Mobile Banking App Development: A Step-by-Step Guide

- Updated: Nov 11, 2024

- 13 min

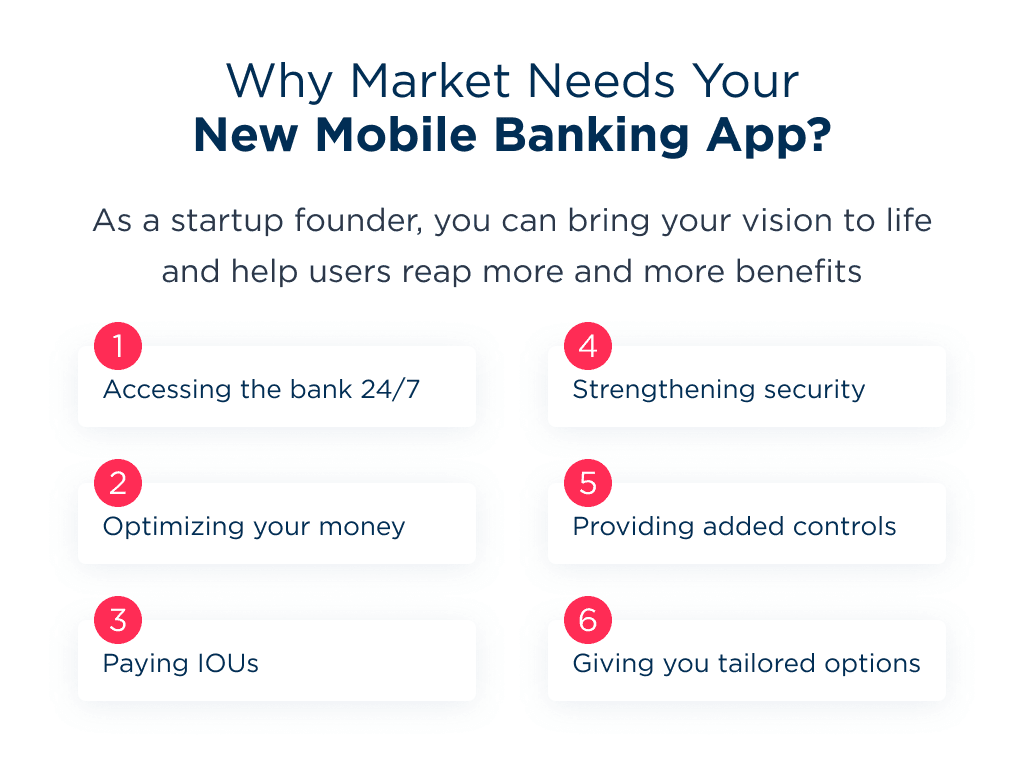

Smartphones have put banking right at our fingertips. These days, there’s no need to visit a bank branch to transfer money or check your account balance. You can easily do it all on a mobile banking app.

You might be surprised at just how popular these apps have become over the last decade. According to Statista, there are around 57 million mobile banking users in the US.

About 90% of users rely on them to check their balances, while 79% use them to see transaction histories.

These stats signal that mobile banking apps could be highly lucrative to develop.

Before starting your project, these essential app development tips can help you avoid common pitfalls.

Unlock your startup potential now — start transforming your vision into a scalable solution with our expert developers!

Market Overview

Here are some more stats that favor the idea of mobile banking application development:

- The Allied Market Report suggests that the market of global mobile banking stood at $715.3 million in 2018. Plus, it is speculated to rise up to $1,824.7 million by the year 2026 at a CAGR of 12.2%.

- People within the age group of 25-34 use banking apps most frequently. The usage rate is 21.6%, followed by those of 35-44 years and so on. People over 65 years of age have the lowest rate of banking app usage (8.5%).

- In the current condition, where social distancing is a must, it has become inevitable for people to ignore the use of a banking app. So, developing a banking application is a great idea to implement and it’s on part with the investment app. Check out our insights on how to create an investment app.

How to Create a Banking App?

The road to outsource mobile app development is an easy one if you consider all the indispensable aspects and take one thing at a time.

So, before you jump into the development formalities of the banking application, you need to make sure if your application idea is viable or not.

