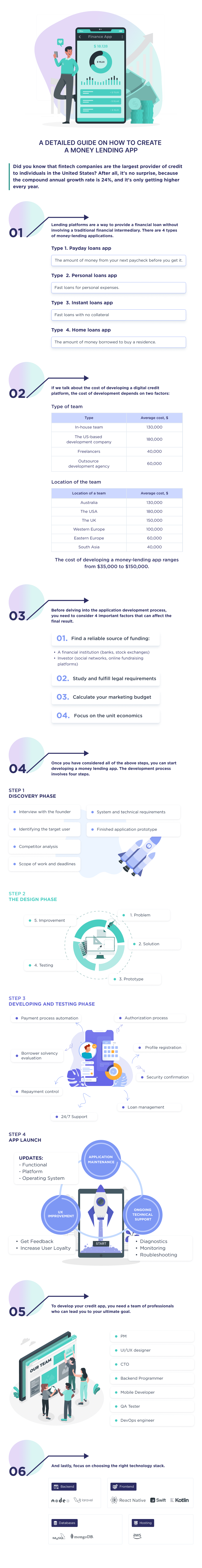

Loan Lending App Development: Costs, Processes, and Steps

- Updated: Nov 13, 2024

- 15 min

Looking to build a money-lending app but not sure where to start?

As a non-tech founder or product manager, this guide will walk you through everything you need to know, including:

- An overview of different loan types, lending processes, and peer-to-peer lending app basics

- Step-by-step instructions for building a custom lending app

- Cost breakdowns for development

- Tips on finding a reliable dev team

- And more!

If you’re a visual learner, feel free to skip ahead to the bonus infographic for the high-level view.

Learn about the key factors that influence app development costs and how to budget effectively for your project.

Ready to get started? Read on!

Start your journey with our expert developers to bring your app idea into reality - contact us today!

An Overview of Online Money Lending Platforms

Money lending platforms allow lenders to register and access money.

As a startup with an intention to own an online money lending product, it’s imperative to properly examine the types of loan platform you’d like to develop. This is because the money lending type determines the development, design, and budget of the application.

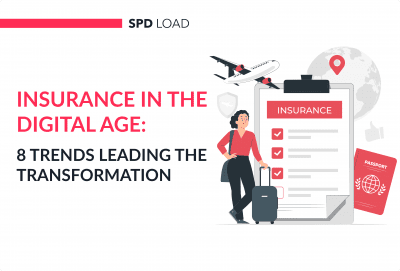

Let’s take a dig into the types of money lending applications available.

Type 1. Payday Loans App

These are loan lending mobile apps that issue short-term cash advances at high-interest rates with a repayable time frame of one month. The loans issued by these apps are intended to help individuals in need of quick cash to hold until their next paycheck. E.g., Advance America.

Type 2. Personal Loans App

These are mobile tools that are designed to let users apply for a personal loan without ever setting foot in a financial institution in contrast to bank loans. This loan type is useful for consolidating debts like student loans, settling an outstanding bill, or financing large purchases. Some apps even work specifically with student bank accounts to give out loans.

They often have a more favorable interest rate than payday loans, and they’re repayable in installments. E.g., Upstart, Prosper.

Type 3. Instant Loans App

Instant loan apps are platforms that are characterized by little documentation and quick loan approval without the need to pledge an asset.

Type 4. Home Loans App

Home loan applications provide mortgage loan seekers with an opportunity to make their intention known to creditors via the internet.

Why You Should Build a Custom Lending Application Now

From cost savings to better service, the benefits of fintech are transforming industries.

