Insurance App Development: A Step-by-Step Guide

- Updated: Nov 11, 2024

- 18 min

In this article, we’ll walk you through everything you need to know about developing an insurance app.

Whether you’re a startup founder, serial entrepreneur, product manager, or anyone else innovating in InsurTech – this guide has you covered.

Here’s what we’ll be covering:

- Why building a new insurance app is worth the investment

- The different types of insurance apps you can create

- Cost breakdowns for insurance app development

- Key considerations before you start building

- A step-by-step guide to the insurance app development process

- Necessary team structure and tech stack

- Common challenges when building an InsurTech product

- How to find and hire the right developers

If you prefer visuals, feel free to jump to the bonus infographic.

Unlock your startup potential now — start transforming your vision into a scalable solution with our expert developers!

Why Create a New Insurance Mobile App?

Owning an InsurTech product helps startups benefit from the over $2 trillion markets.

Through mobile apps, insurance service providers can access a larger pool of audiences, offer customized insurance premiums, enjoy remarkable growth, and increase their consumer-service efficiency.

Let’s check out two sets of statistics supporting our stance on owning an insurance platform.

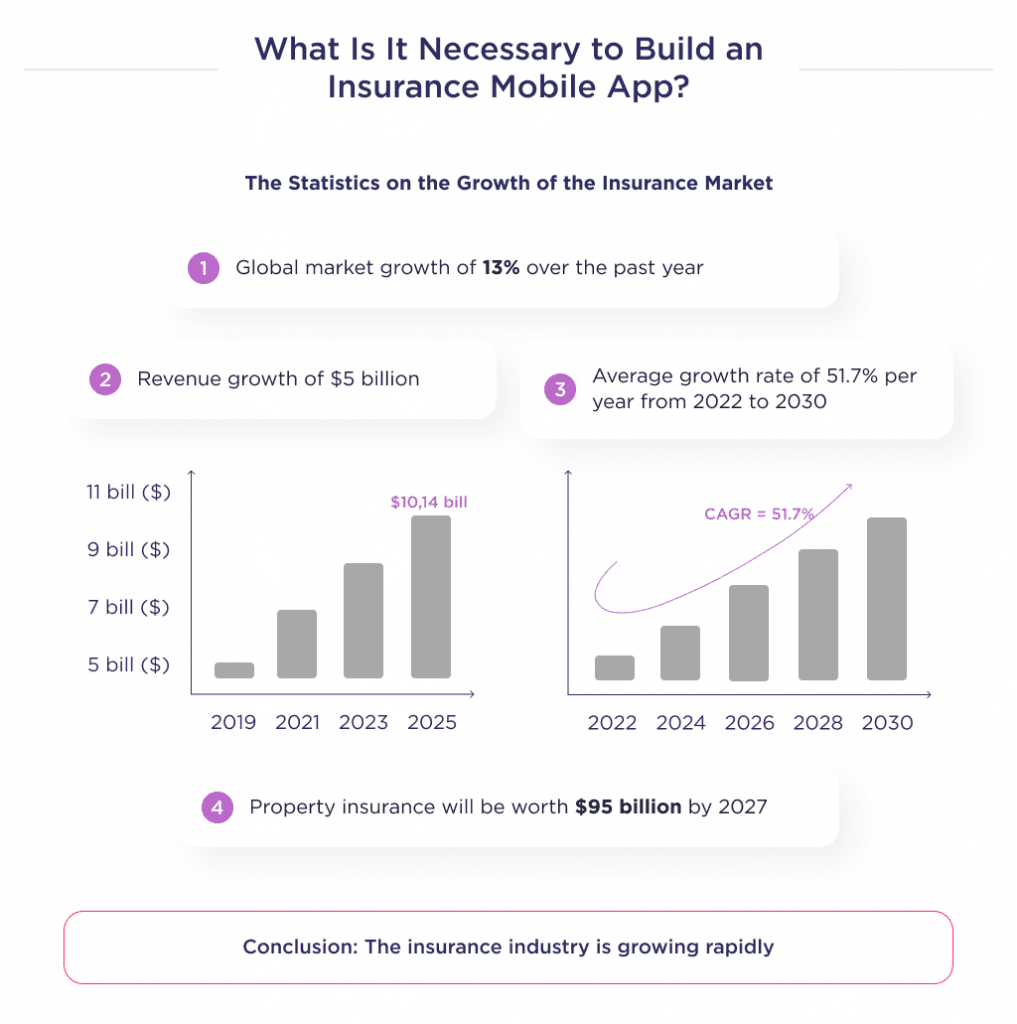

Insurance Industry Growth Trends

Here are some statistics that show that the insurance industry is enjoying rapid growth:

- The global insurance market grew by 13% between 2020 and 2021

- Global InsurTech revenue is expected to reach $10.14 billion by 2025, from 5.48 billion in 2019

- Insurance market analysis suggests that the industry will enjoy a CAGR of 51.7% from 2022 to 2030

- The global property insurance space is expected to be worth $395 billion by 2027

VCs have noticed this impressive growth rate of the insurance market, and are investing heavily in the industry. Below are some statistics to prove that.

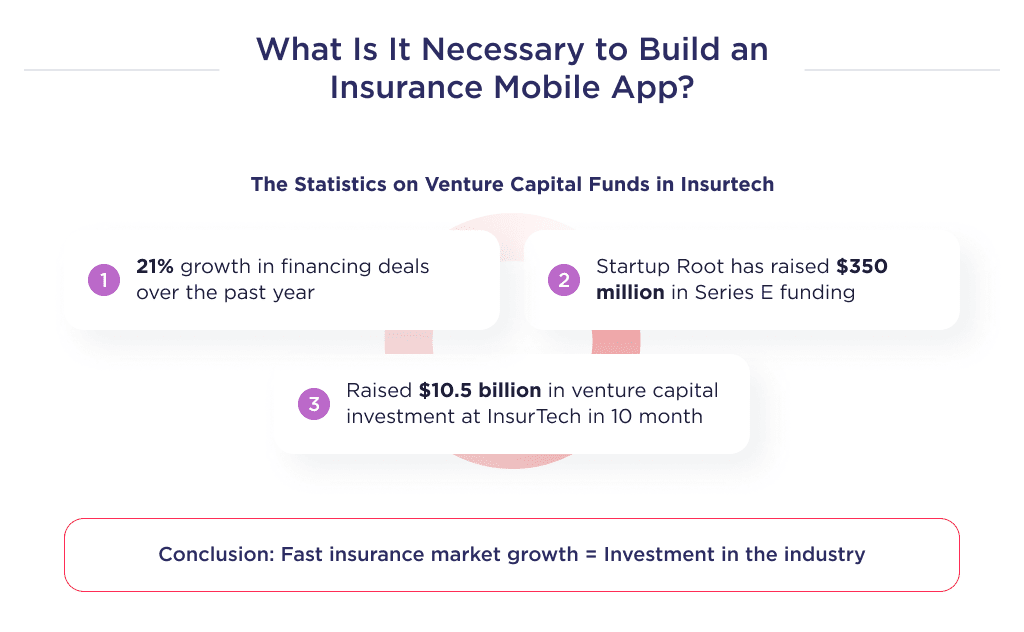

Overview of InsurTech Investments

There are some statistics on venture capitals fund in InsurTech:

- The number of InsurTech funding deals increased by 21% between 2021 and 2022

- Root, an InsurTech startup, raised $350 million in series E funding at $3.6 billion valuations

- Global InsurTech investment for VCs reached $10.5 billion within the first 10 months of 2021 alone

From the statistics above, it’s safe to conclude that the insurance market is growing at a significant rate, and there’s a willingness from venture capital investors to assist startups in benefiting from that growth.

Feeling inspired to launch your own InsurTech product? Let us tell you about your options.

Types of Insurance Apps You Can Build

There are two kinds of insurance applications. Either you create an app for agents, or you make an app for customers.

Let us help you understand what both types of applications mean.

