Top 7 Insurtech Trends of 2025 (and Beyond)

- Updated: Nov 13, 2024

- 11 min

The insurance industry is undergoing rapid digital transformation. Insurtech, the new wave of insurance technology innovation, is disrupting traditional models and processes.

This article discusses the top insurtech trends shaping the industry in 2025 and beyond.

Whether you’re an entrepreneur, insurance executive, or product manager, read on for insights into:

- Current insurtech trends gaining steam

- Emerging insurtech developments to watch

- Stats depicting the growth and impact of insurtech

- Implications for the future of insurance

We’ll start by highlighting some of the most popular insurtech application development trends right now in 2025 that are laying the foundation for future innovations.

Unlock your startup potential now — start transforming your vision into a scalable solution with our expert developers today!

Current InsurTech Trends to Consider Before Launching a Product

What trends should aspiring entrepreneurs look out for? How can new insurance products address these trends? Let’s first discuss these points before considering future trends of digital transformation in insurance.

Current trends in the insurance industry are:

- Remote operations;

- Cashless environment;

- Covid-19-related challenges.

Below is a detailed exposé on the above checklist.

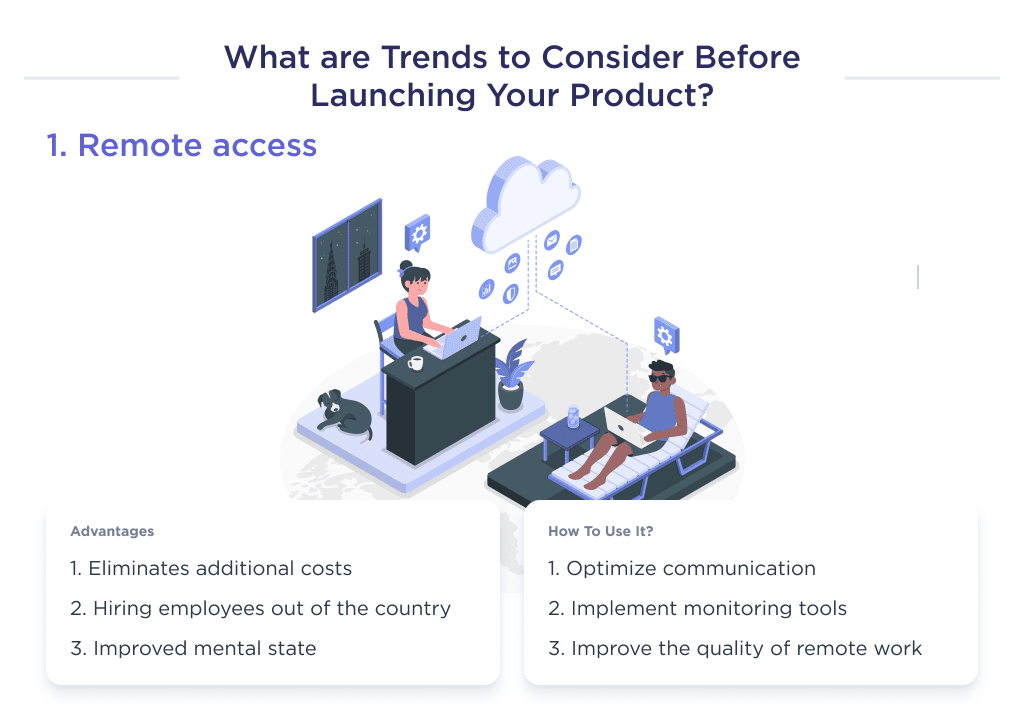

1. Remote Accessibility Becoming Standard

This trend is an arrangement where workers don’t have to be present within the company.

A report says 25% of InsurTech and fintech startups have remote workers. And since over 75% of workers say they prefer teleworking. Experts say the trend will continue.From cost savings to better service, the benefits of fintech are transforming industries.

| Insights | Description |

| Benefits to Startups | This trend has created lots of opportunities that are beneficial to startups. Some potential benefits it can offer your startup include:

|

| How to leverage this trend | You can leverage this trend by:

|

Building a fintech startup? Get practical advice on how to start a fintech startup and navigate the industry.

Beyond remote work, another popular trend is contactless payments. Let’s discuss this.