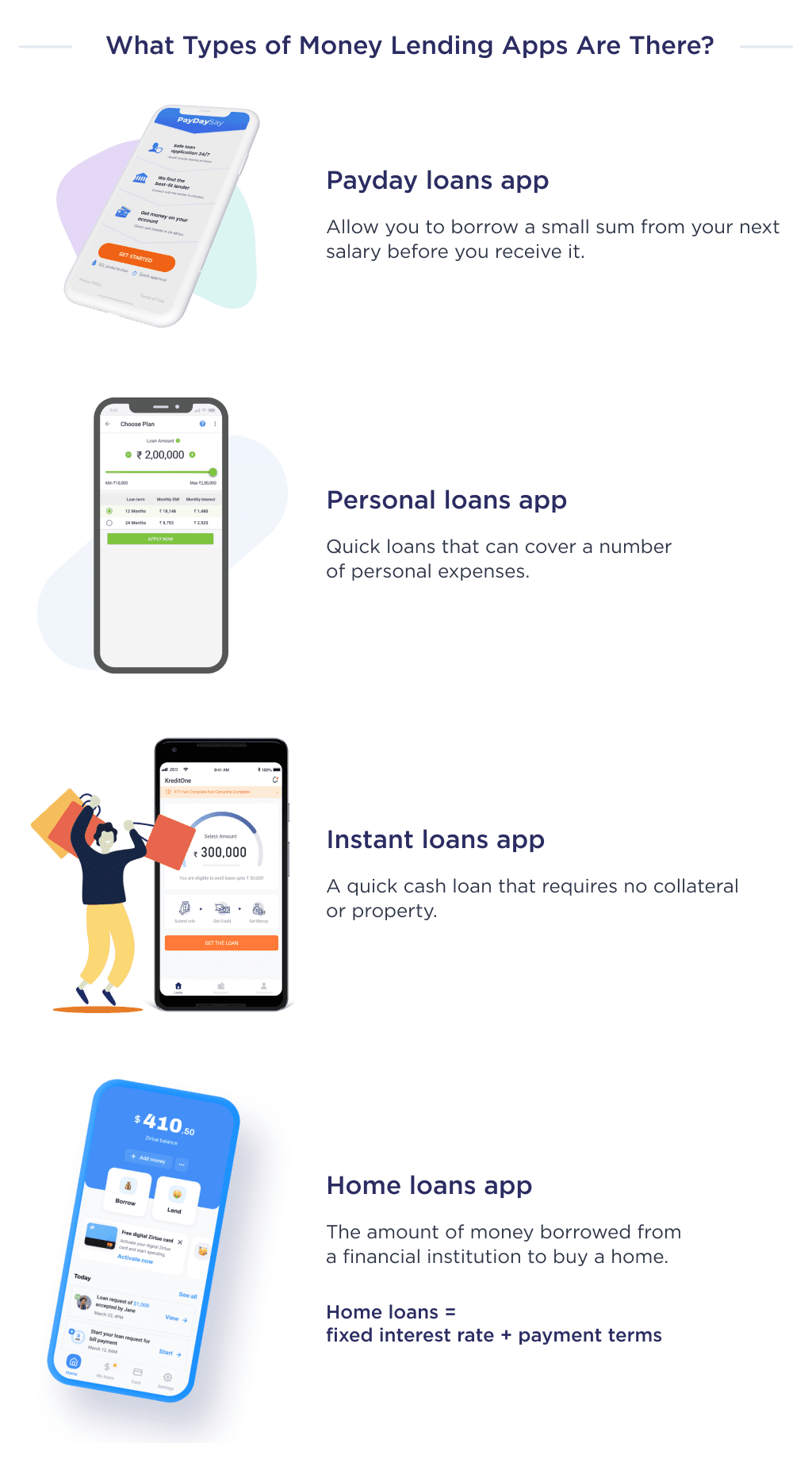

As a startup with an intent to invest in a FinTech category, not owning a custom lending app may rob you of an opportunity to own a stake in a fast-growing financial sub-sector.

Here are some verifiable stats that aligns with our viewpoint on investing in a loan app:

- The largest provider of personal loans in the U.S. is FinTech companies.

- The digital lending platform is expected to expand at a compound annual growth rate of 24% from 2021 to 2028.

- Over 30% of avid online-banking consumers use custom loan apps at least once a month.

Beyond the demand for custom lending apps, another reason to own one is the magnanimity of FinTech funding by venture capitalists. Here are some stats depicting how juicy the sector is:

- US-based FinTechs raised $98 billion in the 1st quarter of 2021.

- Ant Financial raised $14 billion in what market watchers called the biggest-ever single fundraising globally by a private company.

Thinking of launching a financial app? Our fintech app development guide covers it all.

Now that you have an insight into the potential perks of owning a digital lending product, let’s discuss the cost of developing one.

Cost to Develop a Digital Loan Platform

The development cost of a p2p loan application varies from $35,000 to $120,000.

The type of team, as well as the location of the app development team itself, are two major factors that impact a development budget.

Let’s take a look at the details.

How Team Type Impacts Cost

There is a gamut of options for startups, among which you should choose one that best compliments your company’s goals and objectives.

For this calculation, we’ll use the average cost of developing a loan app with basic MVP features.

Let’s look at the table for details:

| Type | Average cost, $ |

| In-house | 85,000 |

| Local development agency | 120,000 |

| Freelancers | 35,000 |

| Outsource agency | 50,000 |

As implied in the paragraph above, there is no right or wrong option to opt for. The best option is one that fits the goals, context, and sensitivity of your project.

However, it’s worthy of note that outsourcing agencies offer you the compendium of benefits from partnering with a local agency at a seemingly favorable price of hiring a freelancer.

If you’re considering outsourcing, check out the benefits of IT outsourcing for insights.

So let’s see how location is also a determinant factor in loan lending app development.

How Team Location Impacts Cost

| Location | Average cost, $ |

| Australia | 80,000 |

| The US | 150,000 |

| The UK | 120,000 |

| Western Europe | 100,000 |

| Eastern Europe | 50,000 |

| South Asia | 35,000 |

Beyond the development team, other factors like the discovery and design phase also affect the overall cost of creating an application.

Now that you have an apt overview of the cost of developing your mobile money lending product, let’s elaborate on some nitty-gritty things to consider before developing the platform.

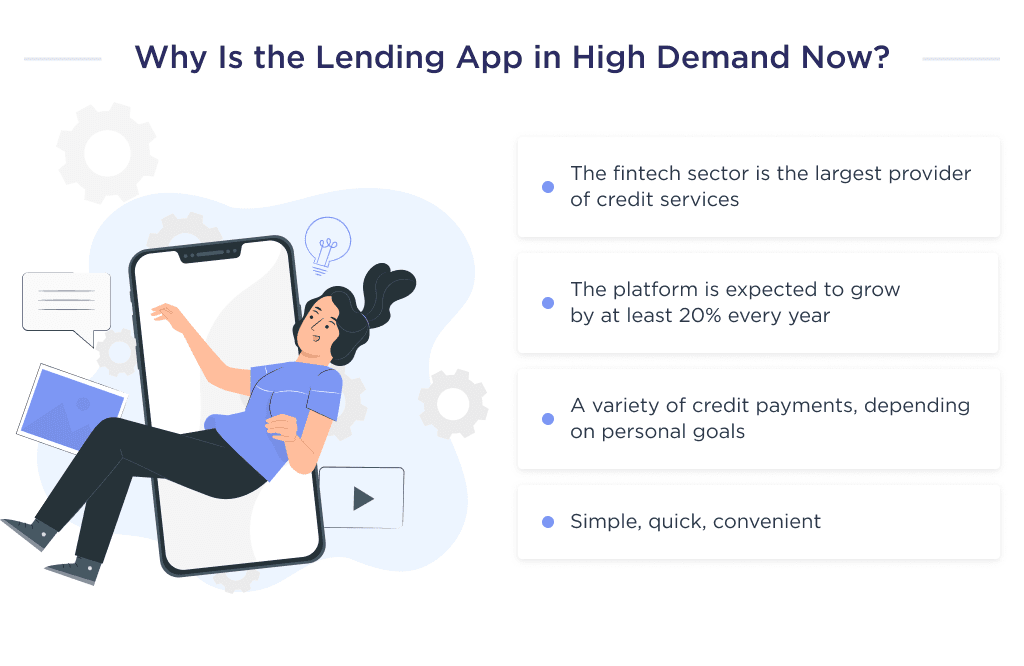

4 Considerations Before Building a Lending App

There are foundational steps to take before delving into the intricacies of creating your lending app.

