How FinTech is Disrupting Banking: In-Depth Overview

- Updated: Aug 27, 2024

- 10 min

Are you a founder, investor, or entrepreneur interested in FinTech?

If so, keep reading to understand how FinTech is disrupting traditional banking.

From cost savings to better service, the benefits of fintech are transforming industries.

Here’s what you’ll learn in this article:

- What is FinTech disruption, and why does it matter?

- Key differences between traditional banking and FinTech innovations

- Specific examples of how FinTech is challenging established banks

- Leading FinTech innovations transforming how consumers and businesses manage their money

- What does the future hold as FinTech aims to upend banking

Read on for an in-depth overview of the FinTech transformation in banking.

Planning your own business? Here are essential business startup tips to guide you.

Unlock your startup potential now — start transforming your vision into a scalable solution today!

What is FinTech Disruption of Banking?

Financial technology disruption is a massive shift in the banking service, from traditional banking to neobanks. Beyond offering banking services, neobanks have also helped users invest in stocks & crypto–niche, creating a platform for stock trading that traditional financial institutions are unwilling to try.

Since their heavy reliance on technology makes them prone to cyberattacks. Financial technology has introduced some noteworthy trends like blockchain, and other cybersecurity innovations as a response.

With cybersecurity risks on the rise, bot attack prevention has become essential for online security.

Now that you have a brief understanding of what FinTech disruption is. Let’s help you with a more illustrative view of the differences between traditional financial institutions and FinTech.

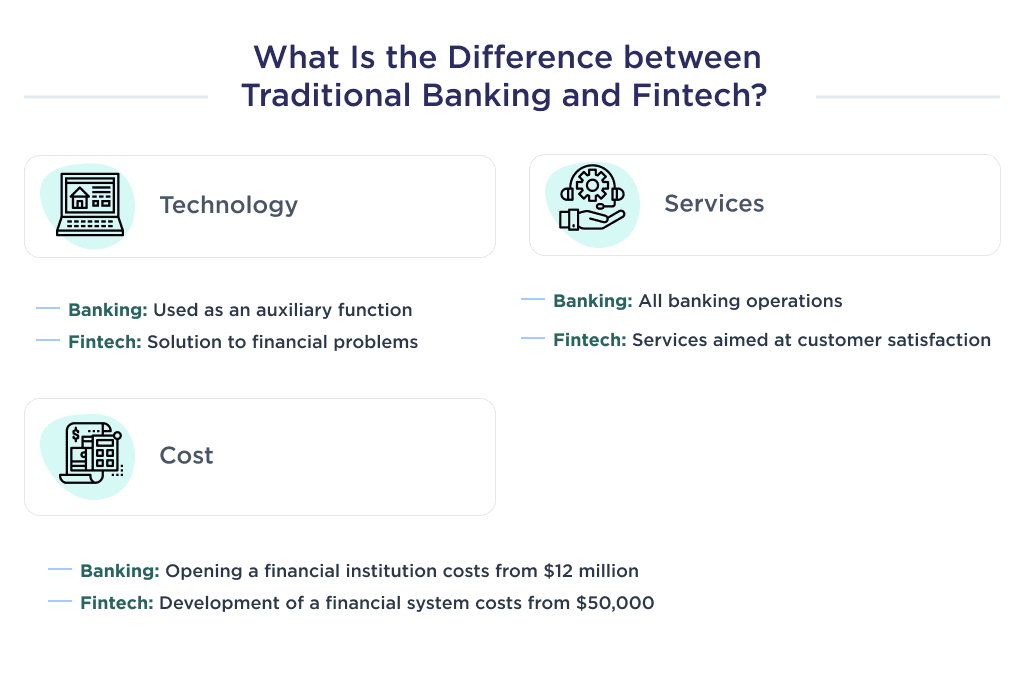

Traditional Banking vs. FinTech Innovations

Traditional finance house differ from FinTech in many ways, with the most noteworthy being in technology, cost, and services. We’ll consider these differences in the spreadsheet below;

| Criteria/options | Traditional Banking | FinTech |

| Technology | They use technology in a supportive role to provide services to their customers. | FinTechs are technology companies that develop products to solve financial problems. The crux of their activity is technologically-centered. |

| Services

| They perform all banking operations: from issuing loans to participating in the developing of a stock trading platform. Banks issue credit, deposits, funds transfer, help users invest, etc.

