How FinTech is Reshaping the Real Estate Industry

- Updated: Aug 27, 2024

- 8 min

Real estate is being disrupted by emerging financial technologies, presenting a massive opportunity for investors, entrepreneurs, and observers.

This article will cover the fintech drivers remodeling real estate, including alternative lending platforms, blockchain technology, artificial intelligence, and big data analytics.

We’ll also explore leading startups like Roofstock, Blend, and Avant and ways to capitalize on emerging trends that will shape the industry.

Buckle up for the fintech transformation in real estate.

For a competitive edge, explore the benefits of fintech and its impact on business.

Bring your app idea to life with our expert software developers — contact us today to get started!

How Fintech is Reshaping Real Estate

Property FinTech creates an effective way for real estate investors to cut out redundant intermediaries in real estate transactions.

The benefits of fintech include helping to reduce costs, reducing friction, and increasing investment opportunities throughout the property evaluation and purchase process.

Here’s a brief look at three use cases of property FinTech:

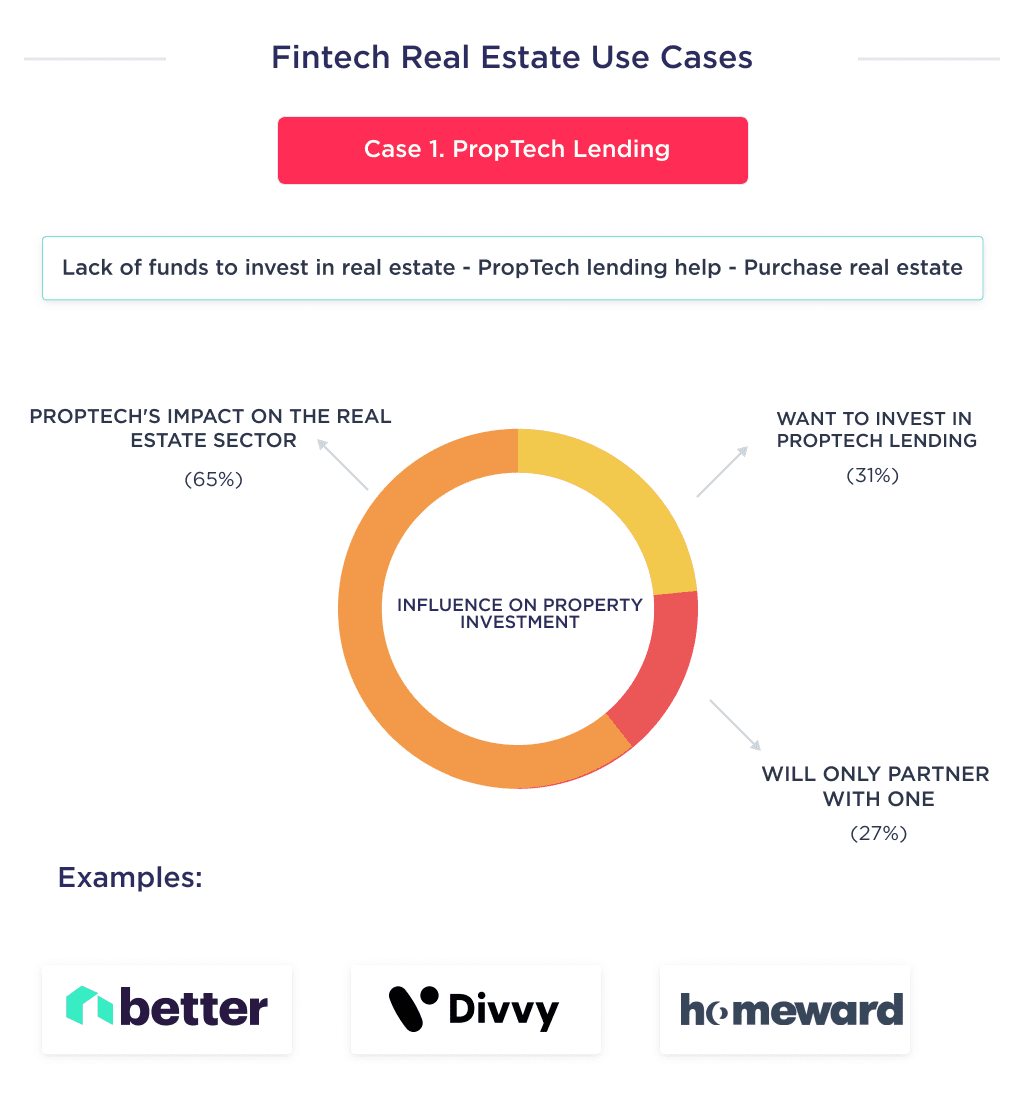

Use Case 1: PropTech Lending

According to Forbes, one of the most significant challenges for real estate investors is the lack of funds. FinTech is solving this problem via PropTech lending.