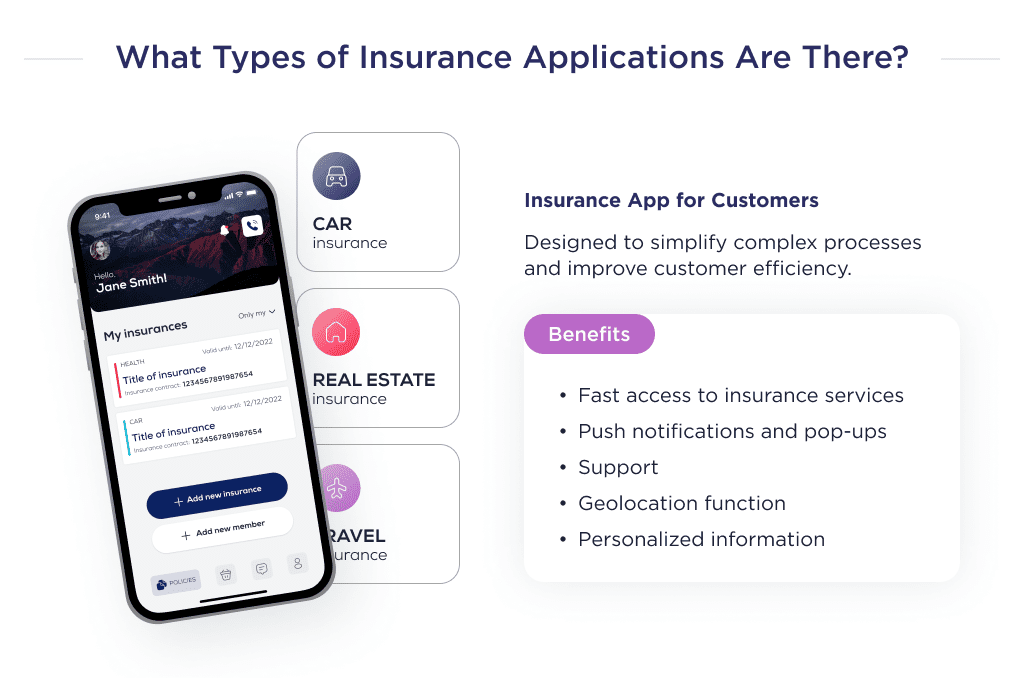

Customer Facing Insurance Apps

This type of offering is tailored to meet the needs of insurance policyholders.

It involves creating a platform for customers to access insurance offerings, make queries, give product feedback, and access customer-centric support services.

Let’s dive into more details about its benefits.

| Benefit | Description |

| Easy access to insurance services | Custom insurance applications allow consumers quick access to insurance services. |

| Notifications | Through push notifications and in-app pop-ups, insurance service providers can quickly disseminate information to consumers. |

| Timely instruction | In an unfortunate incident, consumers can reach out to a representative to get quick instructions to salvage the situation. |

| Location-sensitive help | The platform can direct insurance agents to an incident through the geolocation feature. A map feature in the app allows agents to find their way to the scene. |

| Personalized offering | Through caching and other data capture methods, the insurance provider can predict users’ behavioral patterns and offer personalized information to consumers. This helps consumers get services that optimally address their needs. |

Other than consumers, you can also create an app for agents.

Agent-Facing Insurance Apps

This app type is ideal for startups willing to develop customized apps to assist agents in maintaining insurance services on a single platform.

Let’s discuss the benefits to agents.

| Benefit | Description |

| Process automation | Through mobile devices, you can create forms and use caches to automate gathering user-specific information without the traditional paper-based approach. |

| Information dissemination | Agent insurance apps help to explain basic processes to prospective clients. |

| Better productivity | Insurers’ apps allow agents to streamline tasks, thus ensuring that they concentrate majorly on high-rewarding processes. This can massively increase their productivity. |

| Feedback from clients | Insurance mobile and web apps can be programmed to gather client reviews. This, in turn, helps agents understand customer pain points. |

If you want to learn more about the application development trends that are driving the industry forwarded, make sure you check out our blog about top trends in digital transformation in insurance.

Now that you know the types of insurance apps and their benefits to your target users let’s discuss the cost implication involved.

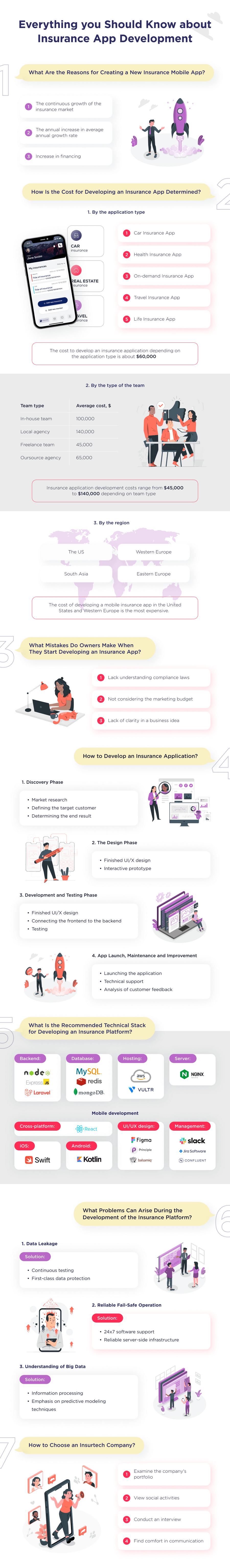

How Much Does It Cost to Develop an Insurance App?

The cost of developing an insurance app ranges between $50,000 and $70,000.

To know the exact amount it’ll cost you to build your insurance app idea, you’ll need to consider the type of app, the team involved, and the country where the development team is based.

This guide lists the best countries to outsource software development, based on cost and expertise.

Let’s discuss each of the factors to help you estimate better.

Costs by App Type

The insurance niche is a factor that determines app development cost. This is because complaint requirements, features, and complexity differ from one niche to the other.

We’ll consider five types of insurance apps, for example.

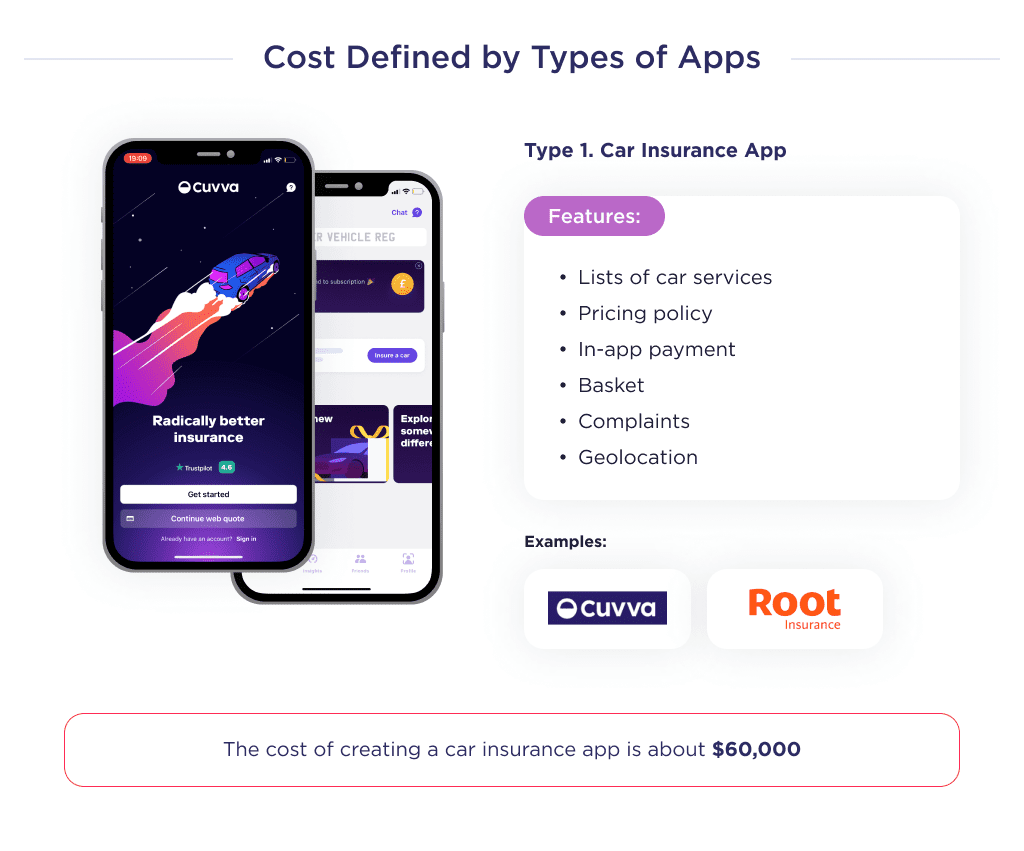

Type 1. Car Insurance App

Statistics show that over 84% of US-based drivers spend an average of $1,548 yearly on auto insurance.

The cost of creating a fully-functional car insurance app that can help you key into this massive market is about $60,000.

However, the exact cost of making the app might differ slightly based on the complexity and functionalities involved.

Car insurance platforms include features like:

- Homepage and automobile service listings,

- Smart pricing,

- In-app payments,

- Product cart,

- Claim filing,

- Geolocation, and others.

A typical example of an app in this insurance niche is Cuvva.

Interested to find out more? Read our complete guide about car insurance app development.

Beyond this, another popular insurance app you should build is health insurance. Let’s discuss this.

