Car Insurance App Development: Processes, Costs, and Tips

- Updated: Nov 11, 2024

- 14 min

In this article, we’ll walk through the entire process of developing a car insurance app – from initial concept to launch.

We’ll cover:

- Why now is the ideal time to invest in a car insurance app and industry outlook

- Cost breakdowns for building an auto insurance app

- What makes these apps unique

- Key considerations before starting development

- Step-by-step overview of the dev process

- Necessary team members and tech stacks

- And more!

This comprehensive guide is perfect for product managers, founders, entrepreneurs, or anyone interested in creating their car insurance app.

For those who prefer visuals, check out the bonus infographic.

If you want to learn more about successful insurance businesses, feel free to check out our article about 15 examples of insurance companies that dominate the industry.

Let’s dive in!

Transform your ideas into reality with custom applications tailored just for your business – contact us today!

Why Develop a Car Insurance App?

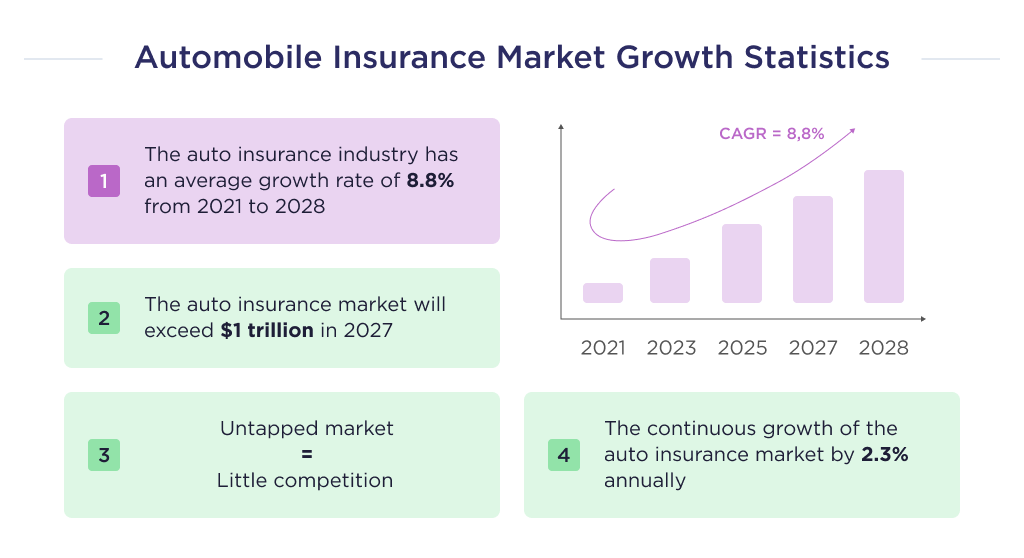

The vehicle insurance market is estimated to be worth over $1 trillion by 2027.

Auto insurance is a huge market with a large solvent audience.

This opens up great prospects for your startup to search for and implement innovative and fast-growing business models.

In fact, this is the idea of investing in the development of your own auto insurance application.

And to prove that statement, let’s take a closer look at statistics.

Growth Statistics for the Car Insurance Market

Numerous statistics suggest that the car insurance market is growing. Here are some:

- The car insurance industry is expected to grow at a CAGR of 8.8% by 2028.

- 1 in 8 motorists lacks any form of auto insurance in the United States – a sign that there’s a massive untapped market therein.

- On average, car insurance costs around $2,014 per year for full coverage and $622 per year for minimum coverage.

- The market size of automobile insurance in the US grows at an average of 7.1% yearly.

These growth statistics have impressed many venture capitalists, and they’re investing a lot of money into car insurance businesses, particularly those in the Insurtech niche.

Here’s a list of facts supporting that.

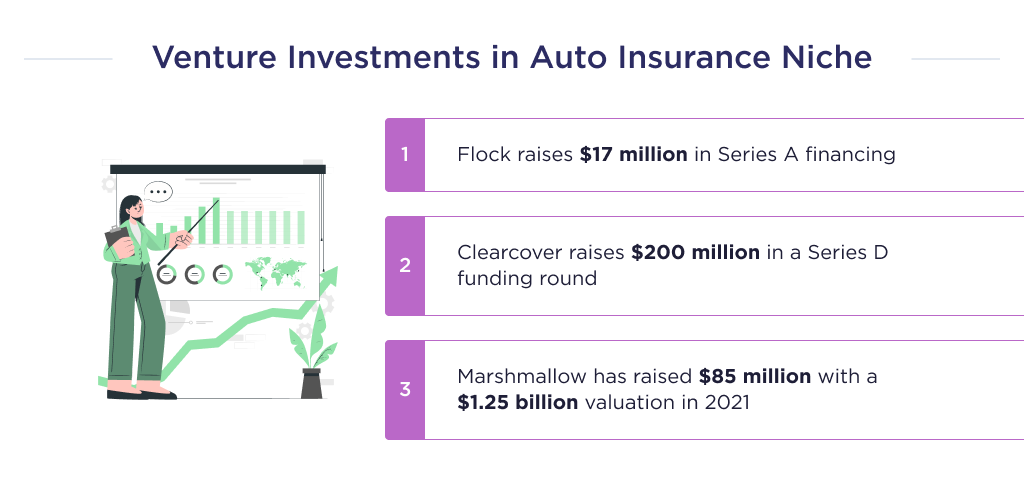

Overview of Venture Capital Investments in Car Insurance

Below are some statistics suggesting that VCs are interested in investing in startups in this sector:

- Flock, a connected car insurance startup, raised $17m in Series A funding.

