6 Steps to Starting a Fintech Company (+Real Examples)

- Updated: Nov 08, 2024

- 15 min

Are you a startup founder, product manager, or serial entrepreneur with big dreams of launching your own FinTech company? Eager to get a step-by-step guide to building a FinTech startup from the ground up?

If so, you’ve come to the right place. This article will explain:

- What it takes to start a FinTech company

- Steps for creating a robust FinTech startup

- How to assemble a top-notch app dev team

- What the FinTech app development process entails

- And more.

Let’s dive in!

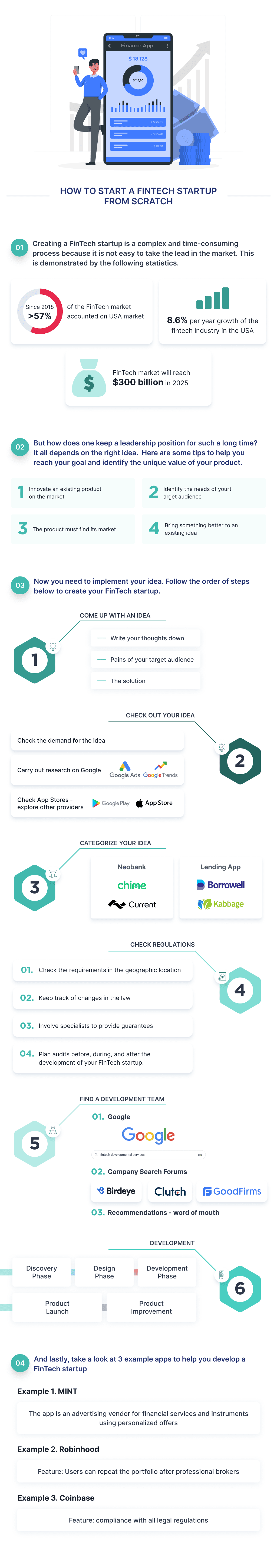

If you’re a visual learner, feel free to skip ahead to the bonus infographic.

Start your journey with our expert developers to bring your app idea into reality - contact us today!

What’s Involved in Launching a FinTech Startup?

With so many benefits of fintech, it’s no surprise that companies are adopting it rapidly.

Starting a FinTech startup entails more than meets the eye. From product launch and marketing to legal compliance, it’s never as simple as it seems.

However, beyond this complexity is a very viable market of financial products. Do you doubt that?

Have you considered the impact of small business statistics on this sector’s growth potential?

Check out the statistics in the section below.

FinTech Market Stats

FinTech is transforming the financial sector at a rapid rate. It impacts how people use their bank accounts and credit cards, invest, lend, or purchase insurance.

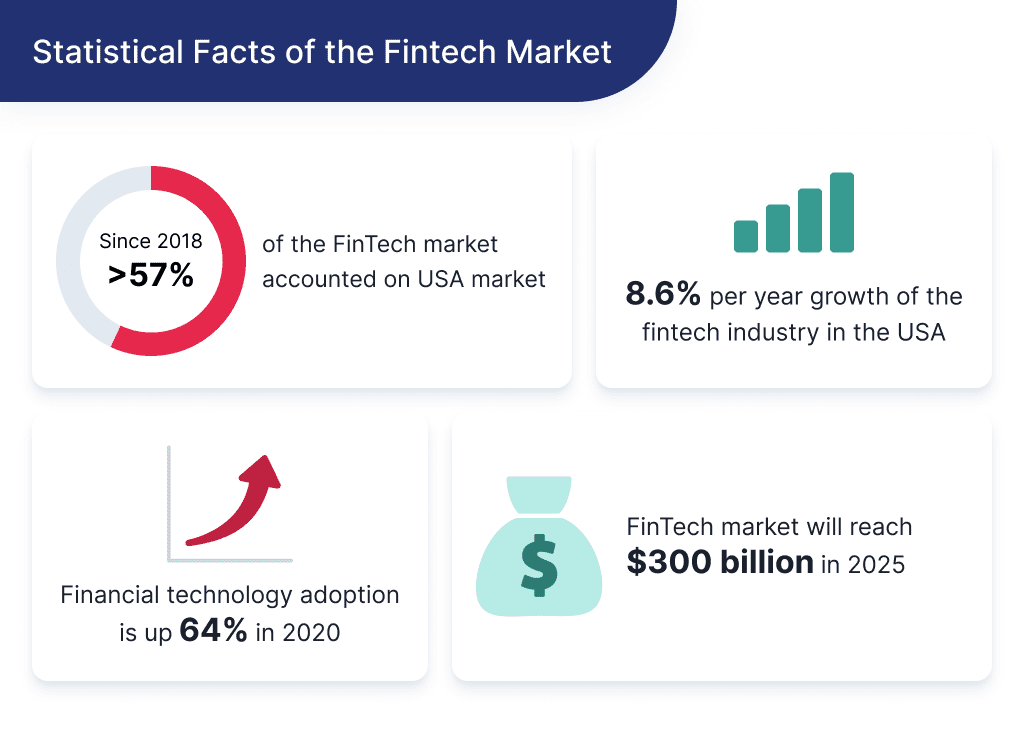

Since 2018, the United States has consistently accounted for more than 57% of the FinTech market.

US-based consumers have highlighted some key benefits they derive from the fintech industry. These benefits include better financial security, simplicity, transparency, personalization, and innovation.

Based on the statistics from Mordor Intelligence, the FinTech industry in the United States has been growing at a CAGR of 8.6%. This growth is expected to continue till 2025.