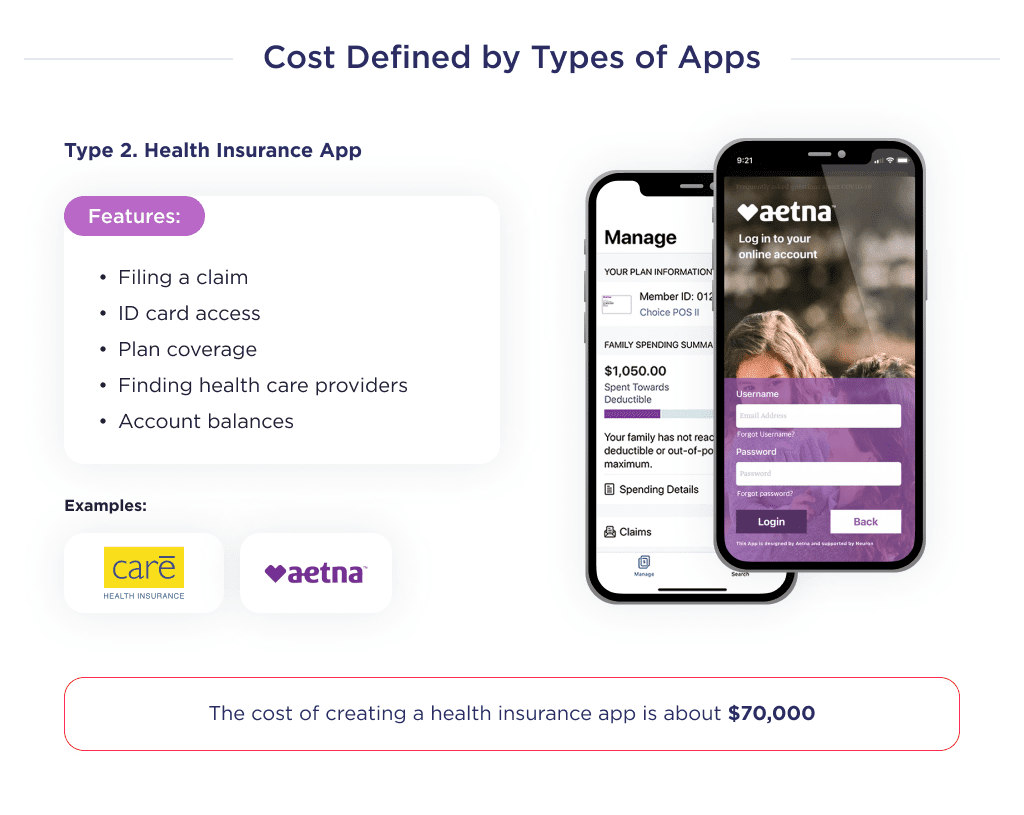

Type 2. Health Insurance App

Total health insurance revenue in the US alone is about $1 trillion annually. That certainly makes it an exciting market to work in.

The cost of creating a full-service health insurance app is about $70,000.

A typical example of such a mobile app is Care Health.

Features that should be in the health insurance app are:

- Check plan coverage,

- File a claim,

- Access ID cards,

- Search for and contact healthcare providers,

- Check account balances, and so on.

Looking for innovation in healthcare? Here are some of the best healthcare startups leading the way.

If you are interested in that kind of app, feel free to read more about it in our guide on how to develop a health insurance mobile app.

Other than health insurance applications, another app type to consider is the on-demand insurance app. Let’s shed more light on this.

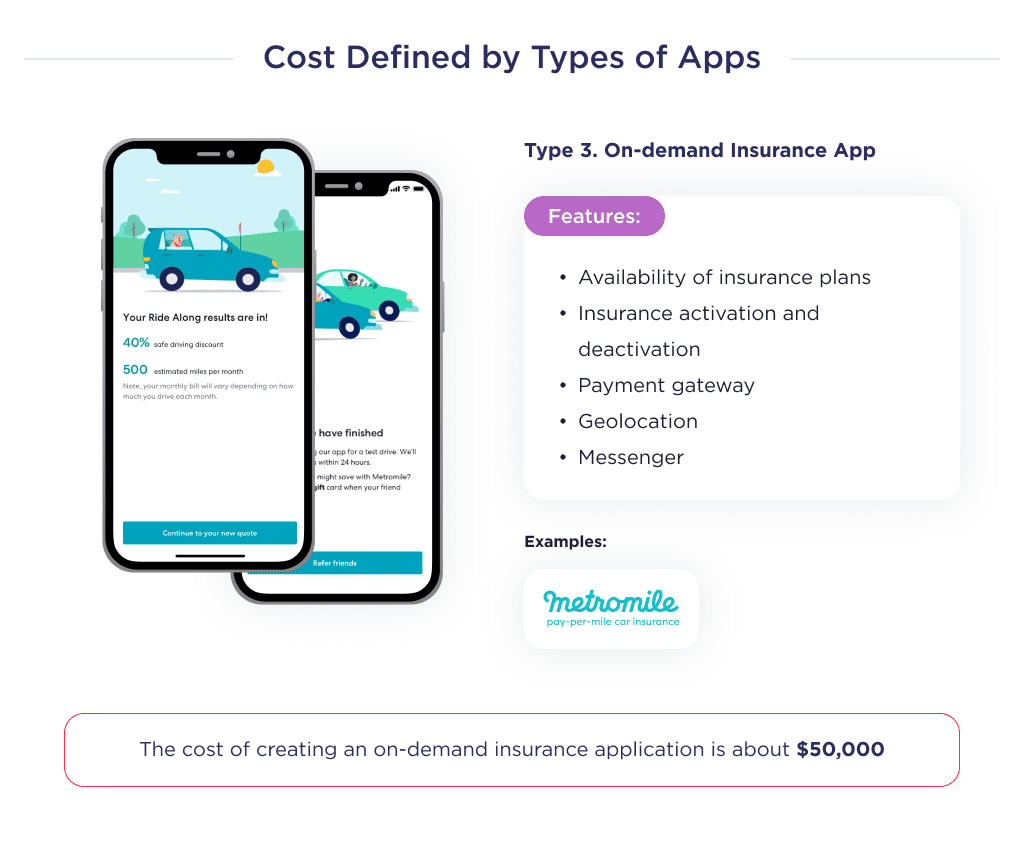

Type 3. On-demand Insurance App

On-demand insurance is a type of online coverage that allows policyholders to turn insurance on and off at will.

The cost of developing an on-demand insurance app is $50,000.

Features of on-demand apps depend on the niche the app is built to cover. Generally, the features of in-demand mobile applications are:

- Insurance plan listing,

- Insurance activation and deactivation,

- Payment gateway,

- Geolocation,

- In-message chat, and others.

An example of an on-demand insurance app for cars is Metromile.

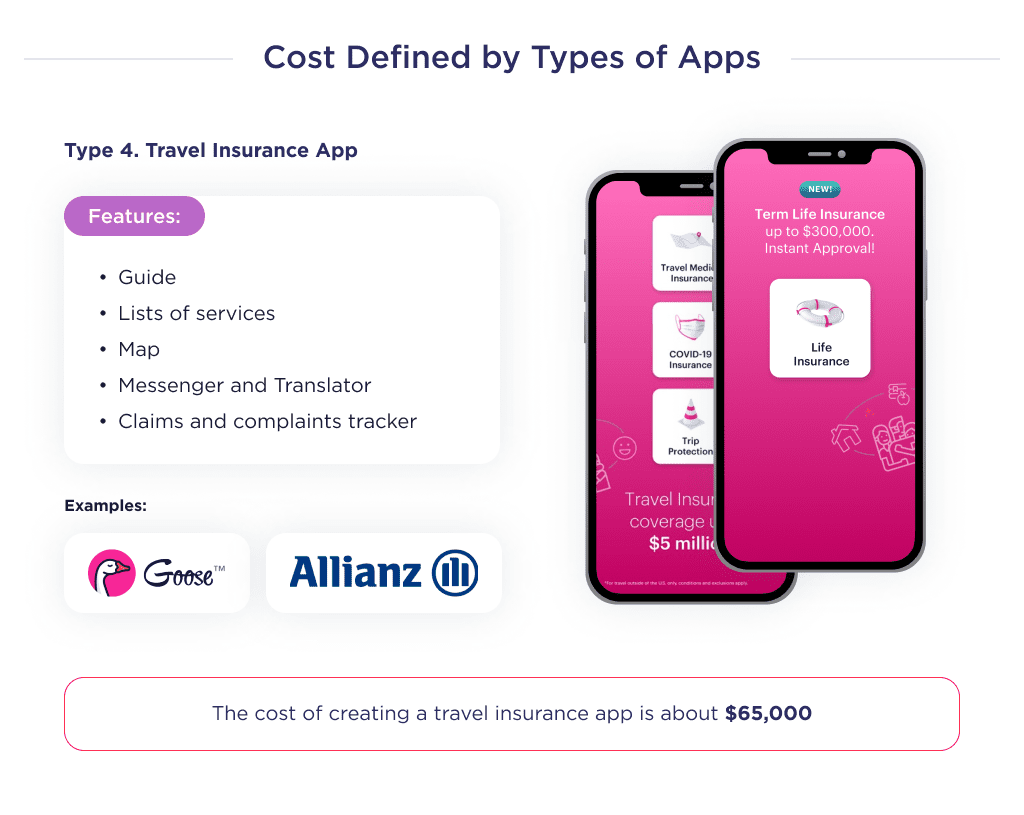

Next is a travel insurance application.

Type 4. Travel Insurance App

The global travel insurance market is growing at a CAGR of 26.1%.

One of the prominent examples of a travel insurance app is Goose.

The estimated cost of creating a full-service travel insurance app is $65,000.

Here’s a list of features that should be in the mobile application:

- Travel guides,

- Service listings,

- In-app map,

- In-app chat,

- Language translation feature

- Claims tracker, and more.

