How to Develop an Online Payment App: A Step-by-Step Guide

- Updated: Nov 13, 2024

- 17 min

If you’re reading this, you must be interested in creating a P2P payment app. You’ve come to the right place!

From cost savings to better service, the benefits of fintech are transforming industries.

This article is designed to help startup founders, FinTech executives, financial organizations, seasoned entrepreneurs, and product managers fully understand what it takes to build a P2P payment app and how much it costs.

By the time you finish reading, you’ll have learned:

- How to build a P2P payment app step-by-step

- How P2P mobile payment platforms work

- The estimated cost to create a P2P payment app

- The development process from start to finish

- And more

Thinking of adding a card payment option on your website? Discover the best options for accepting card payments on your website in our step-by-step guide on how to accept card payment on-site.

If you prefer graphics over walls of text, jump ahead to the bonus infographic.

Let’s dive in!

Start your journey with our expert developers to bring your app idea into reality - contact us today!

What is a P2P Payment App?

A peer-to-peer payment app is a platform that helps people transfer funds from one e-wallet to another e-wallet or a bank account.

However, the process of creating a modern P2P payment app is much more complicated than just sending funds from one point to another. The detailed list of features and user experience interactions should be based on the needs of your target audience.

To understand how it works, let’s learn more about types of P2P apps.

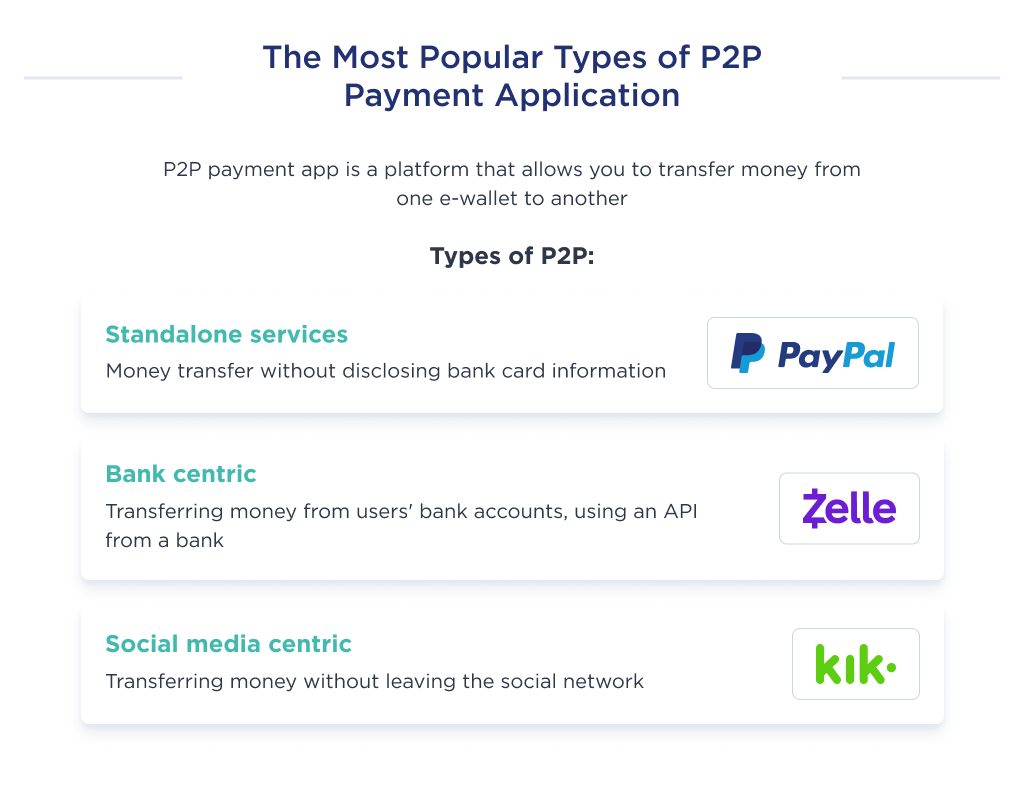

Types of P2P Payment Apps

Before you start investing in P2P payment app development, let’s consider the most popular types of such an app. It helps you to understand the requirements and finalize the concept.

| Types | Description | Examples |

| Standalone services | This type of P2P payment system is one with an in-built mechanism for enabling fund transfer.

They also have a mobile wallet feature that helps users store money before sending it to another bank account or to another app user. You’ll need to have multiple legal compliances to adhere to since you’re directly storing users’ money and aiding online payment. |

|

| Bank centric | Bank-centric applications involve banks as a party to funds transfer.

When building a banking type of app, you’ll need an API from a bank or credit card company. It moves money from users’ bank accounts instead of the platform’s account. |

|

| Social media centric | Social media-centric P2P platforms inculcate their payment systems in their social media app.