| Most finance technology companies only focus on a subset of banking operations. For example, lending apps focus only on meeting borrowers’ needs. Savings apps help people keep money etc. |

| Cost | The cost of opening a traditional financial institution starts from $12 million to $20 million. The exact price depends on the type you want to own. | The average cost of developing a tech-based financial system varies from $50,000 to $300,000. The exact amount depends on many factors. Read this article titled “How to Develop a FinTech App” for more info. |

Now that you understand the differences between traditional banks and tech companies. Let’s help you understand how financial technology disrupts banking.

How FinTech is Disrupting Banking

FinTech has revolutionized banking by introducing solutions that bring value to consumers. Since FinTech 1.0 in the 19th century, financial technology has been at the forefront of banking disruption.

Here are some ways financial technology has introduced digital transformation to banking.

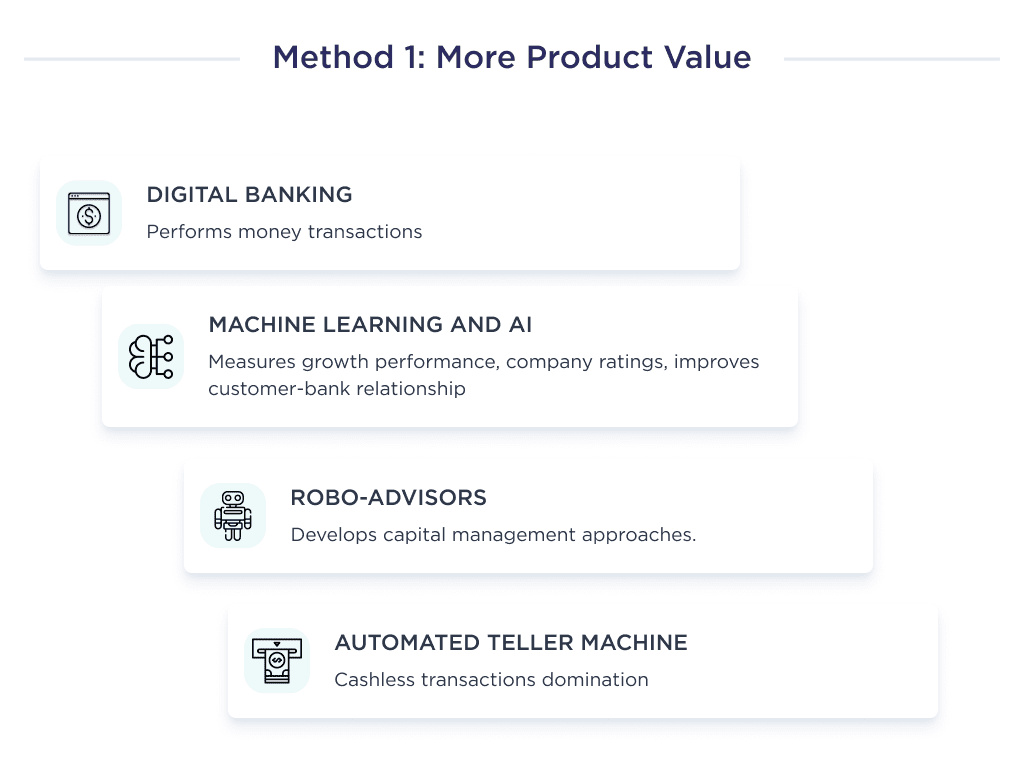

Increased Value Proposition

Most financial technology innovations have led to a single goal in the banking sector: better service value. How? FinTech innovations have a basic infrastructure for creating value for targeted users.