- Clearcover, a car insurance startup, raises $200m in a Series D funding round.

- A car insurance startup in the UK, Marshmallow, raised $85m on a $1.25b valuation in 2021.

The above statistics are verifiable proof that the car Insurtech market is growing, and VCs are ready to fund ideas and products in the niche.

Let’s take a look at the cost of developing an insurance app.

How Much Does it Cost to Develop a Car Insurance App?

The cost of creating an automobile insurance mobile app ranges from $55,000 to $65,000. However, the exact cost primarily depends on your app type, team type, and location.

Cost By Team Type

The spreadsheet below shows the cost of developing a car insurance application for each team type.

| Type of Team | Average Cost, $ |

| In-house, the US | 150,000 |

| Local agency, the US | 180,000 |

| Outsource agency | 60,000 |

| Freelance team | 35,000 |

To know which team type best suits your startup, it’s best to first understand what each entails, and their pros and cons.

1. In-house Development Team

The in-house development team is a workforce of developers employed directly by the startup and works within the confines of the organization.

They carry out day-to-day activities towards creating and maintaining your solution.

Here are the pros and cons of this model.

| Pros | Cons |

|

|

2. Local Agency

A local agency is a software development company that’s domiciled in your country of operation.

Like others, we’ll provide you with the pros and cons of this option.

| Pros | Cons |

|

|

The high cost of this option makes it unattainable for most startups. Thus, we’ll discuss cheaper alternatives.

3. Freelance Developers

They are independent professionals with experience in creating several web apps and mobile applications.

They’re not employees of any organization, but only handle projects on a per-contract basis.

Let’s discuss the pros and cons of this option.

| Pros | Cons |

|

|

Since car insurance companies handle multiple consumer data, it’s not the most ideal for data privacy. Let’s discuss a well-balanced option.

4. Outsource Agency

An outsourcing agency is an offshore software development company with the infrastructure and expertise to create and maintain websites and mobile applications.

Like others, it also has some pros and cons to consider.

| Pros | Cons |

|

|

Now, let’s take a look at how geography affects the cost:

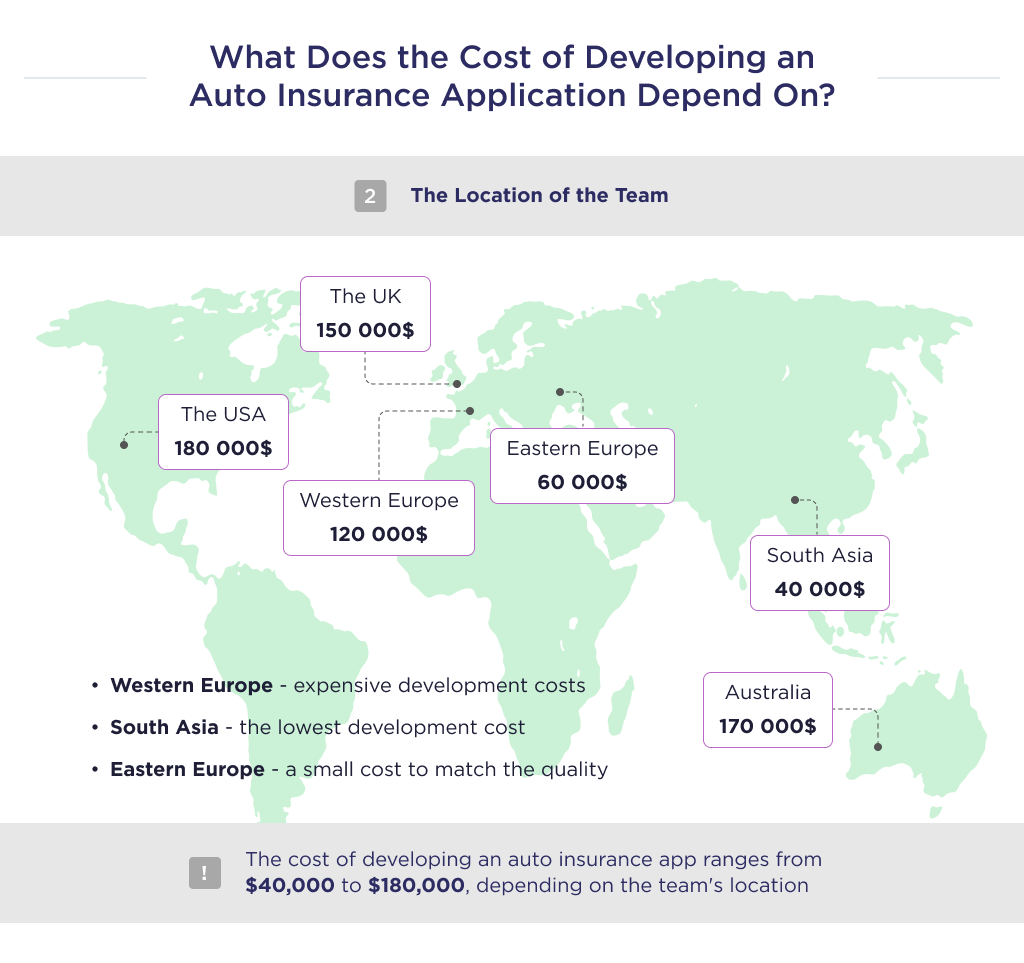

Cost By Team Location

Let’s consider a cost breakdown of car insurance app development defined by agency location:

| Location | Average Cost, $ |

| The US | 180,000 |

| The UK | 150,000 |

| Australia | 170,000 |

| Western Europe | 120,000 |

| Eastern Europe | 60,000 |

| South Asia | 40,000 |

As seen in the spreadsheet above, the cost of car insurance development varies with the team’s location.

Startups developing their mobile apps in the US, UK, Australia, and Western Europe need an exorbitant amount due to labor costs in those nations.

South Asia offers the cheapest development cost on the list. However, they’re known for low-quality applications.

For cost-effectiveness, it’s best to outsource to an Eastern Europe country. Particularly Ukraine, as they have a vast pool of experienced coders.

Looking for quality and cost balance? Here are the best countries to outsource software development.

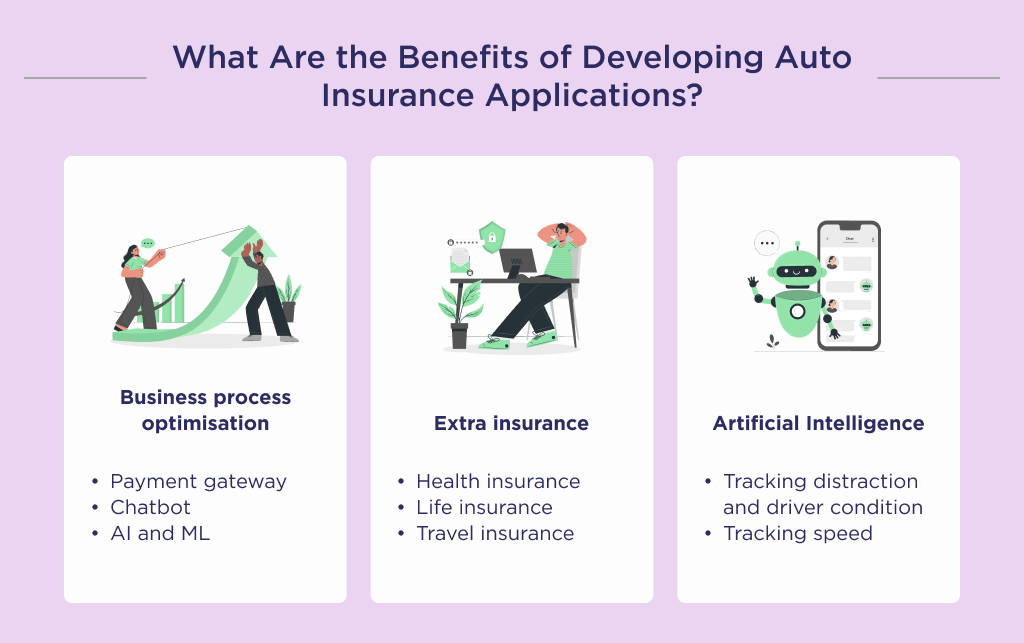

How is Developing a Car Insurance App Different?

Car insurance development differs from other InsurTech apps in both features and characteristics.

Although most insurance applications can thrive without some characteristics, car insurance apps must:

- Automate business processes,

- Use AI to evaluate and price premiums,

- Offer add-on insurance.

Let’s shed more light on these points.

1. Automating Business Processes

Due to the sheer number of policyholders, it’s imperative to optimize claims processing within the car insurance app using business process automation.

In the UK for example, 2.1 million car insurance claims were filed in 2020. As such, automating customer support, transaction, and claim processing is the only guaranteed way to leave consumers with a great user experience.

Features needed for insurance process automation are:

- In-app payment gateways for transaction processing,

- Chatbots for customer support,

- AI & ML for claim authentication.

2. Offering Add-On Insurance Services

There are lots of risks associated with automobile usage, some of which are not covered by traditional comprehensive automobile insurance.

For example, traveling possess some healthcare risks. Thus, as an encompassing service, you can provide policyholders with other types of insurance services in a single policy.

Examples of add-on services to include are:

- Health insurance,

- Life insurance,

- Travel insurance.

