Health Insurance Software Development: Challenges and Chances

- Created: Aug 02, 2024

- 13 min

The healthcare industry insurance market is expected to exceed $4.15 trillion by 2026.

Health insurance companies need to adopt cutting-edge technologies to keep up with the growing demand for health insurance services and meet patient expectations.

This makes health insurance software development more relevant than ever for providers aiming to stay ahead and grow their business.

Are you part of a company looking to innovate in this space? If so, you’re in the right place.

To boost operational efficiency, the health insurance industry is moving away from outdated claim management and insurance systems in favor of automated, all-in-one solutions.

With our over 10 years of experience, you can get expert help in building health insurance app.

Creating an app can be complex, but these app development tips simplify the journey.

In this article, we’ll explore the benefits of custom healthcare insurance software, the different types of software available, the challenges you might face, and future IT trends to watch. Let’s dive in!

Explore our SaaS services today

What is Health Insurance Software?

Before we get into the nitty gritty, let’s start with the basics: what is health insurance software.

In a nutshell, health insurance software is a computer program that manages and automates health insurance processes.

It helps insurance companies run more smoothly by handling enrollment, claims, eligibility, billing and customer service.

One of the key aspects of health insurance management is risk analysis, something that actuaries do to ensure the financial viability of insurance businesses.

So, what should be in health insurance software? Key features include member management, policy processing system administration, premium calculations and reporting.

In short, health insurance software is important because it helps specialists with most of the tasks they do every day, making their work easier and faster.

Is it time to launch health insurance software now? Let’s see.

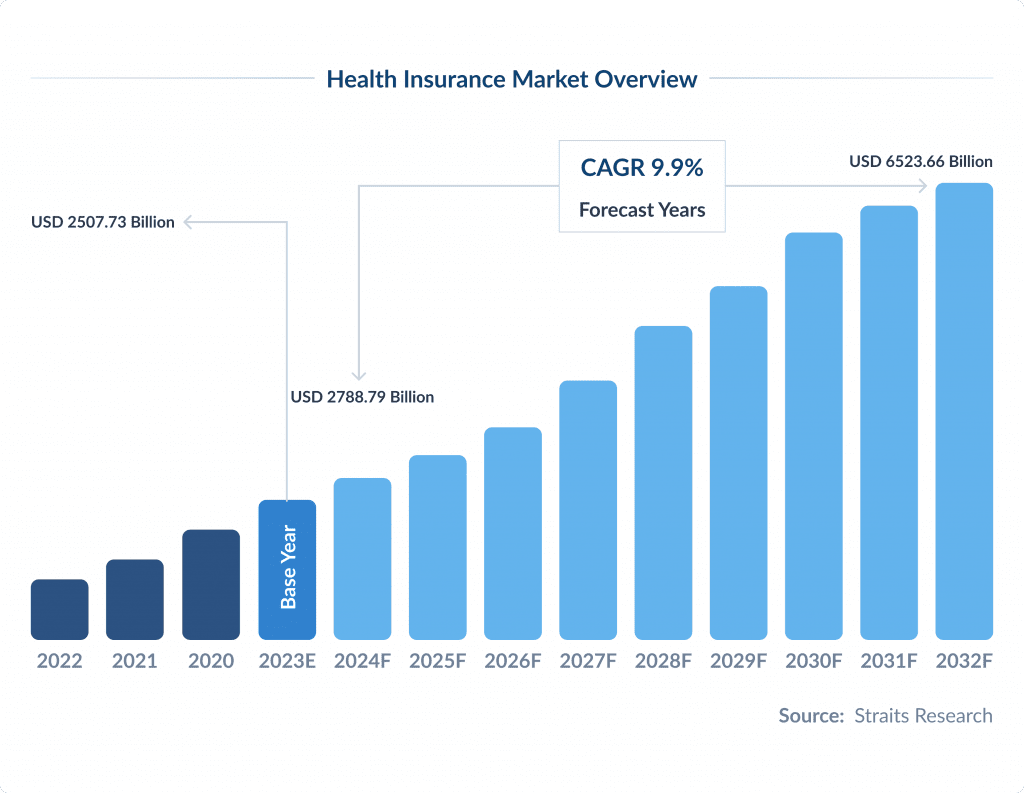

According to market research, the insurance market size was $2507.73 billion in 2023. It will reach $6523.66 billion by 2032 at a CAGR of 9.9%.