Here are other impressive FinTech Statistics:

- FinTech market size is going to reach $300 billion by 2025

- Over 10,000 FinTech startups exist

- The adoption rate of financial technology rose to 64% by 2020

- Two-thirds of financial transactions are made online

- Stripe is the largest venture-backed FinTech company, and it has a current valuation of $95 billion

- FinTech online payment services are the backbone of e-commerce.

I’m pretty sure you are impressed with those statistics. Now let’s give you hints on how to formulate the right idea to make your startup a beneficiary of these numbers.

Want to join the booming eCommerce market? Learn how to develop an eCommerce app that meets customer needs.

Delivering Unique Value

A successful startup is one that executes and implements the right idea with the right mindset.

Let’s consider Stripe, for example. It launched in 2009 with just an initial sum of $2 million. However, in 2021, the company is estimated to be worth over $95 billion. But how did they do it?

The keyword here is “product value.” In other words, the benefits your target audience gets from the use of your application.

Want to know a full-proof way to create a product value? Check below:

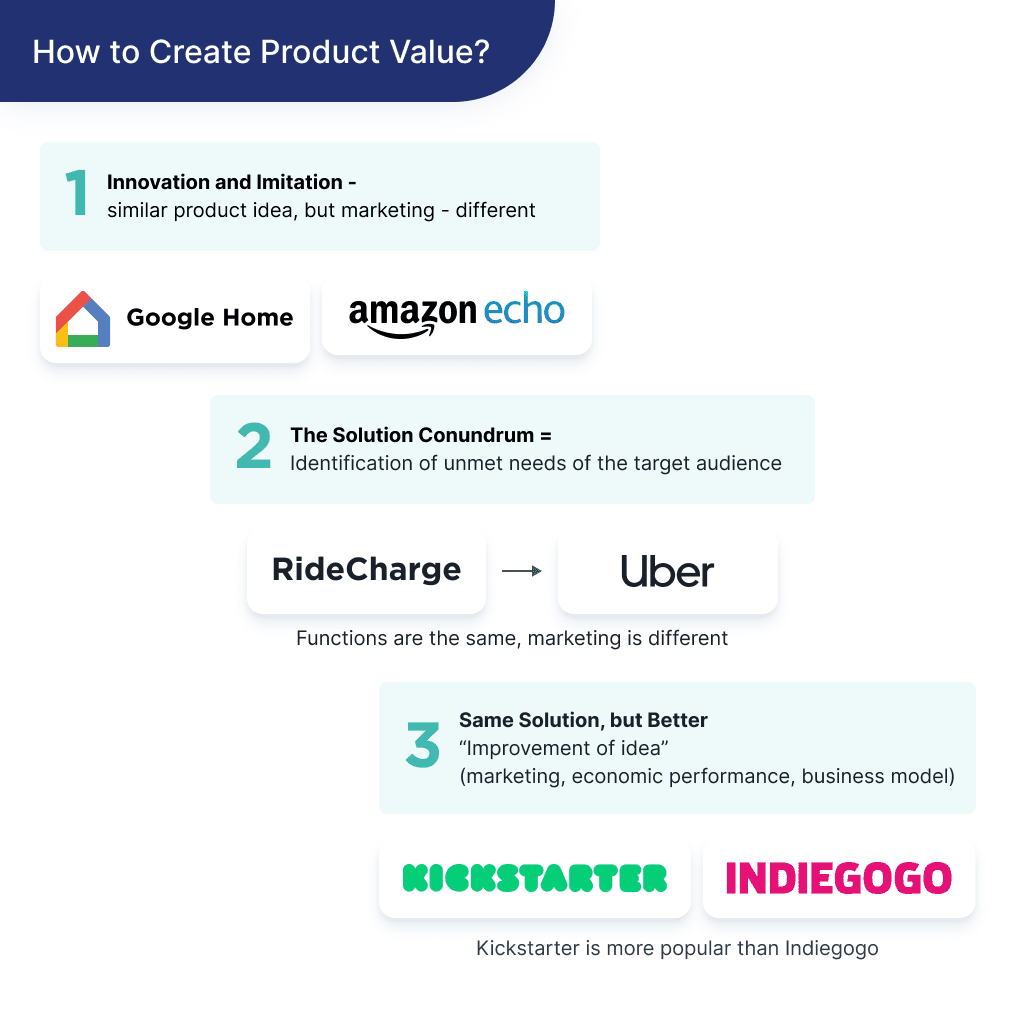

| Approach | Description |

| Innovation and Imitation | Even the most prominent brand you know copies and integrates other apps as its solution. For example, there’s a very different operational replica between Google Home and Amazon’s Echo. There is really no unique way to generate product ideas. However, the ability to copy and tinker is one proven way to create a start-up. Think of it that way. There are many similar apps when it comes to mobile banking app development in FinTech. But the target audience, monetization, and ways of user acquisition may differ. |

| The Solution Conundrum | A more prominent way to come to the stage when you can say I have an app idea is by finding solutions to well-known problems. This approach is based on the ability to identify the unmet needs of the target audience. The most prominent example is Uber, which has created a compelling and fast-growing ride-sharing model. Providing value to both audiences: passengers and drivers is key. However, finding a solution is only half the battle. Have you ever heard of a startup called RideCharge? Probably not. This company existed way before Uber, and it carried out precisely the same function as Uber. But what made Uber a success and RideCharge the opposite? It’s marketing. And this is important to understand. A new solution often requires new approaches to promotion. The product has to find its market, and the target audience has to understand the product and find value in it. |

| Improve existing solution | Check out this example to understand how to make a more valuable product from another. Kickstarter and Indiegogo are two FinTech startups that offer the same service – crowdfunding. It’s easy to believe that Kickstarter joined the market first. However, Indiegogo launched first, then Kickstarter picked up the idea and “made it better.” The “better” in this case may be under the hood: the marketing approach, the business model, or the unit economy metrics. But the fact is that Kickstarter is a more popular platform than Indiegogo. |

Now that you know the importance of a product value and how to create it, let’s dive right into the steps to starting a FinTech Startup.