Looking for innovation in healthcare? Here are some of the best healthcare startups leading the way.

3. Leveraging Artificial Intelligence

It helps to automate data gathering, analysis, and usage. By using AI to track driving behavior, you can predict the probability of the occurrence of accidents.

Insights from data gathered via algorithms can be used to incentivize risk reduction. It also helps to accurately underwrite, and predict risk factors of different groups.

It helps auto coverage startups determine the most ideal premium and remain profitable.

You may consider buying data from a third-party AI system. Otherwise, develop AI to track the following within your app:

- Driver’s drowsiness,

- Driver distraction,

- Speed.

Common third-party AI solutions that can help include Bosch, Nviso, MindtronicAI.

For a data-driven view of how AI is transforming industries, explore the latest AI statistics.

Key Considerations Before Developing an Auto Insurance App

Two common mistakes that startup founders, serial entrepreneurs, and product managers make in auto-insurance app development are:

- Not having a marketing budget;

- Not considering relevant regulatory laws;

Let’s help you make sense of what they entail.

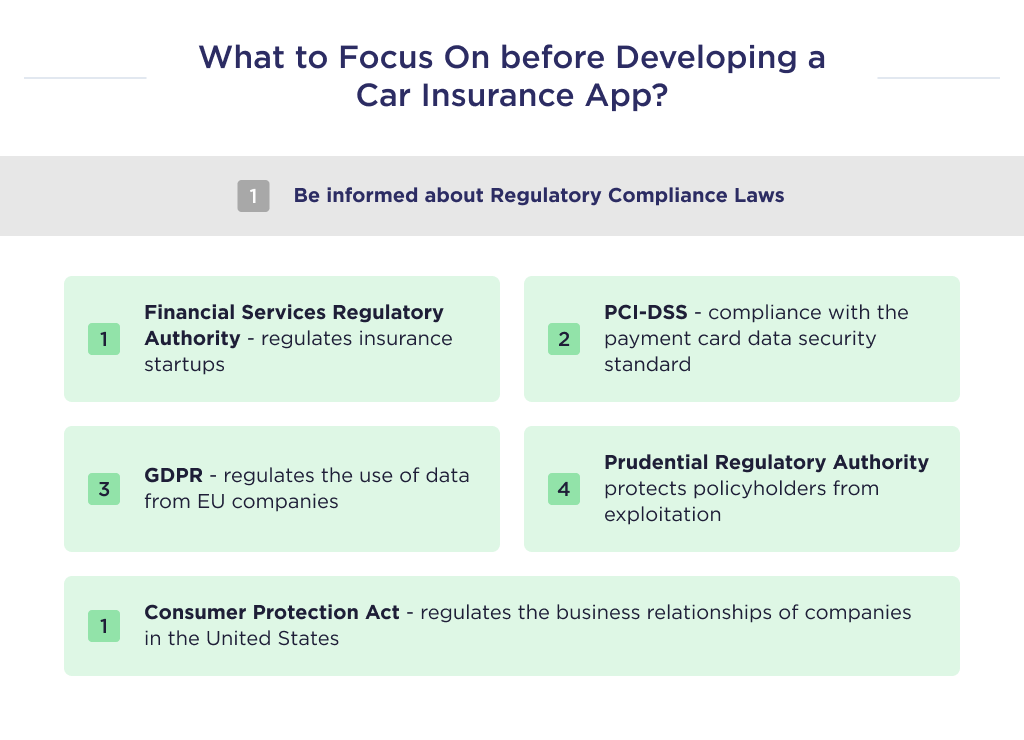

1. Relevant Compliance Laws

The laws guiding the operation of your startup depend on your country of operation.

Here’s a spreadsheet of regulatory laws and countries where they apply:

| Regulatory Laws | Startup Affected |

| Financial Services Regulatory Authority | It regulates the operations of Canadian-based insurance startups and ensures that insurance plan premiums are fair to all. |

| PCI-DSS | All car insurance providers accepting payment via credit cards must abide by the Payment Card Industry Data Security Standard. |

| GDPR | This organization regulates the use of data obtained by EU-based car insurance companies. |

| Prudential Regulatory Authority | It regulates car insurance companies operating in the UK and protects insurance policyholders from being exploited. |

| Consumer Protection Act | It regulates the business practices of businesses located in the United States. |

The spreadsheet above details just a few regulations to comply with. Optimize your compliance with these types:

- Have an in-house workforce of compliance enforcement team;

- Only partner with an app development company with an in-depth knowledge of compliance laws;

- Hire an in-house human resource team with knowledge of present labor laws.

Feel free to learn more about insurance app development in this article.

2. Marketing Budget

A March 2023 survey conducted in the United States shows that top auto insurance firms spent over $1.5 billion on digital marketing alone.

To compete effectively in this niche, it’s imperative to create an effective startup marketing strategy, and back it up with a robust budget. Your budget should be enough to generate the returns needed to achieve your corporate goal.

For the best outcome, your marketing budget should be 2X-3x your product design and development cost.