For example, a mobile payment gateway gives value to online traders. Adoption of digital banking provides ease to the value chain of open banking services.

Here are some statistics that give credence to the notion that financial technology is value-oriented:

- Over 60% of banking executives believe that FinTech adds value to banking services.

- In another statistic, 77% of financial institutions plan to increase innovation to improve value.

Here’s a spreadsheet of some FinTech and the value they bring to banking services:

| Disruptions | Value Introduced to Banking Services |

| Digital banking | The advent of digital banking has exploded banking services for deposits and savings. Digital banking apps also help customers pay bills, check account balances, and transfer money. |

| Machine learning and Artificial Intelligence | As the World Economic Forum noted, AI is significant in creating value for banking as a whole. It does this by helping to improve customer-bank relations and also automating transactions. You can get essential data to measure growth metrics and annual credit scores through AI. See the numbers behind the AI revolution in our latest article on AI statistics. |

| Robo-advisors | Here’s another customer-centric FinTech disruption. Robo-advisors are currently disrupting traditional ways finance experts and institutions offer advice to service consumers. |

| Automated Teller Machine | Since the first ATM debuted in London, banking consumers have shifted more towards digitization because they take benefits of fintech. As of now, over 88% of transactions in the US are cashless. A testament to the effect of disruptive FinTech. |

Beyond product value, it also helps to bring about a more customer-centered approach. We’ll discuss this below.

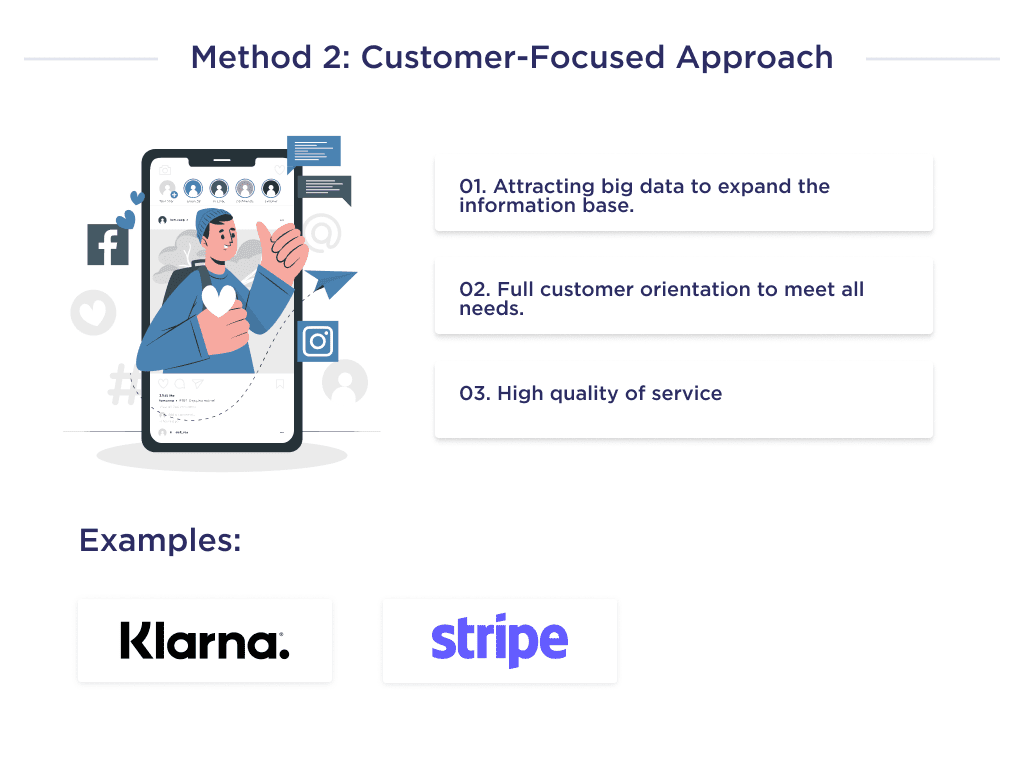

Customer-Centric Experiences

The way FinTech disrupts the banking industry is by offering an improved customer-centered approach.