Consider the checklist below before you start developing the product:

- Have a reliable source of finance

- Adhere to laid-out regulations

- Have a failure-proof business development strategy

- Think about the unit economics

Let’s make a more precise description of the things to consider before you develop your loan app:

1. Prepare Your Loan Financing

Opening a lending app can be capital intensive since the crux of your operation entails transferring money to the borrower.

There are two distinct ways to get this done; one is by partnering with a financial institution, while the other involves finding an investor with deep pockets.

Let’s discuss these two options:

Option 1. Partner with a Financial Institution

An effective way to guarantee top-notch financial resilience for your business is by partnering with a financial institution of repute. E.g., banks. Doing this opens your startup to a large pool of resources to accommodate loan demands from as many users as possible.

The support you’ll get from a financial institution is likely going to be a blanket bank loan, business loans, or per-user support agreement.

However, before you opt for this option, it’s best to first consider the pros and cons of choosing a bank partner. These are:

| Pros | Cons |

|

|

Now that we’ve explained the pros and cons of partnering with a financial institution let’s discuss its next suitable alternative: finding an investor.

Option 2. Find an Investor

Finding an investor is another viable option to consider. However, you may have issues convincing investors to give you enough funds due to the capital-intensive nature of operating the business. What do we mean?

Let’s assume that you have a user base of 10,000 credit seekers taking a personal loan of $5,000 each, this means that you’ll need about $5kk or $5,000,000 from investors. This is undoubtedly a tall order for startups that are just launching out. But at the same time, you will be able to take advantage of the lending application.

Pros and cons of funding your lending app through investors:

| Pros | Cons |

|

|

You now have a more succinct idea of how to sort out the operating finances for your concept; let’s delve into the next thing to consider.

2. Meet Legal Requirements

The Consumer Financial Protection Bureau, amongst many noteworthy organizations, has laws that guide the operation of loan apps.

Some of these legal compliances ensure that loan apps properly keep consumer data, comply with internationally recognized anti-money laundering policies, etc.

As a startup that wants to venture into a highly regulated FinTech sub-sector, it’s best to partner with an experienced legal consulting firm for a proper understanding of location-specific regulations.

Amidst the regulatory landscape, executive compensation consulting firms play a critical role in assisting businesses to navigate the complexities of structuring compensation packages.

An example of legal regulation for U.S.-based lending platforms is the Fair Debt Collection Practices Act.

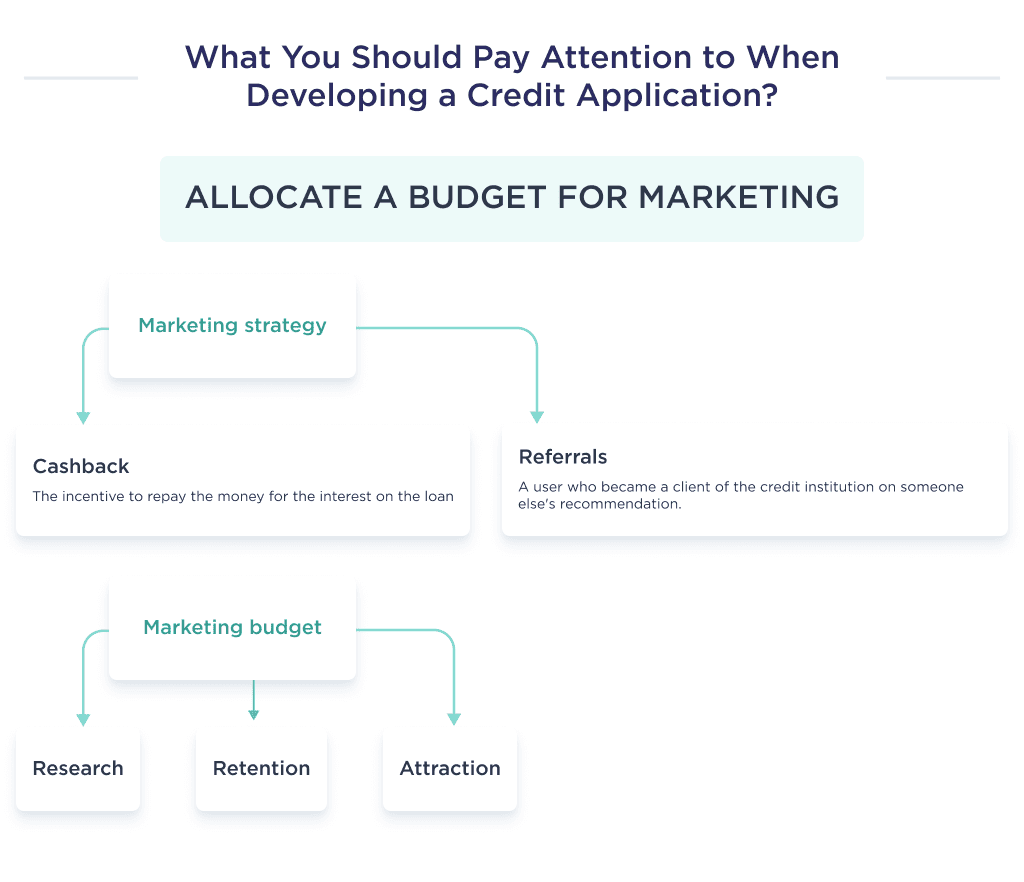

3. Budget for Marketing

The lending apps market is a very competitive one with competition stemming from other FinTech companies and financial institutions. As such, you should employ highly effective marketing strategize and witty professionals to attain market recognition.

