Investment App Development: Costs, Processes, and Steps

- Updated: Nov 11, 2024

- 14 min

Building an investment app? This guide covers everything startup founders, product managers, and serial entrepreneurs need to know.

By reading this article, you’ll learn:

- Why building your investment app is valuable

- The popular types of investment platforms

- Step-by-step development process

- The team and tech stack required

- Case studies from leading investment apps

If you prefer visuals, check out our bonus infographic summarizing how to develop an investment app.

Learn how to transform your MVP into a fully-fledged product with our tips on from MVP to full-scale product.

Unlock your startup potential now — start transforming your vision into a scalable solution with our expert developers!

When to Start Your Investment App

The short answer is “right now”. For a longer one, keep reading.

Thinking about how to create a fintech app?

It requires expending numerous resources into turning your concept from an ideation stage to a live app even without a guarantee of profit.

Let’s clear any doubt you might have about creating an investment platform.

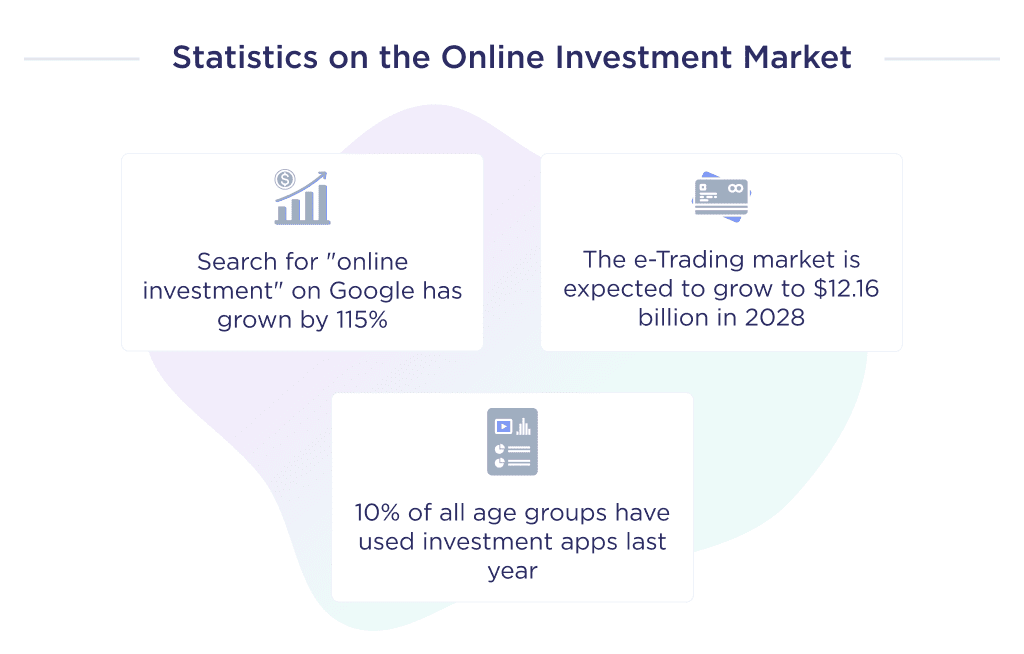

Overview of the Online Investment Marketplace

Numerous statistics depicts the profitability margin of owning an online investment mobile app, here are some:

- Search for online investment on Google has grown by 115% yearly;

- It’s expected that the global eTrading market will grow from $8,7 billion in 2021 to $12,16 billion in 2028; representing a CAGR of 5,1%;

- At least 10% of all age groups have used an online investment tool within the past 12 months.

The above statistics show that while demand for trading platforms is at an all-time high, even greater growth is expected in the coming years.

And the set of statistics suggests that your idea to create a new investment application or investment newsletters is justified not only by internal gut feeling but also by market data.

Let’s take a look at your future competitors.

Investment Startups and Funding Rounds

With so many benefits of fintech, it’s no surprise that companies are adopting it rapidly.

Here is a glimpse at some notable investment rounds made by startups:

- Robinhood raised $2.4 billion in a single funding round;

- FTX trading raised $1 billion in a series B funding round;

- Total value of investment FinTech startups rose from $9 billion in 2010 to $121.5 billion in 2020.

The statistics above exemplifies corporate investors’ interest in online investment platforms, and this degree of interest is likely because of its unrivaled financial prospect.

If profitability is at the forefront of your startup’s goal, then the statistics above show that creating your investment app is a smart decision.

Effective strategies for building a brand from scratch can transform your vision into reality.

Before we unravel the core development steps, let’s help you understand what you’d like to build.

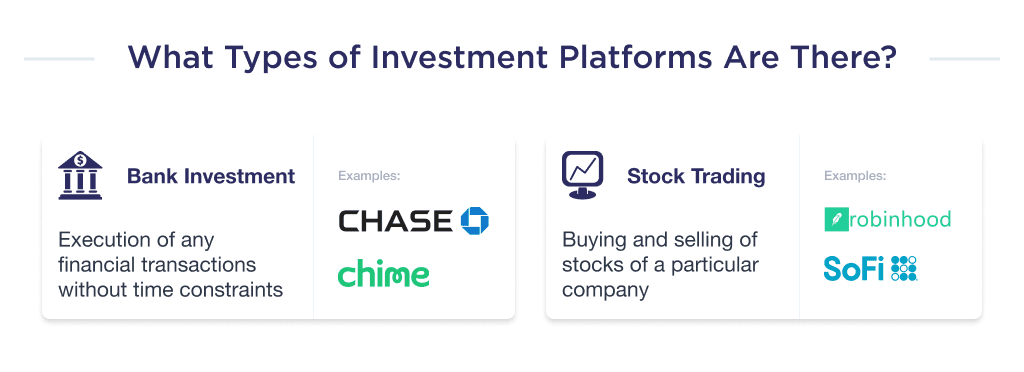

Types of Investment Platforms

There are many ways to group investment platforms, but we’ll help you with an easy-to-understand classification.