How to Start a FinTech Company

Now that you understand the viability of Starting a FinTech Start. The next step is to start taking steps to create your FinTech startup. Here are the steps to follow so you can get that done:

- Come up with an idea

- Validate your idea

- Categorize your idea

- Check regulations

- Find app development experts

- Start an app development

Now let’s consider the nitty-gritty of what each step entails:

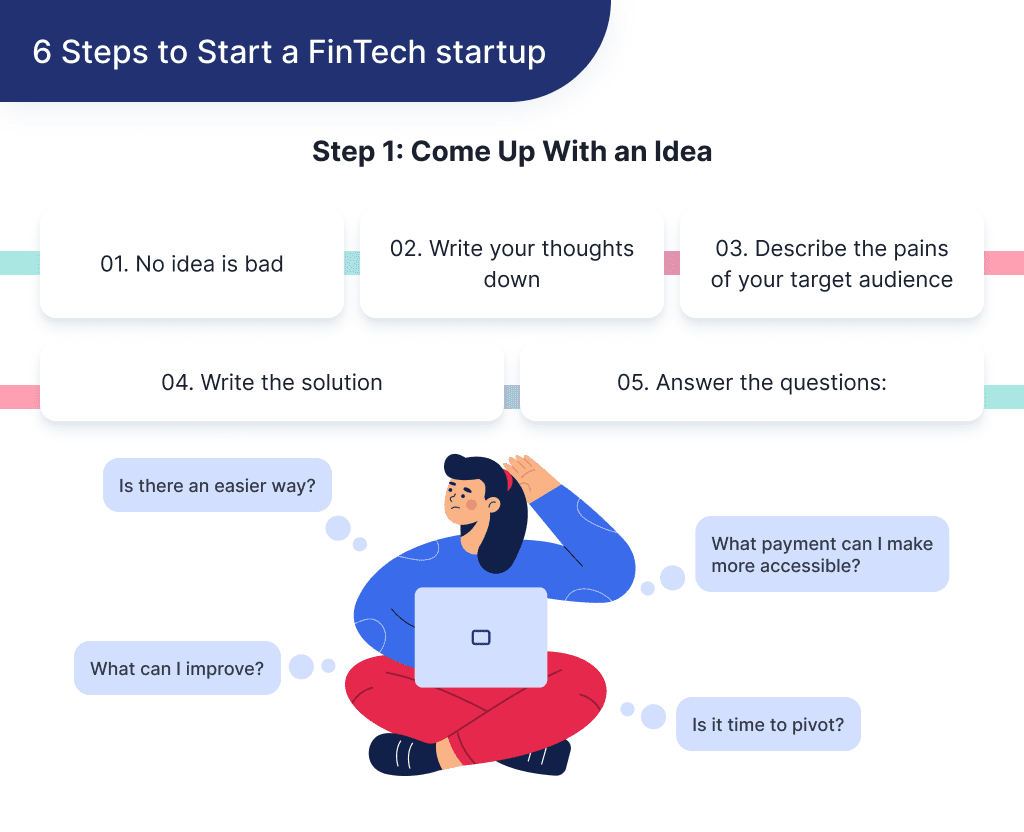

Step 1: Come Up with an Idea

Every venture begins with an idea. To create a unicorn startup, it’s imperative that you first ruminate on a cut-throat idea that can disrupt the market as you desire.

If you’re an aspiring FinTech startup founder, you should brainstorm yourself or with your decision-making team. Remember the great rule of brainstorming: no idea is wrong. You should consider all possible ideas for fintech startups that could occupy the market.

Jot your thoughts down as they flow so you can further streamline your ideas to the most viable ones.

Consider the pain points of your target market that other financial institutions find difficult to solve. Then proffer solutions to this problem.

To come up with a perfect idea for your FinTech, you should ask the following questions:

- Is there an easier way to X?

- What payment can I make more accessible?

- What can my product improve?

- Is it time to pivot?

Question 1. Is There an Easier Way to X?

FinTech services introduce ease to many financial processes.

For example, Paypal became a successful product because it makes financial transactions super easy. More accessible than traditional banking.

Thus Paypal rose from a great idea on paper to a company with a $51 billion net asset.

Question 2. What Payment Can I Make More Accessible?

Another way to create value is to ruminate on payments you can make more accessible.

For example, numerous payments are still made in cash. You can create a means to make such payments accessible by creating a mobile app for those services.

It’s that simple. You just have to come up with an idea that’s impressive enough.

Question 3. What Can My Product Improve?

Have it in mind that nothing is perfect. That awesome product that’s making waves in the FinTech sector right now can still be improved upon.

Create a detailed list of companies you admire and consider some things you can improve about them. Also, be aware of the latest key FinTech trends to take a nudge from this one.

Some things you can improve about a FinTech product include product features and its delivery process, cost, and customer experience.

Question 4. Is it Time to Pivot?

If you have an original idea, and the market seems to demand an upgraded version of your idea, then you must pivot. To pivot means to change the core of your idea to meet the product/market fit. Each and every startup do pivots: Slack, YouTube, or Groupon.

The reason to pivot lies in the basis of the build-measure-learn feedback loop: you have a set of hypotheses to test. Start with the riskiest ones. If they work, keep developing them. If they don’t work, discard them as quickly as possible, and start creating new hypotheses to test.

Changing from one set of hypotheses to another, up to and including a complete rethinking of the original concept, is called a pivot.

