The Future of Automated Insurance Underwriting

- Updated: Dec 12, 2025

- 9 min

Underwriting is one of the most intricate processes in the insurance industry. It requires assessing complex risk factors and analyzing data sets to balance between what is fair for customers and profitable for the company. And it all while following strict industry regulations.

Manual insurance underwriting is a time-consuming process that involves a complicated customer journey and high operational costs, leading to slower decision-making.

That’s why insurance agents are now looking for technologies and tools that can speed up the insurance underwriting process and provide competitive benefits. This is when insurance underwriting automation gets the spotlight.

Let’s discuss underwriting automation and the types of underwriting to automate, like loan underwriting, insurance underwriting, and security underwriting.

We will also dive into three ways of implementing insurance underwriting automation into your workflow. If you are looking for a custom-made automated insurance underwriting solution, our team is experienced in insurance app development services. We can build a tailored insurtech solution to cover all your needs.

Get a strategic MVP to mitigate risks.

How Do Underwriting Processes Work

The underwriting process involves several key steps.

The first one is when agents collect information from the applicant: personal, financial, and medical details. They conduct an initial review of this data to assess the basic acceptability of the application.

Then, it is time to gather more detailed information, such as medical records or financial statements, to support the underwriting decision. For commercial insurance, underwriters also consider business-specific factors like industry risks and financial stability.

Underwriters conduct an in-depth analysis of the collected data to evaluate the risks associated with the application. At this point, they can use advanced algorithms and AI tools to assess the risks.

Based on the risk analysis, underwriters decide whether to approve the application, reject it, or offer coverage with specific conditions or higher premiums. Once a decision is made, the underwriter develops the policy terms and conditions.

When done manually, the underwriting process can take weeks and even months, depending on the complexity of the case. In our fast-paced world, waiting months is not an option. That’s when insurance underwriting automation comes in.

Underwriting processes can be automated to provide easy access to customer data and reduce manual efforts. It does away with the need for manual efforts in insurance application processing, risk assessment, premium calculation, policy issuance, and renewal, making it possible to issue policies much faster.

Automated underwriting systems can be enhanced with artificial intelligence (AI) and machine learning (ML) to provide helpful advice on insurance pricing and enable immediate detection of insurance fraud.

Types of Underwriting

Depending on the type of insurance and methods used, there are several types of underwriting in insurance.

Here are the most popular ones:

Life insurance underwriting

This type of underwriting involves the evaluation of financial and medical risks. Financial underwriting considers assets, liabilities, and loans. Medical underwriting evaluates age, lifestyle, occupation, and medical history.

Health insurance underwriting

This is all about assessing health-related risks: medical conditions, lifestyle habits, and medical history. It often requires additional information on health status from healthcare providers.

If you have been thinking about health insurance software development, make sure you explore our recent article, where we explore costs, features, and tech needed.

Property and casualty (P&C) insurance underwriting

The evaluation of risks is connected with factors like property type, age, geographic risks, and construction materials.

Auto insurance underwriting

Assesses driver’s risk level based on factors like driving history, vehicle type, location, and credit score records, and intended use to determine premiums.

If car insurance app development is in your goals map, check out this guide for detailed instructions and step-by-step.

Benefits of Underwriting Automation

Manual underwriting is often prone to errors, inherently slow, costly, and inconsistent.

The process requires significant human effort and expertise, which can be challenging to scale, but insurance automation makes it simple and efficient, especially with an aging workforce and potential labor shortages.

To address these challenges, many insurers are turning to automated underwriting solutions that leverage technology like AI, RPA, and NLP to streamline processes, reduce errors, and improve efficiency.