The demand for health insurance will continue to grow. As people become more aware, they’re paying attention to the fine print and terms of these policies.

This helps them make informed decisions and choose policies that suit them.

To cater to this growing awareness and demand, the health insurance software market is also booming.

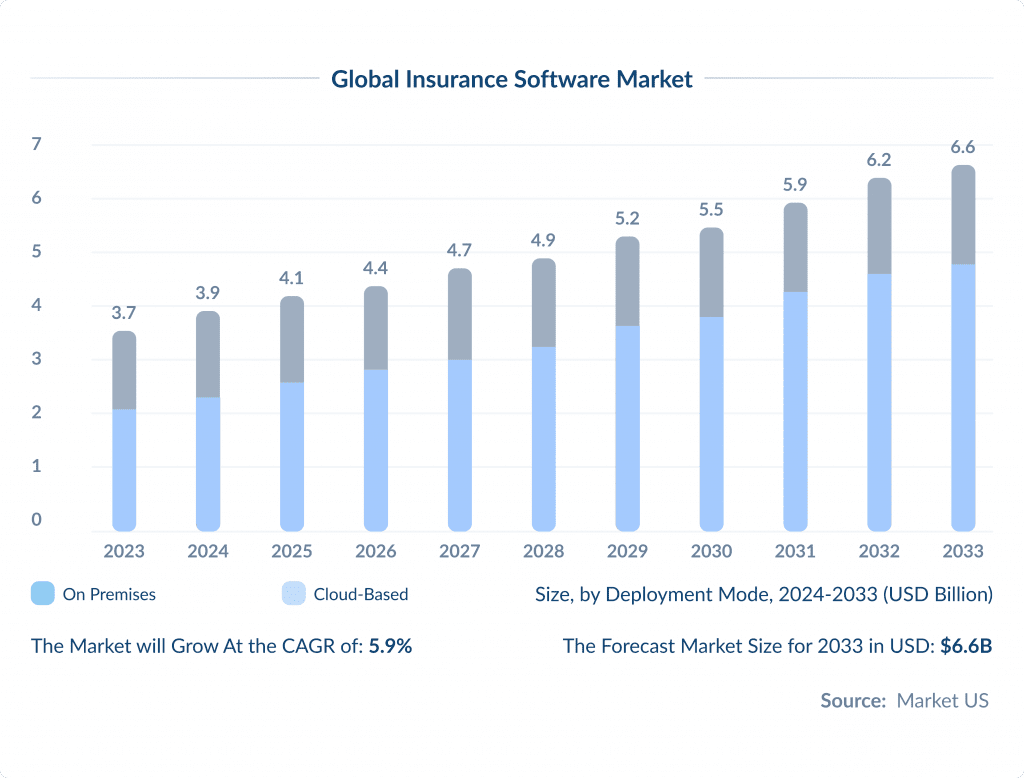

The Global Insurance Software Market size will reach $6.6 billion by 2033. And this is from $ 3.7 billion in 2023,. The CAGR is 5.9%, according to the Market US report.

This is driven by the growing demand for digital and automated insurance processes.

Technological advancements like AI, cloud-based and mHealth have also moved the market forward. They offer security, scalability and flexibility.

These will not only improve operational efficiency but also customer experience.

Businesses aiming to stay competitive are investing in cloud-based app development for enhanced scalability.

So, to answer the question is it time to launch health insurance software now? The answer is YES.

Although the market is competitive, there’s still room for innovation.

Let’s explore the benefits of developing medical insurance software.

Benefits of Developing Health Insurance Software Solutions

So, you’ve decided to develop a health insurance software solution, whether it is a simple online health insurance toll or an advanced application with multiple features.

What benefits can your insurance company expect from this venture for a health insurance company from a business perspective?

Streamlined Operations

Developing health insurance software can really change the game, as this tool will automate and simplify many processes.

Nobody enjoys dealing with endless paperwork and repetitive tasks.

This software takes over those boring jobs, letting employees focus on more engaging and creative work.

As a result, everything runs more smoothly, and tasks like policy and data management and claims processing are done much faster. This not only boosts efficiency but also makes work a lot more enjoyable for everyone involved.