Knowing when to pivot can help your FinTech startup last longer than other competitors in the finance industry.

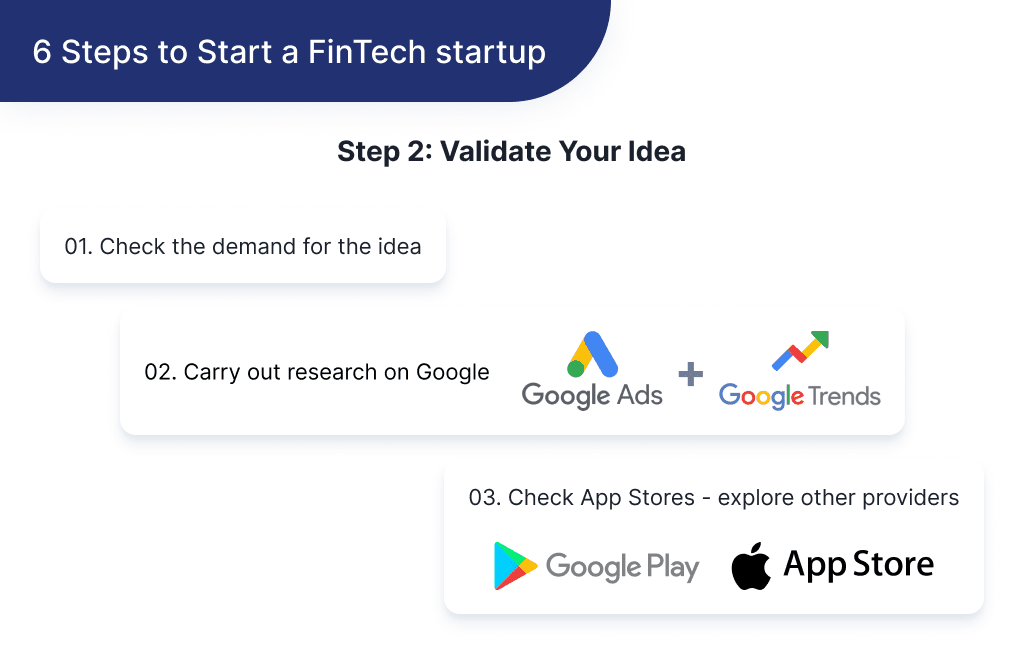

Step 2: Validate Your Idea

Idea validation is a step that helps to identify the viability of your idea for free or in a cheap way.

Once you’ve carved out a FinTech idea, it’s time to answer the question, “Will it work?” Also, is there a demand for the idea you just came up with?

All that’s what you’ll learn in this step.

Carry Out Research on Google

Google has two special tools that can help give you insight into the demand for your product. These tools are Google Keyword Research and Google Trends.

Google keyword research is not just a tool for SEO experts; it can also give you an idea of your product demands. How does it do this?

This tool is a Google-owned product that can help startup owners to know what’s in demand.

Google Keyword Research allows you to search for phrases and keywords related to your product.

It then displays the number of searches that these keywords and phrases have. It can help give deep insight into the demand for your product.

On the other hand, Google Trends helps you know how much people are searching for your FinTech product.

It’s the easiest place to start with and can give you a hint whether you’re selling a trendy product or not.

For example, if you plan a cryptocurrency application, it will give you an idea of whether the search trend is increasing or not. The same will work with your other ideas for developing a fintech app.

Check App Stores

As a FinTech, most of your product will end at an app store, whether the Google Playstore or the Apple Store.

And since it is not all apps that do well, you’ll want to ensure yours belong to the top-performers.

Also, App stores can be a great place to survey other service providers in the same niche as you. It allows you to see the most downloaded FinTech apps solving similar problems with your product.

After which, you can make a detailed comparison to know what makes them highly sought after.

You now have some pieces of information about your idea. The next step is categorizing the concept to scale it into a useful and acceptable product.