Some highly noteworthy strategies to curate include referrals and cashback.

- Cashback. This is an incentive-based marketing strategy that includes giving debtors a cash refund on an interest paid for the loan.

- Referrals. Another budget-friendly and effective marketing strategy is a referral. Basically, this centers around incentivizing existing loan app users to introduce the solution to their family, contacts, and friends to become new customers.

And after choosing a marketing strategy, you should back it up with a budget that compliments your startup’s goal in terms of product research, branding, customer acquisition, and customer retention.

Using a CAC calculator can help you make informed decisions on acquisition strategies.

Although your marketing budget is totally up to you, the average cost of marketing a new app is 2-3 development budget per annum. That is, if it costs you $50,000 to develop a new product, an ideal marketing budget should be $100,000 – $150,000 annually.

If you are looking for ways to elevate your email strategy, our email marketing for startups tips are here to help you communicate effectively with your audience.

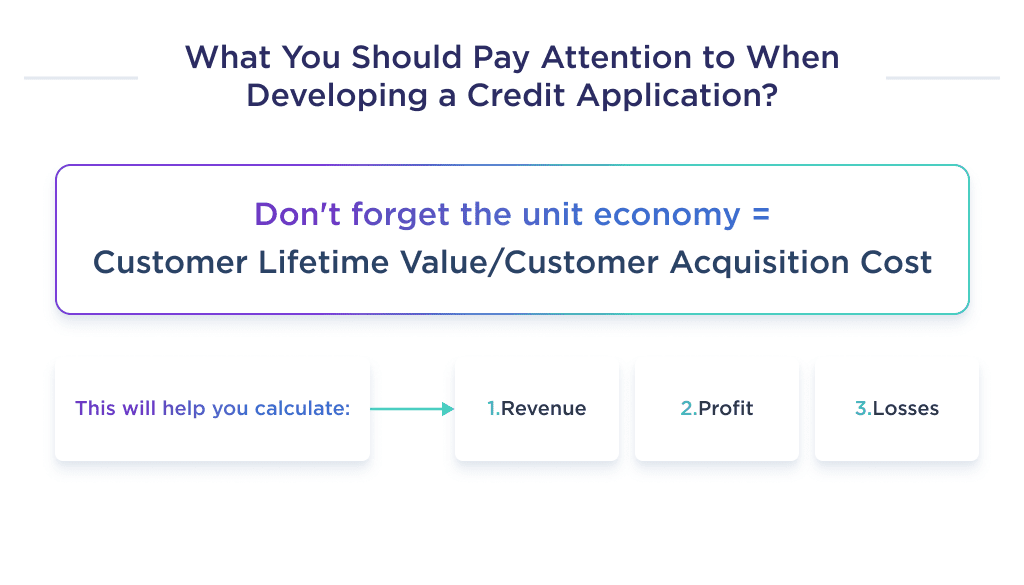

4. Evaluate Unit Economics

Having a proper grasp of unit economics is key to predicting your current financial conditions and future growth. This method basically involves tracking the cost involved in issuing every dollar you loan out and the revenue expected on each dollar. With this understanding, you can easily calculate revenues, profits and losses, and much more.

Our easy-to-use ARR calculator is ideal for SaaS companies looking to track revenue growth.

When your product finally launches, you’ll start to loan out some money with an expectation of getting interest within a scheduled time. This puts your startup at a spendable stage.

Once operation begins, you should craft marketing strategies that can guarantee a fast customer acquisition rate while also ensuring the best user experience for high customer retention.

When your customer retention rate seems desirable to your team, it’s time to begin upselling by encouraging customers to borrow a larger sum of money. Doing this should lead to a desirable Key Performance Index called a negative churn rate.

A negative churn rate occurs when revenue from old customers that are upgrading to higher loan plans supersedes losses from loan defaults.

Tracking customer retention is essential, and this churn rate calculator can help measure your customer loyalty.

So, we’ve looked at the basic things that go into the business development of a credit application. Now let’s talk about the development process.

Step-by-Step Guide to Building a Lending App

The competition in the FinTech space is getting intense. To carve out a niche for your startup, it’s important to take these important steps to create user-friendly software.

Here’s a checklist of steps to take:

- Target audience and competition research phase

- Identify every compliance laws

- Product design

- Think through a visual style

- Opt for a suitable technical partner

- Quality assurance testing

- App deployment & support

- Collect feedback and improve on the mobile lending solution

Let’s dive into the nitty-gritty of these steps.