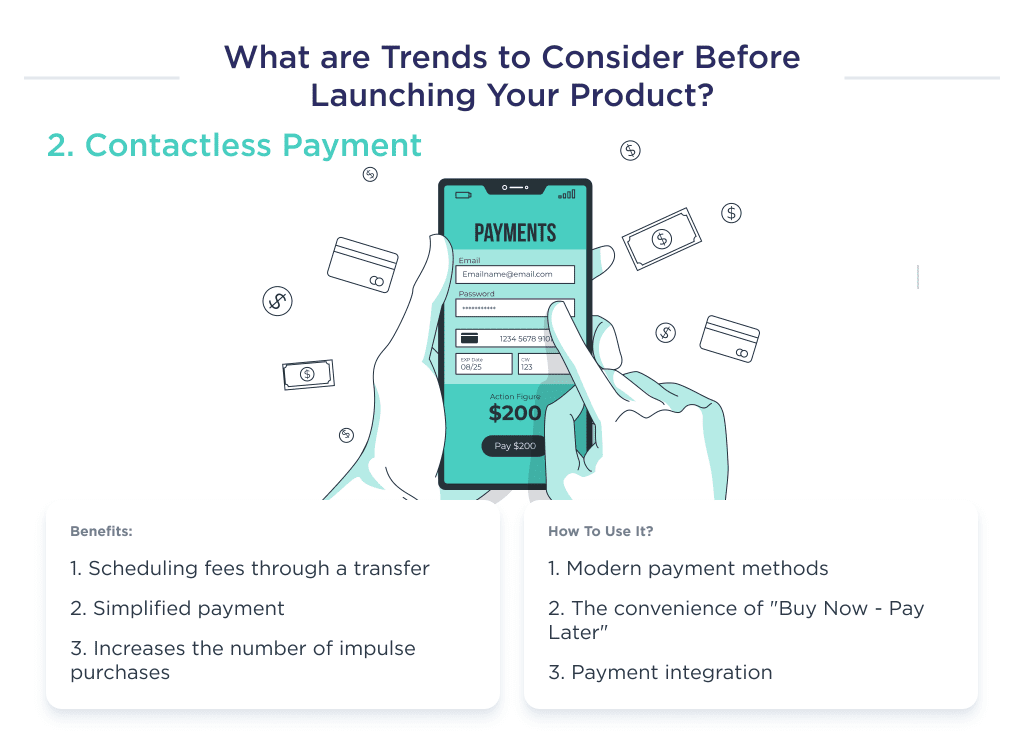

2. Contactless Payments on the Rise

Contactless payment encompasses all payments done without using physical cash. Once the pandemic hit, online payment improved by 30%. According to Ey, over 32% of policyholders currently pay their home insurance online.

This is a sharp increase from 20% that expressed willingness to pay online.

| Insights | Description |

| Benefits to Startups | This trend offers startups the following benefit:

|

| How to leverage the trend | Your insurance startup can leverage this trend by:

|

Other than payment mode, another present trend to watch out for is legal challenges posed by Covid-19.

3. Legal Implications of Covid-19

Disruptions in the supply chain due to the pandemic exposed businesses to lawsuits. According to Natlaw, consumers filed over 3000 lawsuits related to Covid-19 between March 2020 and September 2021.

This has, in turn, created an increase in demand for insurance services offering coverage from legal class actions.

| Insights | Description |

| Benefits to Startups | This trend brought about the following pros to InsurTech startups:

|

| How to leverage the trend |

|

You’re now abreast with current insurance technology trends that have been making waves in recent years.

Let’s discuss some future trends to be aware of.

Find the best TypeScript developers for your project.

7 Emerging InsurTech Trends

The InsurTech space is evolving, thanks to the rapid formation of new technologies. This creates an ever-dynamic trend for both business and technical growth.

Here’s a checklist of IT trends that will shape the future of InsurTech:

- Increase in customer-centrism,

- Usage of embedded insurance,

- Increased use of AI, IoT, and ML,

- Adoption of distributed data aggregators,

- Increase in the use of autopilots,

- Increased adoption of distributed ledger,

- Rise of distribution-based discounts.

Let’s clarify what each of the points above means.