Here are some of the benefits of automated insurance underwriting:

| Benefit | How It Helps |

|---|---|

| Faster approvals | Cuts down processing time from days to minutes, so customers get their quotes and policies almost instantly. |

| Fewer underwriting errors | Reduces human mistakes by using AI to analyze data and detect inconsistencies before they become problems. |

| Lower costs | Saves money by automating repetitive tasks, reducing the need for extra staff and paperwork. |

| Smarter risk assessment | Uses advanced algorithms to assess driving history, claims data, and even weather patterns for more accurate pricing. |

| Stronger compliance | Keeps up with changing insurance regulations automatically, reducing legal risks and penalties. |

| Easier scaling | Handles more applications without delays, helping insurers grow without adding more manual work. |

| Better customer satisfaction | Speeds up the buying process, so customers don’t have to wait long or deal with frustrating paperwork. |

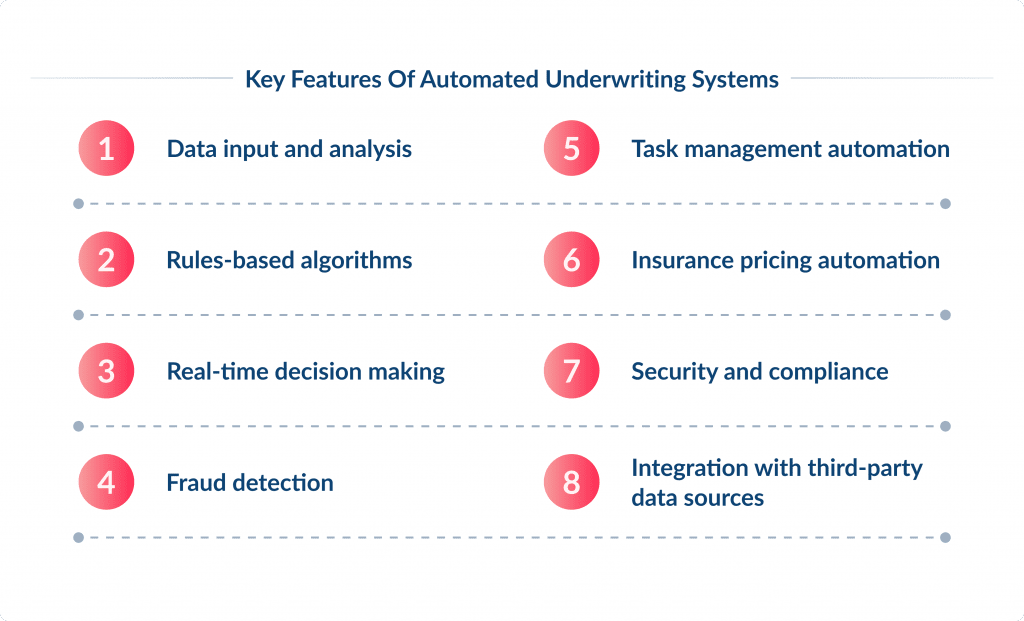

Key Features of Automated Underwriting Systems

Automated underwriting systems are designed for streamlining and improving the underwriting process.

We have already explored the benefits of such systems, and now, let’s dive into their key features:

Data input and analysis

AUS collects and analyzes data from various sources, including credit reports, application details, and financial records. The system uses technologies like OCR to convert paper documents into digital formats and ML-supported data extraction to process insurance applications.

Rules-based algorithms

Systems are programmed with rules that reflect the insurer’s or lender’s specific criteria for consistent decision-making. Also, these rules can be modified to adapt to changing risk profiles or regulatory requirements.

Real-time decision making

Automate insurance underwriting speeds up the approval or rejection process. Automatically routes applications based on expected profitability or risk level.

Fraud detection

With AI integration, it becomes much easier and quicker to identify potential frauds. AI systems spot the red flags, like mismatched information or unusual claims, and compare data with past records to catch anything suspicious.

Task management automation

An automated underwriting system assigns tasks to underwriters based on qualifications, availability, and location. Configurable dashboards provide human underwriters with an overview of tasks, priorities, and deadlines.

Insurance pricing automation

This feature helps set fair and accurate insurance rates. The system instantly analyzes risk factors to make the process faster and more reliable.