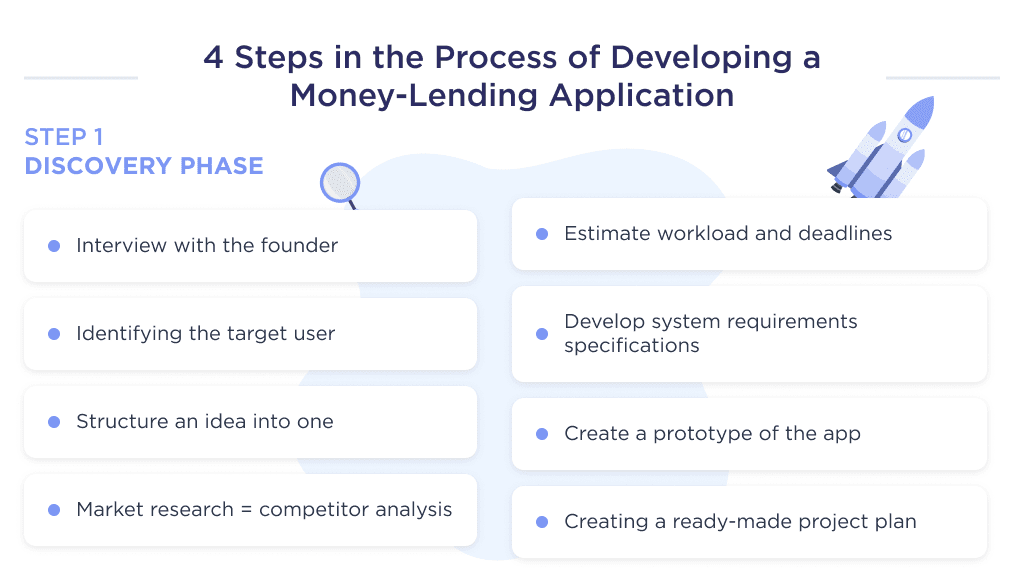

Step 1: Discovery Phase

The discovery phase is a scoping phase, and its aim is to introduce the concept being developed to everyone on the team. Beyond this, it also helps to identify regulatory compliances and restrictions that pertain to the FinTech lending app space.

The workflow of the discovery phase of a lending app differs according to the project’s goals, the development team, and geographic restrictions. However, an ideal discovery phase should touch on the following:

- Familiarize with the idea

- Define target audiences of the product

- Conduct extensive market research

- Determine the scope of work

- Set priorities and deadlines

- Create a prototype for the application

- Revise prototype’s compliance with regulatory laws

That’s just a succinct idea of the steps to take. Let’s dive into a more detailed description of what it includes:

1. Get the Founder’s Perspective

The first notable step in the discovery phase is to discuss with the founder. This involves having an interview to understand the concept of the product and sharing it with other members of the team as well as to finalize the idea for fintech startups.

Doing this helps to prevent ambiguity and ensures that the entire team is aligned in the same direction.

2. Understand the Target Audience

Get to know the end-users by answering relevant questions with your team. Questions like:

- Which group will this loan app best appeal to?

- What pains, problems, & needs do traditional loan seekers have?

- How do they think?

- In what way will this product make loan applications easier?

- How can you reach them?

The idea is to keep asking these questions until every member of the development team knows the target audience.

3. Structure Your Ideas

Use a mind map to create a visual that helps structure all information into a concise and easily understandable diagram for the team.

4. Competition Analyses

In a highly competitive market such as these, you should leave nothing to chance. This includes appropriately analyzing your competitor’s business and technical strategy to properly understand their successes and failures.

5. Regulatory Analyses and Systems Requirement Specifications

This step involves aggregating all regulatory laws and drafting a system requirement specification that aligns with those laws.

Based on the drafted requirement, the UI/UX designer can now make an interactive prototype of the app.

6. Project Blueprint

Based on the information obtained above, the project manager should be able to create a detailed blueprint for team members. An ideal plan should include project scope, budget estimate, and expected deliverable from all team members.

This phase offers loads of founder-specific benefits that include the creation of a budget-friendly product that appeals to the target audience. For more details on the discovery phase, read this article.

Let’s discover the essentials of the design phase.

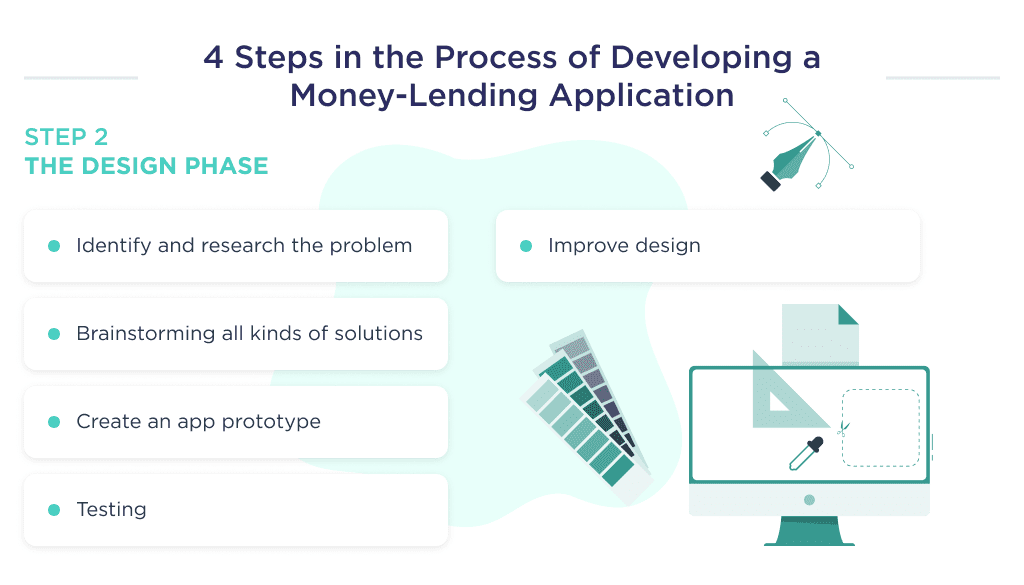

Step 2: Design Phase

The design phase is highly vital to the success of the product. This is because it provides the earliest visions of the founder’s idea.