1. Banks

These apps enable users to invest and perform some specific banking operations irrespective of location and time. Bank investment apps often belong to licensed financial institutions.

Thanks to mobile banking app development, users can seamlessly make investments, and open IRA accounts, in addition to performing financial transactions, checking bank account balances, saving money, taking loans, and other banking activities.

Apps in this category include Chase Mobile, Chime, and others.

2. Stock Trading Apps

This type of investment app is designed to ease stock trading. They’re intuitively built to ensure that investment in the stock market can be made from any location and at any time.

Examples of stock trading apps on the app store that fit into this classification include Robinhood, Charles Schwab, SoFi, Stash, TD Ameritrade.

And if you’re interested to build this kind of software, feel free to check our in-depth guide about stock trading website development.

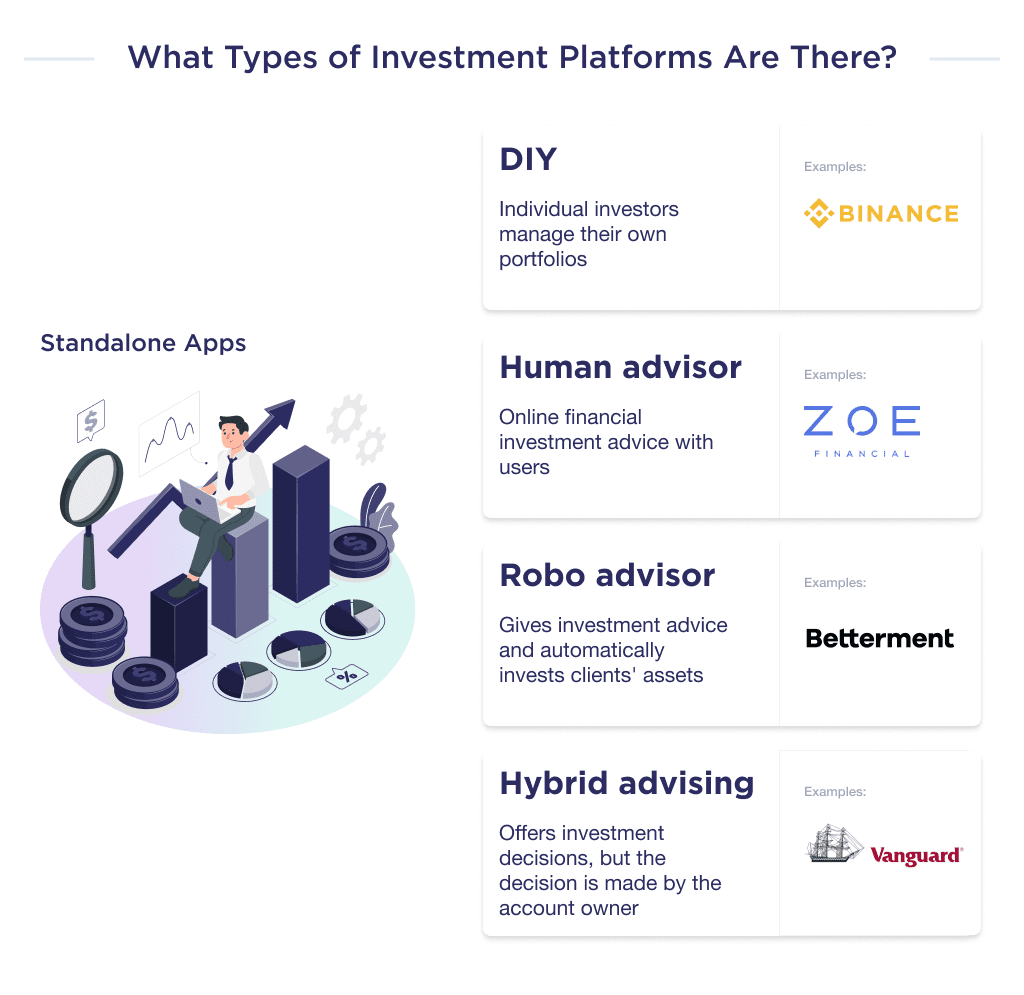

3. Standalone Investment Apps

These are apps built with the sole aim of offering investment opportunities to a target audience. Standalone apps can further be divided into numerous types:

| Type | Description |

| DIY or Do It Yourself | These are investment products that are intuitively built for both amateurs and professionals. These products often have two interfaces: one interface with basic functions for amateurs and another interface with advanced features for professionals. Examples of DIY apps are Binance, Fidelity. |

| Human advisor | At the crux of this online investment platform is the use of technology to connect a team of financial advisors with users in need of investment advice without direct physical interaction. Such apps can be standalone or a hybrid investment advisory with such functionality. A perfect example in this category is Zoe Financial. |

| Robo advisor | These apps are built to help users make intelligent investment decisions and reach their financial goals. Highly sophisticated robo-advisors use AI, a news feed, big data analysis, and algorithms to predict future market trends, while less technologically advanced ones depend on financial analyst predictions. Examples of apps in this category are Betterment and Wealthfront. |

| Hybrid advising | A hybrid app bridges the core functionality of Robo-advising and DIY investment platforms. The app engages online investment platform users to make certain decisions by making suggestions that align with AI-predicted market trends. Just like DIY apps, the ultimate decision lies with the account owner. Examples of fintech products that fit into this category are Vanguard and M1 finance. |

Now that we understand categories, let’s find out the price of developing an investment application.