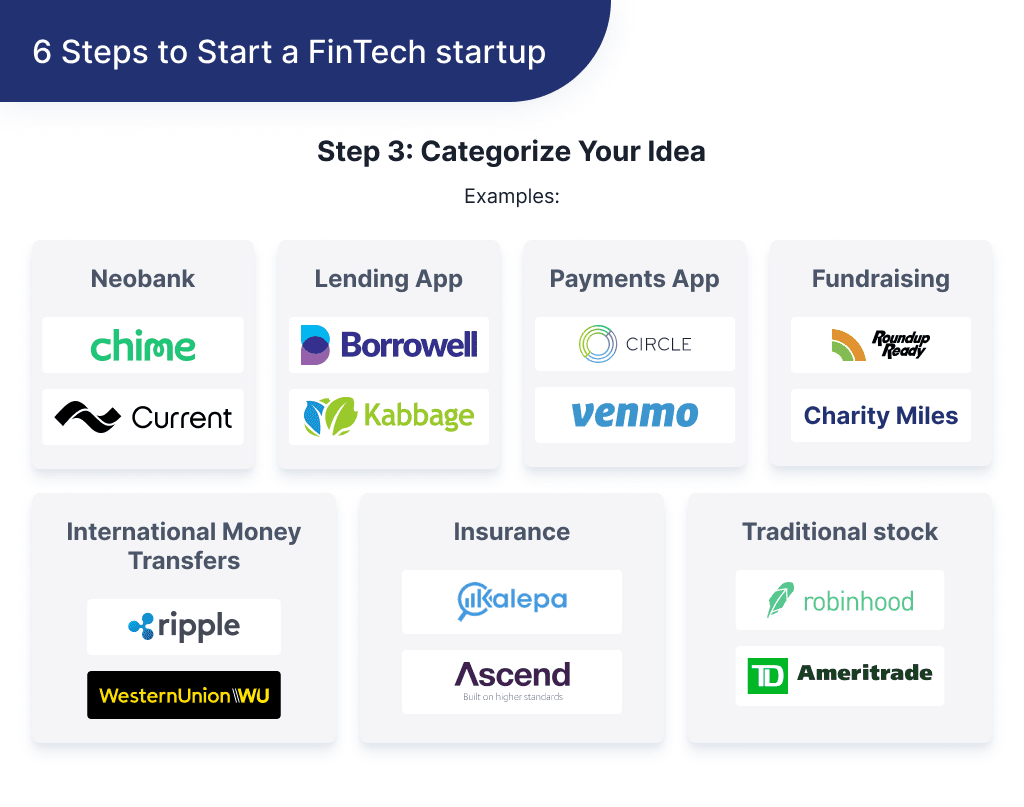

Step 3: Categorize Your Idea

What do we mean by categorizing your idea?

If you thought of an app that can help people to invest in agriculture businesses, then that’s an investment app.

Let’s take more examples to help you understand better:

| Type of Idea | Description | Examples |

| Neobank App | A neobank is a type of digital bank that doesn’t lack a physical location. Neobanks don’t have banking licenses on their own, but they depend on other commercial banks to operate. Neobanks have been making better headway nowadays due to the shift in customers expectations. Financial services customers now demand a better user experience, something that most traditional banks have been finding difficult to guarantee. The development of a neobank is perfectly suited to fill in this gap. |

|

| Lending App | FinTech startups with lending apps simplify how people borrow money. Some decades ago, people had no choice but to visit a bank or credit union for loans. However, with the rise of loan lending app development, new apps help people obtain loans online without the need to approach traditional lenders. Also, their systems are automated. This makes approval very swift. FinTech startups with lending apps access customers’ creditworthiness through advanced software. |

|

| Payments App | FinTech startups with payment apps help people send money without passing through banks. These apps are much cheaper to use. This is because they don’t charge exorbitant prices for a basic peer-to-peer transaction through API. Quite often, these apps are built by leveraging the power of blockchain technology. |

|

| International Money Transfers | As the name indicates, they help people make international transfers. This type of startup offers faster international transfer than most companies. Apps that belong to this category should comply with anti-money laundering acts. |

|

| Insurance | Insurance FinTech startups use technology to offer insurance services. InsurTech, as they’re more fondly called, explores avenues that large insurance firms don’t exploit. See 15 examples of insurance companies that are successful. When reaching for insurance app development services, keep in mind that InsurTech startups now use Artificial Intelligence to handle brokers’ tasks and formulate the right insurance mix for clients. InsurTechs offer a relatively cheaper insurance model than most insurance companies. For insurance companies looking to innovate, car insurance app development is a game-changer in customer engagement. |

|

| Fundraising | Fundraising apps help people to pull funds together in support of a common cause. This money can be for charity or to support a business. Unlike investment apps that offer ROI, this is purely charity investment as there’s no ROI. For example, an individual can open a crowdfunding account to pay for medical bills. Planning a crowdfunding platform? Learn what goes into crowdfunding website development. |

|

| Trading | Traditional stock trading seems so big and distant to many. However, trading FinTech startups closes the gap between average persons and the stock market. Some startups offer an opportunity to purchase international stocks. Trading FinTech startups partner with PSPs for payments. This enables them to purchase stocks internationally. Trading on this app is so easy that traders can start with just a few dollars and watch their funds grow with time. If you’re looking to build a stock trading platform, our article on how to build a stock trading platform covers all the key aspects. |

|

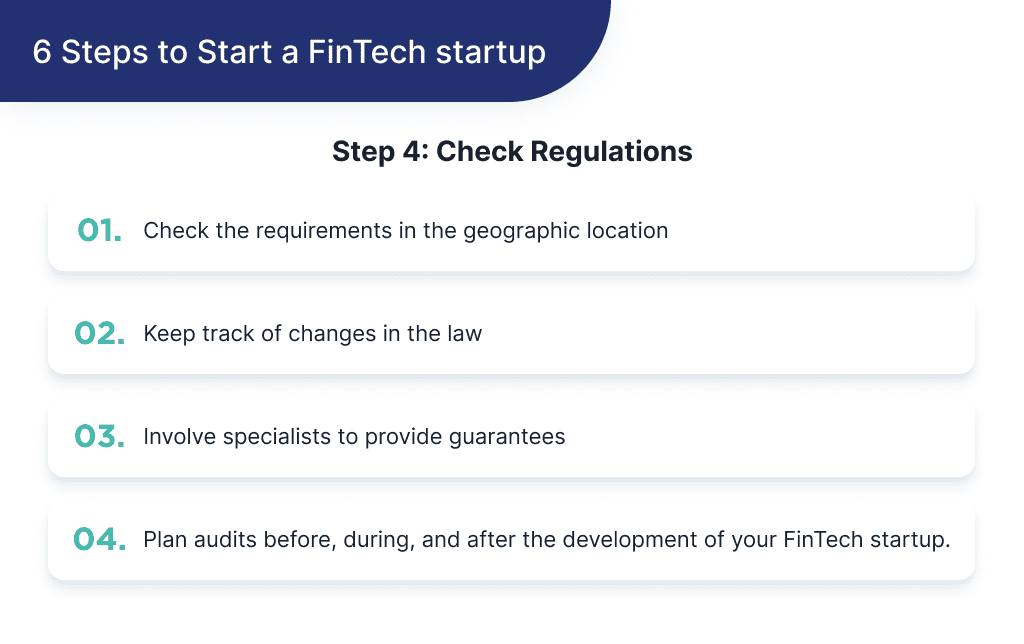

Step 4: Review Regulations

Before you launch your product, it’s necessary that you first check the applicable regulations.