That is, if your design and development budget is $100,000, then your marketing budget should be about $200,000 – $300,000.

Thinking of improving your marketing strategy? Use our CPC calculator to estimate ad costs and maximize your marketing spend.

Car Insurance App Development Process

We’ll be breaking down the process of creating a car insurance app into 4 stages. The steps here include:

- Product research and requirement gathering;

- App design;

- MVP development and quality assurance;

- App launch, feedback gathering, and modifications.

Let’s help you understand the steps involved.

Step 1. Discovery Phase

The discovery phase of a project includes researching the most effective development workflow and gathering information on project requirements through regular meetings between the startup and the development team.

The development team outlines functionality to create, identify relevant compliance laws, and create milestones. The phases involved here are:

| Phases | Description |

| Target market analysis | Statistics from Fortunly suggest that market research is a major factor for business failure.

This process entails researching to understand the potential market and accident risks of different groups. |

| Cost analysis. | Here, the BA, and PM lead the development team in estimating the cost implication involved in creating and designing the app.

Lack of detailed cost analysis is responsible for 20% of business failures. |

| Outline your goals | Not setting goals is responsible for over 10% of business failures.

Identify realistic goals and align team members to abide by them. |

| Competitor analysis | This process entails evaluating and comparing features and designs with competitive apps.

Examples of car insurance apps from competitors to analyze here are: Allstate Mobile, Esurance Mobile, and Geico Mobile. Check out our recent article about insurance website design for more ideas and inspiration for your insurance website. |

The founder benefits the following from this step:

- App idea validation;

- Cost reduction;

- Knowledge of target market;

- Proper adherence to app compliance laws;

- Identification of the best product development team.

Once this phase is complete, the app design process starts.

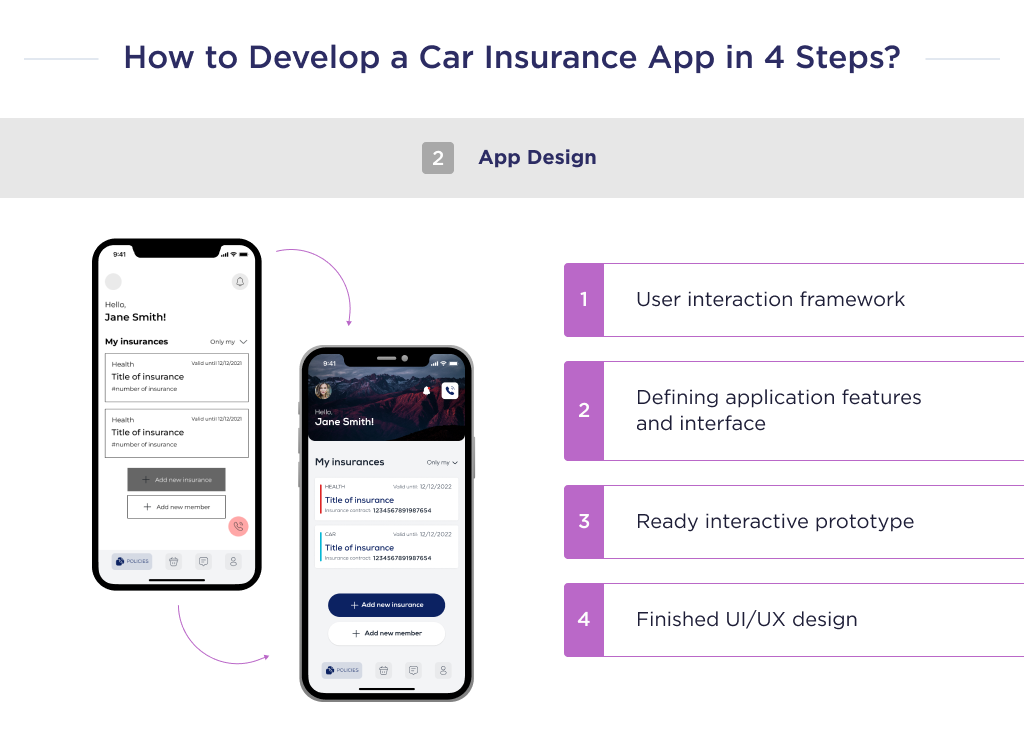

Step 2. Design Phase

The primary task here is designing an architecture that shows what the app will look like.

Requirements and information from the discovery phase serve as a guide for the UI/UX design phase.

We won’t discuss the steps involved in the actual design process, since there’s already an article on the insurance application design guide on our blog.

Rather, we’ll discuss the importance of app design in car insurance app development.

The car insurance app design helps everyone on the development team to understand the product’s value.

The deliverable here includes pages of design that help attain the goals of creating the app. It also helps the developers to know the features to build, and expected deliverables.

This stage often requires multiple modifications because it serves as a guide for coders. It provides the first tangible solution that helps to understand everyone understands the logic behind the solution.

In some instances, startups use deliverables here to pitch to investors and raise funds for projects.