How Much Does It Cost to Develop a Mobile Investment App?

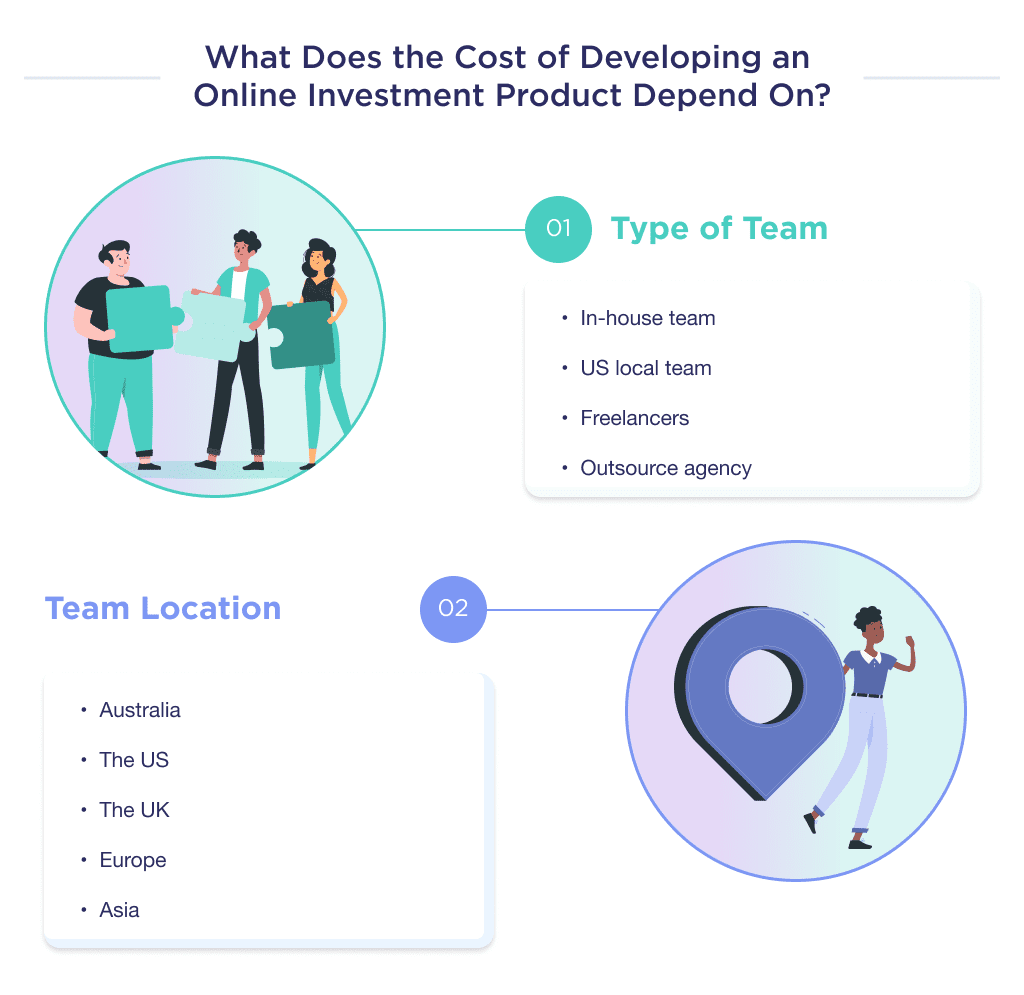

The cost of developing an investment app with minimum viable features ranges from $50,000 to $100,000.

The exact figure depends on a range of factors such as the type of app, type of development team, and location of a team.

Of all these factors, the major determinant of an app cost is the team. Thus, we’ll dwell primarily on this.

Costs by Team Type

We’ll consider a cost breakdown based on the type of team. There are four options to choose from.

The MVP development cost is based on 1,600 development hours.

| Team | Cost, $ |

| In-house team | 200,000 |

| US local team | 250,000 |

| Freelancers | 45,000 |

| Outsourcing agency | 65,000 |

Need more information on app development costs? Then use our in-house outsourcing calculator or app development cost calculator for a better understanding of the intricacies involved.

Each of those options has its distinct quirks, so you might want to carry out a careful study on each choice before finally settling with an option.

However, please note that opting for an outsourcing agency is appealing to most startups. It presents them with the pros of having an in-house team at a cost similar to hiring freelancers.

For trusted IT partners, explore the best IT outsourcing companies listed here.

Costs by Team Location

The labor laws and cost of living in countries differ. As such, their price is highly dependent on the team’s location.

Below is a cost comparison of hiring developers in six different regions:

| Location | Average Cost, $ |

| Australia | 180,000 |

| The US | 250,000 |

| The UK | 200,000 |

| Western Europe | 120,000 |

| Eastern Europe | 65,000 |

| South Asia | 45,000 |

Now you’re aware of the rough cost of creating an investment app; we can now discuss more details of how to build an investment app.

But first, let’s take a look at some must-do steps before development.