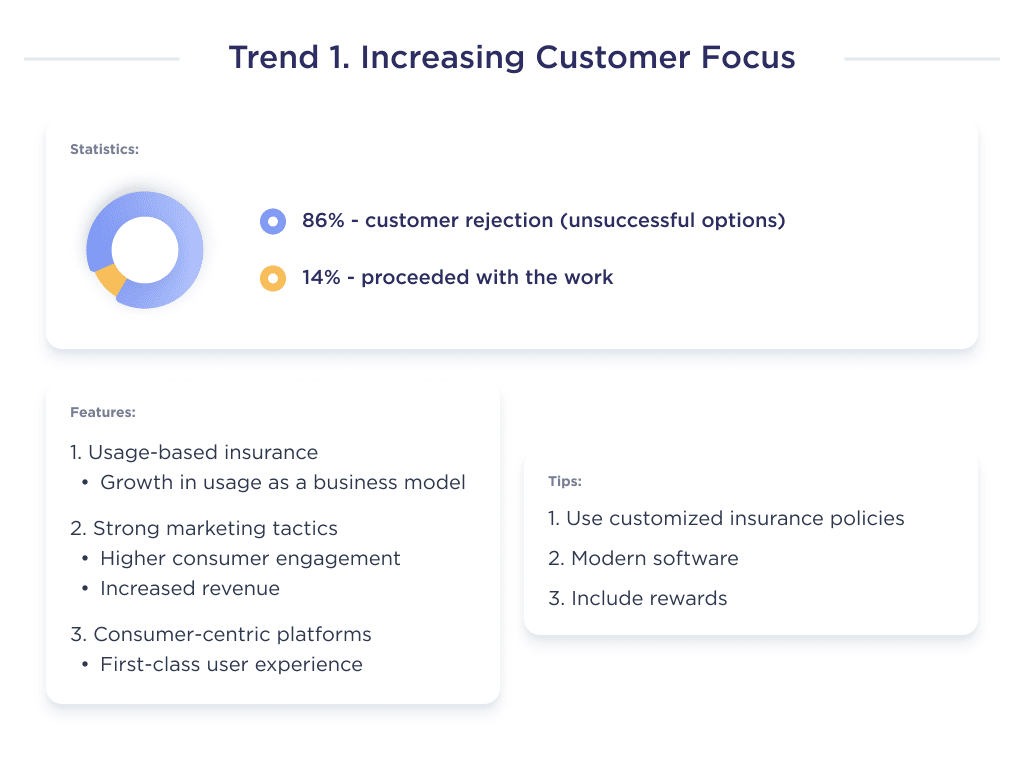

1. Customer-Centric Approach

The growing demand for better customer experience has led to the rise of on-demand insurance services.

Statistics suggest that over 30% of policyholders believe that insurance firms aren’t doing enough in this aspect. Also, more than 86% of customers have abandoned a service due to two bad experiences.

Using a CAC calculator can help you make informed decisions on acquisition strategies.

This growing demand creates the need for the following :

| Opportunities Created | Description |

| Usage-based insurance | The demand for personalized insurance offerings is creating a rise for usage-based insurance as a primary business model. In a 190-page report by MarketsAndMarkets, the usage-based insurance market will increase from $19.6 billion in value in 2021, to $66.8 billion in 2026. |

| Analytics-based Marketing Tactics | Insurance with powerful data analytics can offer more personalized services than competitors. Earnix predicts that analytics-based personalized offerings can improve insurance broker channels by 60%. It also improves consumer-base engagement by 89% and increases revenue by 60%. Find out how email marketing for startups can create powerful relationships and drive leads. |

| User-oriented InsurTech platforms | Since 45-62% of insurance users buy and pay premiums via a mobile app, owning an app is a no-brainer. What’s also important is guaranteeing top-notch user-friendliness. This is of great importance as reports suggest that 74% of users will return to an app that’s mobile friendly. |

Here are some tips for adopting this trend in your InsurTech business model:

- Offer on-demand insurance services,

- Offer rewards for risk aversion,

- Offer self-personalized insurance policies,

- Use modern data gathering and analytics software,

- Hire experienced app UI/UX designers.

Embedded insurance is another model that’s expected to dominate the market space. Let’s provide you with information on this.