Once the regulation stipulations seem within your reach, you can then take steps to create your FinTech startup.

Take time to check for regulations within the geographical location where the app will be used. For example, a product with usage in Europe has to conform with the GDPR act.

It’s not just enough to meet up with Fintech regulations; you should also constantly monitor regulatory changes while building your product.

Depending on the sensitivity of the app you’re building, you might want to take some extra steps. Here are some extra steps to properly vet regulatory requirements.

Access premium design and development services for unmatched success.

Involve Specialists

It’s quite common to see small businesses and growing organizations breaking laws unintentionally. To avoid this, have a transparent operational procedure.

It’s also advisable to employ specialists and consultants to guarantee that everything is in order. This enables founders to ask questions when necessary.

Schedule Regular Audits

Schedule regular internal audits before, during, and after building your FinTech startup. Your internal audits should focus on technological, operational, financial, and regulatory aspects.

Ensure that your internal auditor is independent of any internal and external influence. Also, the auditor should adhere to the generally accepted auditing standards.

Once you’ve acquainted yourself with necessary regulations, you can then move to the next step by finding a knowledgeable app development team.

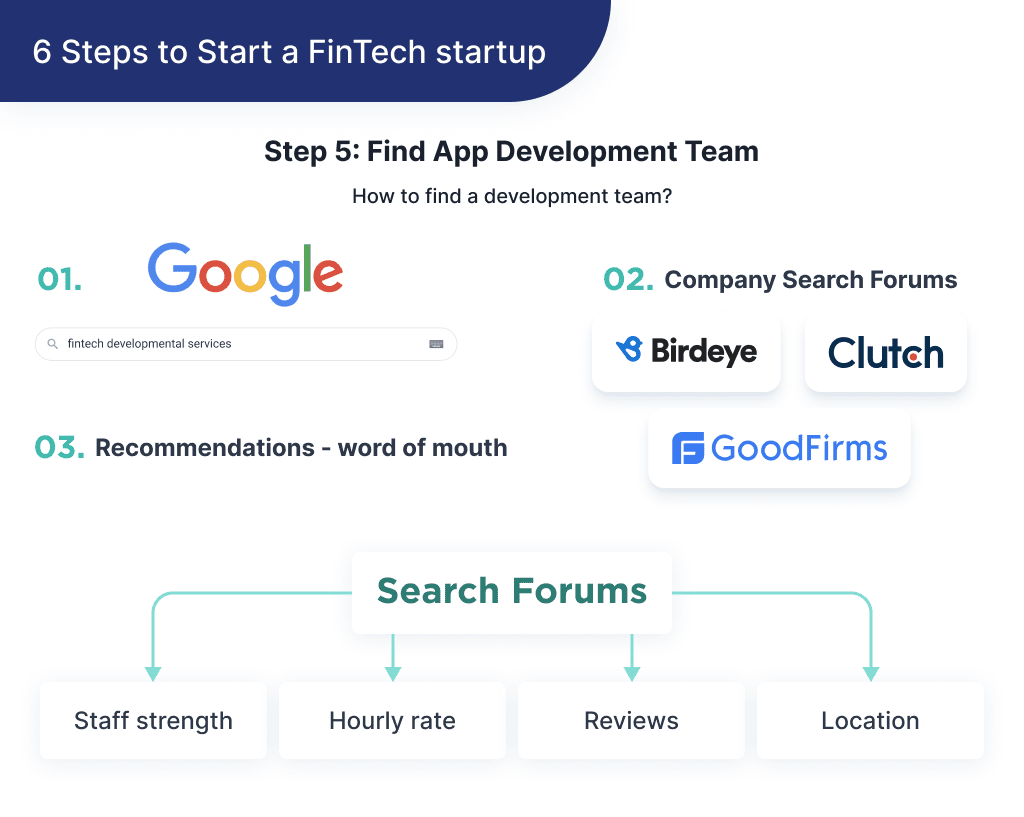

Step 5: Find a Skilled App Dev Team

An intricate part of creating a FinTech startup includes hiring an App Development team that can guarantee fastidious execution.

Finding a perfect app development team with the right tech stack is nothing short of a “herculean task.” Especially when you have a non-tech background.

Discover how to choose a tech stack with our expert advice.

However, with the right knowledge, you’ll definitely scale through. Here are some places to look at for the right app development team.

| Source | Description |

| Google search | Google offers the easiest way to find professionals for your FinTech development team. You can find yourself some professionals by entering keywords like “FinTech development services” and “FinTech app developers” in Google’s search query. Although you may not find the FinTech app developers you need on the go, it does offer numerous options to explore. When you type in your query on Google, it’ll bring out a list of platforms to visit for recruitment. This method will also suggest some agencies you might want to work with for app development partnerships. |

| Business listings | Another way to find partners is through search forums for firms and agencies. A benefit to using this method is that you’ll get straight to the point. It means that you’ll get an exact result that’s based on your search query. Top online forums and websites to leverage on for the best development agency include:

Using such a platform gives you access to information like:

These portals are properly verified, so you need not worry about the authenticity of the information. |

| Word of mouth | This is a great way to hire a partner for your software development. If you know a fellow founder that has partnered with an app development company before, you can ask them for a recommendation. Also, take steps to verify all vital factors while holding talks with the recommended team. |