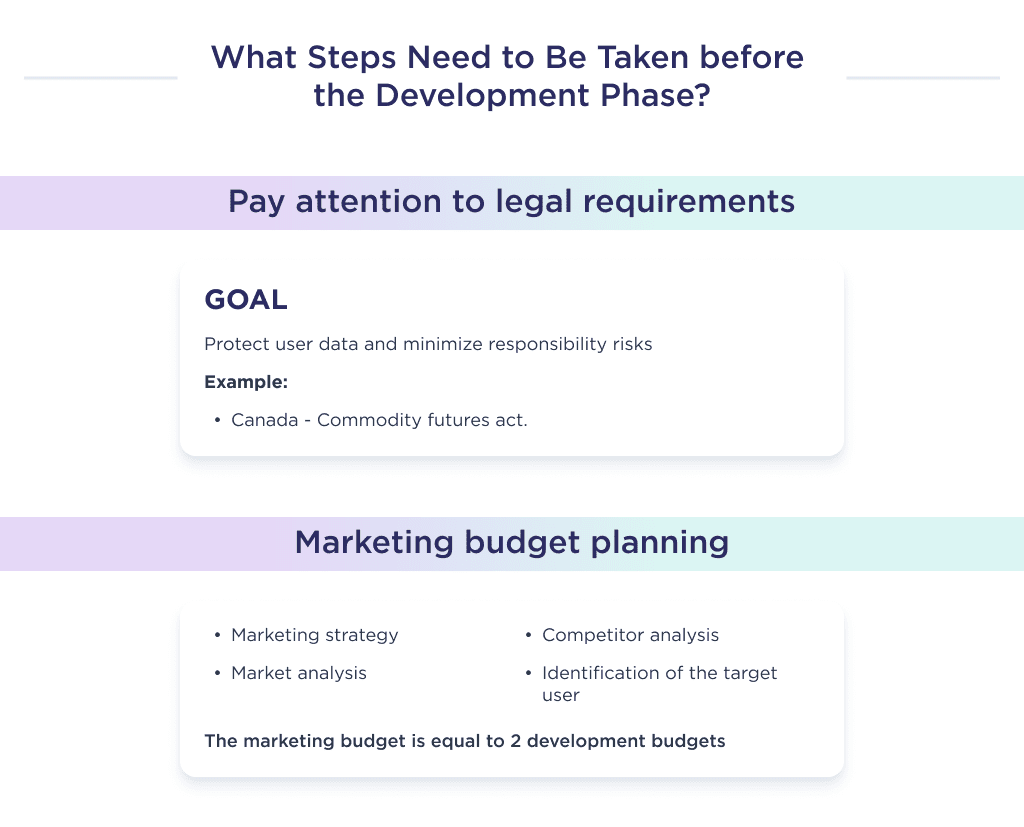

Pre-Development Steps

Before coding and other core development steps, it’s best to pay cognizance to legal requirements and have an ideal marketing budget. Let’s discuss these points further.

1. Researching Compliance Requirements

To protect users and minimize the risk of liability from violating others’ rights, your startup should consider and address legal requirements before starting the core development process.

Every country has its distinct set of laws and regulatory bodies to protect its internet space and financial environment. However, all the skeletal frameworks of those laws are similar, and they’re mostly related to the following:

- Advertising and promotions

- Intellectual property rights

- End-user privacy

- Market manipulation

- And money laundering detection.

Here are some examples of legal compliances and countries where they hold:

| Country | Legal compliance |

| The United States | The Anti-Money Laundering Act of 2020, Securities Exchange Act of 1934, and others. It depends on the state. |

| The United Kingdom | The Rule Book of the London Stock Exchange, UK Industry Act, and others. |

| Canada | Commodity Futures act. |

Another thing you should pay attention to before starting the design and coding is business development.

2. Planning Your Marketing Budget

A marketing budget is vital to bringing your financial product into the limelight.

To achieve market dominance, you should have a robust budget and expert professionals to help curate strategies that can appeal to your target audience in the most convenient way possible.

An ideal yearly marketing budget is 2-3 times the total sum of money spent on developing your product. That means if you spent $50,000 on all the development processes of your investment platform, then an ideal marketing budget should range from $100,000 to $150,000.

Once you’ve perfected the key activities needed to have a successful product, you can then begin the actual development process. Let’s help you with what steps to take here.

How to Develop an Investment App: Step-by-Step

Your investment platform’s development process aligns with the checklist below to ensure success. Take a sneak peek at this checklist, and map out a creative strategy that complements it:

- Conduct extensive market research

- Verify the profitability of the founders’ concept

- Create a technical specification

- Develop a UX wireframe

- Create an intuitive prototype

- Build an MVP

- Scale up to a more user-oriented product

- Launch, maintain and support your application

The list above is undoubtedly too succinct for an actionable plan. Thus we’ll go into a more elaborate description of the steps above.