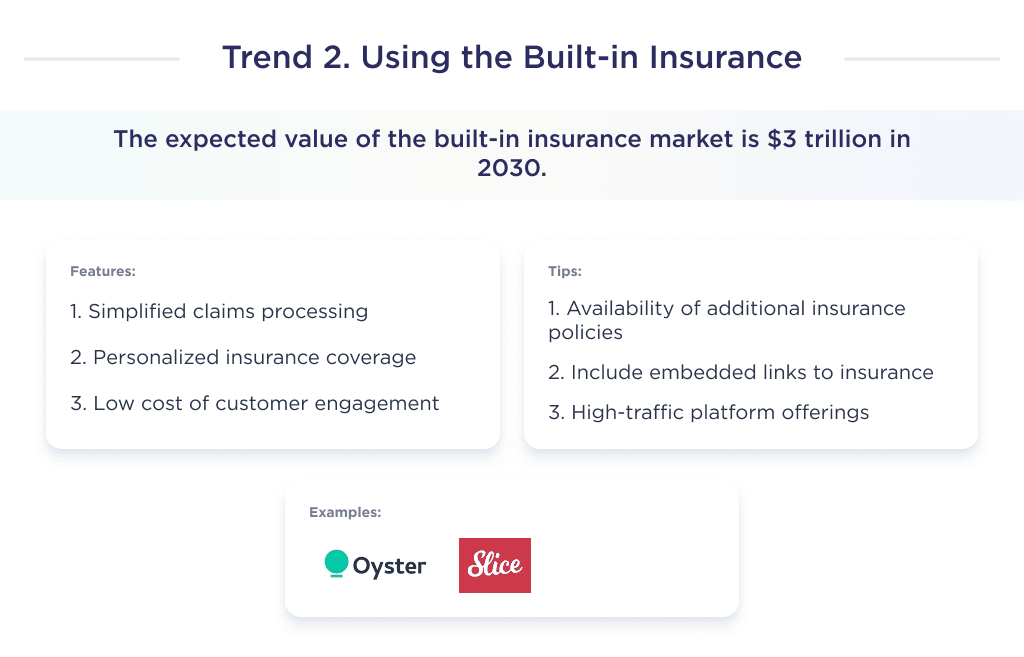

2. Embedded Insurance Gaining Traction

Embedded insurance is the act of selling personalized insurance to potential policyholders at a point of need.

For example, selling auto insurance to vehicle buyers at the point of sale. The embedded insurance market will be worth $3 trillion in 2030.

Noteworthy companies currently championing the rise of this business model in the InsurTech space are: Oyster, Slice, and Trover from the US. Inshur and bSurance in Europe are also doing the same.

Today, these types of firms only make up 1% of total InsurTech.

This rising trend results in the following:

| Opportunities created | Description |

| Hassles Insurance Sales | Insurance processes are a hassle. From application filing to claim verification processes. Embedded finance will change this as insurers offer this coverage after the insured has submitted many details. Also, there’s streamlined claim processing, since there’s no need to prove purchases. |

| Personalized Policy Plans | By utilizing data from third-party sales companies, coverage providers can offer more real-time personalized cover. |

| Lower Customer Acquisition Cost | Most insurance companies spend over 20% of their revenue on advertisements. But, with embedded insurance, the cost of acquiring new customers will reduce, as startups only have to have to approach businesses for partnership. Partnering up for app development? Here’s what to keep in mind for a productive app development partnership. |

Here are some helpful tips for startups that want to key into this trend:

- Build resilient backend APIs,

- Offer add-on insurance policies,

- Add embedded insurance links on popular eCommerce sites. e.g., Amazon, (Looking to launch an eCommerce business? Check out these eCommerce startup ideas for fresh inspiration).

- List offerings on high-traffic platforms.

Digitalization of the insurance sector will improve due to the rise of AI, IoT, and ML. Let’s discuss what the trend entails.

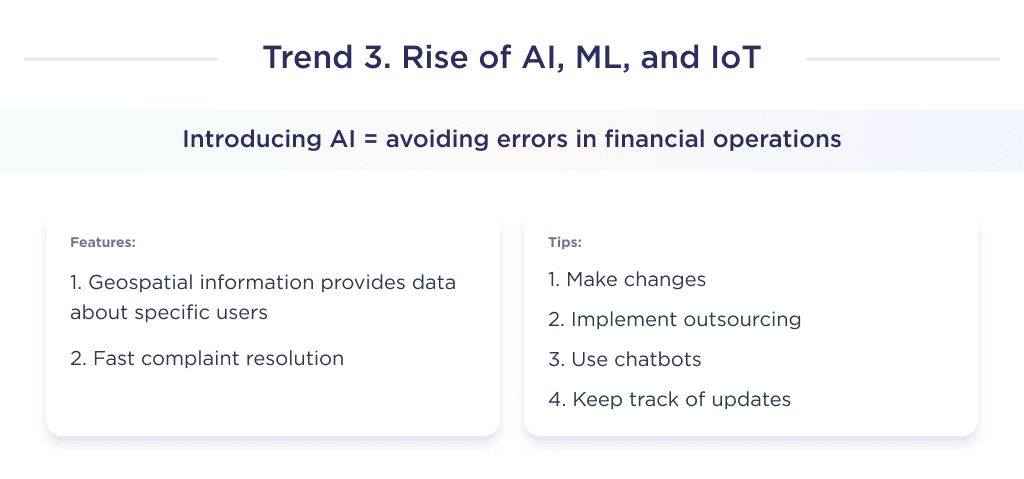

3. AI, ML, and IoT

AI, ML, and IoT are influencing how InsurTechs access and value risk. Their rise is due to the failure of traditional insurance techniques, and the discovery of big data.