But as a founder, you could consider cloud-based application development products that are able to connect in different social media accounts. For example, Facebook has a payment feature in its messenger that lets users transfer funds while using their accounts. |

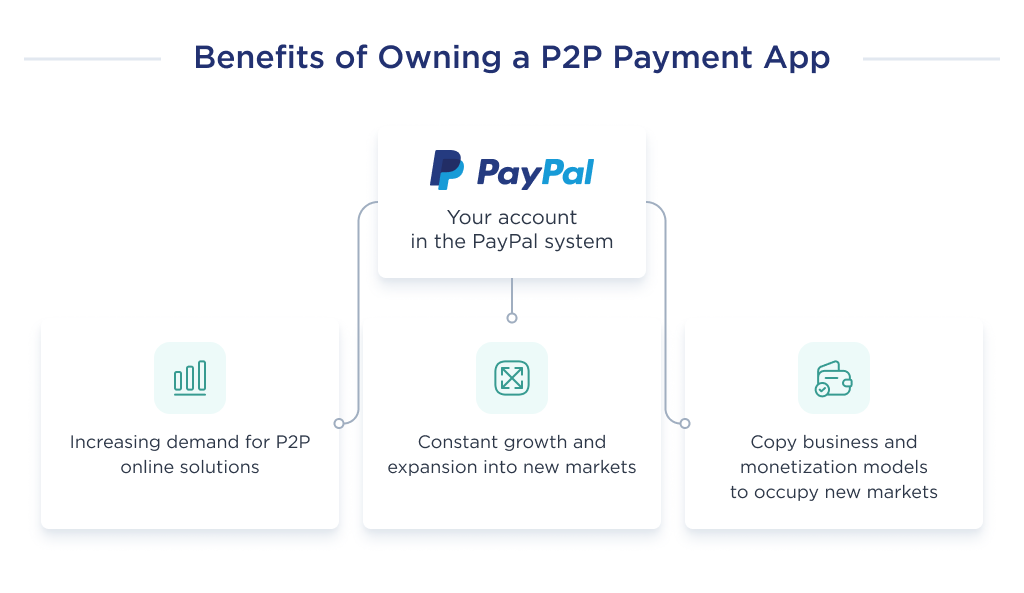

Why You Should Own a P2P App

There are 4 points that will help you to make sure – creating a P2P payment app is worthy to invest in. Let’s consider each of them:

- There is an increase in demand. Users across all age groups are beginning to demand more cashless, order-in-one-click, pay-contactless, and card-free fintech solutions; thus, the rise of P2P online solutions.

- It grows faster than other FinTech. The P2P mobile payment transaction volume will reach $785.19 billion in 2021. A real case: Revolut started in 2015 as just another P2P platform, but it currently has over a million active users and is available in over 15 EU countries.

- There are untapped niches. The financial inclusion rate is merely 69%. This means 31% of the world populace still don’t use payment solutions. By having an effective marketing strategy for this group of unbanked users, you’re undoubtedly creating the next unicorn product for your startup.Thinking of improving your marketing strategy? Use our CPC calculator to estimate ad costs and maximize your marketing spend.

- You can copycat a model for a new market. Business and monetization models like PayPal or Stripe can be duplicated to carve a niche for your P2P wallet app in a growing market. A great example – Paystack acquisition by Stripe.

We hope that you have decided on the type and found confirmation of the viability of the idea. Now let’s talk about price and the development process.

How Much Does It Cost to Develop a P2P Payment App?

The cost to build a P2P payment app varies from $100,000 to $150,00 for an MVP.

The design and development of Fintech application price is based on a complex of factors like the type of an app, complexity of workflow, number of integrations, the type and location of the team.

Cost Based on Team Type

We’ll consider the cost breakdown based on the type of team. There are 4 options.

The cost of MVP development of your P2P payment app is based on 1,500 hours.

| Team | Cost, $ |

| In-house team | 200,000 |

| US local team | 300,000 |

| Freelancers | 60,000 |

| Ukrainian outsource agency | 75,000 |

If you’re interested to find out more about an app development cost, you could use our app development cost calculator or in-house team development calculator.

Cost Based on Team Location

We’ll consider the cost breakdown based on the location of the team. There are 6 options:

| Location | Cost, $ |

| Australia | 200,000 |

| The US | 300,000 |

| The UK | 120,000 |

| Western Europe | 100,000 |

| Eastern Europe | 75,000 |

| South Asia | 55,000 |

Now, let’s dive into the P2P payment app development process.

Step-by-Step Guide to P2P Payment App Development

Developing a successful software product involves paying attention to both the business and technical sides.

Paying attention to only the tech side will leave you with a good product but poor sales.

On the other hand, paying attention to only the business side will give you lots of traction, even if you know how to start a fintech company, but your product will soon fade out of the market due to poor quality.

Thus, let’s give you an exposé of what you need to succeed in both the business and technical aspects of your P2P product development.

The Business Aspect

The business side of an ideal P2P product development entails three significant categories. These are legal compliance, business model, and marketing.

Let’s discuss each of these categories briefly.

Legal Compliance Based on Region

| Region | Legal Compliance |

| US Region | If you’re thinking of creating an online P2P product for the US market, it becomes somewhat complicated. Why?

This is because the USA has over eight federal regulatory agencies for FinTech. Also, all 50 states of the US have laws regulating financial transactions. Thus you may need a substantial regulatory labor force for the US market. |

| The UK | There is no legislation in the UK which is aimed specifically at the FinTech sector.