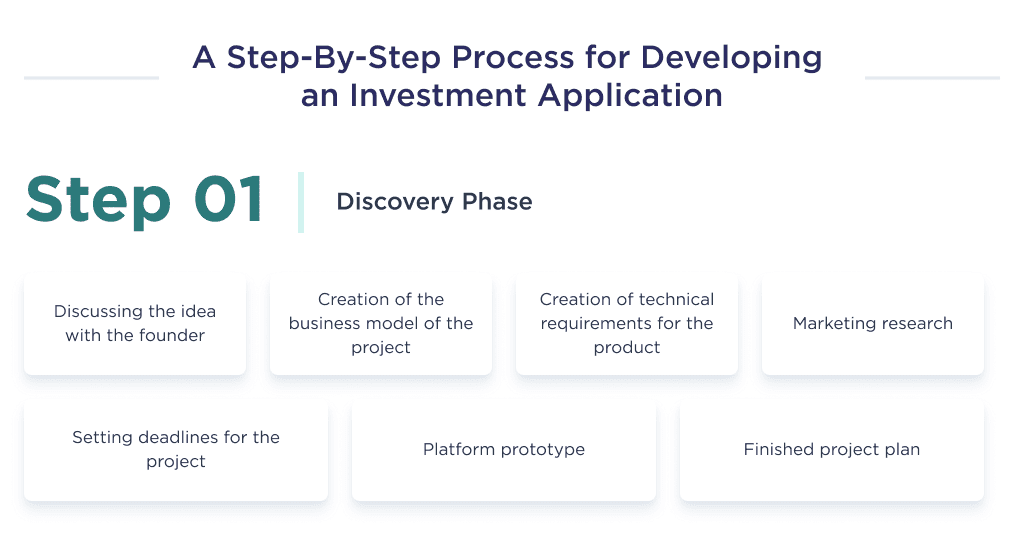

Step 1: Discovery Phase

The discovery phase is a bridge between the founders’ theoretical investment product and its technical realization.

It helps every member of the development team to understand the founder’s idea and come up with an actionable plan to turn a concept from ideation to a live app.

Most discovery phases follow this checklist:

- Uncover the founder’s purpose

- Do a business overview

- Define required technical parameters

- Conduct an extensive market survey

- Set deadlines and priorities

- Create a prototype for your application

- Revise prototype’s compliance with regulatory laws

This is a very brief idea of the steps to take. Let’s discuss further.

1. Understand the Founder’s Perspective

The team’s project manager and business analyst should hold regular meetings with the founder to have a grasp of the business idea. Meeting notes should be shared with other team members.

2. Create a Deliverable Plan

You need a well-detailed plan that includes your business model and a technical product requirement that your live app must conform to.

The bulk of the work at this stage will primarily be executed by the project manager, business analyst, and CTO. The actionable plan forms the template for other technical activities.

3. Conduct Extensive Research on your Target Market

Get to understand the market reaction to your product when it’s launched. Hold briefs with stakeholders and get answers to the following:

- What pain points & market needs will this solution solve?

- How does your target audience think?

- What’s the most effective marketing strategy?

- What are your competitors doing?

The aim here is to ask enough questions till every team member understands the expectation of the target audience and how your product affects them.

Find the best TypeScript developers for your project.

4. Have a Project Blueprint

Based on the information obtained above, the project manager and the business analyst will collaborate with the project manager to create a project blueprint. This document serves as a guide for team members.

It includes everything from project roles, milestones for deliverables, functionalities, tech stacks, and an estimated budget for each milestone.

At the end of this important step, you should have a well-documented strategy for creating a product that appeals to your target audience, understand the strength and weaknesses of your competitors, have a UX wireframe and/or prototype of your app.

Read this article for more elaborative information on the project discovery phase.

Let’s discuss the design phase.

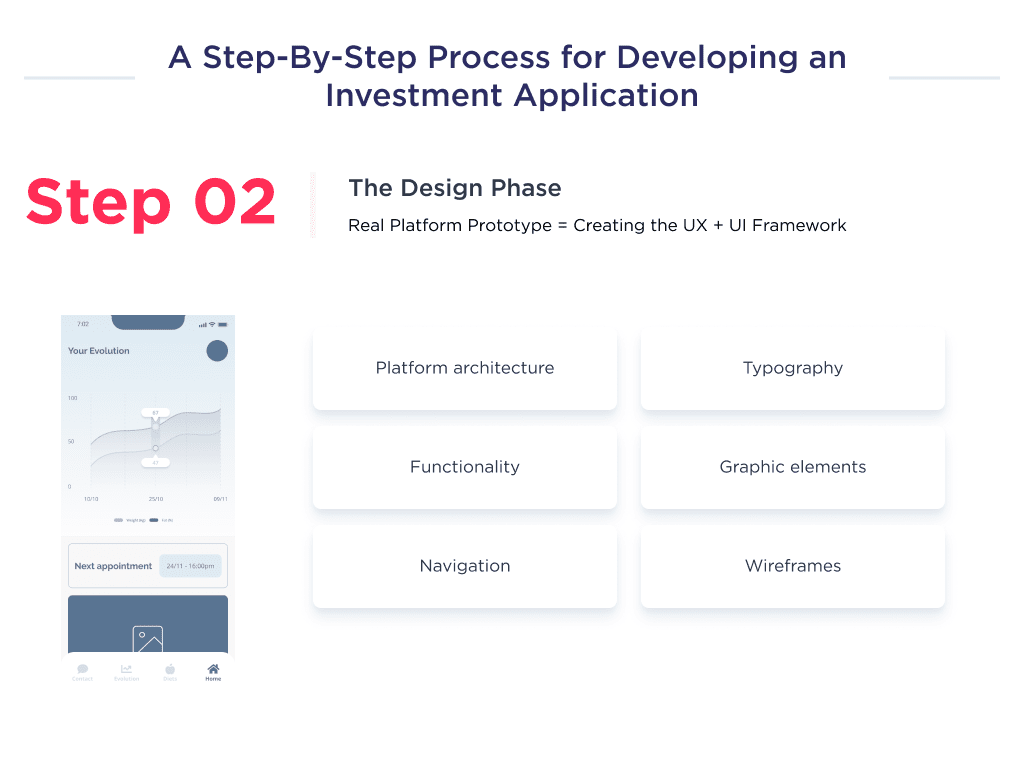

Step 2: Design Phase

One of the most vital foundational steps to the core development process is the design phase. This is because it gives the earliest pictorial illustration of the founder’s idea and allows team members to make further contributions that align with the startup’s goals.