Beyond this, you should also consider owning a life insurance app. Let’s take a dig at this.

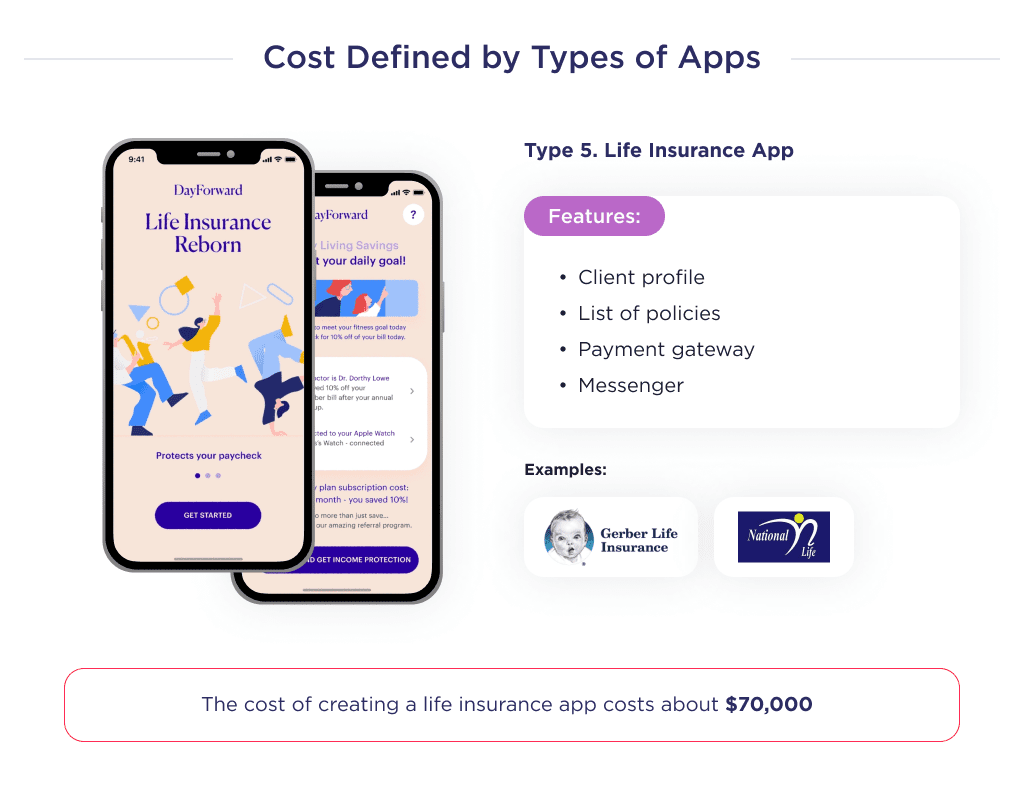

Type 5. Life Insurance App

More than half of Americans own a life insurance policy. A great way to tap into this niche is to create a life insurance app with features similar to National Life.

Building a similar custom full-service life insurance app costs $70,000.

A life insurance app should have a pretty the same list of features as previous types of apps:

- Policyholder profile,

- List of policies,

- Usage of policies,

- In-app payments,

- In-app chat, and others.

Once you’ve figured out the type of application you want, team type is another essential cost-influencing factor to consider.

Let’s discuss this in the section below.

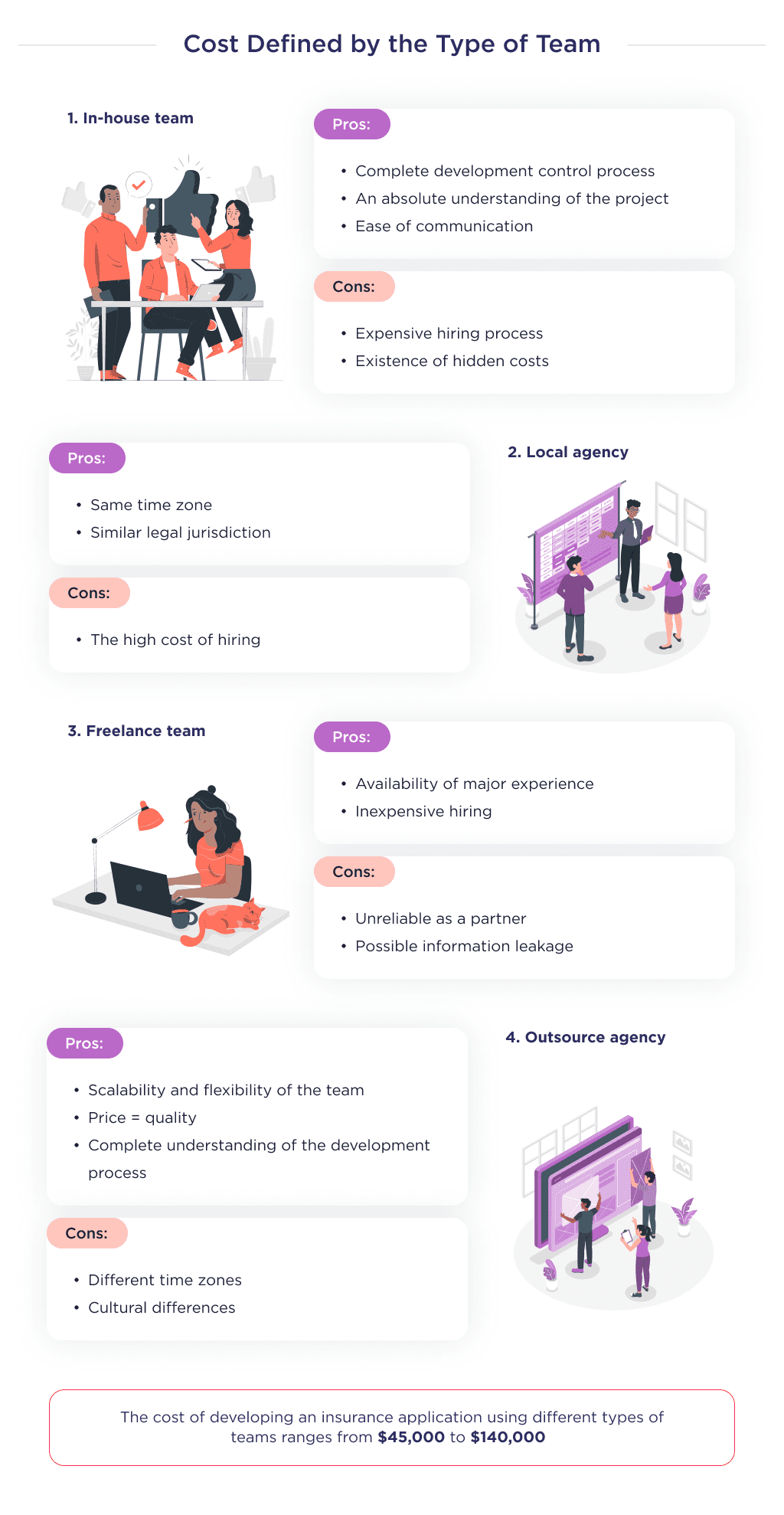

Costs by Team Type

Team type is another cost-influencing factor to consider. The teams in software development are an in-house team, a local agency, freelance team, and outsourced agency.

Below is a spreadsheet for a cost estimate of developing an insurance app using different team types:

| Type of team | Average cost, $ |

| In-house | 100,000 |

| Local agency | 140,000 |

| Freelance team | 45,000 |

| Outsource agency | 65,000 |

To make an educative decision and choose an ideal team type, we’ll discuss the intricacies of each.

1. In-House Team

This model entails hiring developers to work as an employee of your organization full-time. This means you’re fully responsible for meeting tax and other employee-bound obligations.

Before you opt for this model, you should consider its pros and cons:

| Pros | Cons |

|

|

2. Local Agency

This is a development team in the startup’s country of residence that is available for hire on a contractual basis to create or maintain an insurance mobile app.

As with others, it also has its pros and cons to be considered:

| Pros | Cons |

|

|

Due to the exorbitant cost of hiring and maintaining a local agency, we’ll discuss a much cheaper alternative.

3. Freelance Team

This is a workforce of professionals & independent developers with expertise in tech stacks required to create a fully-functional mobile application.

They work solely on a contractual basis and are not employees of any organization.

Like other options on this list, they also have pros and cons to consider:

| Pros | Cons |

|

|

Although cheap, a freelance team is not the ideal model for insurance mobile app development. A better yet cost-efficient option is hiring an outsourcing agency.

Let’s discuss that.

4. Outsourcing Agency

Outsourcing entails hiring a seasoned software development agency domiciled outside your home country, to help create and maintain a website, software, or mobile application.

The use of outsourcing agencies has risen from 12% in 2019 to 14% in 2021, evidence that IT-based startups prefer this model to others due to its multiple benefits.