Any additional relevant regulatory regimes would likely be specific to the sector in which a particular FinTech firm operates. The Financial Conduct Authority makes financial regulations in the UK. |

| E.U. | The details of E.U. regulations on FinTech are expressly laid out in Directive (EU) 2015/2366.

There is a list of specific rules on how your app should manage and operate with personal and financial data. You can read more here. |

| APAC region (Asia-Pacific) | If your P2P app is for the Asian region, it’s sacrosanct that you get approval from a different nation’s regulatory body.

For China, you must get approval from the FinTech committee under the People’s Bank of China. To put your product in the Korean market, then you need approval from the financial services commission. To sell to the Australian market, you need to comply with the legal issues stipulated by the Australian Securities and Investments Commission. |

Beyond this, there are some pitfalls that might obstruct your aim to improve your customers’ loyalty and guarantee a much better user experience.

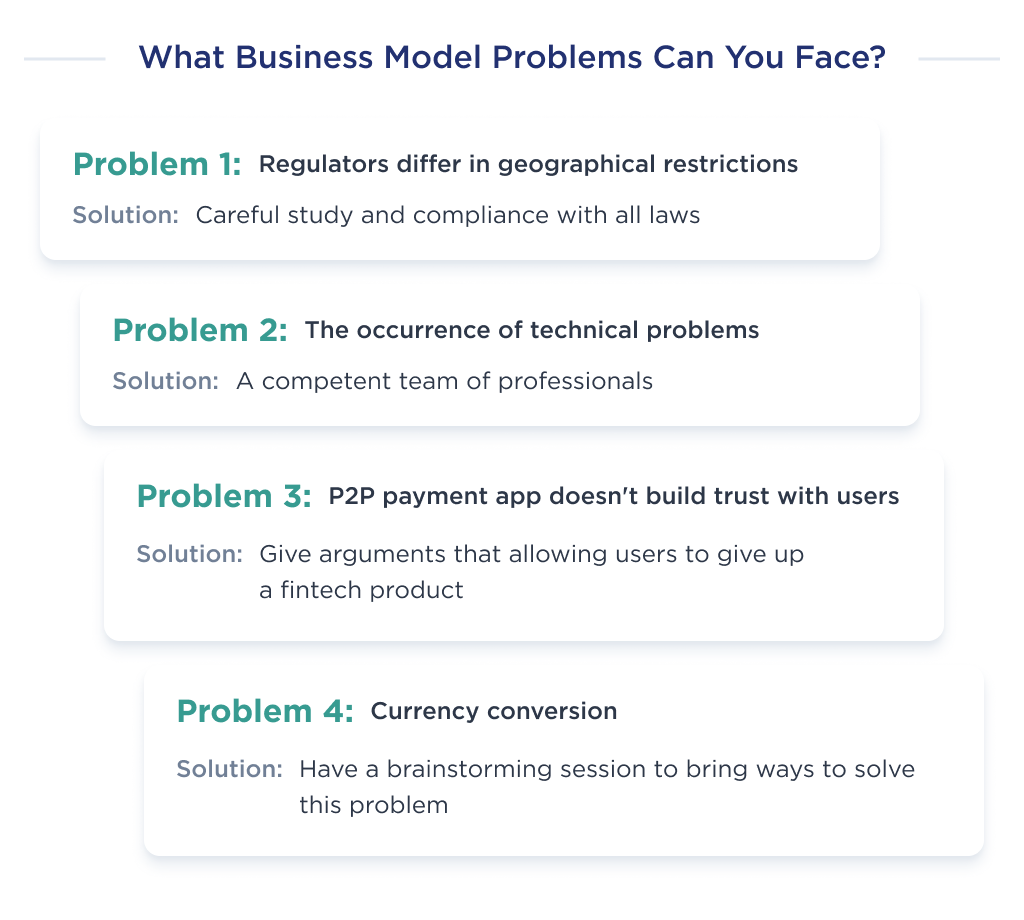

The Business Model Challenges to Consider and Solve

The challenges that you need to take into account during your P2P payment application developmental process include:

| Challenges | Description |

| Geo limitations | As seen above, each region has its distinct regulators who formulate different rules.

This regulation difference rises the cost to develop fintech app that can adhere to all financial standards. As a startup, it’s imperative to take into account all geographical restrictions when developing your P2P application. |

| Dispute settlement | Disagreement is inevitable when you’re dealing with financial transactions.

Quite often, the source of disagreement is due to technical glitches resulting in failed transactions. To remedy this problem when it occurs, ensure that you have a knowledgeable financial support team that your platform users can easily reach. |

| Conservatism | You can’t compromise on your credibility with your P2P payment app.

Some people don’t like to use a new product. As such, you need to convince them on why they should drop a FinTech product they’re acquainted with for yours. |

| Currency conversion | All international P2P apps face this problem.

There are over 160 currencies, and it’s very challenging to carry out currency swaps regularly. So, you’ll need to ruminate on the issue. |

Another thing you should consider as a startup is having a startup marketing strategy. Roughly said, you’ll need to spend x2 or x3 of a development budget to promote your P2P payment app.

If you spent $75,000 on the development, marketing would cost $150,000 annually.