A report by the Economist shows that FinTech is fast making banks more customer-centered in their business model. Banks now have more insight into more information through Big Data and Artificial Intelligence.

Also, FinTech tends to focus on a specific financial process, which opposes traditional banks’ strategy of hooking customers to its entire ecosystem. This method helps them build trust with their customers. In fact, 90% of FinTechs believe that customer experience is a priority.

Take Revolut, a FinTech company that focuses on customers’ needs at all levels, which grew from 150 thousand customers in 2017 to more than 8 million customers. According to Ron Olivera, Revolut plans to expand its product in the US in 2022 by taking customers from legacy banks.

A payment and service provider, Klarna, is another customer-centric FinTech company disrupting finance with its marketing strategy. They recently launched a “Consumer Council” program for consumers to share their experiences of using the product. By listening to consumers, FinTech has understood consumers’ wants and needs.

Similarly, Stripe holds Stripe Sessions, where a team listens to users’ experiences from using the payment system. The same practise is widelly used within Shopify and Stripe integration.

Branding and Marketing

We’ve all heard the phrase “Venmo me”. This is a branded language to promote Venmo.

The marketing team of most startups develops branded language to drive the use of their product.

When building a brand from scratch, a well-planned approach can make a lasting impression.

Branded language helps to improve brand resonance and familiarity for customer acquisition. It can also help industry entrants, and in the most effective case, the name may become an industry-adopted term. (Think “Hoover”!)

For startups, using a CAC calculator is essential to monitor customer acquisition costs.

FinTech firms are also adopting new and innovative approaches to branding. An example of such is gamification, which uses game-like elements in a non-game context.

It’s used to guarantee users have a fun experience using a product. When done right, gamification can improve customer retention rates.

In numbers, gamification is set to rise from a little over $9 billion in 2021 to over $30 billion in 2025.

Here are five examples of disruptive FinTech apps shaping branding with Gamification;

- ikano Bank: A Swedish bank focusing on wealth management for small savers.

- Revolut: The most valuable FinTech in the United Kingdom.

- Monobank: 20% of Ukrainians have a bank account with this neo-bank.

- Cake: A Belgian startup that shares profit with its users.

- Fortune City: A Taiwanese city-building app that organizes your finances

Upon helping you know how FinTech’s new technologies disrupt financial services. Let’s also discuss some examples of innovations championing this change.

3 FinTech Innovations Transforming Finance

Financial technology, despite its demerits, has successfully crept into the operational procedure of every facet of the financial services industry.

Here are some examples of FinTech innovations that are currently trending.

Chatbots and Virtual Assistants

FinTech offers improved customer service to users through chatbots. A recent study conducted by Statista suggests that chatbots effectively address customers’ needs. An ai chatbot for banks can streamline customer interactions and provide real-time financial assistance.

Customer service in FinTech is a primary activity of traditional financial services. Hence, chatbots are helping finance houses to manage customer expectations and automate costs.

Chatbots also gather information on user experience while interfacing with consumers. It then sorts these details through criteria.

Find the best TypeScript developers for your project.

Metrics gathered (income, spending patterns, predominant inquiries in a geographical location) are then used for predictive analysis when crafting marketing strategies.

Other uses of chatbots include;

- Upselling and cross-selling

- For increasing the customer retention rate

- Increasing user engagement

Some real-life examples of chatbots used in the financial sector are Erica, used by Bank of America, and Eno for Capital One.

Alternative Credit Scoring Models

Traditionally, an individual’s creditworthiness is determined based on a set of credit scores provided by reporting agencies like Equifax, Experian, SCHUFA, etc.

But these metrics are not encompassing enough. That made tech companies invent a different way to determine creditworthiness.

Alternative credit scoring is a FinTech innovation that determines creditworthiness based on varying data. For health insurance, tech companies may use quantifiable data such as weight, blood sugar level, age, and unquantifiable data like exercising to determine a policyholder’s health risk.