Increased Accuracy

The key problem for many healthcare and insurance organizations is that they have to analyze huge amounts of data.

In the past, they had to compromise and only review the most complex information.

Now, with dedicated software, health insurance companies can efficiently manage vast amounts of information, including policyholder details, medical records, and claims data.

Accurate data is crucial for assessing risks and settling claims fairly and efficiently, making the process smoother for everyone involved.

Enhanced Customer Service

A well-designed health insurance software architecture can offer a user-friendly experience for policyholders.

It provides easy access to policy information, claims tracking, and customer support.

Why does this matter?

In the past, many insurance tasks were paper-based, leading to major headaches. Clients often struggle with complex legal language in important documents.

With modern software, everything is simplified and accessible, making it much easier for people to manage their insurance needs.

Get a clear picture of your customers’ lifetime value with this CLTV calculator. It’s designed to make insights quick and simple.

Regulatory Compliance

Health insurance software can include compliance features to ensure that everything follows the insurance industry’s complex regulations and standards.

If your company supports global operations, the list of policies to comply with is quite long.

A comprehensive health insurance software helps reduce risks related to compliance, ensure data security and privacy, and avoid penalties or legal troubles.

This is especially important because navigating legal issues can be very complicated, whether you are an advanced software company or a startup. But the software makes it much easier to stay on the right side of the law.

Competitive Advantage

Next-Gen Health insurance software gives the business a robust position that translates well, standing them out amongst competitors and ensuring a balance between industry major corporates that welcome you for an association to be part of an innovative laboratory.

Offering/appealing leads to better customer satisfaction and is directly observed in line with the company strategy of giving customers an augmented service culture and building customers’ trust further.

Also, the system ensures that the transition costs are minimal and that you actually increase the pricing overall, helping you become a more cost-efficient service, thereby ridging the competitive scenario.

The only problem with having such large customer demand before is not that we do not share enough sureness in the straightforward rate-reducing curve, but rather, it’s very line-cutting usage data and the ROI each year.

Key Features of Health Insurance Software Solutions

What should be in your health insurance software to stand out from other health professional networks? Let’s see.

Plans and Policy Comparison

Users should be able to compare different health insurance plans.

Advanced filtering and sorting will help users narrow down options based on coverage, cost, tenure and network hospitals.

User friendly interface will show comparisons in tables and charts so its easy to see the difference.

Tooltips and pop-ups that explain insurance terms can be a nice add on as they help users understand what each plan offers.

Insuring and Buying Policies

This feature speeds up the process of buying and getting policies approved.

In many cases it gives instant decisions, improves customer experience by giving quick answers and reducing wait times.

This automation reduces efficiency, cost and errors for insurance companies. The software also informs applicant about their application status and what more to do.

In-App Payments

Users can pay premiums, view transaction history and manage payments in-app.

Your software should support multiple payment modes like credit/debit cards, bank transfers and mobile wallets.

Customer data security is top priority. So you need to implement strict encryption and comply with standards like PCI DSS.

Additional features can include automated payment reminders, recurring payment setup and instant payment confirmation. They will make financial management easy and efficient for both users and insurers.

Thinking of adding a card payment option on your website? Discover the best options for accepting card payments on your website in our step-by-step guide on how to accept card payment on-site.

Advanced Healthcare Providers (HCPs) Search

This feature helps users find healthcare providers they can trust.

Advanced search filters will allow users to search HCPs by specialty, location, ratings and availability. Detailed profiles will have qualifications, languages spoken, services offered and appointment links.

This will make it easy for users to find the right care and book appointments and improve health management and outcomes.

Another feature that will come in handy is HCP to patient communication.

It will include secure messaging and video conferencing tools for appointments, consultations and follow ups.

Patients can discuss health concerns, get advice and have telehealth appointments from home.

It also supports sharing of electronic health records, lab results and prescriptions to improve patient-provider relationship and proactive health management.

Document Management

Comprehensive document management allows to store, organize and share policy papers, claims forms and medical records and other documents.

Here’s a deeper dive into this feature:

- Digital document management.

- Data should be secure and policy compliant.

- Learn about version control, auditing and document history.

- Collaborate and share group documents.

- Ensure document management works seamlessly with other software features.

- Mobile access for all your devices & cloud so you never have to worry about access to your documents.

Claim Management

Claim management automates the entire claim process from submission to settlement.