Here are its pros and cons:

| Pros | Cons |

|

|

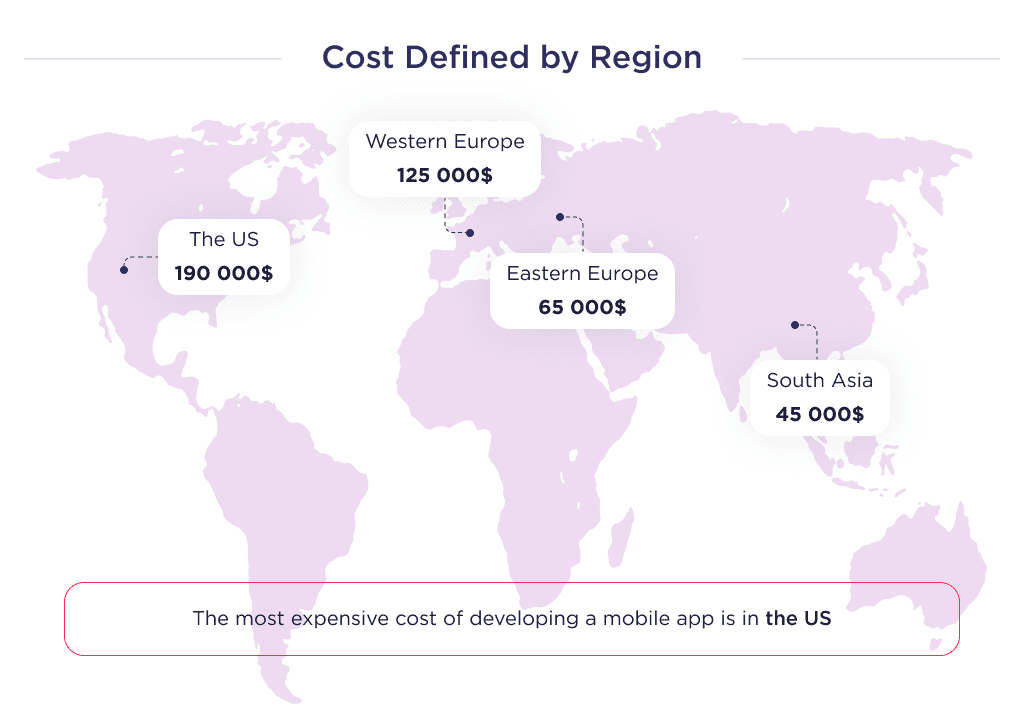

Now let’s look at how geography affects the cost of InsurTech software development.

Regional Cost Differences

Let’s look at the cost breakdown of insurance app development defined by agency location.

| Type of app | Average cost, $ | |||

| The US | Western Europe | Eastern Europe | South Asia | |

| Car insurance | 180,000 | 120,000 | 60,000 | 40,000 |

| Health insurance | 210,000 | 140,000 | 70,000 | 50,000 |

| On-demand insurance | 150,000 | 100,000 | 50,000 | 30,000 |

| Travel insurance | 195,000 | 130,000 | 65,000 | 45,000 |

| Life insurance | 210,000 | 140,000 | 70,000 | 50,000 |

As seen above, the cost of developing a mobile application in the US and Western Europe is the most expensive.

While it’s true that South Asia is the cheapest option on the list, they’re known for developing low-quality apps.

For the best quality at the most cost-efficient price, it’s best to hire the development service of a company in Eastern Europe, particularly Ukraine.

Beyond development cost, there are other things to take cognizance of.

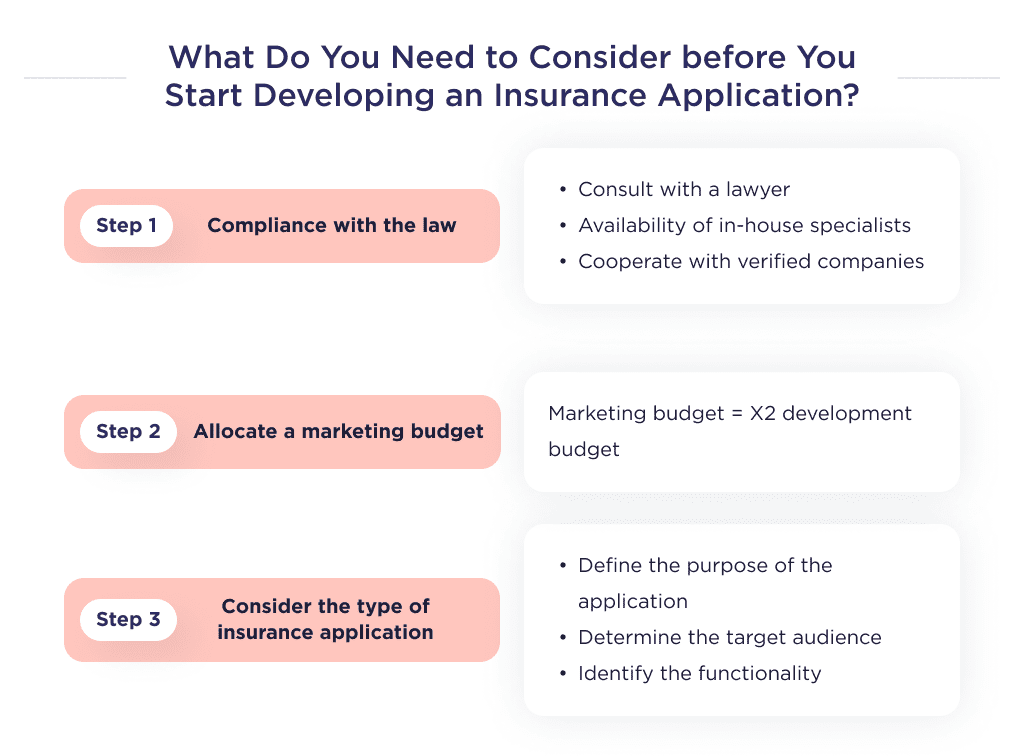

3 Key Considerations Before Starting

Product owners, founders, or entrepreneurs make several popular mistakes when they start building their products:

- Not figuring out legal compliance laws,

- Not polishing the insurance business idea,

- Not and not creating a marketing budget.

Let’s discuss each of these.

1. Ensure Legal and Regulatory Compliance

InsurTech, just like FinTech, is regulated by several organizations.

For the United Kingdom, the service is regulated by the Financial Conduct Authority, while those operating in Canada are regulated by the Office of the Superintendent of Financial Institutions (OSFI).

Irrespective of your country of operation, follow these tips to remain legal compliant:

- Speak to the counsel of a legal luminary before you embark on development.

- Have in-house human resource specialists knowledgeable of present labor laws on deck.

- Have an in-house insurance and financial services legal compliance team.

- Only partner with a development company that can guarantee data protection. Picking the right partner is crucial — here’s how to choose an app development company that fits your needs.

2. Have a Marketing Budget

According to Forbes, lack of a marketing budget is one of the top reasons of startup failure. See what percentage of startups fail.

It’s common to see startups within the InsurTech niche focus on product development while neglecting marketing. This will only leave you with a great product with no users.

As a startup, ensure you create a marketing budget that appropriately reflects your business goal and can confidently fund the startup marketing strategy needed to reach your target market.

Your marketing budget should be 2-3 times the development budget. For example, if the cost of developing your insurance application is $75,000, your marketing budget should range between $150,000 and $225,000 annually.

Thinking of improving your marketing strategy? Use our CPC calculator to estimate ad costs and maximize your marketing spend.

3. Validate Your Business Idea

Clarity is key to creating an effective product. Ensure you can clearly articulate the type of insurance app you want, your target audience, and the aim you wish to achieve for people using your product.

Before developing, do the following:

- Hold observation sessions with your team.

- Discuss the functionalities to include in the insurance app. E.g., biometric authorization, authentication, OTP, chatbot, preferred payment gateway, etc.

- Sample the opinion of your target market.

For more information on thinking further than I have an app idea, read this article.

Finally, let’s discuss the insurance app development process.

Step-by-Step Guide to Building an Insurance App

In this part, we will look at the 4 stages of app development to create a useful and user-centric InsurTech mobile app.

MVP development services are considered the first step you should take to develop an insurance app.

Once you finish developing a Minimal Viable Product, you should launch it, gather user feedback, and start a new development cycle.

And the first step in product development is the discovery phase.

Find the best TypeScript developers for your project.