Now that we’ve elaborated on what you should do from the business point of view, let’s consider the technical steps to create your P2P application.

The Tech Aspect

This side should be treated as necessary as your business side. The ultimate aim of this side is to create a highly desirable FinTech product. Let’s take a look at the details:

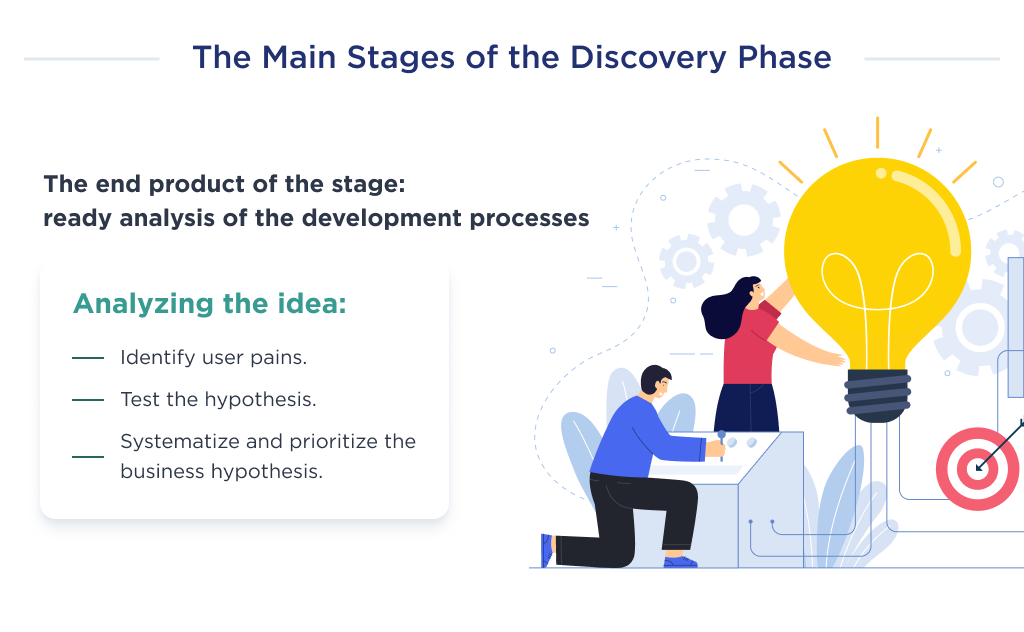

The Discovery Phase

The project discovery phase can best be described as the initial scoping stage of the developmental process.

The ultimate aim here is to undertake an upfront analysis of the processes involved in the P2P payment mobile app development.

To have a successful discovery phase, you’ll need to set up a series of meetings with everyone playing an important role in creating the product.

This phase will involve the following aspects:

Analyze Idea and Target Audience

In fact, the analysis of an idea helps to identify users’ pains. While the research of a target audience helps to find out how a hypothesis of your mobile payment app matches real life.

In terms of product management, this step of the discovery phase is called product discovery.

We generate or identify, systemize, and prioritize the business hypotheses we would like to test using our app idea via landing pages, paid ads, or an MVP in business.

We’ll use this data to develop a market-driven money transfer app as well as a basis to launch a marketing strategy.

If you are looking for ways to elevate your email strategy, our email marketing for startups tips are here to help you communicate effectively with your audience.

Conduct Competitors’ Research

Beyond the market, it’s also essential to keep tabs on your competitors, especially the market leaders. Statistics have shown that competition is directly responsible for as many as 19% of startups’ failures.

As such, competitor research helps you know their best-selling products and how you can better compete. It also gives you insight into their corporate weaknesses and how you can better position your startup to exploit that.

Crafting Custom Mobile Apps That Delight Users!

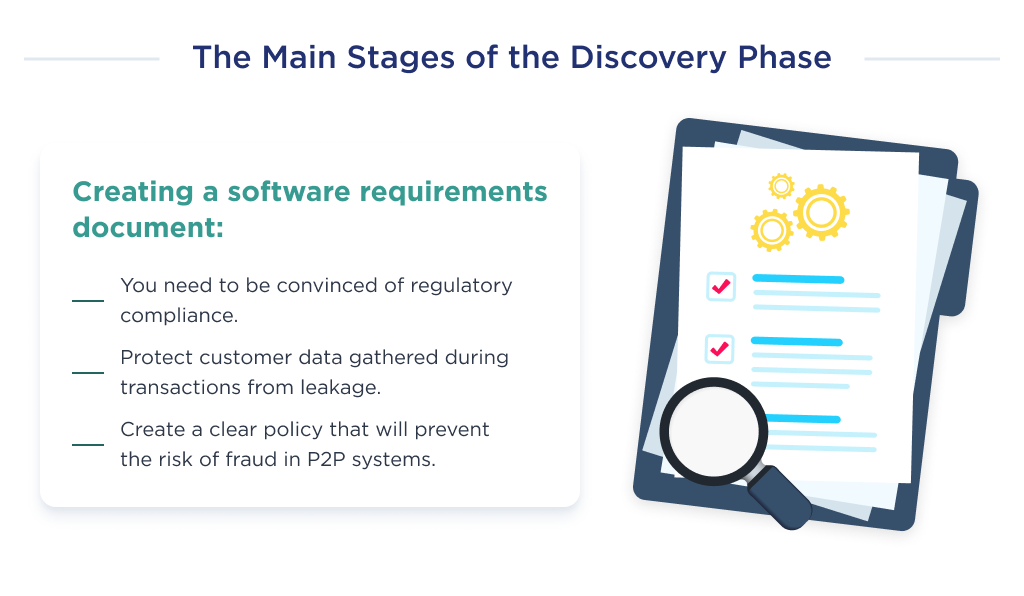

Create Software Specifications

Based on our findings of the idea analysis and competitors’ research, we’ll create a document with software requirements.