This feature gives timely, informative and user friendly notice of claim handling. Online submission with all required documents in one place is simple and prevents errors that will speed up claim processing and assessment.

Once the claim is submitted, the system will assess the claim against policy terms, flag any issues that need to be investigated further or if fraud is suspected.

On the policyholder side, this will give real time tracking and communication with claim handlers making the process more transparent and less scary overall.

It will also improve financial management at every level.

Users will get value added services, more service features and innovative solutions going forward.

Service platforms will allow real time withdrawal action tracking and development and enhancement of workstream solutions.

Customized to form a partnership with your insurer while multilevel coordination is unscheduled for you, segmented by punctual measured regulation.

So this will create a stronger, more efficient and more valuable relationship with insurers where everyone involved has someone to talk to in real time.

Push Notifications and Reminders

Push notifications and reminders are crucial as it keeps policyholders informed and engaged.

If you build mobile based health insurance, personalized notifications about policy renewals, appointments, health check ups and claim updates can be sent to mobile devices.

These timely notifications will help users manage their health proactively and stay on top of important deadlines.

This will improve user experience, increase satisfaction and build a supportive relationship between the insurer and policyholders.

Types of Health Insurance Software

Now that we have a general idea of health insurance software let’s look at some of the types of apps in this space that you as a healthcare technology company should be aware of.

Claims Management Software

Claims Management software is a daily task for insurance companies and hospitals.

With advanced databases and cloud storage, these apps simplify many specialist processes and reduce the risk of data loss.

Modern claims software can automate routine requests and provide detailed forms for complex ones, reduce errors and save time. As a result of automation workers are less stressed and can do more within strict error limits.

Agent Management Tools

Agent management tools are designed to help manage and administer insurance agents or brokers.

They offer a centralized platform to track activities like sales performance, commission calculations and licensing compliance.

These tools usually have lead management, appointment scheduling, document management and performance reporting.

Compliance and Regulatory Software

Compliance and regulatory software helps organizations manage the many rules that govern their financial activities.

These apps allow companies to sort policies by criteria and search for information quickly.

Compliance and regulatory software also save time by replacing manual paper-based systems and reducing the chances of hidden or informal requirements.

It helps track regulatory changes, manage compliance documentation and conduct audits to prevent legal issues.

Customer Relationship Management

CRM systems are important for attracting and retaining patients or clients like individual healthcare professionals.

These tools are smart organisers, helping healthcare providers track potential patients and categorize their information.

CRM systems collect customer data like contact details and medical needs to help in scheduling appointments and follow up. This ultimately increases patient engagement and hospital revenue.

This guide to choosing the best recruitment CRM highlights top features that improve hiring efficiency.

Partner with SPDLoad to improve how you deliver patient care

Health Insurance Application Development Challenges

Let’s see what are the main challenges health insurance software companies can bump into when developing their solutions.

If you want to learn more about successful insurance businesses, feel free to check out our article where we cover 15 examples of insurance companies.

HIPAA and GDPR Compliance

When developing health software solutions, you should consider the challenging requirements of HIPAA.

The Health Insurance Portability and Accountability Act (HIPAA) sets strict standards for the protection of health information.

Compliance obligations include security and privacy policies as well as emergency data breach coverage. These rules are aimed at protecting patients’ healthcare data confidentiality and providing access to medical records or health information while maintaining their security.

Non-compliance can result in hefty fines, as seen in the 2018 case where Anthem agreed to pay $16 million to settle HIPAA violations.

When privacy matters, these best HIPAA-compliant chat apps are essential for secure communication.

Lack of Mobile Apps Solutions

Despite the growing demand, some health insurance companies still do not offer fully functional mobile apps. This limits users’ ability to manage their policies and claims on the go. This gap represents a significant opportunity for development.

According to a survey by Deloitte, 42% of consumers want more mobile access to their health insurance information, yet many insurers lack comprehensive mobile solutions.

Users prefer using mobile apps over traditional patient app engagement methods.

They are much more convenient and efficient as they don’t require any physical presence of a doctor or nurse.

Lack of Technologies for EMR Integration

Currently, most healthcare organizations don’t have the facilities to integrate their EMR systems with others.

Thus, it becomes critical for developers to design new technologies that help patients and physicians coordinate activities between multiple EMR systems.