1. Preparing for Development

To test the viability and other factors that affect the success rate of the application, you need to undertake the process of project discovery phase.

The project discovery stage is the foundational stage, not just for banking app development but for any other type of application, such as a personal finance application.

It includes some of the necessary aspects such as:

| Aspect | Description |

| Market research | As 42% of businesses fail due to the lack of a market fit product, it is crucial for you to conduct thorough market research. And if we talk about the banking sector, it needs apps like these for maintaining a streamlined workflow and retaining their valuable customers. |

| Competitor research | There is always room for improvement. And you will get to know this by doing a competitor’s research. Download their banking app and check how its UI and UX work. Find out what you can do to enhance it. Closely check the security, reliability, language, and convenience factors of the app. Competitors are your best teachers when you are looking to do something unique. It is the best way to learn from their mistakes and innovate. |

| Cost analysis | No matter how ingenious your idea is. Without enough money, not only will you not be able to develop a reliable banking application, but you won’t launch your product. Learn more about how to start a fintech company for more insights on this topic. The discovery phase helps you estimate the banking app development cost. This will include everything from banking app developers fees, cost of hosting, adding features, MVP development services, and designing prototypes, etc. |

| Business goal | To excel at developing the best banking app, it is necessary to have a crystal clear idea of what you want from it. As long as one is not focused on his or her business goal, they may end up in the 13% of the startups that fail due to losing their focus. |

| Identify target audience | If you have undertaken the market research process well, then this will be a bit easy for you. But it doesn’t mean you can leave this. After all, it’s the users that will be using your app. So, it is necessary to check if they need your app. And if they do, which users need it. Gen X, Gen Z, and Millennials should be your primary target audience for a banking application. |

What Are the Pros of the Discovery Phase?

If you are a founder and take up the discovery phase of your banking application seriously, you will surely get rewarded with the following:

- Validates the idea: This phase will validate the viability of the idea. Thus, leading to the development of a market-fit product.

- Assemble a team: With proper knowledge of the overall process requirements, you will be able to get the best team of banking app developers, designers, managers, marketers, etc.

- Risk management: Every new thing poses a risk, but you can convert it into a calculated one. With an agile discovery method, you can estimate potential issues that you may face and plan ahead to counteract them if they happen. That’s particularly important in the banking sector given the risks of debit card fraud. You can reduce banking app development costs, prevent missing deadlines, and can also foresee your target clearly.

- Overall cost reduction: When you undertake the project discovery process, you get to know a lot about the application development process. Steps like documentation, MVP, core development, designing, prototyping, testing, distribution, and marketing can be planned ahead. This helps save a lot of cost as compared to when everything is done on the spot.

As a founder, the project discovery phase will help you produce the best banking application in the market with utmost efficiency.

2. Building the App

So, now we are at the core part of the app.

After you have a clear vision about your goal and have planned everything out from the start till the end, it is time to jump into the development stage.

The banking app development stage includes features that you need to add to your application to make it stand out.

There are many basic features that your application needs to have so that it can cater to the basic requirements of the customers.

List of Core Features of a Banking App MVP

Here are some core features that are a must-have for your banking app!

| Feature | Description |

| Account or profile creation | If you have a banking app, you need to add the feature of account creation for the users. This will help them log in securely into the app with the account ID and password. To enhance login security and speed, you can use biometric authentication or multi-factor authentication. An excellent example of this is the Standard Chartered Bank mobile app. It allows the users to login into their accounts with their fingerprints. |

| Account management | The account management aspect of the mobile banking application should allow the users to:

It is also possible to add add-on account management features like setting saving goals, managing repeat payments, etc. |

| Branch locations and ATMs | It will be tough to find ATMs for someone who has just started using the services of the bank. To save them the hassle of searching the web, you can include the location of ATMs and bank branches in the app itself. You can enhance this feature by providing information about the nearest ATMs. However, you will need location access from the user. This feature is in most banking apps. |