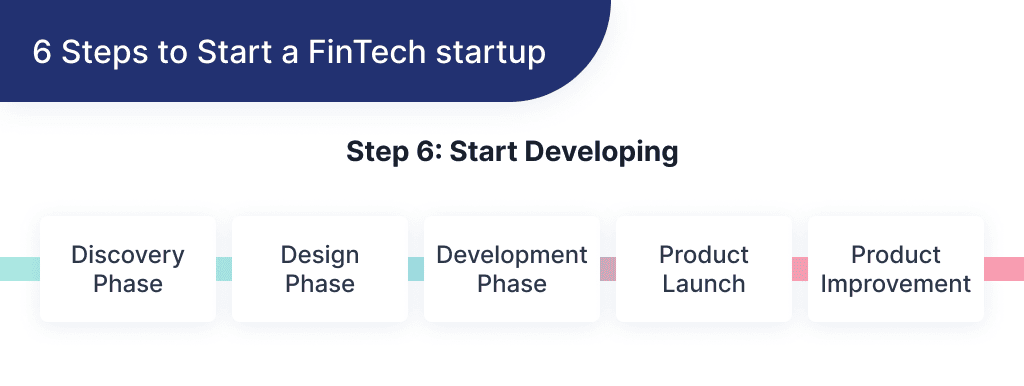

Step 6: Start Building

Once you’ve chosen a team, the next step is to start developing. Ideally, you should first create a Minimum Viable Product.

It’s best first to estimate the cost of building an MVP and ensure it’s a project you can afford before starting out.

In developing your FinTech app, the ideal product development flow should be:

- Discovery phase

- Design phase

- Development phase

- Product launch

- Product improvement

Let’s dig into what each stage entails:

Step 1. Discovery Phase

The project discovery phase is basically a phase where the emphasis is placed on information gathering.

Here, information about the product and market is articulated. This is to create an adequate strategy for technical and business processes.

The discovery phase here entails:

- Market Analysis

- Competitor Analysis

- Understanding your Target Audience

- Identifying your startup Goals

- Cost Analysis

- KYC

Benefits from this phase include:

- Overall cost reduction

- Improved risk management

- Formation of an effective development team

- Goals clarity

- Idea validation

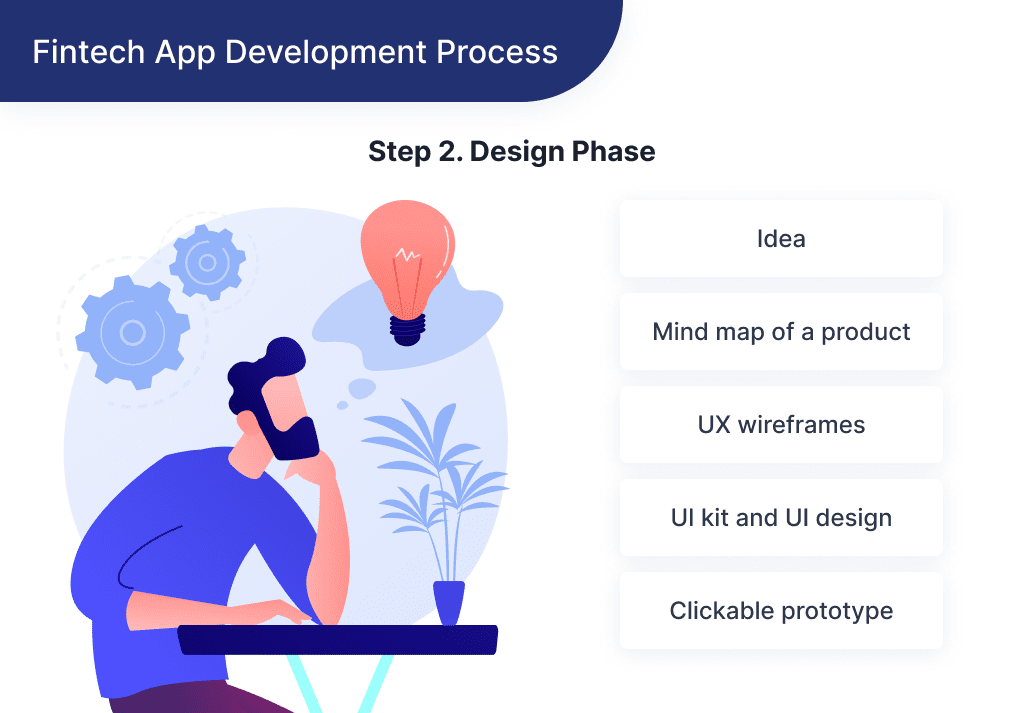

Step 2. Design Phase

After the discovery phase, the next step is to design your app.

The design phase helps to transform your idea into a form your app developers can easily implement.

By the time this phase ends, you should have the following mapped out:

- Mind map of a product

- UX wireframes

- UI kit and UI design

- Clickable prototype

Your design phase should properly illustrate your app’s basic functionality and everything that a developer may need.

We won’t focus on this phase, as it is quite a subjective thing and could vary depending on what you gonna build.

Secure, user-friendly, and innovative — discover how to design a FinTech app.