Based on this document, we’ll design a fintech app, which will be turned into your live app.

There are a few important aspects of requirements to consider.

| Aspect | Description |

| Regulatory compliance | From the stage of I have an app idea to the initiation of the development process, you must ensure the entire process complies with regulations.

Depending on the level of regulation, you may have to hire both an external FinTech regulatory consultant and an in-house regulatory team. Doing this prevents your p2p money transfer app from falling on the other side of the law. |

| User data security | The discovery phase is the ideal place to strategize on ways to keep the data gathered from user registration and transaction processes safe.

Beyond the fact that all regulatory agencies mandate this, there’s also a moral obligation to protect customers’ data from a breach. For example, standalone P2P services are subject to the Payment Card Industry Data Security Standard (PCI DSS). This policy forces startups like yourself to take actionable measures to protect user data. |

| Fraud risks | The risk of fraud in P2P systems is very high. This is no brainer as the major motivation for fraud is finance, and financial platforms offer the most reward.

Beyond costing your startup and platform users money, fraud may also lead to a loss of public trust. Brainstorm on the potential risk of fraud from outside your startup, such as identity theft and social engineering scams. To prevent this, agree on a clear policy that’ll help to checkmate major softsports for these nefarious individuals. |

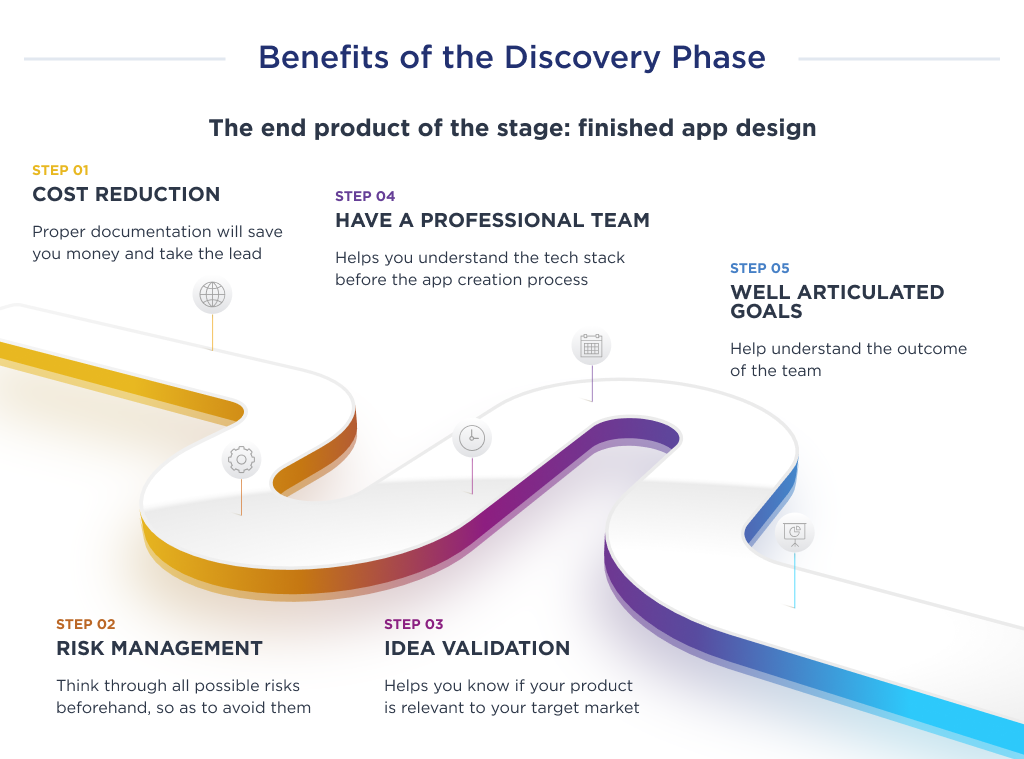

When you adhere to every aspect of the discovery phase mentioned above, you’re sure to enjoy many benefits.

Here are some benefits of a well thought out and executed discovery phase:

| Benefit | Description |

| Cost reduction | This is a very noteworthy benefit as stats suggest that 18% of startup failure is due to pricing issues.

Proper documentation with your team helps save capital, thus helping you be more effective than your competitors. |

| Risk management | Risks are inevitable in business, but you can identify and mitigate those concerns with a proper discovery phase process. |

| Idea validation | Irrespective of your idea, the discovery phase can help you know how viable the idea is.