Once this phase ends, you should have the following:

- A user experience wireframe,

- UI kit and a clickable prototype,

- An original Figma design file.

The next phase only begins when stakeholders have approved the design.

Step 3. Development and Testing

This is the most technical aspect of the car insurance app-building process. Here, programmers will write codes using several tech stacks to create the features in the mobile application.

The step here is split into the backend, mobile, and in some instances, frontend development. Here’s what each step entails.

| Kind | Description |

| Backend development | It involves the creation of server-side functionalities that forms the entire framework that’s needed for the insurance app to work.

Backend developers handle this stage, and they use tech stacks like Jave, Node.JS, etc. |

| Mobile development | It involves the creation of the app itself and ensuring that it works across all mobile devices.

They’ll also implement endpoint APIs from the backend so that insurance agents & users can interact with server-side features. Mobile developers use Flutter or React Native for cross-platform apps. They also use Swift for iOS apps and Kotlin for Android applications. |

| Frontend development | It involves the creation of interfaces, but only web-based pages. Front-end developers often come in handy in mobile app development when creating admin panels.

Developers here use Angular, Vue.js, and React.js. Our guide to the cost to hire a React.js developer explains everything from hourly rates to experience levels. |

Let’s shed light on features to include in your car insurance mobile app.

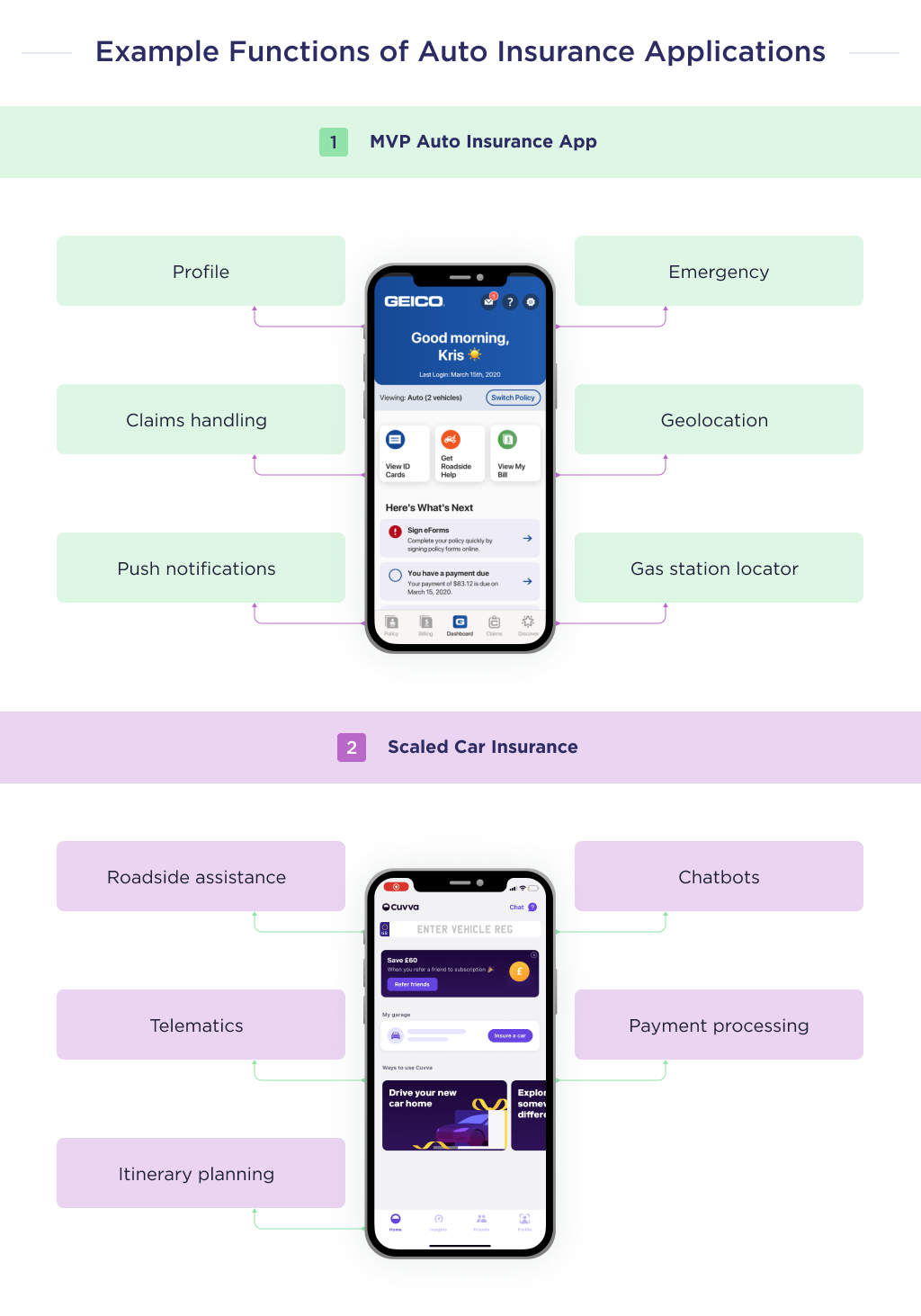

Example of Features to Use in Car Insurance App MVP

An MVP app helps the startup to do a real-time analysis of the market reaction to the idea. Thus, they only need features needed to test the app’s logic. These features include:

- User profile,

- Claim management,

- Geolocation tracker,

- Emergency,

- Pop-up and push notifications,

- Gas station locator,

For a full-service app, you should add more features to improve user experience.

