9 Steps to Discover Unicorn Business Ideas

- Updated: Aug 27, 2024

- 8 min

Nearly every tech titan that now motivates founders across the globe began as a unicorn startup.

These trailblazing companies have set the pace as technology pioneers and trendsetters.

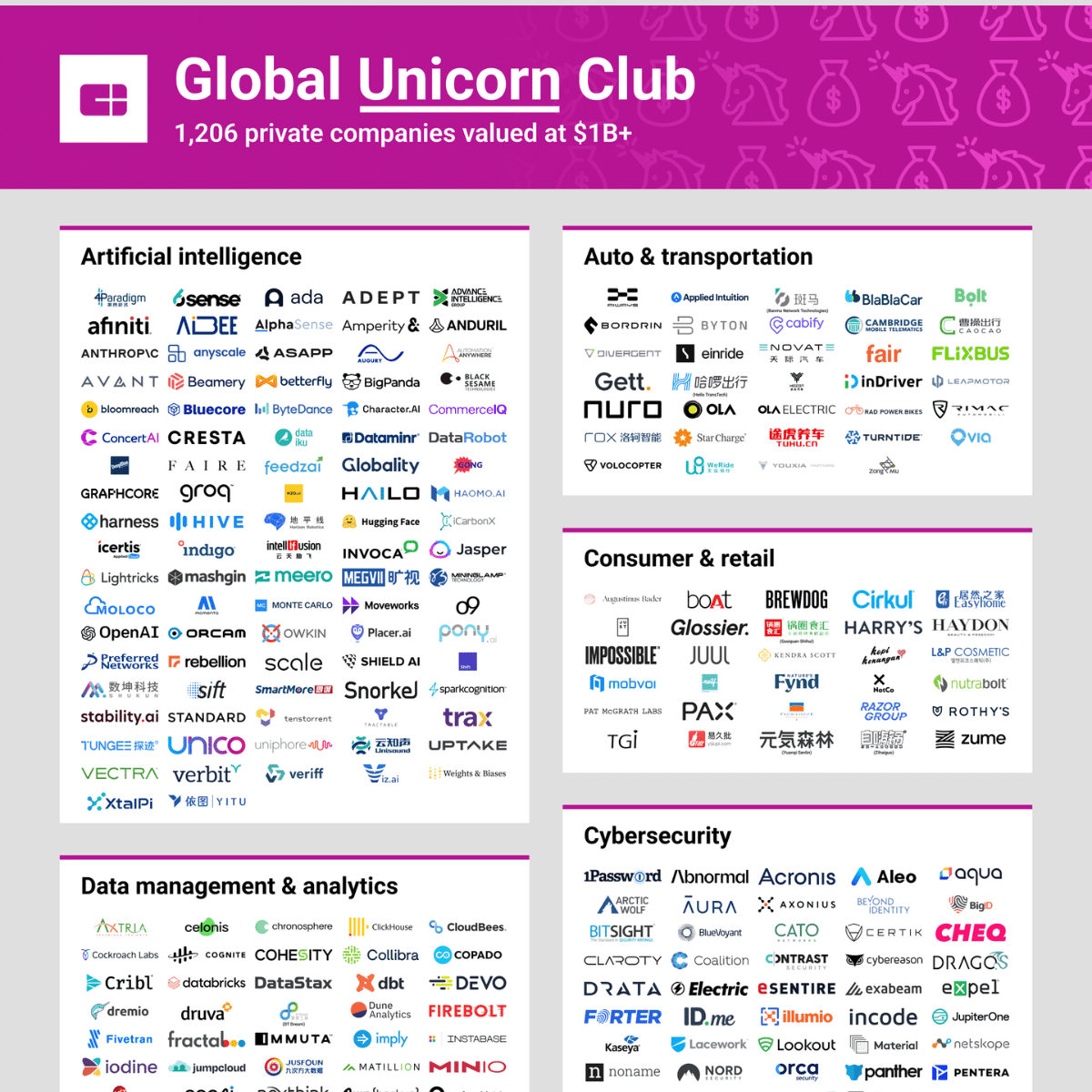

Not long ago, building billion-dollar unicorns seemed inconceivable. Yet today, more than 1,200 unicorns stand out as market frontrunners.

So, what does it take to join their ranks?

Unlock your startup potential now — start transforming your vision into a scalable solution today!

6 Startup Funding Stages

As soon as you launched an MVP it’s a perfect time to raise funds.

The main reason to do so is the rapid growth in the market.

It helps to ensure the predictable improvements of the features and business logic at each of the startup phases.