Security and compliance

Insurtech compliance is paramount for any insurance business. That is why automated underwriting systems comply with all relevant regulations to keep customer data safe and reduce the chances of fraud and data leaks.

Integration with third-party data sources

The automated underwriting system integrates with credit bureaus, medical information bureaus, and other external data sources for comprehensive risk factor assessment.

Main Underwriting Processes to Automate

Deloitte’s report on the future of insurance underwriting highlights that insurers that continue to rely on traditional, tried-and-true ways of underwriting or that take too long to transition to a more exponential approach could have much to lose in both the short and long term.

However, without a clear strategy, business case, and involvement from forward-thinking talent, technology, and data investments will likely not be appropriately focused and designed to achieve sustainable business value creation.

To stay competitive, insurance companies need to automate their processes. You can explore the following insurance processes as potential for automation:

Compliance

Automated insurance underwriting helps you follow the required legal regulations without the manual work. How does it do this? By applying regular automated compliance checks.

Risk assessment

You can use big data analytics in insurance and connect your underwriting solution to many different data sources to quickly and accurately assess customer risks.

Data intake

Utilize AI, RPA, and NLP technologies for immediate aggregation and precise handling of insurance applications and customer documents. Less than 10% of processing tasks will need human intervention.

Task management

Thanks to the intelligent triaging and automated assignment of underwriting tasks, you can maximize underwriting capacity and increase revenue potential.

Risk pricing

Use AI to make sure insurance prices are fair and competitive. Use an innovative, dynamic pricing pricing model to increase revenue by up to 15%.

If you want to learn more about what technologies can help you upgrade your insurance business, check out these digital transformation in insurance trends. In the article, we dive deeper into trends that shape the digital transformation in insurance, such as low-code and no-code development practices, headless tech, rise of customer self-service, usage-based insurance, and more.

How to Implement Underwriting Automation

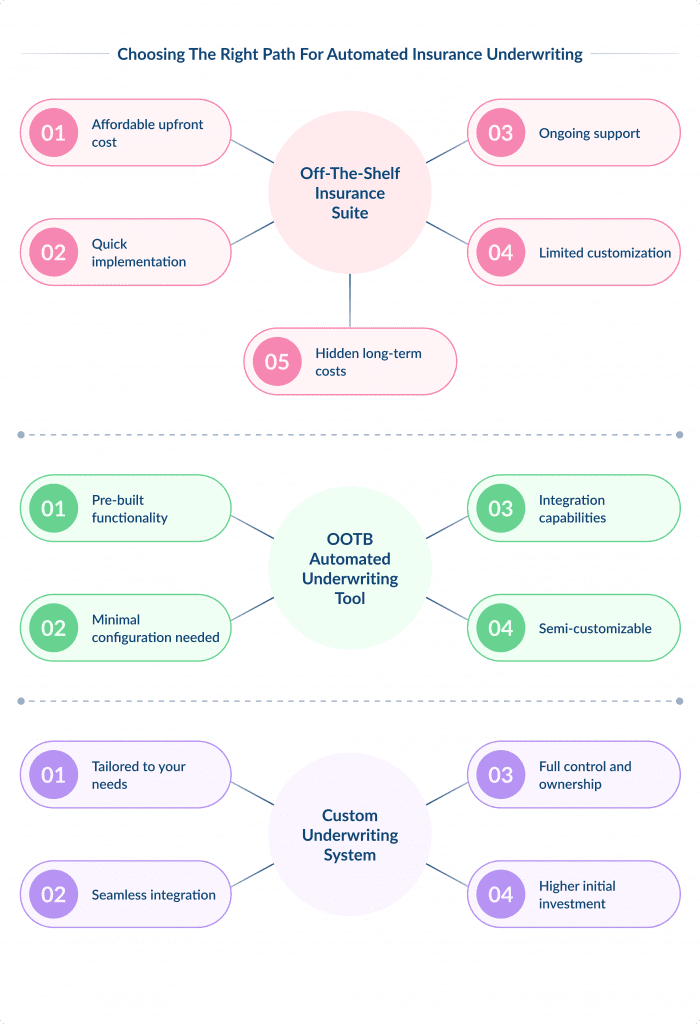

If you are ready for automated insurance underwriting, there are three paths for you to choose:

- Off-the-shelf insurance suite

- OOTB automated underwriting tool

- Custom underwriting system

Off-the-shelf insurance underwriting solutions entail lower upfront expenses, which enhance accessibility for smaller insurers with tighter budgets.