PropTech lending occurs when a FinTech company issues credit to an individual or firm with the principal aim of purchasing a property.

Numerous statistics and experts’ predictions show that PropTech lending is the future of mortgages.

And according to JP Morgan’s CEO Jamie Dimon, “Silicon Valley is coming: ” this singular statement depicts the emergence of technology in every facet, including real estate.

Between 2014 and 2020, the total number of real estate tech deals has continually been increasing, summing up to a total of 501 deals in 2020 alone.

The average value of PropTech lending deals also increased during this time frame, rising from $3 million in 2014 to over $20 million in 2020.

The increase in PropTech lending has a significant influence on property investment.

A 2018 survey of real estate investors shows that over 65% of survey respondents believe PropTech lending significantly influences the real estate sector. This survey shows that over 31% of property investors want to invest in PropTech lending, while over 25% will partner with one.

Examples of PropTech lending startups include:

- Better

- Divvy

- Homeward

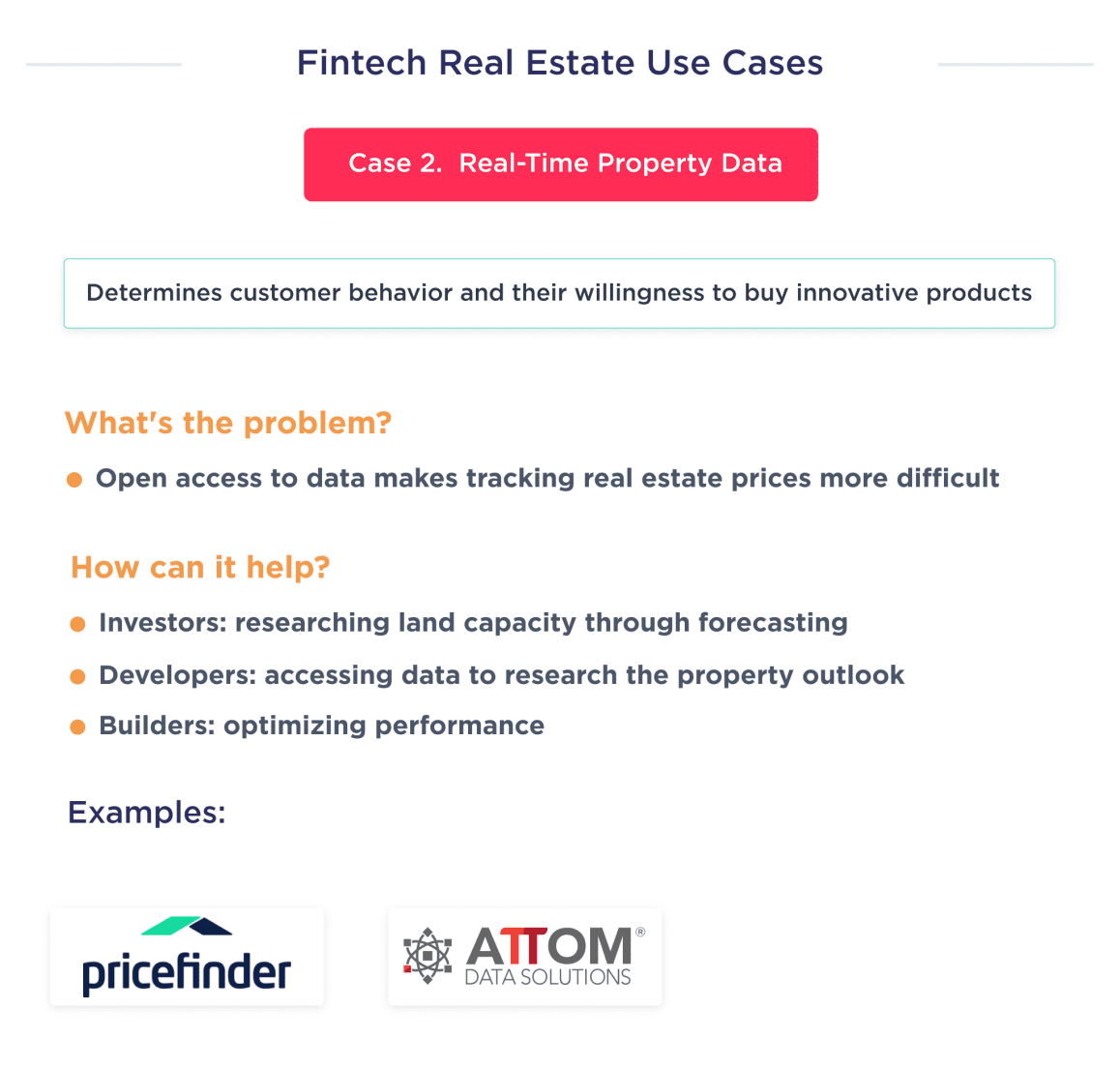

Use Case 2: Real-Time Property Insights

Real-time property data refers to information that’s presented as it is acquired. This innovation helps real estate investors and real estate agents keep track of what buyers are willing to pay based on real-time purchases, with features such as blockchain technology, cryptography, etc.

Every past transaction is timestamped and immutable – this helps to eliminate market price manipulation.

However, a significant problem with this method is that it opens real estate investors to numerous sources of data and price prediction. And ironically, too much data can complicate the entire property price tracking process.

But thanks to machine learning algorithms and advanced analytics, FinTech data analytic experts can now aggregate apt data sources and interpret disparate information sources.

For example, if you’re a real estate investor searching for underused parcels for development, you might want to pull data from recent transactions on the Multiple Listing Service. However, this data shows nothing about their potential in isolation. They reveal past events.

As reported by McKinsey & Company, advanced FinTech analytics of past transactions helps investors identify areas of interest and investigate land potential through a predictive lens. It also helps developers access hyperlocal community data, market forecasts, and land use data to understand a property prospect.

With these insights at hand, developers can optimize property types, timing, and segment properties based on price, thereby maximizing the effectiveness of their real estate leads.

Examples of FinTech providing real-time property data include:

- Pricefinder

- ATTOM data

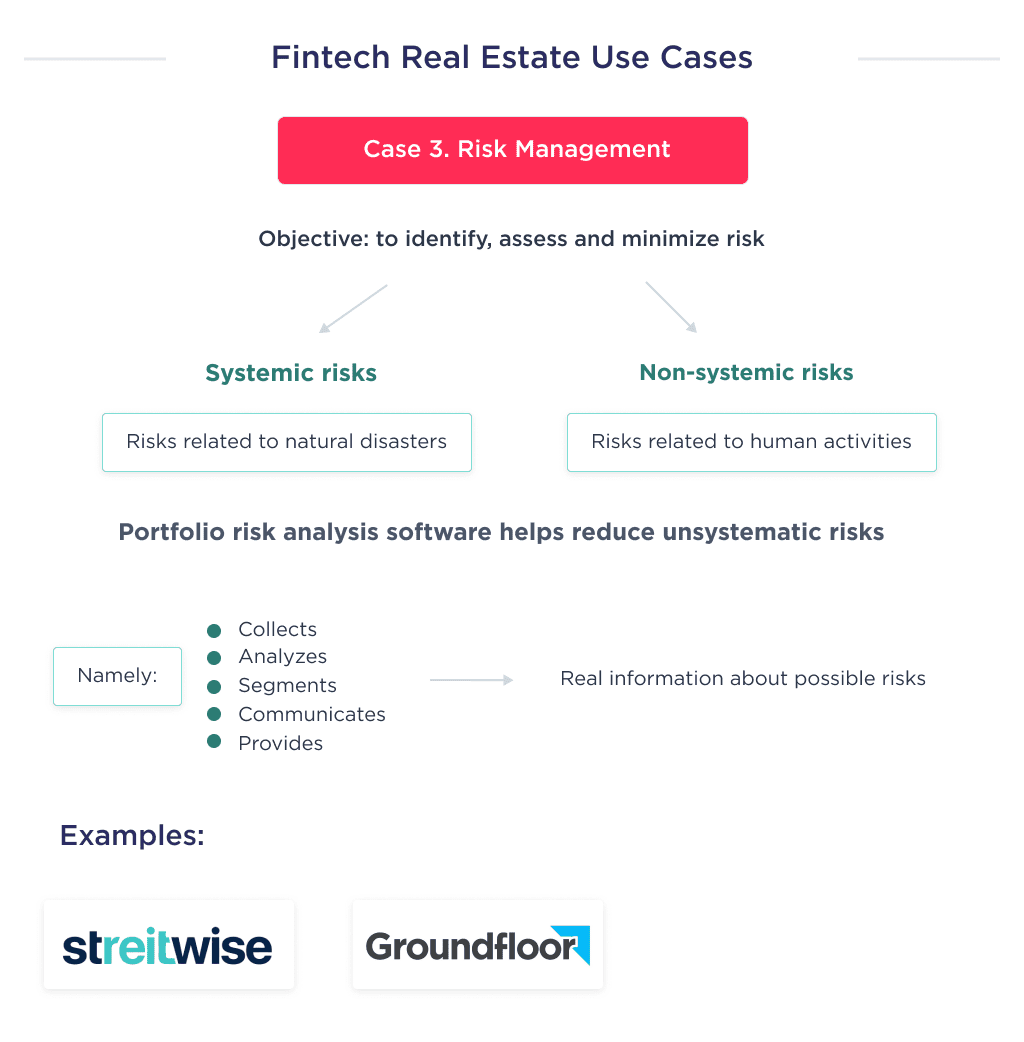

Use Case 3: Improved Risk Management

Risk management in real estate entails identifying, assessing, and controlling threats to a property’s estimated value and projection. At the crux of real estate investment is keeping risk at a bare minimum.

Real estate investors often face two risk types:

- Systemic risks: This type of risk is caused by natural catastrophes such as earthquakes, tsunamis, etc.

- Non-systemic risks: This risk type is caused by human activities like governmental policies.

To help mitigate these unsystematic risks, entrepreneurs looked at many options for ideas for fintech startups that could help close this need and settled on creating portfolio risk analysis software. . Such software gathers big data, segments it, churns it, analyzes it, and gives real insight in conjunction with AI.

Crafting Custom Mobile Apps That Delight Users!

There has been an increase in demand for FinTech-backed risk management software since 2000, and there are statistics to back this claim up. Here are some:

- There were only two robo-advisor firms in 2000. There are over 52 real estate advisory robo firms in the United States.

- The robo-advisement globally reached $8.1 trillion in investment in 2020.

And a significant impetus for FinTech risk management software growth is that FinTech software solutions for risk management are cheaper than traditional manual research. They are also faster.

Speed and efficiency are crucial to an investor’s success in the real estate industry.

The demand for FinTech-backed real estate risk management solutions is poised to keep rising over the next decade. Here are statistics to support this claim:

- 40 – 45% of affluent investors who switched investment firms did so to utilize solutions provided by FinTech.

- Millennials consider Big Data and AI a trusted source of investment advice–including real-estate-related investments. AI’s impact is growing rapidly, and these AI statistics highlight the trends you need to know.

Here are examples of investment real estate FinTech startups:

- Streitwise

- Groundfloor

Now that you have some knowledge of some FinTech use cases in real estate, let’s discuss some startups in this sector.

Top 5 Fintech Real Estate Startups to Watch in 2025

There has been lower friction in buying a home through financial technology, and transaction costs in real estate have been reduced. At the crux of this improvement are PropTech companies like Opendoor technologies or Blend inventing helpful solutions.