Pitched funds are usually used to continue product development and reinforce marketing/sales activities.

Let’s find out how startup funding works.

Let’s clarify the essence of the stages of startup funding:

- The pre-seed stage. In general, this phase isn’t about investment, rather about bootstrapping. the founders usually have to rely on their own financing to get the project off the ground. As a rule, at this stage, founders deal with idea validation. The startup valuation ranges from $10 000 to $100 000. Usually, the investors at this stage are:

- Founder and co-founders,

- Friends and family.

- Seed stage. At this stage, the startup valuation ranges from $3 000 000 to $6 000 000. Usually, investments at this phase are necessary to build up scalable business processes and find a product/market fit. In fact, the founders exchange startup equity for investments. Those who do not follow this step join the 90% of failed startups. Some sources can provide financial help at this stage:

- Family and friends,

- Angel investors. In 2018 an average angel’s financing round was $149 000,

- Business incubators. Take a look at YCombinator or 500 Startups. These are specific mentoring, advising and investment programs for startups,

- Micro venture capitals funds.

- Series A. It’s the first stage of venture capital investments. At this stage, your startup should have a profitable and predictable business model with a stable customer base. This stage isn’t about innovative ideas. Focus on the strategy that will help you to conquer the market. The valuation of startups at Series A starts from $10 000 000 up to $30 000 000. It says that you should find 30 investors who are interested in your business idea. 10 of them would like to invest, and 2 of them will eventually invest. These investors are:

- Venture Capital companies or capitalists,

- Super Angel Investors. It’s something like a typical angel investor but with a more massive amount of money available for investments,

- Business Accelerators. These programs are like incubators, but for more mature startups.

- Series B. It is the next round of venture capital investments. The startup market valuation varies from $30 000 000 to $60 000 000. This round continues the ideology of round A. This means that you should keep on conquering the market and focus on rapid growth. Outline the competitors or even consider acquisition – why not? At this stage, you can use some investments from such huge players as:

- Venture Capital,

- Specific late-stage VCs.

- Series C and all rounds above. This round is about rapid market acquisition. Your startup should be substantial enough at this stage. These investments aim to speed up the market expansion for your project even more. At this stage, you can rely on such investors as:

- Late stage VCs,

- Private market investors and equity companies,

- Hedge funds,

- Banks.

- IPO. In a nutshell, it’s a process of entering the market of corporate shares for the first time. You must have heard about the fiasco of WeWork’s IPO. This startup failed to ensure this process well because this stage requires a corporation-like attitude with a few teams of lawyers and public accountants on your side. The majority of the unicorn startups have already done IPO or at least considered this step.

List of Unicorn Startups

The unicorn startups are the best new companies in terms of market valuation. They make a list of first-class companies, with an excellent implementation of their vision and scalable business development.

Let’s find out what the unicorn landscape be in early 2020:

- Uber. It is a giant of a taxi business and one of the most recognizable startups ever. Its market valuation is $62 billion.

- Xiaomi. It is a Chinese hardware company that builds everything – from toothbrushes to backpacks. It has a market cost of $45 billion.

- Airbnb. It is another recognizable unicorn in the rental market, with a valuation of $25,5 billion.

- Palantir. It is a big data analytics trendsetter with a market value of over $20,5 billion.

- Didi Kuaidi. It is a Chinese taxi app, with a market price of $16 billion.

- Snapchat. It is a multimedia messenger that allows photo exchange and video streaming, with a market valuation of $16 billion.

- Meituan Dianping. It is another startup from China that specializes in the delivery of food and small goods. Its valuation is $15 billion.

- Flipkart. It is an Indian marketplace, something like an Amazon for a local Indian market. This private company valued $15 billion.

- SpaceX. It is another famous project founded by Elon Musk. It is a $12 billion aerospace manufacturer and space transportation services company.

- Pinterest. It is a world-famous visual design and inspiration platform that costs $11 billion.