This will help you know if your target market truly needs your product. |

| Have a reliable and professional team | Lack of a reliable team is responsible for the failure of 23% of businesses.

A well-performed discovery phase lets you have a better understanding of the tech stack you need for the P2P app development process. As such, you can hire developers for startup before the actual application creation process starts. |

| Well articulated goals | One advantage you’ll get from this phase is that all team members will have an understanding of the goals. |

I’m pretty sure that you’ll agree now that the discovery phase is indeed a vital foundational step. Now let’s dive into the next step.

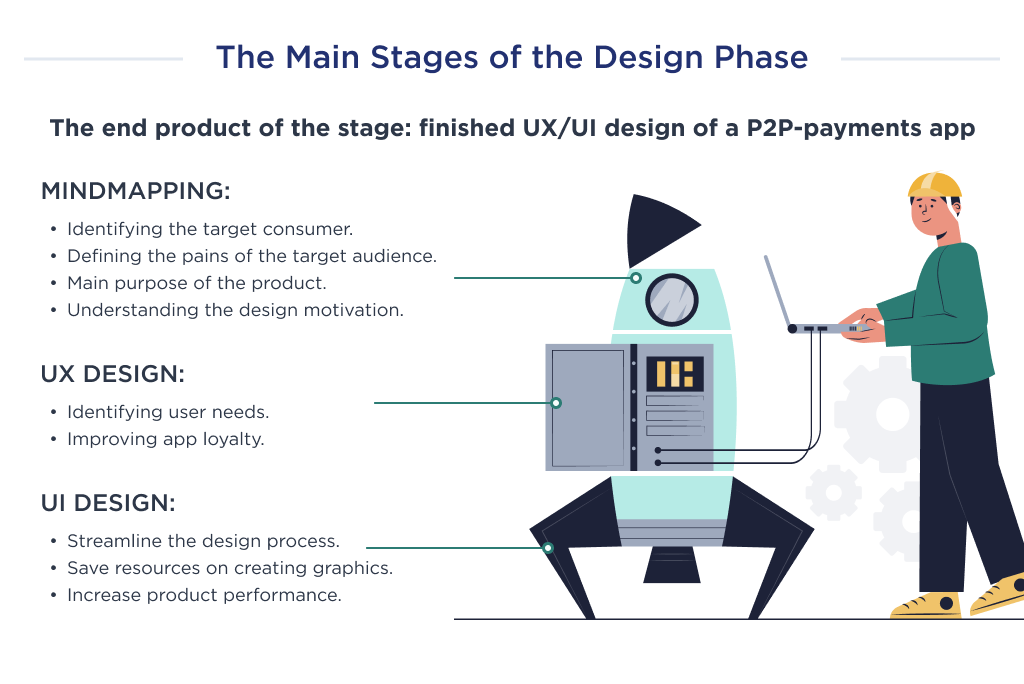

Step 2: The Design Phase

Moving on from the discovery phase, we’ve entered the app design process. It is the initial stage of the app development process.

Application design is a phase where your P2P idea will be turned into an actionable form for your software engineer to create.

The UI/UX can be beneficial to your P2P app like PayPal as it helps to increase your app users. How? It does this by improving the customer satisfaction and the user experience of your P2P app users.

It can also help build your payment platform visitors’ confidence and make them use your product. However, this stage doesn’t include much effort from you, as the UI/UX designer will perform the bulk of the task.

When planning business strategy and customer outreach, this CLTV calculator gives companies a way to see the long-term revenue potential of their customer base, making it easier to plan ahead.

There are four significant steps involved in this process.

| Processes | Description |

| Mindmapping | Upon completing the discovery process, the UI/UX designer should properly understand the founder’s vision. The main aspects of this process include:

The designer needs to consult with the founder, a business analyst, app developers, and other designers to get answers to these points. |

| UX Design | UX design stands from the user experience. While the process mentioned above helps to know users’ journeys, the UX focuses on identifying the users’ needs.

The motive of this stage is to guarantee a positive experience for users. This will, in turn, make them stay loyal to your app. Usually, UX is based on the findings of the discovery phase. |

| UI Design | A vital thing to understand here is the UI kit.

The UI kit is a library of numerous resources and graphics for designing the product’s user interface. You should provide your UI designer with a top-notch user kit as it helps them do the following:

|

Finally, once the UX/UI design of a P2P payment app is ready it’s time to develop it as a mobile application.

