of the most sentimental (and expensive) jewelry pieces in their lives.

Insurance products: Engagement rings, fine jewelry, and luxury watches.

What you can learn from this insurance company: A true example of an innovative and customer-centric insurance provider. BriteCo offers affordable (and convenient) insurance that sets them apart in the jewelry insurance niche.

5. Progressive Corporation

Progressive is a major player in the car insurance sector that dates back to 1937.

They’re notable for their “Name Your Price” tool, which allows customers the utmost flexibility in selecting their insurance coverage.

Insurance products: Auto, property, motorcycle, RV, and life insurance.

What you can learn from this insurance company: With its innovative and easy-to-use digital platform, Progressive has successfully modernized insurance.

Discover the essential features in car insurance app development to create a user-friendly and secure application.

6. Allstate

Allstate, established in 1931, provides a variety of insurance coverage, including home and auto policies. The “You’re in Good Hands” slogan has a significant presence across the United States.

Insurance products: Auto, home, and renters insurance.

What you can learn from this insurance company: Allstate pioneered the customer-centric approach. The result? Its personalized policies have set them apart.

7. Liberty Mutual

Since 1912, Liberty Mutual has grown to offer diverse insurance products worldwide. Their focus ranges from personal to commercial insurance, emphasizing tailored solutions for their clients. They even have a car insurance app.

Insurance products: Auto, home, condo, renters, life, pet and flood insurance.

What you can learn from this insurance company: Liberty Mutual shines with its corporate responsibility initiatives, proving that companies can indeed “do well by doing good.”

8. UnitedHealth Group

UnitedHealth Group is a leading name in health insurance, which offers healthcare products and other insurance services. Founded in 1977, it’s now one of the largest and most diversified health insurance companies globally.

Insurance products: Health, dental, vision, and supplemental insurance.

What you can learn from this insurance company: UnitedHealth boasts the largest market cap among insurance companies. It’s a pure powerhouse in the insurance sector. Why not learn from the best?

9. MetLife

MetLife, or Metropolitan Life Insurance Company, is one of the global giants in the insurance and financial services sector, providing life insurance, annuities, and more since 1868.

Insurance products: Accident, life, disability and absence, dental, vision, and pet insurance.

What you can learn from this insurance company: MetLife’s global presence and diverse product offerings highlight the importance of market penetration and diversification.

10. USAA

The United Services Automobile Association (USAA) is more than an acronym. It proudly serves military members and their families. It’s known for its exceptional customer service and commitment to its niche (community) by offering banking, investing, and insurance services.

Insurance products: Auto, property, life, and umbrella insurance.

What you can learn from this insurance company: USAA is an example of a successful niche selection, catering specifically to military personnel.

Access premium design and development services for unmatched success.

11. Nationwide

Beginning its journey in 1926 as a car insurance provider for Ohio farmers, Nationwide has since diversified. It now provides a wide range of insurance and financial services nationwide. Get it?

Insurance products: Auto, business, life, pet, homeowners, and renters insurance.

What you can learn from this insurance company: Nationwide embodies the power of customer loyalty with its “Nationwide is on your side” mantra.

12. AIG

The American International Group (AIG) traces its roots back to 1919. AIG offers a range of insurance products, from life to property, with an impressive and expansive international reach.

Insurance products: Property casualty and travel insurance.

What you can learn from this insurance company: Showcasing resilience, AIG bounced back from the 2008 financial crisis, reminding us that recovery (and redemption) is possible.

13. Pumpkin Pet Insurance

Even though it’s a more recent player in the game (2020), Pumpkin provides some of the best pet insurance coverage on the market. Their straightforward, affordable plans emphasize transparency to help pet owners achieve 90% back on all covered vet bills.

Insurance products: Cat and dog insurance.

What you can learn from this insurance company: Pumpkin provides your family with peace of mind that your furry companions get the care they deserve via comprehensive accident and illness policies for dogs and cats.

They also offer optional preventive care packages that cover annual wellness exams, parasite screening, and vaccines. Best of all, Pumpkin has no maximum age limit for pets and accepts all breeds. It’s a worry-free solution.