Traits of a Unicorn Startup

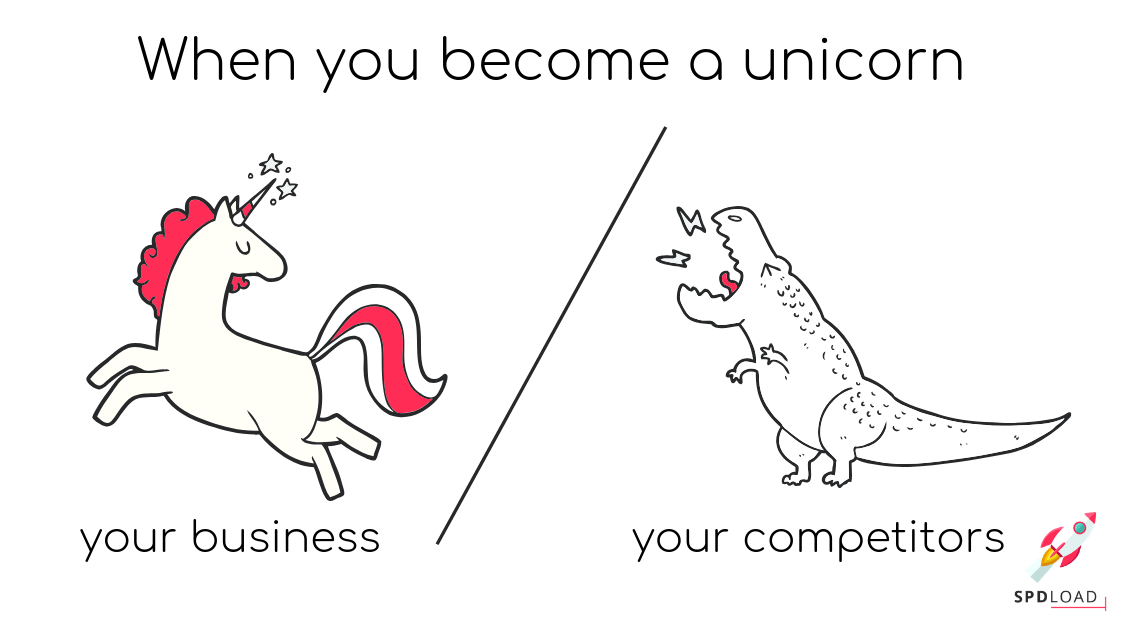

The best way to embody your idea and create a unicorn-level solution is to create a valuable product. It should not only differentiate from the existing solutions but be even better.

Basically, there are multiple options to add value. For example, take the product you use every day.

Taxi app? Messenger? Management system?

It can be anything.

Once you can spot anything that can be improved from the user-experience perspective, you are in the game.

When it comes to building a unicorn, there is no assured formula that leads to success. But here are some tips that might help:

- Let product evolution happen. Change the strategic direction in response to new market conditions, if it’s necessary. There will always be a similar app or app with the same idea (learn more in our article called I have an app idea). I am not even talking about clone apps sweeping across the digital market. But having a bunch of killing features doesn’t mean having that one feature that changes the game. You should be unique in your own way and adapt to market challenges.

- Recognize your weaknesses. Sometimes a change of direction does not work as you planned. But if you understand your gaps and imperfections, you can always make away with them. This ability defines the success of a startup.