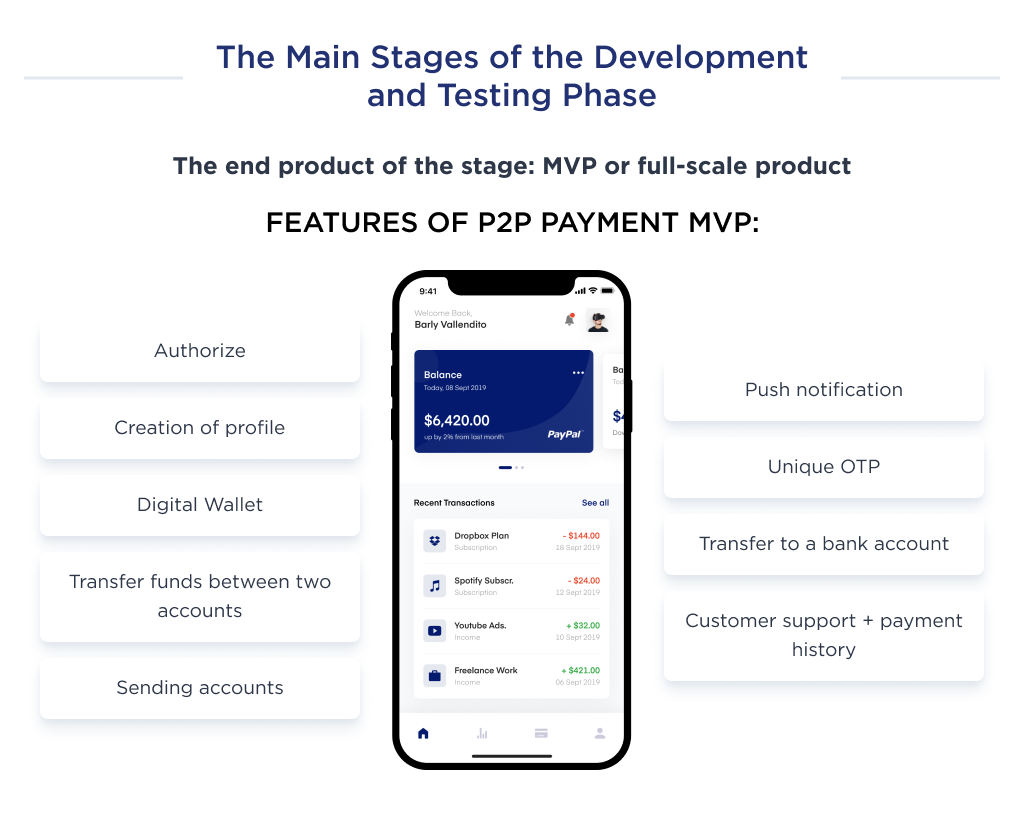

Step 3: Development and Testing Phase

Now that the design is ready, what’s next?

This phase is where the design is turned into a live P2P application. Before you begin the stage, the design phase should’ve provided a wireframe of the app screen and its connection.

You may also request an interactive prototype to understand how it feels to navigate through the app – the clearer the delivery from the design phase, the better the development and testing phase. There is an example of a prototype made by us.

The end-product of this stage should be an MVP or a full-scale product. The MVP application, which stands for a minimal viable product, introduces a new product with basic features.

The full-scaled app contains all the features that can guarantee the best user experience for your startup.

List of features for your P2P payment MVP includes:

| Features | Description |

| User authorization | User authorization is system security that permits users to access a particular function or resource. It is an exchangeable term with client privilege or access control.

As it concerns your P2P app, this feature helps to secure each transaction process to prevent interference from a third party. |

| Creation of user profile | The user profile in a P2P platform is a collection of settings and information associated with a user.

It provides a set of information for identifying the user, such as their age, photograph, and other personal details. |

| User digital wallet | This is a software-based functionality that stores the user’s payment details and passwords.

For some types of P2P applications, the digital wallet may also display details of the money on their e-wallet account. |

| Money transfers | It is a feature that lets account owners on your P2P payment application transfer funds from one account to another. |

| Send invoices | This feature allows users to request money from customers. This is particularly useful for freelancers and those in the e-commerce business.

What’s more? Transaction fees are often low, making it one of the most user-friendly means of receiving payments for online businesses. |

| Push Notification | The notification feature helps to call the attention of the user to the app. It’s a sound that the user hears when an action occurs on the payment app. |

| Unique OTP | An OTP, which stands for one-time-password, is an automatically generated alphanumeric or numeric string of characters.

It uses a unique id to authenticate that a transaction should be permitted on the online platform. A type of OTP is two-factor authentication. |

| Bank account transfer | Apart from e-wallet to e-wallet account, users should also be permitted to make real-time direct transfers to a traditional bank account. This feature improves the acceptability of your app. |

| Customer support | Customer support is a feature that answers customers’ inquiries. If you’re keen on guaranteeing maximum satisfaction, here’s a must-have feature.

A typical example of customer support to have is live chat. For startups, using a CAC calculator is essential to monitor customer acquisition costs. |

| Payment history | This feature provides users with a record of all past transaction history. |

Find the best TypeScript developers for your project.

If you’d rather have a more encompassing P2P platform, then you can add a cryptocurrency wallet to your features.

This will enable users to store and send cryptocurrencies like Bitcoin, Ethereum, or other altcoins., to other crypto app owners through blockchain technology.

Another advanced feature you should consider is a chatbot. A chatbot is a functionality that helps.

Let’s pay attention to the app launch.