These are a few challenges for developing health insurance applications. Health insurance software development company can help you stay ahead and prepare.

Integrating new health insurance software with legacy systems can be complex, but it needs to be done to overcome competitors and provide impeccable service for your customers.

Data Security and Privacy

IBM revealed that the healthcare industry in 2020 exacted the highest average cost of a data breach at $7.13 million per incident, according to a study.

The 2015 Anthem data breach exposed the personal information of close to 79 million persons, emphasizing the dire need to tighten security measures surrounding health insurance applications.

As you can see, there is still a lot of room for improvement and innovation in the field of health insurance.

With technological advancements, it can be much easier to solve these issues and become a top player in the market.

Learn about the most impactful cybersecurity trends to safeguard sensitive data and prevent breaches.

Let’s see what the future holds for this software sector and what you can do now to stay ahead of the curve.

Future of Health Insurance Technology

The future of health insurance technology holds great promise, with no end to advancements and improvements in how health insurance is managed and delivered.

Let’s walk you through the major influences and anticipations that will help define the future face of health insurance technology before all is said and done.

Artificial Intelligence and Machine Learning

Artificial Intelligence and Machine Learning promise to be game-changers for health insurance.

AI-driven algorithms can analyze massive data sets to forecast patient outcomes, root out potential fraud, and even craft personalized insurance plans.

As per Accenture’s report, AI healthcare mobile application development offers potential annual savings of $150 billion for the United States health sector by 2026.

Insurers are able to deliver more precise risk assessments and pricing, leading to better service for policyholders.

Telehealth Integration

The integration of telehealth services within health insurance platform is another increasing trend.

During the COVID-19 quarantine, the only way to see a doctor was online. This raised the usage of telehealth by 38 times pre-pandemic according to McKinsey.

In order to widen their services, health insurance providers are incorporating telehealth applications like virtual consultation, remote monitoring and online health management tools to cater to the needs of patients looking for immediate help and convenience.

Find out how other healthcare technology trends are transforming patient care and healthcare delivery.

Wearable Devices and Health Monitoring

Wearable devices such as fitness trackers, smartwatches, and more are shaping the health insurance paradigm.

These devices generate real-time data that allows insurers to measure the health parameters of the insured who have wearable devices and design personalized wellness programs.

IDC is looking for global wearable devices to reach 559.7 million units by the end of 2025.

This technology can be used by insurers to incentivize healthy behaviors, resulting in fewer claims and healthier policyholders.

Mobile-Based Health Insurance Applications

The consumer clamor for mobile health applications is skyrocketing, having the integration capability to offer policyholders easy access to their insurance information, claims status, and health resources.

According to Deloitte’s 2020 Health Care Consumer Survey, 42% of consumers wanted to have more mobile access to their healthcare data.

There is a growing demand for digital health solutions as consumers use technology and apps to maintain their health.

Insurers that develop robust and user-friendly mobile-based health insurance applications can see increased engagement, improved user experience, and, most importantly, better customer service and market loyalty.

Globalization

Healthcare is becoming more globalized, and so health insurance follows this trend and supports global operations.

Digital health services allow patients to access quality healthcare from anywhere in the world. For example, U.K.-based healthcare technology company Atlas Biomed ships at-home microbiome testing kits internationally.

Health insurance follows this trend, with many companies offering global coverage.

This is especially beneficial for frequent travelers and digital nomads. As international health insurance options grow, local insurers may be pushed to innovate and offer more competitive packages.

The app development landscape is evolving. Explore the most important application development trends for your business.

Do these trends and predictions sound inspiring? If so, then let’s move on!

Custom Software Development for Health Insurance Software Companies: Let’s Start

As an advanced software development company specializing in health insurance development, we are here to help you develop a solution that will satisfy the market demand.

Successful apps are often the result of strong partnerships. Learn how to build one in our article on app development partnerships.

Whether you want to build a simple online health insurance software, a mobile or web-based online quoting tool, or other risk management systems – you can count on us.

For over 10 years in the software development market, we’ve built multiple systems, including insurance software, healthcare solutions, fintech apps, and more.

Thinking of launching a financial app? Our fintech app development guide covers it all.

Let’s connect and discuss how we can be helpful for your company.

Discover some of the best SaaS startup ideas that are driving innovation in the tech industry.