This innovation has received noteworthy acceptance in the banking and FinTech community, so much so that the latest transaction value from platforms using this scoring model is $259 billion.

Beyond the reliability of this credit scoring model, another advantage is that it helps individuals deemed non-creditworthy by regulatory agencies access loans. It’s also vital for small businesses and service firms to access credit.

About 53 million Americans don’t have a credit score in the United States alone. So as a startup based in the United States, adopting this financial technology innovation in your loan app opens you to 53 million potential users.

Examples of companies that are adopting this innovation include Nova Credit, Zest AI, Canopy, Perfios, and Cortera.

Frictionless Payment Solutions

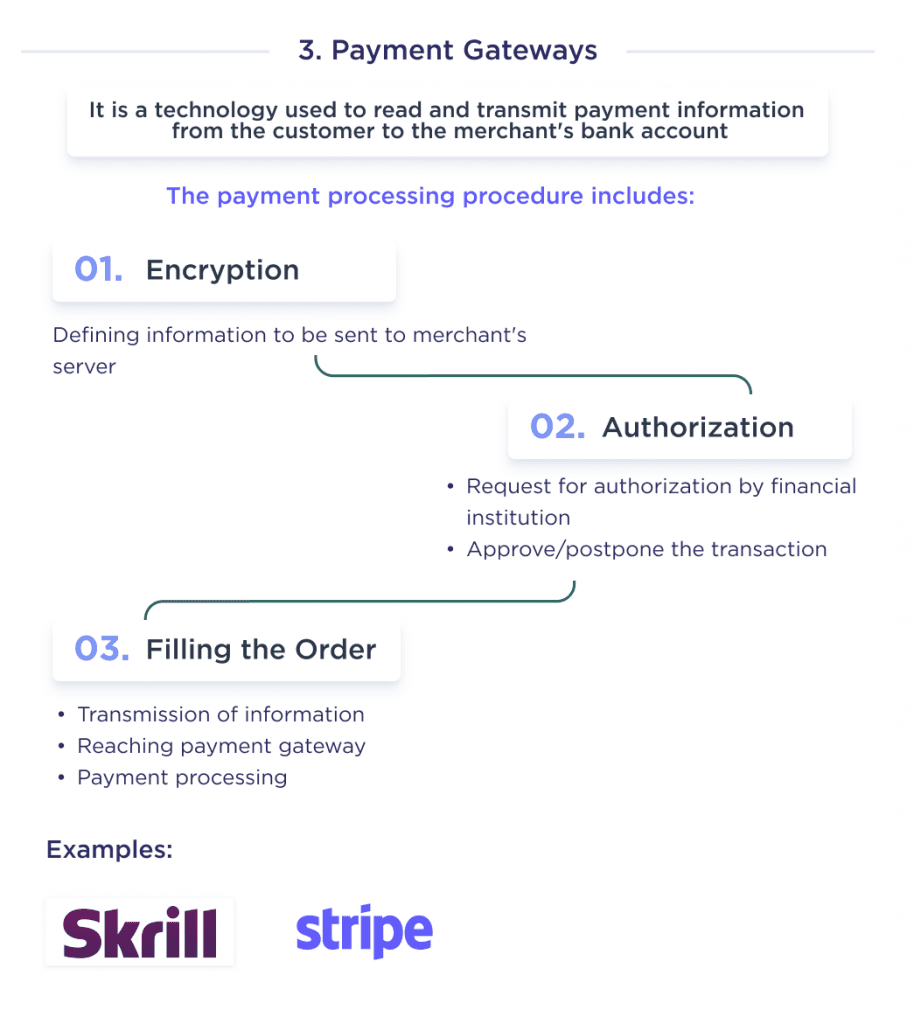

A payment gateway is a technology that merchants use to accept debit and credit cards from customers. Ever since the introduction of the first payment gateway in 1969, it’s generally perceived as FinTech’s most noteworthy innovation in e-commerce.