Below is detailed information on some noteworthy FinTech real estate startups:

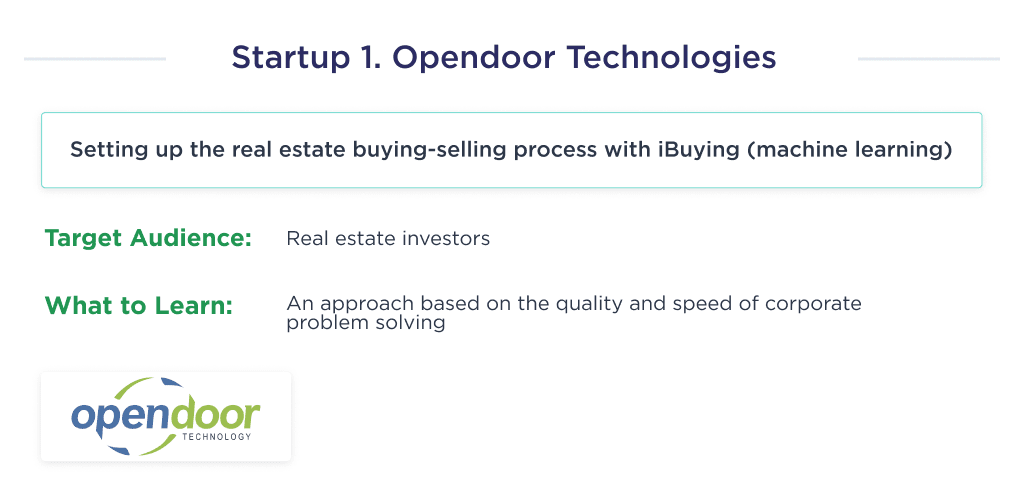

Opendoor – The “Amazon of Real Estate”

Opendoor Technologies is an online real estate marketplace operator for streamlining the sales process of home purchases and sales. The FinTech startup buys and sells residential properties through a machine learning algorithm called iBuying.

As reported by SeekingAlpha, Opendoor technologies experienced significant revenue growth at a CAGR of 58.15%. The FinTech platform reported revenue of $2.26 billion in the third quarter of 2021, representing a 187% increase in its revenue for the 3rd quarter of 2019.

| Start Date | Target Market | Raised Fund |

| 2014 | Opendoor targets real estate investors that need a detailed analysis of every price influencing factor. | $1.9 billion |

What to Learn from Opendoor Technologies

By helping homeowners sell their homes in record time, they’re getting rid of the notion that real estate is not an easy-to-liquidate asset. This business model makes them standout institutional investors with an interest in liquid assets.

You can learn from them as a startup by applying a solution-based approach to corporate and daily problems.

Let’s discuss another noteworthy startup, Blend.

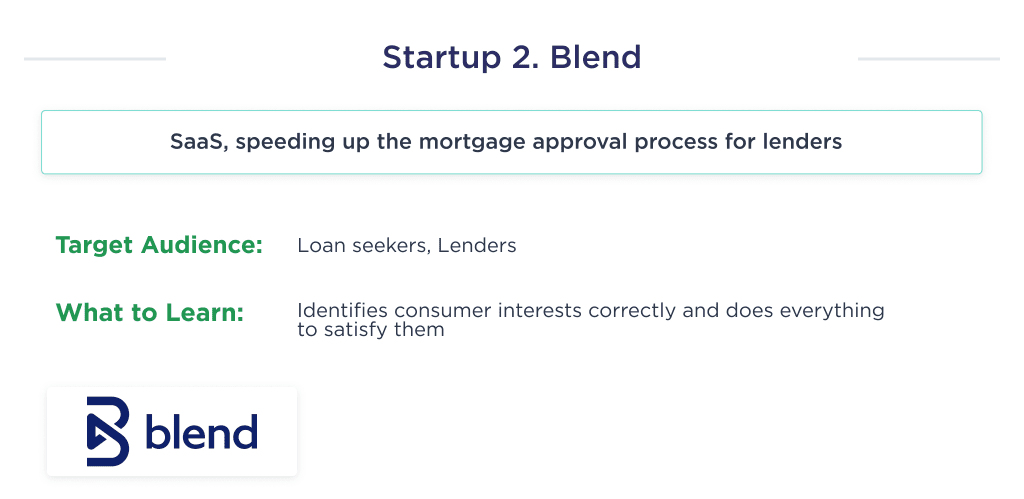

Blend – Digital Mortgage Lending

Blend is a cloud-based white-label software that speeds up the mortgage approval process for some of the largest creditors, including U.S. Bank and Wells Fargo. The platform is often used when developing an online payment application.

The platform allows prospective borrowers access to online bank statements, pay stubs, and tax returns. Currently, the platform processes more than $4 billion in consumer loans and mortgages daily, and it currently partners with over 285 institutions.