Example of Features to Use in Scaled Car Insurance Application

- Roadside assistance,

- Route planner,

- Telematics,

- Automated payment processing,

- Chatbots.

What you need to remember, is there are no perfect apps exist.

Thus, once you develop an app, it’s time to launch it as quickly as possible.

The time-to-market is the universal advantage of startups in comparison to large players.

The faster you’ll launch an app, the faster you’ll be able to test your hypotheses, and the faster will collect feedback from the market on what you must adjust in your product.

Overall, creating an app can be complex, but these app development tips simplify the journey.

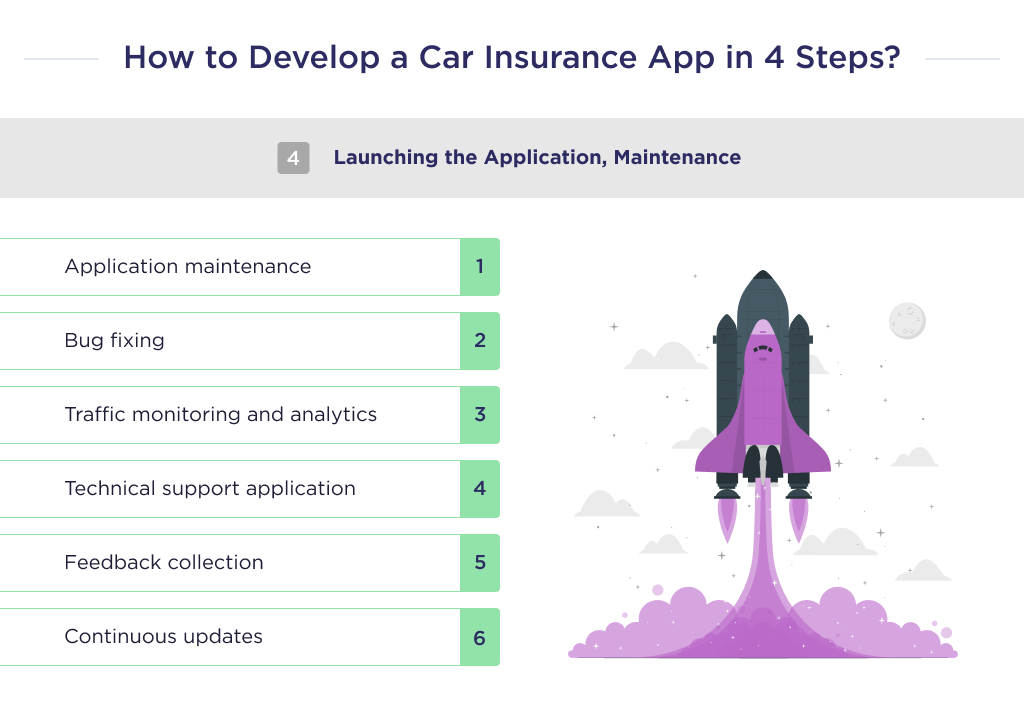

Step 4. App Launch, Maintenance, and Improvements Phase

Launch your applications on requisite app stores. We’ve mentioned the marketing budget earlier – this is when you should begin spending.

Your marketing should be aimed at making your target audience to download and use your application. Collect user feedback, and brainstorm with other team members on making necessary modifications.

Ensure that future releases still align with the founder’s vision, user expectations, market demands, and car insurance compliance laws.

Find the best TypeScript developers for your project.

Hire a fully dedicated app team for on-demand adjustments, app maintenance, and technical support.

Just like the other steps mentioned above, this one also requires an annual budget that shouldn’t be less than 25% of the total app development cost.

The bulk of app maintenance activity includes:

- Bug fixing,

- Real-time app support,

- Traffic monitoring & analytics,

- Feature extension.

Necessary Team Members for a Car Insurance App

The development team for creating a car insurance application should include:

- Project manager,

- CTO or Solution architect,

- Business analyst,

- UI/UX designer,

- Mobile developer,

- Backend developer,

- Quality assurance tester.