Beyond being a tool for processing payments for easy purchases, this innovation also benefits online retailers. Part of these include;

- AVS checks

- Delivery address confirmation

- Geolocation

- Computer fingerprinting innovation

- Identity morphing identification

- Velocity pattern examination

Payment gateways work in a pretty complex manner. But we’ll break it down for an apt understanding of this FinTech innovation.

A basic payment processing procedure includes three basic steps. These include;

- Encryption. In this first step, the payer’s web browser identifies the information it should send to the seller’s server. The gateway sends transaction details to the payment processor, which the merchant’s receiving institution uses.

- Authorization Request. A payment processor sends transaction details to the financial institution your card is related to. The authorization request is received by the credit card’s issuing financial institution, and it may choose to confirm or delay the transaction. Wondering how to accept card payments on your website? Check out our guide on how to accept card payment on-site for all the details.

- Filling the Order. The processor sends information between the client, merchant, and the payment gateway in this last step. Once this reaction reaches the gateway, it processes the payment. The merchant can begin to handle the order once the process is complete.

The partnership between e-commerce retailers and payment gateways has blossomed. As it stands, a payment gateway is the most preferred means of online retail transactions.

Startups willing to create a product with this innovation may get inspiration from significant disruptors like PayPal, Amazon Pay, Skrill, Stripe, etc.

Other noteworthy innovations include;

- FinTech API

- Peer-to-peer lending platforms

- Cryptocurrencies

- Online retail

- Banking platforms

- Retail banking digitization, etc.

Now that you know some innovations disrupting the banking system, let’s answer the question: “Will FinTech replace banks?”

Will FinTech Replace Banks?

Yes! This is poised to happen soon, as branchless banks are gaining ground.

With a mobile device and app, financial technology allows users to make financial transactions on their devices.

Financial technology is gradually growing its capability to replace many banking processes. As of now, consumers can pay bills, transfer money, take loans, get credit cards, and even develop digital wallet apps, via a financial technology application.

Even from a business founder’s perspective, FinTech offers various tools that can help companies save time, effort, and money. Whether it’s simply managing a business account or paying employees, tech-driven finance is the future.

Most pessimists believe that the consumer market doesn’t trust neobanks, a changing notion.

Between 2018 and 2020, consumers using neobanks increased from 17% to 23%. This shows that consumer trust in neobanks is growing, and more users are beginning to adopt the strategy.

Below are some statistics depicting that they will overtake the incumbent banking model in the near future:

- Over 28% of traditional banking services will be disrupted by financial technology in the next four years.

- Most payment services in recent years have been mobile banking-based.

- Financial technology is the primary enabler of cross-border transactions.

- Robotic Process Automation yields an ROI of 100% for financial institutions within 3 to 8 months.

- According to McKinsey, FinTech is catching up with traditional finance houses in customer trust.

- Tech-based financial products grow at a CAGR of 26.87%, while the traditional financial sector has a CAGR of less than 10%.

- FinTech users in the United States grew from 58% in 2020 to 88% in 2021.

Now that you understand where the future lies. Let’s consider more helpful information that can aid your dream of starting a financial technology business.

From concept to creation – launch your marketplace with SPDLoad!

Want to Build a FinTech Startup?

Financial technologies will continue driving the digital transformation of banking and financial services. FinTech disruptors are just getting started revolutionizing how consumers and businesses manage money.

If you have a promising FinTech concept but lack the technical firepower, our developers can help. We specialize in building, launching, and scaling leading FinTech startups.

Our end-to-end technical capabilities for early and growth-stage FinTechs include:

- Mobile and Web Apps

- Data Analytics Integrations

- Payments, Transactions, Lending

- Blockchain and Crypto Protocols

- AI and ML Engineering

- Cloud Infrastructure Setups

- Security and Compliance

If you have an innovative FinTech vision and want to get practical advice on how to start a fintech startup – let’s connect and build the future of finance.

If you have been thinking of moving your fintech app to the cloud, here is our recent article about what is cloud migration and how to do it right.