Data for Consumer Finance suggests that the financial technology company accounts for more than 25% of the $2.1 trillion U.S. mortgage market by origination volume. In 2020, a report from NASDAQ suggested that the platform processed $1.4 trillion in mortgage loans, more than double of 2019 volume.

| Start Date | Target Market | Raised Fund |

| 2012 | Blend acts as a bridge between loan seekers and creditors. Thus, its target market is the two groups. | $665 million |

What to learn from Blend

Blend is primarily on this list due to the company’s management’s ability to serve the interest of both corporate institutions and consumers.

The company effectively guarantees maximum satisfaction to every party stakeholder.

Beyond Blend, another FinTech startup on this list is Cadre. Let’s discuss it.

From concept to creation – launch your marketplace with SPDLoad!

Cadre – Fractional Property Investment

Cadre is a New York-based FinTech real estate startup.

The startup’s online platform uses advanced data analysis to raise funds online through elite trader funding and source deals that allow individual and institutional investors to buy at sell stakes in real estate.

The company also runs a StubHub-like secondary market that enables investors to sell illiquid real estate holdings.

Cadre recently launched a $400 million fund for financial advisors, individual investors, and institutions early last year. The company’s CEO and co-founder, Ryan Williams, is a 30 under 30 alumni.

| Start Date | Target Market | Raised Fund |

| 2014 | Cadre targets both individual and institutional investors that want to purchase a property. | $113 million |

What to learn from Cadre

Through the excellence of the company’s founder, Cadre has been able to venture into purchasing and selling liquid real-estate holding–an untapped niche. The company treats all platform users with dignity and ensures everyone gets maximum satisfaction.

Roofstock – Tech-enabled Rental Marketplace

This is a real estate investment marketplace that allows users to evaluate, purchase, and own single-family rental properties.

The FinTech startup pre-inspects rental properties with information about tenants, current rent, and property managers. It then makes this information available to renters and investors online. Users can compare properties around the country based on real-time data.

Albeit launched in 2019, the company currently has 205 employees and has processed more than $3 billion transactions.

| Start Date | Target Market | Raised Fund |

| 2019 | Roofstock targets both renters and investors. | $132.3 million |

What to learn from Roofstock

Roofstock shows that rapid growth is possible if you value user experience as a startup. The platform also practices niche marketing at its best as they only cater to single-family homes and choosing a real estate marketing platform is an essential step for your startup.

Another startup to learn from is Divvy Homes. Let’s discuss that too.

Divvy Homes – Rent-to-Own Housing

Divvy Homes is a FinTech startup that purchases homes for clients who can’t qualify for a standard mortgage loan and then become their landlord.

The company requires a 1-2% down payment and an opportunity for renters to convert a portion of their monthly rent to a down payment for property ownership. After three years, the customer will own a 10% equity on the property.

Since the company began in 2017, it has stood out as an excellent company for helping people with poor credit scores own a home at an affordable price.

With funding from financial juggernauts like Caffeinated Capital and Singaporean sovereign wealth fund, Divvy rents more than 1,500 homes in nine U.S. states. The company hopes to convert 750 renters to homeowners at the expiration of the first lease.

| Start Date | Target Market | Raised Fund |

| 2017 | Divvy homes target mortgage loan seekers that are deemed “not creditworthy”. | $1.2 billion |

What to learn from Divvy Homes

Divvy is an excellent credit card program and expense management, and the only one that does this for free. Their customer service is awe-inspiring. They help users open an account, obtain credit, and set up a Divvy account, and use custom features when developing banking applications.

Reading this section of the article shows that you’re keen on FinTech. However, there’s more to learn.

If you’re looking to build a stock trading platform, our article on how to build a stock trading platform covers all the key aspects.

Want to Build Your Own Fintech Startup?

The fintech revolution has demonstrated its power to disrupt the real estate sector, bringing greater efficiency, transparency, and convenience to the industry.

For real estate companies, the message is clear – adapt or get left behind.

Partnering with fintech providers and leveraging cutting-edge technology will be vital to remaining competitive.

At SpdLoad, our team of expert software and app developers stays on the cutting edge of fintech innovations.

We can help you implement the latest fintech solutions to take your real estate business to the next level.

Contact us today to discuss how we can collaborate to shape the future of real estate.

If you are thinking about creating your own fintech app, feel free to dive into fintech app development to see what it takes to create a standout financial app.