The developer independently creates every actionable icon and feature mapped out in the deliverables. The design forms the framework for the programmers’ coding process, helping them structure functionalities according to the project blueprint.

Upon completing the design phase, the deliverables include a UX wireframe and user interface designs for Android and iOS apps. Furthermore, a designer can create a prototype, i.e. clickable design, that would act as a real app, but without any code or data behind it.

Prototyping is the most efficient way to develop an investment application accordingly to your initial vision, a team will have access to an actionable example of how features must work.

Deliverables from the UI/UX designer should only be approved when there’s an agreement that it’s aesthetically appealing enough for the target audience. It should also improve product efficiency, usability, and responsiveness.

This is a brief look at investment app design, with the aim of acquainting you with the design phase, its deliverables, and its benefits.

Read articles about app design cost and the mobile app design process if you’re interested in educating yourself further on the subject matter.

In the meantime, we’ll discuss further how to create an investment app.

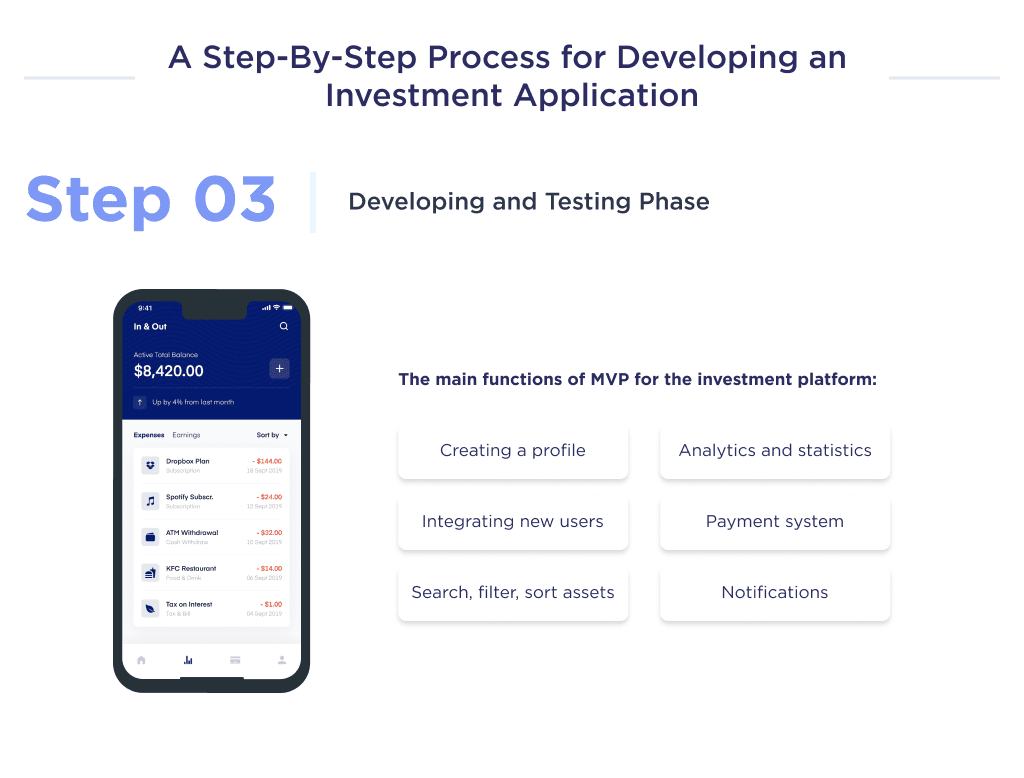

Step 3: Development and Testing

The developing and testing phase is the most complex part of any online investment product development. You shouldn’t worry about the technicalities in this phase, as your software development company will manage the process.

The team will implement the deliverables from the design phase using approved tech stacks and coding structures under the supervision of a CTO.

You should have either an MVP app or a fully scaled feature-packed app at the end of this phase.

Picking the right partner is crucial — here’s how to choose an app development company that fits your needs.

MVP Features for an Investment Platform include:

| Features | Description |

| Profile creation and management | Profile creation is a directory of settings that are designed to help users customize their experience on the platform. It also contains the account owners’ data, and as such, it requires user authentication for access. |

| Onboarding | An onboarding feature is an admin-oriented tool for integrating new users to the investment site and helping them familiarize themselves with the app features. |

| Asset search and sorting | This feature allows users to search for assets, e,g, stocks. It also filters, sorts, and divides assets into basic categories for a more seamless user experience. |

| Real-time analytics and statistics | This feature helps you with systematically analyzed data that can help guide your investment decisions. It shows historical data on asset performance and helps users track their return on investments. |

| Payment gateway integration | Your app needs a secure payment system to initiate an investment safely. Paypal, Stripe, Braintree, credit cards and debit cards are some great ideas for this. Plus, it would work for developing an app for online payments. |

| Push notifications | This feature help user receives real-time on-screen information on updates, reminders, transactional messages, etc. |