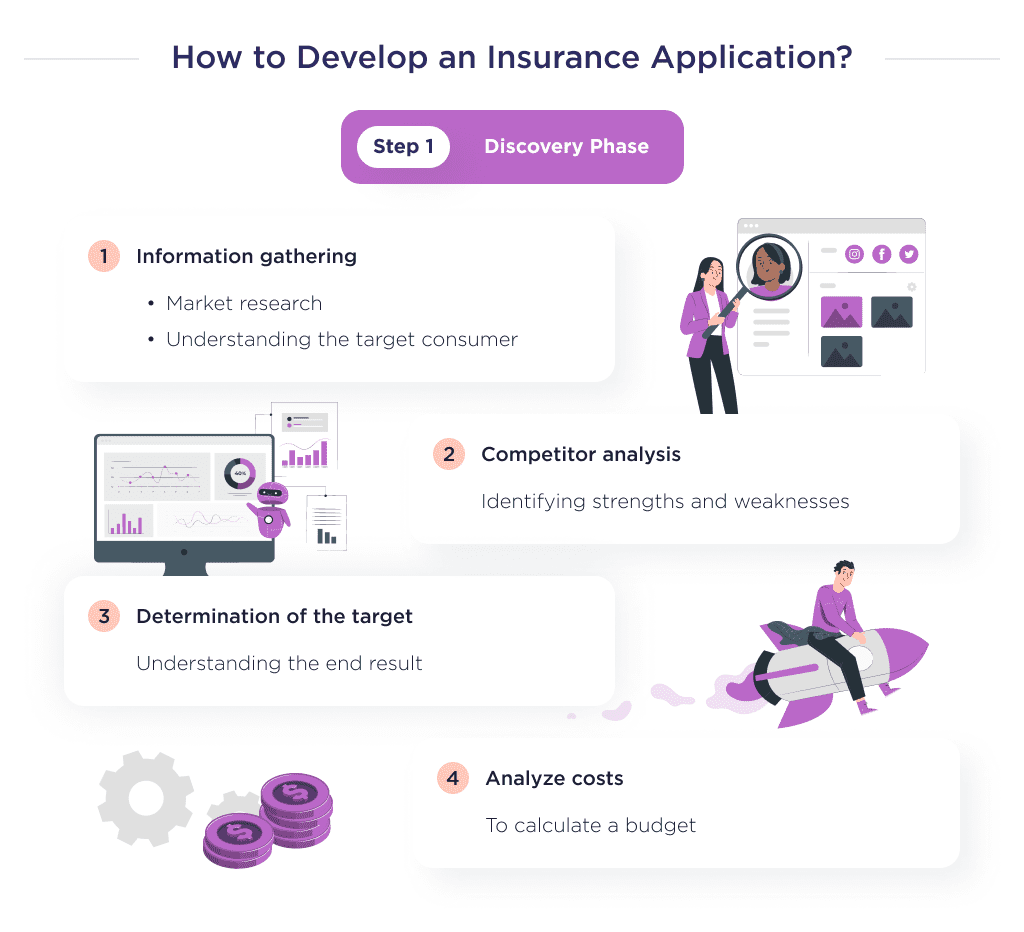

Step 1. Discovery Phase

The project discovery phase is an information-gathering stage where a team creates an upfront analysis of the insurance sector as a whole, and the development process involved.

The team also creates a blueprint of developmental activities, creates milestones, and outlines features to build.

This step ensures that team members have an apt understanding of expected deliverables. The phases involved in the step are:

| Phases | Description |

| Market Research | Poor market research is responsible for nearly half of business failures. By conducting in-depth research, you’ll know what type of insurance app to create. It also helps you understand your target market, their expectations, and what they’re ready to pay as an insurance premium. |

| Competitor Analysis | 19% of businesses fail due to competition. You need to analyze your competitors to know their strengths and weak points. Identifying their weaknesses and creating a USP or Unique Selling Proposition can create a niche for you to thrive. Here, you can explore 15 examples of insurance companies to better understand your competitors. |

| Identify your goal for being in InsurTech | According to CB insights, lack of purpose is responsible for 13% of business failures. Thus, be clear about why you want to create an insurance application, regularly analyze your goals, and stick to them. |

| Cost analysis | The insurance business is capital intensive. Thus, to increase your chances of meeting your development goals, it’s best to perform a detailed cost analysis and seek the funding needed for the development, marketing, and maintenance process. |

Although some skip this step, the discovery step is vital for founders that want the following:

- Overall cost reduction,

- Better risk management,

- Ideal validation,

- Best fit team for the development process.

Once you map the development process, the second step is app design.

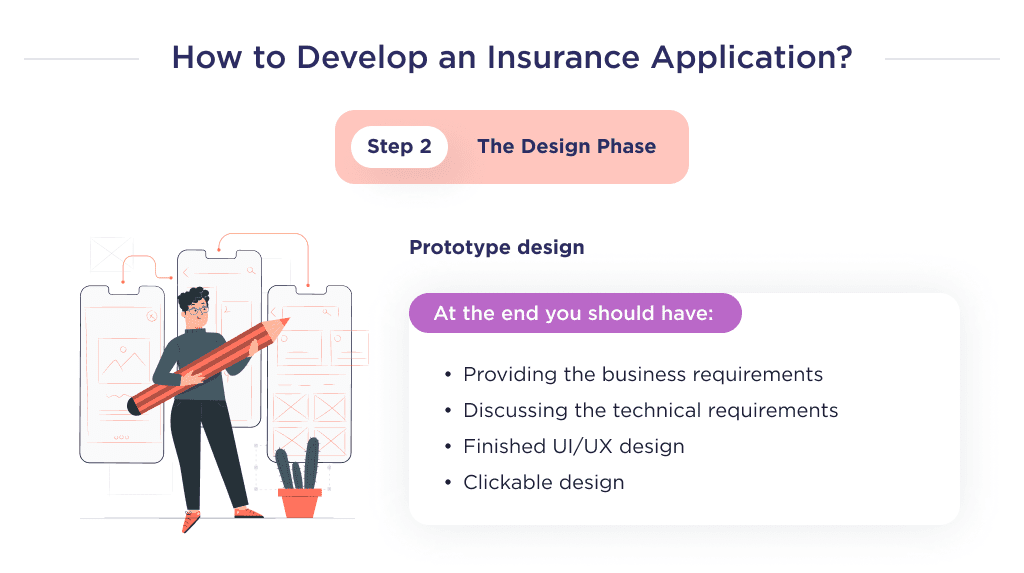

Step 2. Design Phase

The app design process aims to show how the application will work and what it will look like.

The prototype design can be used for different purposes: to adjust user flows, as a development guide, or as a fundraising presentation.

This stage is more fluid than the others, as the output may regularly require a redesign when the startup’s expectations are not met. Learn more about how to redesign an app.

However, you can read more about it in our guide on how to design an insurance app.

The blueprint in the discovery phase will give the UI/UX designer an idea of the business and technical requirements for the application.

At the end of this step, you should have these:

- A complete user experience wireframe,

- UI design for different screen types for optimal responsiveness,

- An interactive prototype, i.e. clickable design,

- An original Figma design file.

And only once the team has requirements and design, the development begins.

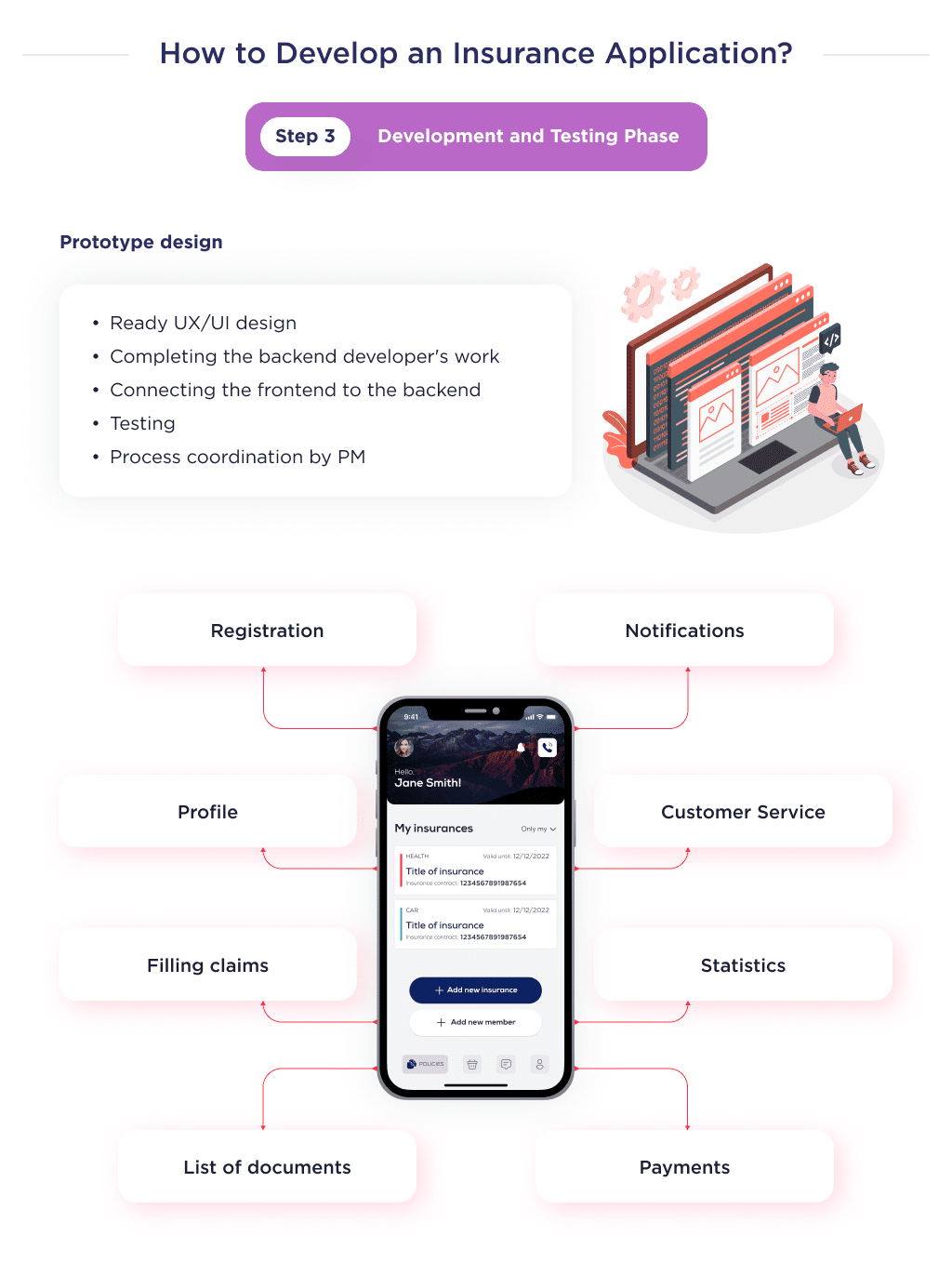

Step 3. Development and Testing

This phase entails turning the UI/UX design into a live mobile application through the efforts of the backend and frontend programmers. To ensure timely delivery, it’s best to have a project manager keep tabs on the development and set milestones for strict deadlines.