It is fast and easy to implement and provides out-of-the-box features thanks to which insurers can see the results sooner.

On top of that, ready-made platforms usually provide assistance and maintenance as well as frequent updates for smooth operation and ongoing improvement.

Despite being a cost-effective option, off-the-shelf tools lack customization. Without tailored features, your operational performance might slow down, and you risk ending up having to adjust your processes to fit the platform rather than adapting the software to your specific business requirements and workflows.

On the flip side, ready-made solutions might contain extra features that you don’t need and which will only drive up expenses.

And, I must say that the cost-benefit is valid for only a short time. Off-the-shelf solutions may entail ongoing additional expenses for customization, subscription, maintenance, and updates, which might even add up to the point of outweighing the initial costs of custom solutions.

Now, let’s talk about OOTB automated underwriting tools. This is the second path you can choose when it comes to automated insurance underwriting.

An out-of-the-box insurance underwriting tool is basically a software solution that is provided with pre-built functionality and requires minimal configuration to start using. This tool may include pre-designed workflows, algorithms, and decision-making processes that are ready to use without needing significant customization or development. Also, OOTB solutions often offer integration with existing systems, such as ERP systems and loan origination systems, to streamline data exchange and processing.

Overall, the main advantage of such systems is that, while not fully customizable, these platforms can be configured to accommodate specific business needs to a certain degree. They are cheaper than custom-made solutions and easy to implement. However, such platforms may still fall short of meeting unique requirements.

If none of the two options fits you, then custom-made insurance underwriting software is what you are looking for.

Custom applications are designed from scratch to address an insurer’s specific needs, challenges and workflows. Unlike off-the-shelf platforms, custom solutions are crafted to be fully compatible with the systems you already have in place, which, in turn, improves efficiency and data flow.

Also, you get full control and ownership over the software.

The initial investment can be quite significant, depending on the tech stack, software development partner, location, and other factors. Feel free to learn more about money matters in this guide on insurance app development. But you end up with a tool that is tailored to your needs, built with your business goals in mind, and ensures scalability. Is it worth it for you? If yes, then the custom insurance underwriting tool is what you need.

How to Achieve Maximum ROI for Underwriting Automation

To get the most out of automation in insurance underwriting, you need to pay attention to the following aspects:

- Establish KPIs (for example, processing time, accuracy, and customer satisfaction) to measure the success of automation efforts.

- Leverage AI and machine learning to enhance risk assessment accuracy and speed. These technologies can analyze vast amounts of data quickly and identify patterns that human underwriters might miss.

- Use robotic power automation (RPA) for repetitive tasks such as data entry and compliance checks.

- Use automation as much as possible to free underwriters from time-consuming manual tasks like processing applications, scoring customer risks, generating quotes, and more.

- Implement strong security measures to prevent insurance fraud and data leakage and guarantee reliable protection against cyber attacks.

- Use automation to increase underwriting capacity without proportionally increasing staff. This will allow for more efficient handling of higher volumes of tasks.

Final Thoughts on Underwriting Automation

Automated underwriting in insurance is a game changer. Many industry reports highlight that insurance companies turn to automation for cost savings, improving customer experience, and increasing employee productivity.

Despite the numerous benefits of automated insurance underwriting we have explored in this article, there are also possible issues that come with underwriting automation. The questions arise: How can insurers balance automation with the human touch? What role will underwriters play in an automated future?

These are debatable questions that are yet to be answered. But what we do know for sure is that with the right approach, underwriting automation can provide significant benefits to insurance companies and their customers.