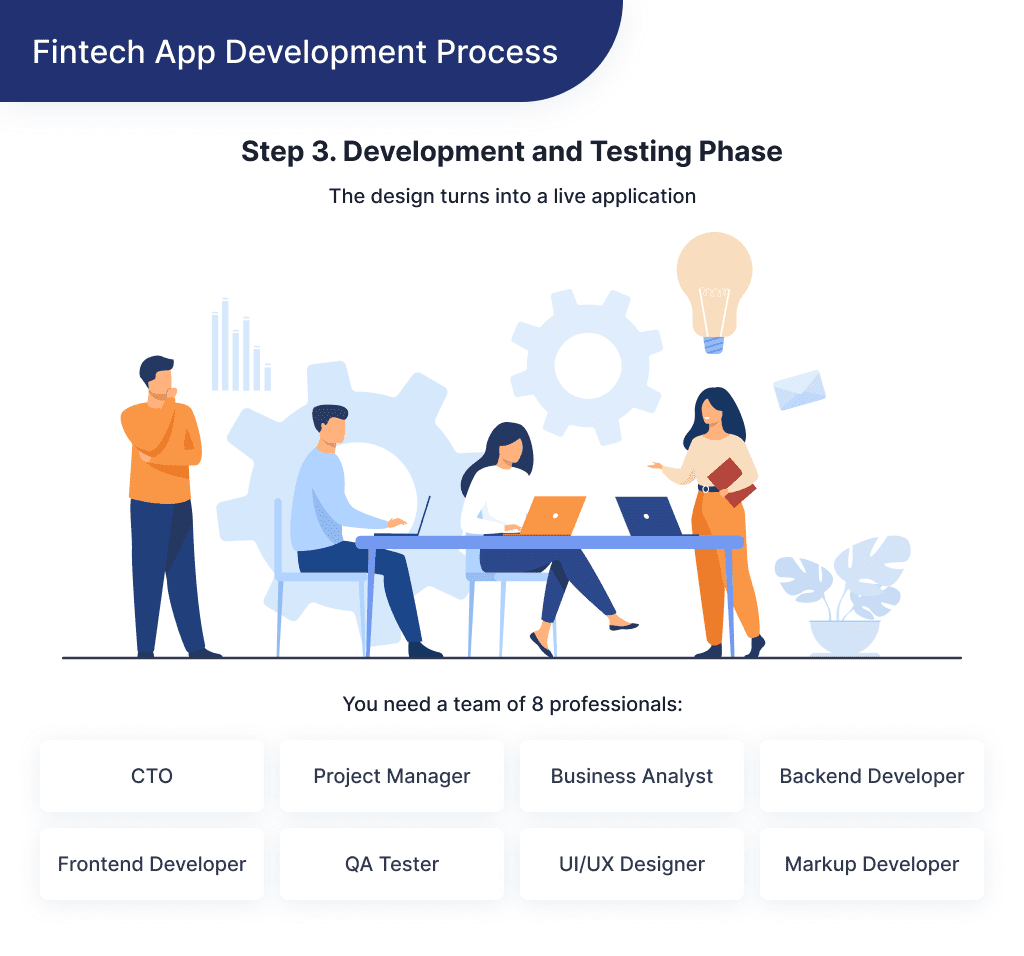

Step 3. Development and Testing Phase

Now that the design is ready, hand it over to the development team. The crux of this phase is to turn the design into a live app.

You’ll need a team of eight professionals to work on your app. They are:

- CTO

- Project manager

- Business analyst

- Backend developer

- Frontend developer

- Mobile developer

- Quality Assurance tester

- UI/UX designer

Need a CTO but not ready for a full-time hire? Here’s how to hire a CTO on demand and get the expertise you need.

Step 4. Product Launch

After going through the steps above, the next step is to release your product.

Irrespective of the drama that surrounds your launch, ensure you release an app that guarantees a top-notch user experience.

From concept to creation – launch your marketplace with SPDLoad!

Step 5. Product Improvements

As a new FinTech business, you’ll be encountering top-notch competition.

As such, you should regularly focus on improving your product. You also need to constantly improve on your cybersecurity.

Even if users consider your product perfect, you should always test new hypotheses to get even better.

3 Companies to Learn From

Now that we’ve properly described how to create a startup, let’s consider three examples:

Example 1. MINT

Mint is a free-to-use budgeting app that allows you to connect your financial accounts on a platform like a digital wallet app. This allows you to have a good view of your finances.

The app was founded in 2006 and was later purchased by Intuit in 2009.

But what the founder should look at is Mint’s monetization model.

There is a ‘Offers’ screen where Mint places personalized ads for financial services and tools.

In this way, the app acts as an advertising vendor with extremely personalized and timely offers. This increases conversion rates for advertisers and helps with users’ finances.

Example 2. Robinhood

Robinhood is a free-trading app that allows investors to trade options, stocks, cryptocurrency, and exchange-traded funds.

All these are done without requiring users to pay fees or commissions.

But what will be a really useful lesson from their story is their approach to the product value.

They offered a simple solution to democratize stock trading and allowed ‘ordinary’ people to automatically replicate professional brokers’ portfolios. It became a killer feature that changed everything.

Example 3. Coinbase

Coinbase ranks among the most prominent cryptocurrency exchange platforms. It’s also the first crypto-exchange platform to be publicly traded. Today, Coinbase has over 50 million users, and it trades over $1 trillion worth of crypto a year.

Coinbase’s success is majorly due to its drive to build a secure and compliant platform. This strategy enabled it to appeal to the average venture capital and institutional investors.

As a startup, a major takeaway from this company is to guarantee top-notch legal compliance. Do this while also ensuring that users gain maximum satisfaction from using your product.

What’s Your Next Step?

Launching a FinTech startup takes careful planning, research, and execution. Developing the technology is crucial, so you’ll want an experienced development team you can trust.

Our software engineers have decades of combined FinTech app development experience.

We stay updated on the latest regulations, security protocols, and tech innovations. Whether you need an app, website, or integrated platform, we can bring your FinTech vision to life.

Schedule a free consultation to discuss your ideas. We’ll provide recommendations to maximize opportunities while avoiding pitfalls.

Let’s start building the next breakthrough FinTech startup!

Bonus Infographic

Here you’ll find a summary of our in-depth guide. Learn the highlights of how to start a FinTech startup in 2025.