For example, you can set deadlines for the completion of server-side functionalities, another for creating endpoints, and one for integrating backend APIs.

However, a great deal of time will expectedly be spent creating server-side codes as the backend of insurance applications have to be very secure.

There has to be regular communication between the QA tester and the backend developer to ensure that the quality needed is guaranteed.

Once the development is complete, multiple tests are carried out to check for vulnerabilities in endpoints and user interfaces. Let’s give you insight into generic and niche-specific features your insurance app should have.

Example of Features to Use in an Insurance MVP

While some features are essential to all insurance platforms, others are more specific to the insurance niche. We’ll discuss both.

Let’s start with a generic mobile app:

- Sign up and sign in,

- User profile,

- List of available policies,

- In-app payments,

- Policies’ usage statistics,

- Filling a claim,

- Uploading of documents,

- Notifications,

- Customer support.

In some instances, the type of insurance service you provide determines the feature that should be on your mobile application. Below are some examples:

| Insurance App Types | Features |

| Car Insurance |

|

| Health care Insurance |

|

| On-demand Insurance |

|

| Travel Insurance |

|

| Life Insurance |

|

As we said earlier, product development is cycled. The steps above describe the whole development process and a particular iteration simultaneously.

Creating an insurance app can be complex, but these app development tips simplify the journey.

However, a new iteration’s re-start should always be based on customer feedback. Let’s find out more about it.

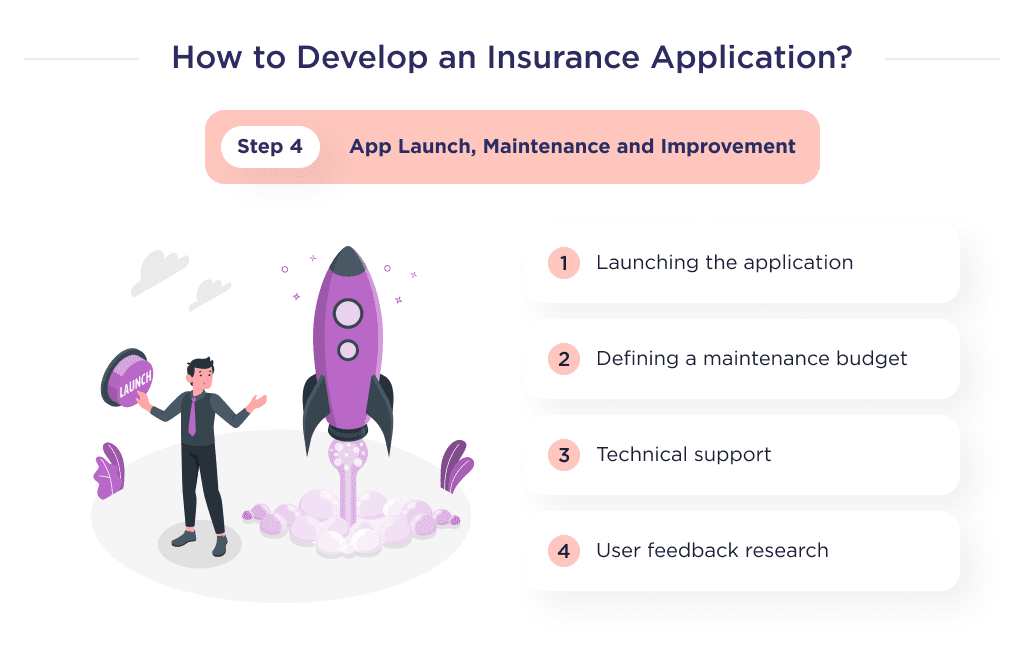

Step 4. Launch, Maintain, and Improve

The next step is to launch the platform on Apple App Store and Google Play. However, soon after the product launch, you should start applying and studying users’ feedback.

Take appropriate steps to ensure rapid improvements and updates when required. The aim here should be to ensure that multiple people use your product.

This is because the more users you have, the more feedback you get. And the more your feedback, the quality of your improvements.

You’ll continually receive feedback and inculcate complaints and suggestions to improve the platform and your insurance offerings.

Now that you understand the insurance mobile app development, let’s educate you on the team and tech stacks you’ll need.

Required Team to Build an Insurance App

The team required to develop a fully-function insurance app, irrespective of niche, include:

- Project Manager

- Business analyst

- Solution architect or CTO

- UI/UX designer

- Backend developer

- Mobile developer

- Quality assurance tester

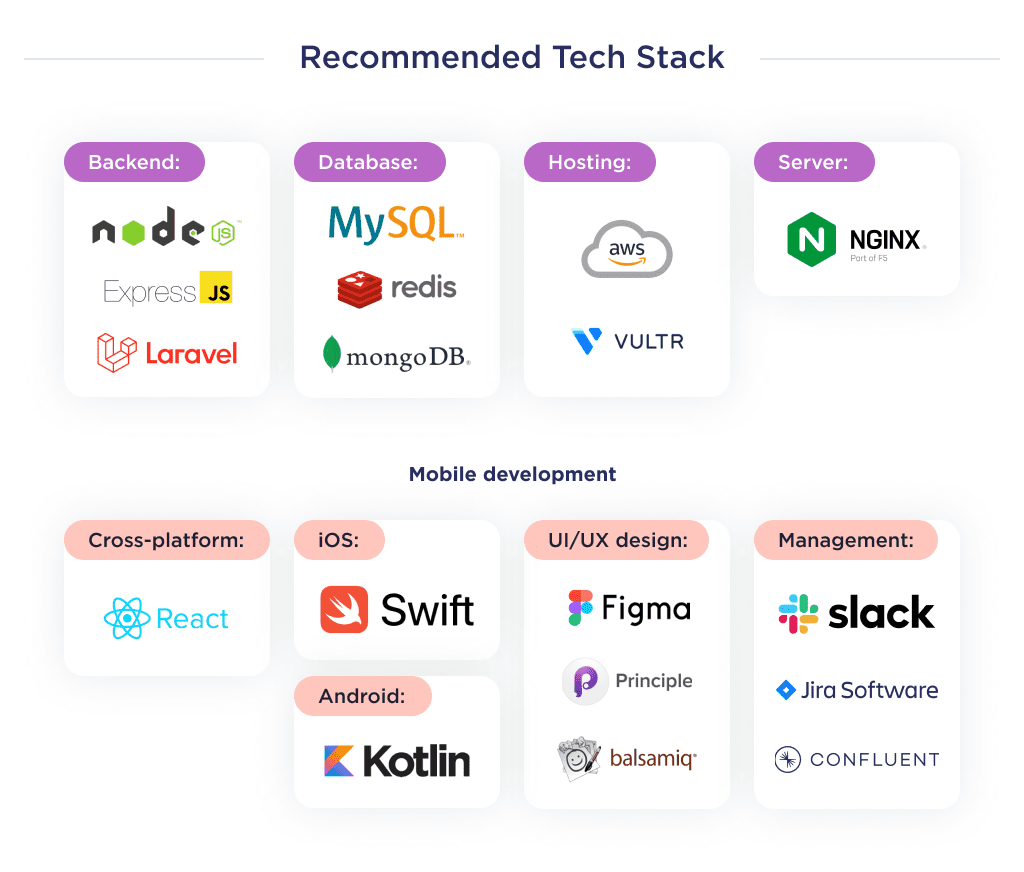

Tech Stack for an Insurance Platform

When we talk about technology stacks, the options are endless. Let’s take a look at one that we use.

What’s more, we think it’s the best one for fast-growing products:

| Type | Tech Stack |

| Backend |

|

| Database |

|

| Hosting |

|

| Server | NGiNX |

| Mobile development |

|

| UI/UX design |

|

| Management |

|

If you’re working with Laravel, these best Laravel tools and resources will streamline your workflow.

What’s next? Let’s educate you on potential challenges you may encounter.