| Secure payments and fund transfer | Banking apps of today are not just limited to providing account details, transaction history, etc. They also allow their users to receive and send payments. Hence, it is necessary to add this feature to the application. Add this feature to the app while keeping the security of the transaction in mind. Use features like OTP authentication for funds transfer. Moreover, allow the users to scan a dynamic QR code to make payments for services like movies, groceries, goods, etc. It is one of the most popular & safe methods of paying. In 2019, 10.44 million households in the US scanned a QR for paying. Google Pay, which is not exactly a banking app but a payments application allows the users to pay via scanning a QR code. We at SpdLoad also developed a QR code payment application, Smartpolka. React, React Native, and Laravel was the technologies used in it. If you’re working with Laravel, these best Laravel tools and resources will streamline your workflow. |

| Push Notifications and Alerts | This is one critical feature of a banking application. You need to assure that your users are communicated about every little thing that happens with their account. With push notifications, you can keep your users aware of every financial transaction that happens in their accounts. Moreover, with notifications, you can also keep them aware of your new plans and policies. However, you need to ensure that these notifications are not unwelcoming for the users. Create a communication strategy for this first! |

| Customer Support (Human & AI) | If you have an application, it will never be perfect; you have to keep making efforts to make it better. But, how will you know what’s wrong? Yes, your customers will be your key source for this information, and the customer service feature will connect you to them. With the customer support feature in the app, you can know about the issues faced by the customers. It may also enlighten you with app issues if any. Based on this, you can make improvements to your banking application. You should know that a customer support executive will not be available 24×7. Hence, it is critical to have a backup. A chatbot will be an innovative addition to your app. It can help in handling customer queries in the inactive hours. American Express is the banking app that leverages the power of a chatbot to serve its customers. |

| Offline access | You can add this feature to your app to make it available to users if their internet connection is weak or completely disconnected. |

To serve the users, these features are enough. However, if you want to retain the users for a long and want to level up to the competition in the market, you need to integrate some out-of-the-box features in the banking app development process.

List of Potential Additional Features of the Banking App

Here are some add-on aspects that you can add to your app!

| Additional Feature | Description |

| Special Offers | This is a cool characteristic feature that you can add to your banking app. It will include partnering with some service partners like grocery shops, movie theaters, restaurants, and more. You can provide the users with coupons, cash back, and discount offers to serve them better while boosting the acquisition and retention rate. The cashback feature will always entice the users to use the banking app for payments. Yes, it will increase the banking app development cost a bit but will yield remarkable results in the end. This churn rate calculator is a useful tool for SaaS businesses aiming to maintain a stable customer base. |

| App for wearable devices | Smart devices have evolved to be much smaller and more utilitarian. Hence, it will be a game-changer if you develop a version of your banking app for these devices also. One example of this is a banking app for a smartwatch. For reference, check out the Smartwatch Banking feature of Midland States Bank. It easily runs on Apple Watch and helps the user check balance, set account order, locate the nearest ATM, etc. Bank of Melbourne is another cool example of this. |

| Trackers | Keep the user disciplined to their spending and measure how much they spend. Do this by including the feature of a spending tracker in mobile banking application development. Be creative here! Include colorful dashboards with charts and bar graphs indicating spending in different colors. Also, include a progress bar for the goal set by the user to motivate them. Furthermore, you can let users set reminders for payment or can provide them with the scheduled payment option. |

| Finance sharing feature | This feature can come into use for those people who have to split bills. Moreover, those who collectively invest in shares or bonds will also favor this aspect. Emirates NBD is an app that supports the bill splitting feature. |

| Cardless ATM access | In the process of mobile banking application development, include this feature for sure. If anyone tends to forget their card, the app should have the ability to get the cash. HomeStreet bank app allows the users to withdraw cash in the absence of a card. |

These are all the features that you need to include in the banking app development process. They will surely hike the banking app development cost but will surely garner users faster.

Required Team for Banking App Development

Now, to develop the best banking app in the market, you need to have the best team. Here you will have options like:

- You can hire an in-house team, or

- You can find a reliable partner

This will entirely depend on your budget. If you have a good budget, you can go for an in-house team.

On the other hand, you are looking for a bit of an economical option while maintaining the quality. You can find a reliable partner like Spdload.