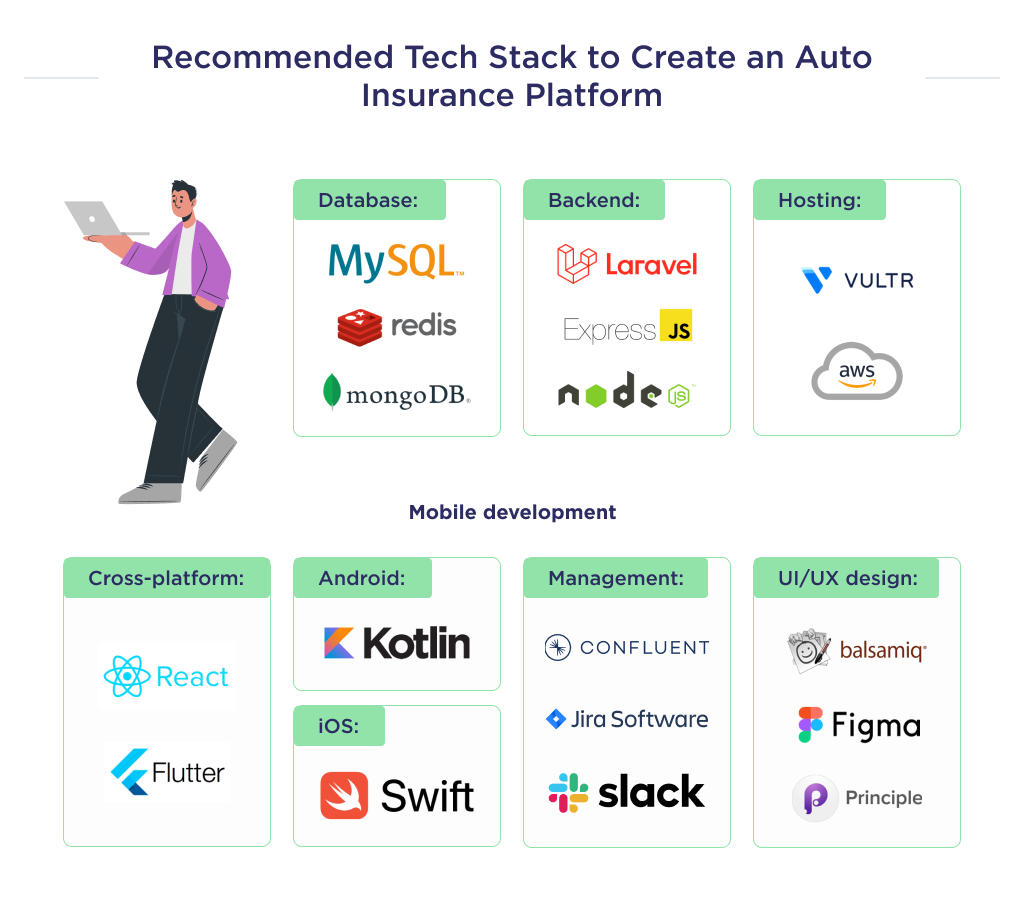

Recommended Tech Stacks for a Car Insurance Platform

There are many options to explore in finding the right tech stack for automobile insurance solutions. However, here are some of the best:

| Type | Tech Stack |

| Database | Redis, MySql, and MongoDB |

| Backend | Laravel, Express.JS, and Node.js

If you’re working with Laravel, these best Laravel tools and resources will streamline your workflow. |

| Server | NGiNX |

| Hosting | Vulty, and AWS

Compare Digital Ocean, AWS, and Google Cloud for insights into which platform fits your business best. |

| Mobile Development |

|

| Management | Confluent, Jira, and Slack. |

| UI/UX design | Balsamiq, Figma, and Principle |

What else? Let’s help you with some helpful tips to create a motor insurance app.

Choosing a Car Insurance App Development Team

Let’s educate you on how to choose a reliable app development agency for partnership.

These tips can guide you to choose the right team:

Step 1. Review Their Project Portfolio

Go through their past products to vet their ability to deliver. However, if you want to create a distinct solution, then simply watch out for the quality of projects, and their team’s expertise.

Step 2. Check Reviews on Reputable Sites

Before you sign a contract, check out reviews on reputable sites like Clutch. Case studies, blog posts, websites, and social media profiles can also provide a hint on the team’s ability.

Step 3. Interview Developers One-on-One

After shortlisting prospects, interview prospective vendors to know if they have enough knowledge of the product you plan to build.

If you’re a non-technical founder, then involve the service of a CTO. Don’t forget to compare fees.

Looking to collaborate effectively? Our guide on app development partnerships explains what to consider.

Next Steps

Car insurance mobile apps can provide a significant opportunity to improve customer experience and unlock usage-based coverage.

Creating a seamless and dependable mobile experience demands relevant expertise.

At SpdLoad, our software developers offer custom design and development services that deliver a next-gen experience for your customers.

Being a Clutch Leader in Ukraine speaks to our dedication and hard work in the software development field.

Contact us today to schedule a free consultation. Let’s transform your vision into reality!

Ever wondered how to keep your customers coming back? Discover how car wash app development can help you create a seamless experience that keeps them happy and engaged.

Bonus: Infographic

Here is a summary of our detailed guide. Learn the highlights of developing an auto insurance app, as well as the costs and tips to help you create the best app.

Find out how long it really takes to develop an app with our comprehensive guide on how long it takes to develop an app.