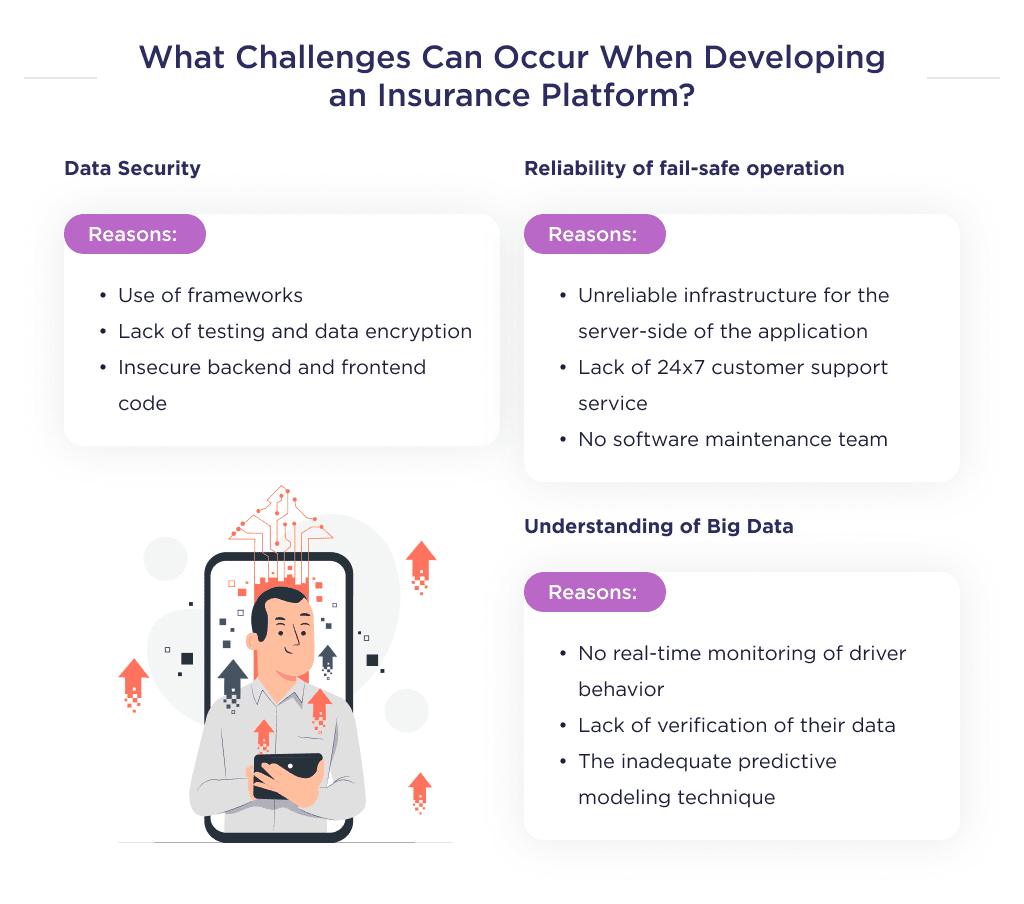

Key Challenges in InsurTech Development

Like other tech processes, creating an InsurTech solution has some challenges you’ll have to surmount for your product to thrive.

Here are the three most common issues encountered in insurance platform development.

1. Data Security

Among insurance institutions, data security is the major challenge.

A single data breach involving sensitive information can knock your product out of the market. Sometimes, it can result in multiple lawsuits that bankrupt your company.

For example, the Texas Department of Insurance suffered a significant data breach in 2018, which led to a leak in the data of nearly 2 million Texans.

The significant causes of data insecurity in product development are:

- Random use of frameworks,

- Not testing the app,

- Lack of data encryption,

- Insecure backend and frontend codes.

Once you’ve ensured top-notch data security, another challenge to surmount is uptime reliability.

From concept to creation – launch your marketplace with SPDLoad!

2. Uptime and Reliability

Cloud-based insurance platforms provide users with an avenue to reduce setup and maintenance costs.

However, not choosing the proper backend infrastructure can result in prolonged downtime, damaging your reputation, especially in an emergency.

You can overcome this challenge by:

- Picking a reputable infrastructure for the app’s backend. E.g., Microsoft Azure or Amazon Web Services,

- Have a 24/7 customer support team,

- Hire a software maintenance team.

The cloud migration discovery phase is essential for identifying potential risks and ensuring data integrity.

Another challenge has the right Big Data insights. Let’s discuss that briefly.

3. Leveraging Data and Insights

Big data insights are essential to helping InsurTech understand customer-segment risk ratio, risk modeling, and understanding the behavioral pattern of groups.

Without the right Big Data insight, InsurTechs will misrepresent risks, thereby, undercharging on premium for highly risky groups, which often leads to profit loss.

For example, Alpha Insurance was declared bankrupt in 2018 as they sold their premiums for a meager price due to misrepresentation in Big Data.

To surmount this challenge, do the following:

- Analyze with the right information,

- Vet your data,

- Adopt the right predictive modeling technique,

- Monitor real-time driver behavior.

Now that you know the potential challenges you’ll need to overcome, you are ready to start developing. But how will you choose a reliable development partner?

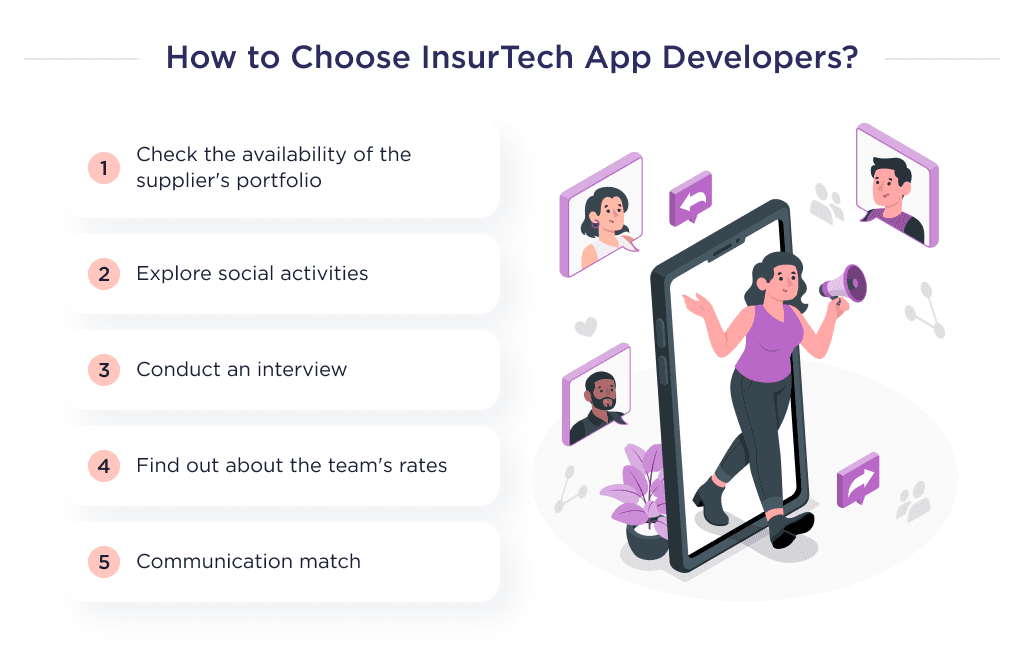

How to Choose InsurTech Developers

Let us briefly tell you how to choose a reliable agency for cooperation.

These tips are universal, and you can use them when choosing developers for any other software product.

An unambiguous and understandable selection framework consists of 3 steps:

- Check the portfolio of a potential vendor. The most notable marker is a successful track record of creating products similar to your idea. But this is quite difficult – if you want to create something new, you won’t find such a case. And on the other hand, if you focus only on domain expertise, you will be competing with existing brands. So, if you like the case studies and approach, you can continue the selection.

- Check the vendor’s background. Before sharing your request, spend time researching reviews, social media profiles, a website, case studies, blog posts, and so on. An ultimate option is to add one of the past or current agency’s customers and communicate about their work style and capacity.

- Conduct an interview. Once you have shortlisted a few vendors, it’s time to speak to them to find out whether there is a match. With a ready-made list of selection criteria, it will be easy to sort potential vendors after interviews. And, for sure, pay attention to their rates and the communication style.

Successful apps are often the result of strong partnerships. Learn how to build one in our article on app development partnerships.

Now you’re ready to start developing a new mobile insurance app.

What’s Next?

As you build your InsurTech solution, leverage our expertise here at SpdLoad.

We specialize in designing, developing, and delivering custom insurance apps on ambitious timelines.

Being a Clutch Leader in Ukraine speaks to our dedication and hard work in the software development field.

Don’t just take our word for it – browse our portfolio and reviews on Clutch to see our experience building high-quality insurance products.

Ready to bring your insurance app idea to life? Reach out for a free consultation today. We’ll provide estimates and advice tailored to your unique requirements.

Bonus Infographic

Here is a summary of our detailed guide. Learn the highlights of developing a mobile app for insurance and the factors that affect pricing.