An important deliverable from the design phase is the wireframe or/and prototype that properly details a borrower’s experience on the money lending app.

Here, every executable action and icon on the wireframe are programmed as independent features by the programmer.

Find the best TypeScript developers for your project.

The design creates an actionable plan to guide the thought process of app developers, ensuring that every line of code is tailored to support the realization of the founder’s goals.

The deliverable from the design phase should maximize the aesthetic of the lending app while also improving its engagement rate, responsiveness, and efficiency.

This is a pretty succinct look at credit app design, that highlights the importance of design in development.

If you’re interested in learning more, read articles about the mobile app design process or app design costs.

In the meantime, we’ll continue with credit app development.

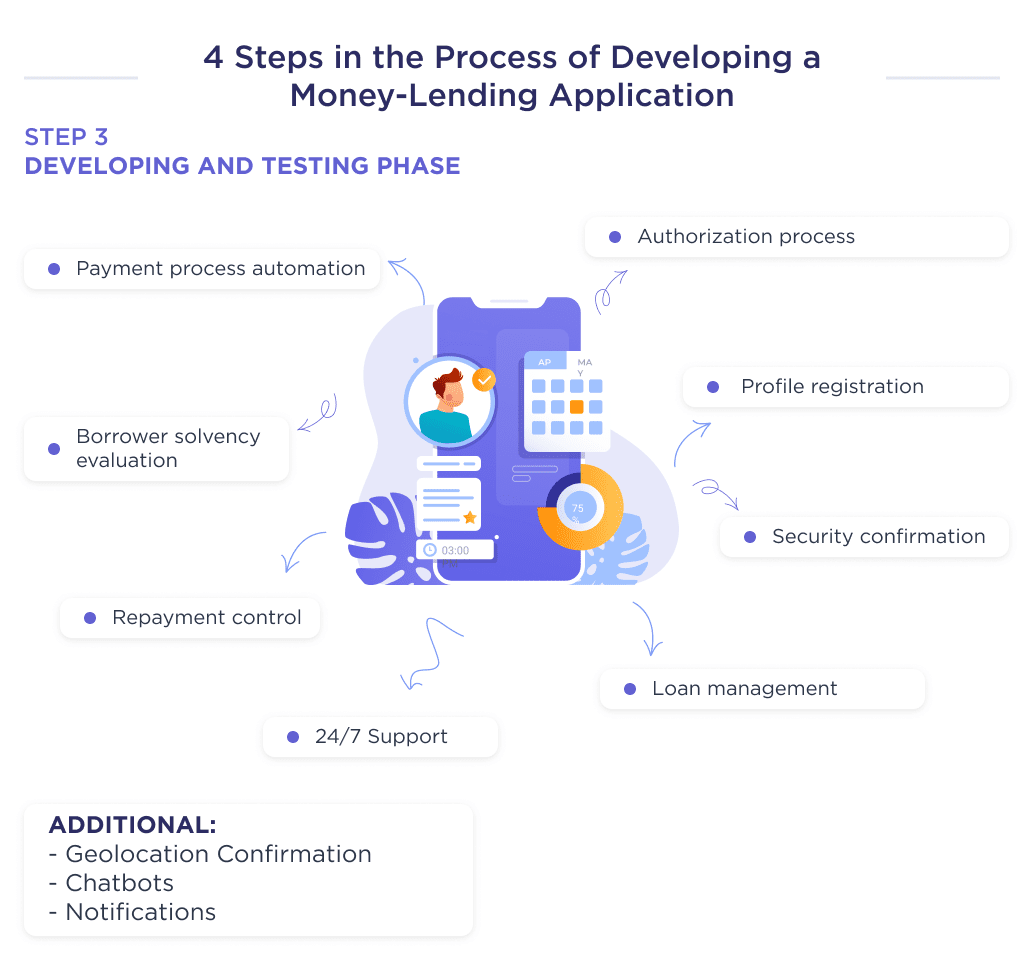

Step 3: Development and Testing

The developing and testing phase is the crux of money lending application development. This step is handled by the development team that’s responsible for implementing deliverables from the UI/UX designers.

The result of this phase should be an MVP app or a fully functioning scaled app that is endowed with a gamut of user-oriented functionalities.

An MVP, which is a short form for a minimum viable product, is an application with basic features released with the sole purpose of testing the acceptability of the idea in a chosen target market.

Once a desirable rate of customer satisfaction for the solution is reached, the developers then create a scaled-up app with more customer-oriented features.

MVP Features for a p2p Lending Platform:

| Features | Description |

| User Authorization | User authorization is an intricate part of the application’s security features that grants access to users in need of certain resources. Its main purpose is to safeguard vital user-specific data from getting into the wrong hands. |

| Profile Creation and Management | This feature can best be described as a directory with settings and information for account personalization. It also contains highly sensitive data, and as such, requires user authorization for access. |

| Security Module | A security module is a highly sophisticated feature for encrypting payment information and other sensitive data to prevent data leaks. |

| Loan management | The loan management feature is one that helps to automate every stage of the loan lifecycle, from application to closing. Further, it involves calculating interest rates and supervising payments. On additional demand, this feature may provide vital analytics and insights for both borrowers and lenders. It often acts as the platform’s loan calculator. |

| Payment gateway integration | Payment gateway integration is an online payments service that, when integrated with the loan app, facilitates the disbursements of loan payments to and from the bank account. Quite often, payments are done via credit card, debit card, bank transfers, as well as by online payment application. |

| Integration with credit score API | The credit score API delivers current and historical credit scores according to data from all nationwide credit unions. Integrating your application to credit score API gives you a measure of safety on the loan by determining the probability that the borrower will pay back the loan. It’s the ultimate test of eligibility for most p2p lending app. |

| Analytics | This feature helps users to have a better overview of the repayment of their loan amount. |

| Customer support | The customer support feature is a channel for customer inquiries. |

Advanced Features for Mobile Lending Application

However, if you prefer a lending platform with all user-oriented features possible, consider these features.