Explore our SaaS services today

On a general basis, an app effective mobile banking application development needs:

- Project Manager

- Business Analyst

- Designer

- Backend Developer

- Mobile Developer

- Testing professional

- DevOps (check out our DevOps glossary that covers key terms to help you stay on top of DevOps practices and tools)

Tech Stack Required for Mobile Banking Application Development

No matter how powerful or experienced banking app developers you have, it will never be enough if you don’t have the required tools.

You need to use state-of-the-art tools for the development of your mobile banking app. Let us help you out by highlighting the best ones!

If you are interested in iOS development, check out these best iOS development tools.

| Technology or Tool | Application |

| Project Requirements | Every project requires some form of documentation and communication tools. For you, it will be better to opt for Google Suite. It has a plethora of tools that include:

They help in the better development of your app. Moreover, you can easily keep the communication going. |

| Hosting | To bring your app or website in front of the audience, you need a professional hosting solution. And you need to look no further than Amazon Web Services (AWS). It is affordable, scalable, and has broad platform support. Compare Digital Ocean, AWS, and Google Cloud for insights into which platform fits your business best. Explore the top hosting solutions for SaaS products and find what works best for your business in our hosting for SaaS article. |

| Mobile | As the primary running device for your banking app will be mobile. You need to choose the best development software for that. We at Spdload use React for mobile app development. You can go for Java or Kotlin for Android. And Swift or Objective C for iOS. These detailed guides on Android app development costs and iOS app development costs will help you navigate the financial aspects. |

| Testing | To ensure that your applications work as intended, you need to get the best testing tools like:

And others! |

| Prototyping | Prototyping is one of the crucial steps of the app development process. Hence, you need to use good tools for that. You can use Figma, which is an awesome graphics editing and prototyping tool. |

| Backend | To enhance the usability aspect of the app, it is imperative to focus on its backend development. Laravel is the best server-side PHP framework for backend development. |

| Implementation of third party integration | Your banking app will need various third-party integrations for successful payments. Hence, you need to use tools like Tibco for the same. Ensure that your app has that. Integrations can also cover bank statement analysis to save you development time, since tools already exist for this as well. |

How Much Does It Cost to Develop a Banking App?

So, the how part of developing a banking app is clear. Now, it is time to analyze the banking app development cost.

The cost of a banking app depends on various factors like:

- The complexity of the app: If your banking app has more features, it will have a higher development cost and vice versa.

- Type of cooperation: Here, you will have various options, freelancers, in-house team, or overseas collaboration.

Freelancers will charge you less, in the range of $20-50 an hour. But, the quality of work may not be that good.

An in-house team of banking app developers will deliver excellent quality work. However, their hourly rates may go over $100.

Outsourcing your work to an overseas development agency like SpdLoad will help you save costs. Moreover, the quality of work will also be pristine.

Location of Dev Team

The location of development also affects the cost. For instance, you can get an app developed by banking app developers in the US, Ukraine, India, or any other part of the world.

Based on the complexity and type of cooperation, the banking app development cost can be anything between $100k-500k.

If you are hiring an in-house team, it can even go over $1 million.

You can also build an app under $100k, provided it is a simple one.

If we talk about time, making a mobile banking app will take around 640 hours to build an MVP or 1280 hours to build a scaled product based on the complexity.

| Team | Hourly rate | MVP | Scaled product |

| The local agency in the US | $150 | $100k | $200k |

| Outsource in India | $20 | $13k | $26k |

| Outsource in Ukraine | $40 | $26k | $52k |

All of these figures are just estimates. They can vary based on app complexity, the competitiveness of the outsourcing firm, and their pricing.

This guide lists the best countries to outsource software development, based on cost and expertise.

Ready to Develop Your Own App?

With so many benefits of fintech, it’s no surprise that companies are adopting it rapidly.

If you want to build a mobile banking app, partnering with the right development team is key.

At SpdLoad, we specialize in bringing fintech visions to life through thoughtful discovery, strategic planning, and robust engineering.

Over the past 10 years, we’ve launched dozens of successful MVPs, focusing on market viability from day one. Our full-cycle teams handle everything from research and branding to coding and deployment, providing complete solutions under one roof.

Contact us to learn more about how we can help you turn your mobile banking idea into a high-performing product.

Check out our case studies on Clutch and Dribbble to better understand our work.

If you’re entering the SaaS world, these best SaaS startup ideas are worth exploring.