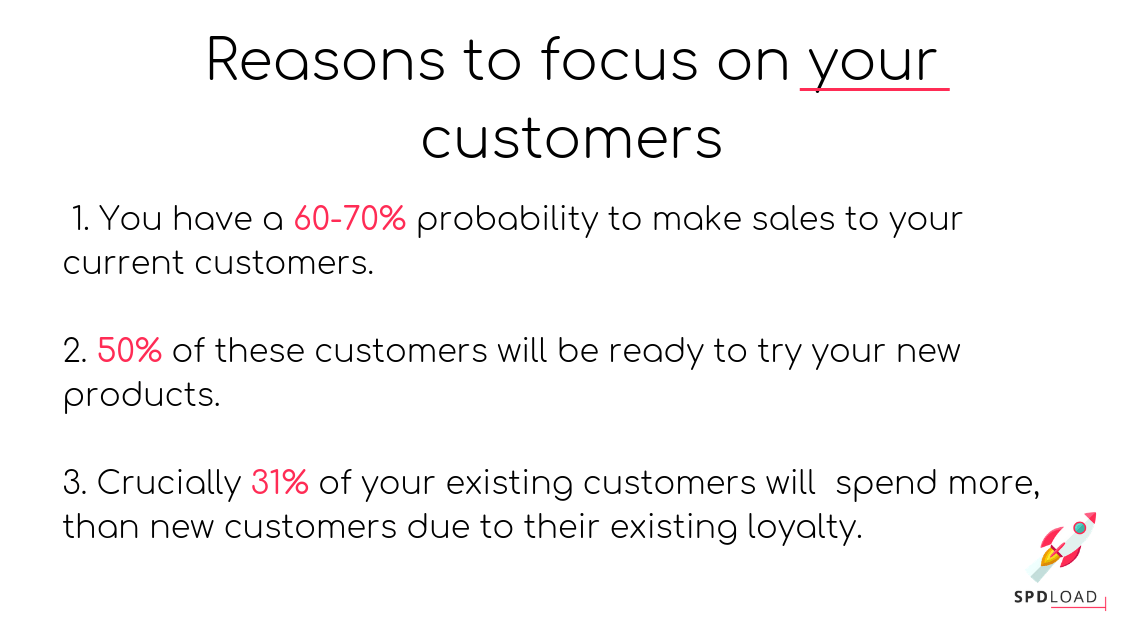

- Be customer-centered. Before you actually reach a “one-size-fits-all” stage, focus on the particular customer portrait. Start with a specific target audience to ramp up a customers base:

- There is a 60% probability of making an upsell to an existing customer. Meanwhile, there is only a 15% likelihood of selling a product to a new-joined customer,

- 50% of your existing customers are ready to try new products you’ll make.

How to Become a Unicorn Company?

The process of building a unicorn startup differs significantly from those of Fortune 500 companies.

There are only two requirements that differentiate a unicorn:

- Your product has a considerable impact on customer satisfaction. It changes customer behavior and can improve their lifestyle. Uber is an excellent example of such a product.

- Your product has a revenue-generated model from inception. It needs to reduce costs on the one hand and generate enough value on the other. In Uber’s case, it saves riders time and allows drivers to earn money.

And these are the reasons why unicorn companies become what they are. Uber is more than just a taxi application. It is a phenomenon that changed our perspective on how a transport service should work. Learn more about how much it costs to build an app like Uber.

Market Demands for a Unicorn Business Model

It is believed that $1 billion is the ideal market value size to launch a startup in our business world.

Such a market ensures enough customers, but also provides some room for a new player.

Therefore, it’s vital to ensure that your product has enough potential to be influential in a Unicorn marketplace.

The main point of market analysis is to make sure your product has a market/product fit in a crowded market.

You also need to ensure it is attractive enough to encourage customers to pay a premium price on a regular basis.

That’s why there are specific empirical-based requirements for the projects at the unicorn level. It’s not a single framework, but rather the combination of the founder’s skills, that empower the dynamic of startup growth:

- If a company shows x10 times growth over 3 years, it signals the potential to reach a billion dollars valuation.

- A founder has to be obsessed with results. The trick is to do whatever it takes – write new rules and break the common ones, as every famous unicorn does.

- Continue doing unicorn stuff until it stops working. If customers like what you are doing, keep moving on. If your company grows, you don’t need to change your core activity. Do the same things for the broader target audience, taking into account the hypothesis that works well with your smaller audience.

How to Launch a Billion-dollar Business

The job of any startup is to find a solution to a problem that customers want to solve.

In case you want your company to get a $1 billion market valuation – try hard enough to find a unique solution to solve a user problem. There is a good approach to how this can be done:

- Identify the problem. For example, let us say that the environment is deteriorating.

- Consider the problem. People drive short distances via vehicles.

- Reverse the problem. Try to discourage people from using vehicles for these purposes.

- How do you achieve this? Help people to move over short distances in a more environmentally friendly way.

- Find the solution. Create a free rental service for electric bicycles.

- Add value. You can achieve that by providing cheap and eco-friendly rent stations with electric bicycles. The battery charges up whilst on the move, and subsequently can be used to charge street lights.

- Create a user journey. Visualize and note how the process will work. Include the answers to such questions as:

- Where would people find stations?

- How would this application look?

- How would the battery be charged?

- Would there be any ride limits?

- How would customers connect a battery to urban electricity?

- Validate your idea. Use Proof of Concept or prototypes to obtain feedback from your target audience. Ask bicycle riders and people who drive the short distances. Don’t forget to investigate legal requirements relevant to the town or city.

- How much is this likely to cost? Calculate your costs which should include the following factors:

- Building the bicycle rental station,

- Price of bicycles,

- Cost of replacing or recharging the batteries,

- Cost of app development and so on.

Turn Your Billion-Dollar Idea into Reality

Starting a unicorn company is hard. It takes dedication, visionary thinking, money, and some luck. But with the right help, your billion dollar idea could become a game-changing business.

Our team has helped dozens of entrepreneurs build breakout startups from ambitious ideas.

We create minimum viable products and build strategic apps to turn dreams into real user traction. Our experts work closely with you to prototype, engineer scalable tech, launch successfully, get funding, and lead the market.

Let’s discuss how we can strategically turn your billion-dollar vision into a real, successful business.