- Social media authentication

- Reward system

- Geolocation

- Chatbot

- AI-driven prediction scoring and analytics

- Blockchain technology

- Push notification

- Cryptocurrency integration

Once you’ve embedded the solution with desirable features, an equally important step is a product launch and maintenance.

Let’s dig into more details of this.

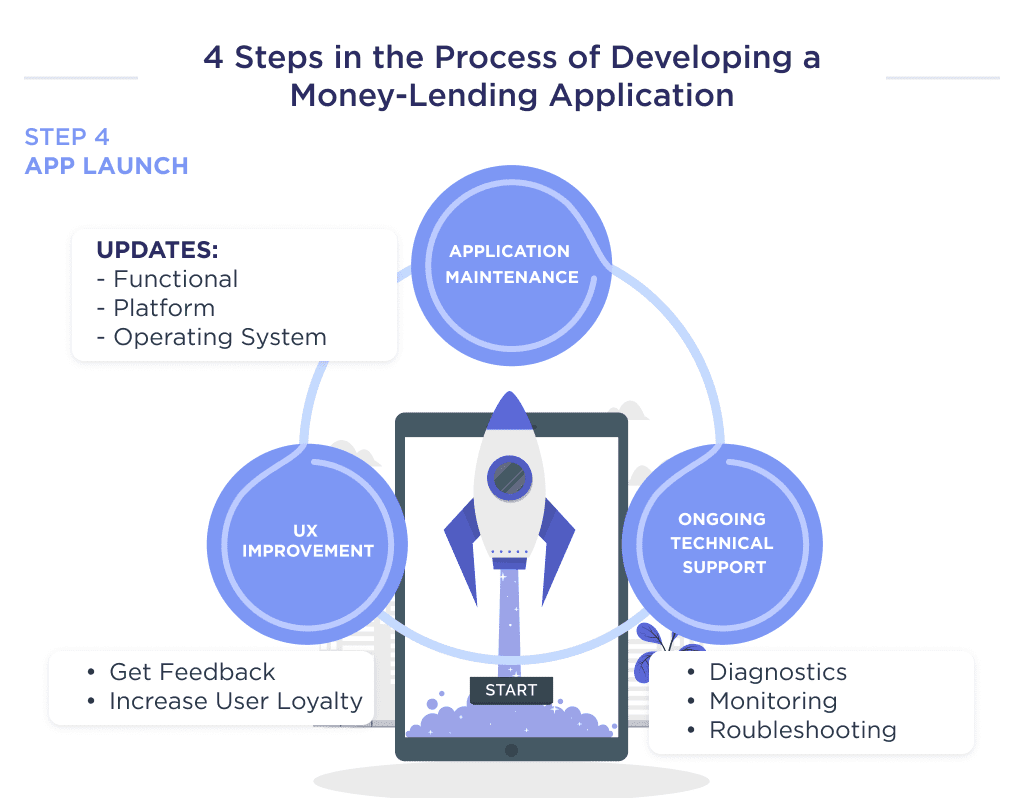

Step 4: Launch, Updates, and Improvements

After creating a super effective and catchy product, what else? The next logical step is to launch your product on app stores for your target market.

This last step is more than a mere formality; it’s essential to the existence of your startup and its profitability in the FinTech sub-sector.

However, work doesn’t end with just launching your product, as you need to expend a great deal of time on maintaining it.

Doing this requires a fully dedicated mobile app maintenance team with the skill to make timely adjustments when the need arises.

Ideally, this team should include a few developers with a budget that’s 25% of your loan lending app development cost. This means a $50,000 requires an annual maintenance budget of $12,500.

Beyond product maintenance, the team is also saddled with the responsibility of keeping tabs on complaints and detailing them to the management.

Irrespective of the type of app, the bulk of the maintenance budget will be expended on;

- Support & maintenance for iOS, Android, or cross-platform app

- Deleting features

- Adding new features

- Real-time analytics & monitoring

- Debugging

Wondering about the web stacks and team you’ll need for the steps above? Let’s discuss that in the section below:

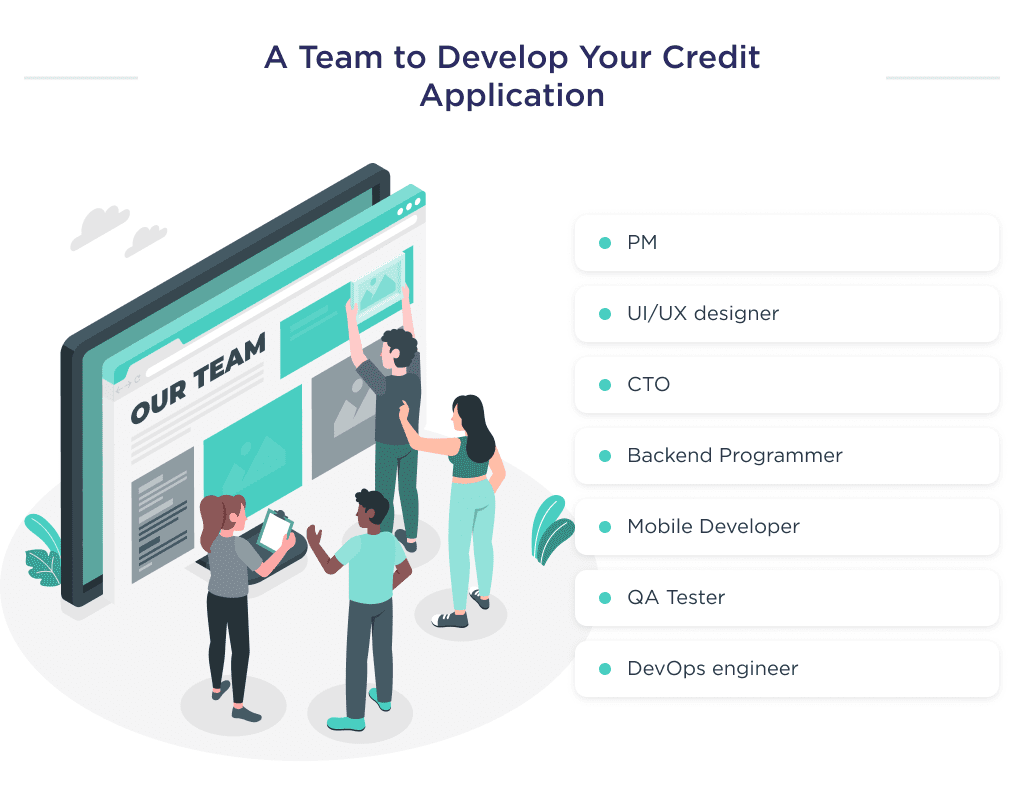

Required Team

The team of experts you’ll need for your entire loan app development are:

| Required Team | Job Description |

| Project Manager | The project manager plans, organizes, and directs the team towards the timely completion of the software. |

| UI/UX designer | The UI/UX designer is saddled with the responsibility of mapping-out the user experience in a wire-frame and designing a prototype of the user interface. |

| CTO | The CTO is responsible for overseeing the development and dissemination of technology. |

| Backend Developer | The backend developer is responsible for creating and maintaining the technology that the application’s functionality relies on. |

| Mobile Developer | The mobile developer is responsible for implementing the UI/UX design and creating interactive features that are mapped out in the design phase. |

| QA Tester | The quality assurance tester ensures that the live app adheres to the laid out expectations in the discovery phase. |

| DevOps | DevOps engineer oversees the entire coding activity of both the frontend and backend developers. If you want to learn more about DevOps specialists, check out our DevOps glossary that covers key terms to help you stay on top of DevOps practices and tools. |

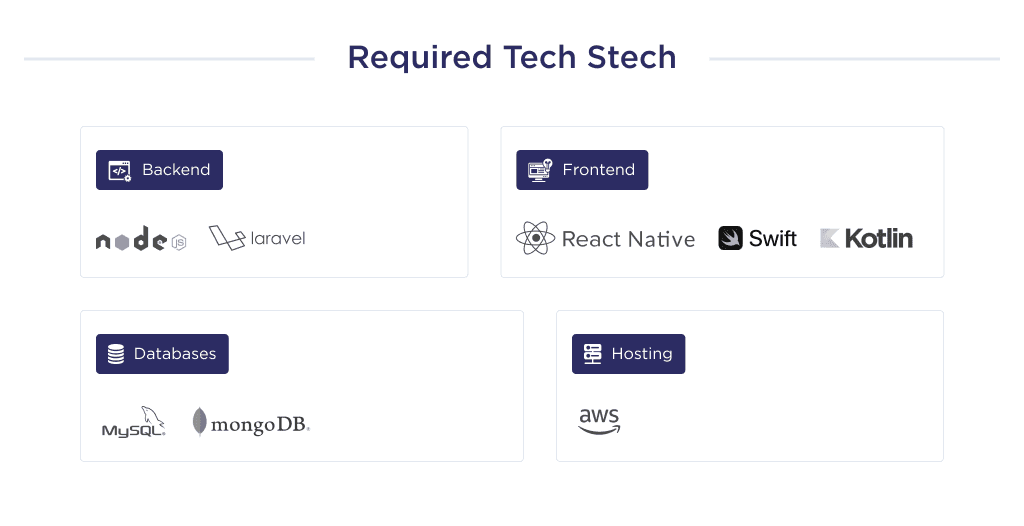

Tech Stack

Your team of developers should be knowledgeable about these tech stacks:

| Feature | Tech Stack |

| Backend development | Laravel, Node.J.S. |

| Front end | Swift, Kotlin, ReactNative |

| Database management | MySQL, mongoDB |

| UI/UX Design | Figma, Principle, balsamiq |

| Product Management | Confluent, Jira Software |

| Hosting | Amazon Web Services |

Struggling to pick technologies for your project? Discover how to choose a tech stack with our expert advice.

Selecting the right hosting solution is key to your SaaS success. Learn about the best options in our guide to hosting for SaaS.

Discover the best Laravel tools and resources for developing robust web applications.

Want to Develop a Loan Lending App?

Successfully building a lending app relies heavily on choosing the right development team. You’ll want to partner with a mobile app dev firm with proven expertise in building cutting-edge FinTech products.

At SpdLoad, our team helped dozens of startups design, build, and launch custom lending apps quickly and effectively.

Don’t just take our word for it – read our case studies and client reviews on Clutch to see the quality of our work.

Creating an app can be complex, but these app development tips simplify the journey.

Ready to bring your lending app idea to life? Schedule a free consultation with our product discovery team.

We’ll dig deep into your vision, needs, and goals to craft a plan for designing an app that delights users and drives revenue. Let’s talk!

Need guidance on how to choose an app development company? This guide has you covered.

Bonus Infographic

Here’s a summary of our in-depth guide. Learn the highlights of the process of creating a money lending app from scratch in 2025

Find out how long it really takes to develop an app with our comprehensive guide on how long it takes to develop an app.