Advanced Features for a Full Scaled eTrading Application

- Investor portfolio management

- Investment recommendations

- Updates feed

- Biometric authentication

- Trading fees estimator

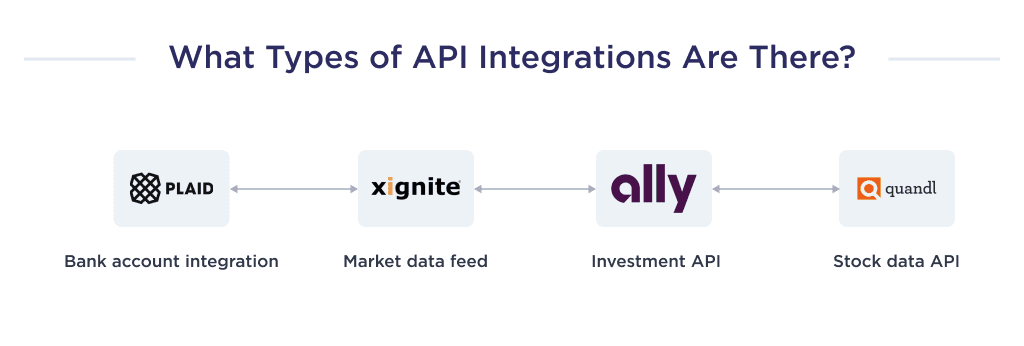

API Integration

This section will help you understand some APIs you may have to integrate with and the providers willing to support you.

| Type of API integration | Description |

| Bank account integration | An example of an API in this category is Plaid. It helps to implement the key function of linking users’ bank accounts to your application. |

| Market data feed | You need a data feed API to provide users with key insights into various investment instruments like indices, futures, mutual funds, Forex, ETFs, etc. An example of a reliable API in this category is Xignite. |

| Investment API | If you need a technologically sophisticated tool that automates trading activities, then an investment API is a must-have. Some APIs offer features for managed portfolios and self-directed trading. An example of investment API is Ally. |

| Stock data API | You need a stock data API to update avid traders on real-time market updates. An example of API in this category is Quandl. You may also check other stock APIs here. |

Once you’ve developed your app, either MVP or a scaled app, the next step is to assemble your team. We’ll discuss that in the subsequent section below.

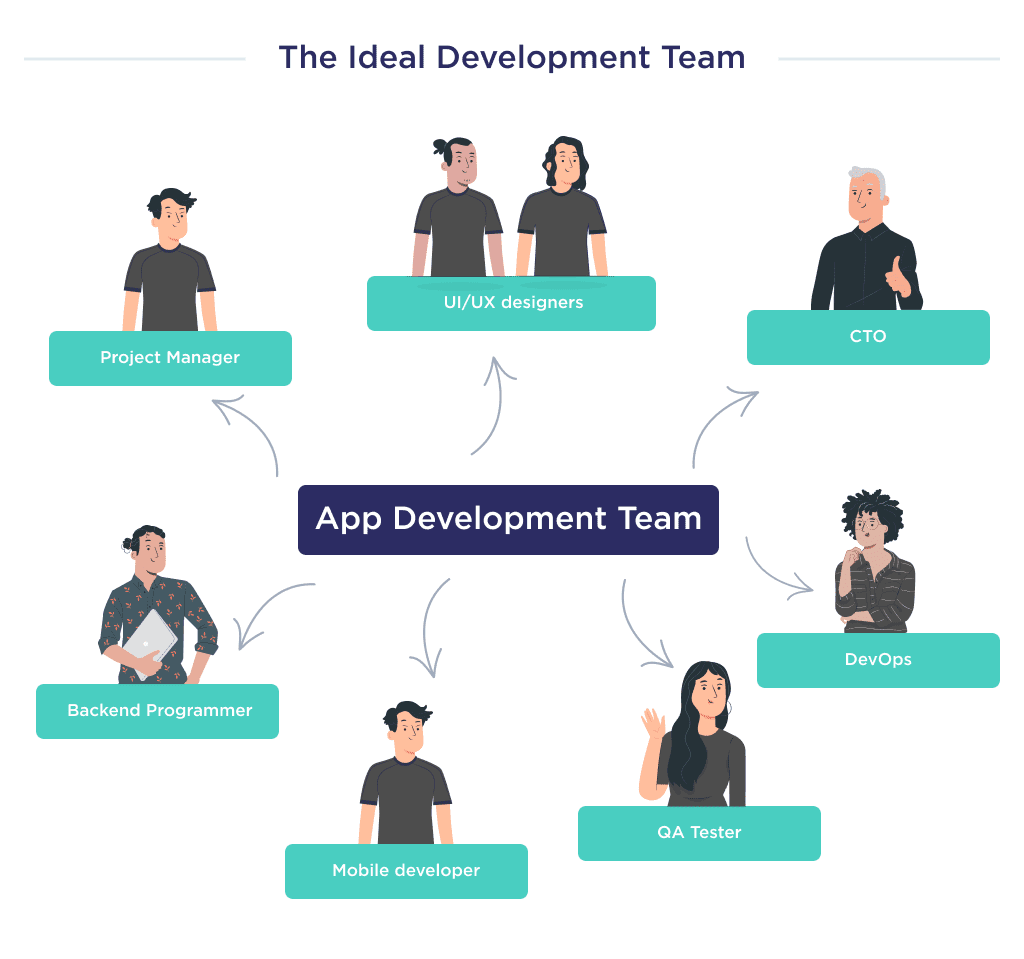

Required Team

The quality of your application is highly dependent on the versatility of your development team and their tech stacks.