With consistently high ratings on Trustpilot, it’s clear that Pumpkin is a leader in customer satisfaction, making it a worthy addition to our list of inspiring insurance companies.

14. Next Insurance

Paving its own path since 2016, Next Insurance caters to the entrepreneurs of the world (small businesses). Their digital-first approach simplifies the process of getting business insurance.

Insurance products: Small business insurance.

What you can learn from this insurance company: A game-changer in the insurance industry, Next Insurance helps meet the unique needs of small business owners.

With over $881 million in funding, they offer tailored policies ranging from general liability to workers’ compensation. The result? Small businesses (across industries) get the coverage they need to thrive.

15. Coalition

Cyber insurance. Ever heard of it?

Coalition blends cybersecurity with insurance services to protect businesses against cyber threats. Their proactive approach (active insurance) helps with risk mitigation and provides comprehensive coverage.

Insurance products: Active cyber, tech E&O, and executive insurance.

What you can learn from this insurance company: Coalition is redefining the insurance industry, setting new standards, and inspiring a generation of entrepreneurs with active insurance.

They can identify emerging risks (like cyber threats) and craft an insurance product that addresses this specific need.

How Do Insurance Companies Make Money?

Insurance provides peace of mind to drivers, homeowners, and travelers. But how do companies profit from managing risks? Let’s uncover their formula for success.

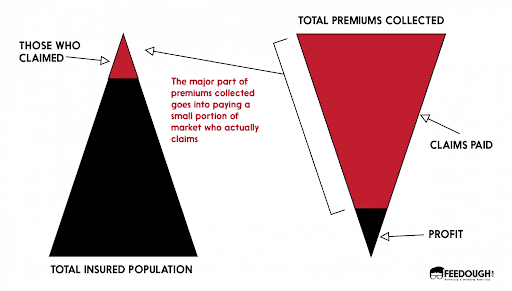

Insurance companies create value by converting risky exposures into sustainable profits. They do this through pooled risk, premium investments, reinsurance, diversification, and reserved capital.

By accumulating premiums from thousands of clients, insurers fund shared pools that pay out claims submitted by the few needing financial assistance. Most customers rarely file claims yet pay regular recurring premiums. This spread risk is the foundation.

Additionally, insurers amplify earnings by investing float income from collected premiums into interest/dividend-generating assets. This provides added returns as claims go mostly unpaid.

Firms also transfer portions of heavy risk exposures to reinsurer companies. This further dispersed risk to optimize sustainability even in major loss events.

These combined practices are supplemented by substantial capital reserves that enable insurers to remain profitable in worst-case loss scenarios.

TL; DR. Insurers create immense shareholder value by converting risky exposures into reliable profits through prudent risk management and financial governance.

It’s a true masterclass in balancing risk and reward. And we haven’t even touched on captive insurance companies (or mutual companies).

How Insurance Companies Can Achieve Success

- Niche Focus. Specializing in particular market segments means less competition and targeted appeal.

- Excellent Risk Assessment. Accurately pricing policies require mastery of risk data and actuarial science.

- Top Customer Service. Great service, competitive rates, and a strong reputation earn customer loyalty.

- Robust Financial Governance. Sufficient claims reserves and wise investments allow smooth operations.

- Regulatory and Ethics Rigor. Strict compliance and integrity shape an ethical, trusted brand.

- Technological Innovation. Digital capabilities improve efficiency, experience, and competitiveness.

Leading carriers strategically specialize their offerings while upholding risk, finance, and tech prowess. Expertise across these interlinked disciplines drives prosperity despite industry complexity and volatility.

For startups, using a CAC calculator is essential to monitor customer acquisition costs.

Innovating Insurance Technology

Insurance gives people critical financial safety even if the industry is complicated behind the scenes. There are lots of ways to improve insurance using updated technology.

Our team has specialized skills in risk analysis, product design, and software engineering. We work with insurance companies to create custom software, mobile apps, and data tools that help them succeed.

Reach out today to explore how our tailored insurance app development services can upgrade systems, better serve customers, and reach new markets. Let’s discuss building the next generation of insurance solutions.