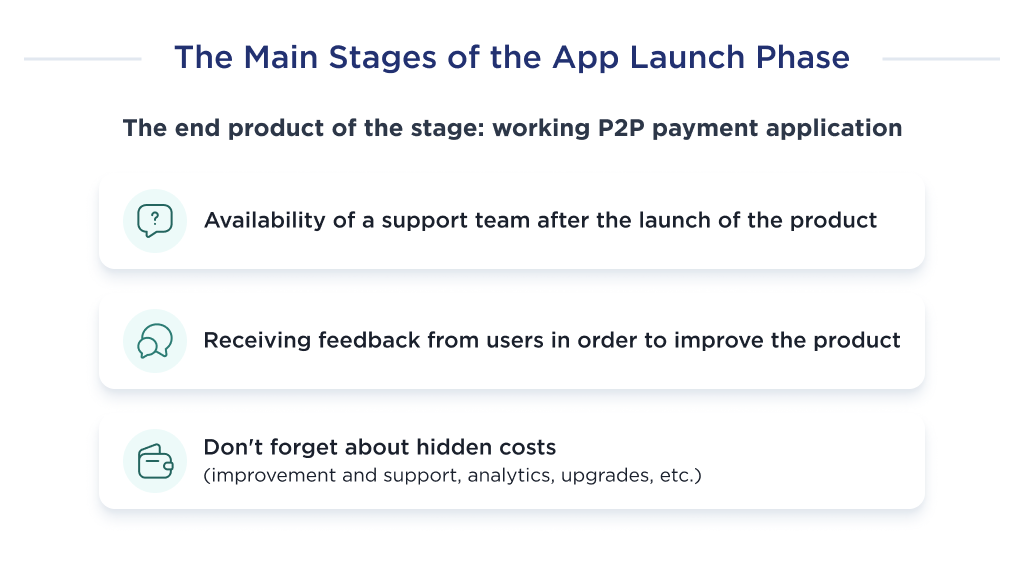

Step 4: The App Launch Phase

The entire development process will be futile without releasing your P2P app for use. The product launch phase is integral to the existence and profitability of your startup.

However, you shouldn’t rest on your oars after launching the product, as just like every other product, a great deal of effort has to be expended on maintenance and product scaling.

To properly maintain your app, you need a standby support team.

Ideally, the budget for support should be 25% of the cost of developing your P2P payment service. So, if the cost of building the app is $100,000, then maintenance will be $25,000 yearly.

What should be the goal here? Make sure that many people from your target market use your product. The more users you get, the more feedback you’ll receive.

And with a large number of feedbacks on P2P transactions, you can make improvements that truly address your customers’ concerns.

Whether your P2P app is for Android, iOS, or cross-platform, the bulk of your budget will be expended on these:

- Feature extension

- Enhancement

- Support & maintenance

- Analytics and monitoring

- New features

- App upgrade

Now let’s talk about the structure of a development team and tech stack.

Struggling to pick technologies for your project? Discover how to choose a tech stack with our expert advice.

Required Development Team and Technologies

The team you’ll need to make this a reality include:

- Project manager

- UI/UX designer

- Business analyst

- Mobile developer

- Backend developer

- QA tester

An example of a tech stack you’ll need for the developmental process are:

- Backend: Laravel

- Admin panel: Javascript and Laravel Nova

- Mobile development: Java for Android app, Swift for the iOS app, and or React Native for a hybrid app. To learn more about iOS development, take a look at these best iOS development tools. Make sure your project is financially sound by reviewing the various elements that influence Android app development costs.

- Payment gateway: Stripe, Paypal, Braintree, Mastercard, and other options

- Geolocation: Google Maps API

- Server: AWS (discover the strengths and weaknesses of Digital Ocean, AWS, and Google Cloud to find your ideal match.)

- Utilities: Firebase, Twilio, Facebook SDK, and Google SDK

This article on the best Laravel tools and resources includes essential frameworks and libraries.

We have one more important question to cover.

How to Choose the Right Development Partner (Checklist)

The app development partner you’ll be working with must be an expert in both the development and business aspect of product management. Otherwise, the quality and success-on-the-market is a big question.

So think through the type of cooperation in P2P payment app development you’re looking for: a dedicated team of developers or a turnkey solution provider.

There are 3 points you must pay attention to:

- The development expertise. The level of designers and developers you’ll be working with. The best way to find out is to conduct an interview. The ability to speak a common language is the most important sign.

- The successful cases. Another point is the number of successful products. Yet, it is less crucial, if the team could handle your project.

- Social proofs. Check the portfolio, different platforms like Clutch and GoodFirms, as well as testimonials from existing customers.

The process of choosing is quite simple and, in fact, the same as for choosing a service provider in any other niche.

Need a Reliable App Development Partner?

There you have it – everything you need to know about building a successful P2P payment app.

At SpdLoad, our talented team of 70+ experienced app developers can design, build, and deliver an intuitive, user-friendly P2P payment app for your startup.

We’ve helped dozens of happy clients launch and scale innovative FinTech solutions. Don’t just take our word for it – check out our Clutch reviews and product portfolio.

Schedule a quick product discovery call with our team to kickstart the development process for your dream P2P application.

The future of safe, easy payments is now.

Bonus Infographic

Here you’ll find a summary of our in-depth guide. Learn the highlights of the P2P payment application development process in 2025.

If you’re looking to build a stock trading platform, our article on how to build a stock trading platform covers all the key aspects.