Here is the team of developers you’ll need to create a highly sought-after product.

| Required Team | Description |

| Project Manager | The role of a project manager revolves around coordinating the development team and making strategic project decisions. They ensure a timeline delivery of a low-cost investment platform that’s within the management’s scope. |

| UI/UX designer | The UX/UI designer creates a wireframe and an actionable prototype that gives a first-hand description of our product looks and its functionalities. |

| CTO | The chief technology officer is an executive with the responsibility to manage the entire technological process in your startup. |

| Backend Programmer | A backend programmer is responsible for coding features and functionalities for the server end of your application. |

| Mobile developer | The mobile developer helps to translate codes into user-friendly applications. They do this by implementing the user interface designed by the UX/UI designer. |

| QA Tester | A quality assurance tester ensures that the live app adheres to laid out expectations in the discovery phase. They also test the code against any error and loopholes that might lead to a data breach. They also help check against breaking Google play store and Apple store rules. |

| DevOps | DevOps help to unify and automate some aspects of the entire coding process. Discover which DevOps trends are set to impact the future of software development. |

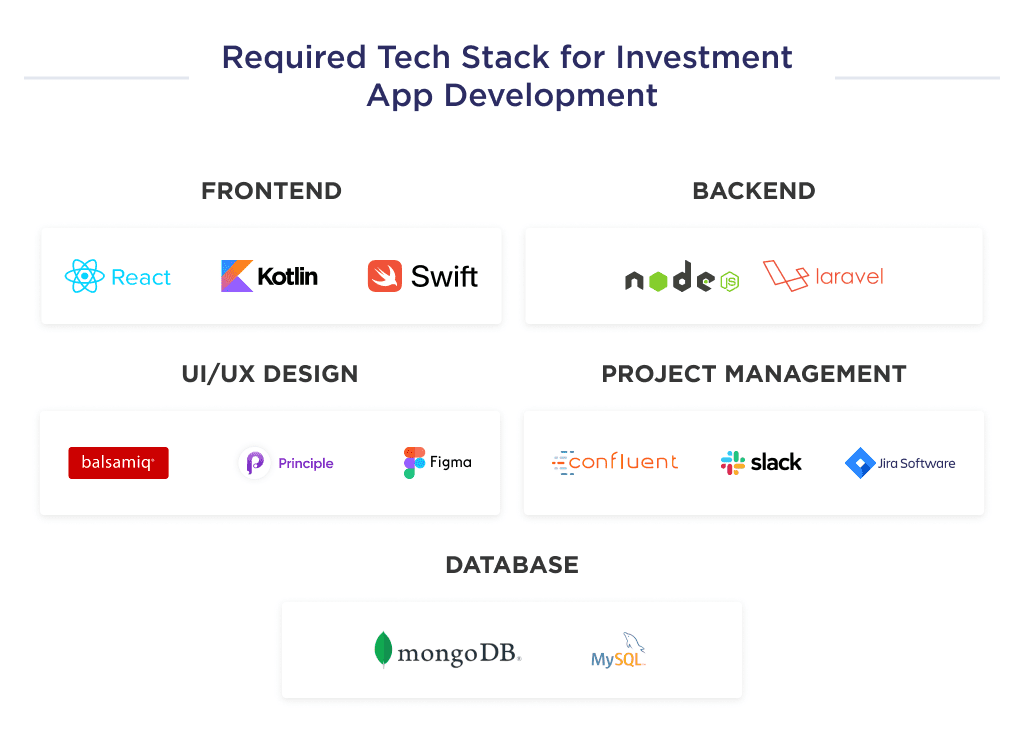

Required Tech Stack

You should hire a development team with the knowledge of the following tech stack.

| Aspect | Tech Stack |

| Mobile | React Native or Flutter for a hybrid app, and Kotlin for Android app or Swift for iOS app. Kickstart your app project with these best iOS app development tools for smooth and efficient coding. |

| Backend Development | NodeJS, Laravel. If you’re working with Laravel, these best Laravel tools and resources will streamline your workflow. |

| Database management | mongoDB, MySQL |

| UI/UX design | Balsamiq, Principle, Figma |

| Product management | Jira Software, Confluent |

| Hosting | Amazon Web Services |

Now that you have apt information on how to build an investment app, let’s help you with some suitable examples that you can use to model your business idea.

Case Studies from Successful Investment Apps

Now that we’ve properly described how to create a startup, let’s consider three of the best investment apps that will inspire you to get into a fintech idea.

Example 1. Acorn

The Acorn app helps users bank faster, invest spare change, and seamlessly save in an individual retirement account.

The platform requires a management fee of 1% for investment accounts with less than $5,000 in net sum and 0.25% for brokerage accounts that have over $5,000 in equity. Students have the perk of using the platform commission-free for four years.

Their killer feature is automated investing. Users can schedule their investment beforehand and get in-depth market insight on potential opportunities and pitfalls.

Example 2. Robinhood

Robinhood is a micro-investing e-trade app that allows users to purchase stocks, options, and cryptocurrency easily. Its unique selling proposition is commission-free trading.

But what’s the game-changer feature that brought them into the limelight?

They allow average platform users to copy professional broker’s investment portfolios. They also make it possible for users to purchase fractional shares. This made naive users without prior trading experience benefit greatly from the stock market.

Example 3. eToro

eToro is a multi-asset brokerage and social trading platform with a penchant for providing financial and copy trading services such as crypto, forex, maverick trading, and other investing options.

Users can open long-term positions or day-trade according to their market view. However, the most admirable feature of this app is its user-friendly functionalities for beginners, including casual traders.

Ready to Develop Your Own Investment App?

At SpdLoad, our expert team can guide you from concept to launch.

We use an iterative discovery process to align on product vision, validate market demand, prototype rapidly, and deliver a polished MVP optimized to delight users and drive growth.

Check out our portfolio of fintech products and Clutch reviews.

Let’s connect to map out an actionable roadmap rooted in real-world insights.

Planning a crowdfunding platform? Learn what goes into crowdfunding website development.

Bonus Infographic

Here’s a summary of our in-depth guide. Learn the highlights of the step-by-step process of developing an investment platform from scratch that will be similar to Robinhood.

Find out how long it really takes to develop an app with our comprehensive guide on how long it takes to develop an app.