The first introduction of AI to insurance was to detect insurance fraud and prevent human error in financial transactions. For a data-driven view of how AI is transforming industries, explore the latest AI statistics.

Beyond that, insurers now use it for insurance marketing, distribution, risk modeling, and insurance underwriting.

Its usage in the Insurance sector will rise as time goes by. According to McKinsey, insurers will automate 55% of major insurance functions within the next decade.

This phenomenon will bring the following opportunities to InsurTech:

| Opportunities | Description |

| Usage-based Insurance. | Although this is currently in trend, experts expect demand, and supply to increase over the next decade. This is due to AI’s ability to provide information on specific users. The Internet of Things has made this personalized offering more conceivable since it gets data from wearables and items using sensors. Geospatial information from satellites also aids usage-based insurance. |

| Quicker and More Effective Claims Processing | McKinsey believes that claims processing will remain a primary function of carriers by 2030. But, automation powered by Machine Learning will replace over 50% of these activities. Advanced algorithms will handle claim routing, and insurance processing, increasing accuracy and efficiency. |

Here are some tips that can help you adopt these technologies:

- Capture the right metrics for each customer,

- Test each machine learning adoption and make requisite changes,

- For third-party AI and data capture services, outsource from reputable companies,

- Use in-app chatbots,

- Investigate every data anomaly, and watch out for loopholes.

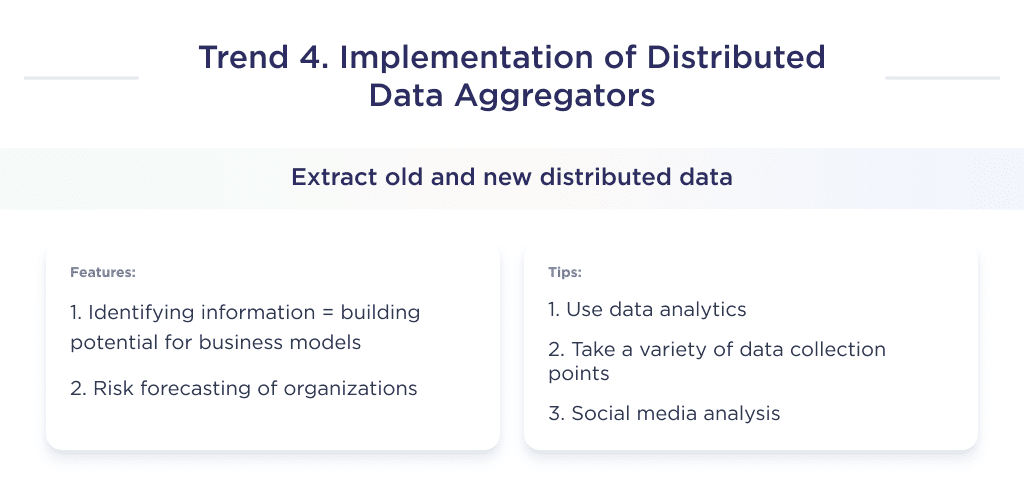

4. Distributed Data Collection

Distributed data sits all around waiting. With the right AI algorithm and analytic tool, you can extract information from them.

Artificial intelligence technology now allows InsurTech platforms to extract old and new distributed data. Insights from past occurrences help to understand underlying reasons and claims.

It also helps to model increasing or decreasing risks assists to set industry benchmarks and adds more value chain to current business models.

The benefits of distributed data collection in the Insurance sector are:

| Opportunities | Description |

| Discovery of New Business Models | Distributed data collections help insurance firms identify information outside their traditional scope of analysis, thereby creating the potential for new business models. |

| Redesigning Policy Offerings | Insurers use distributed data to predict the risk patterns of entities within a small geographical environment and provide personalized policies. For example, Climate Corporation collects and analyzes distributed data on soil characteristics and weather patterns for crop insurance. |

Thinking of how to adopt this trend in your platform? Then consider doing the following:

- Use Google data analytics or other reputable tools,

- Have diverse points of collecting data,

- Integrate social media data collection and analysis tracker,

- Use a high-quality data extraction system.

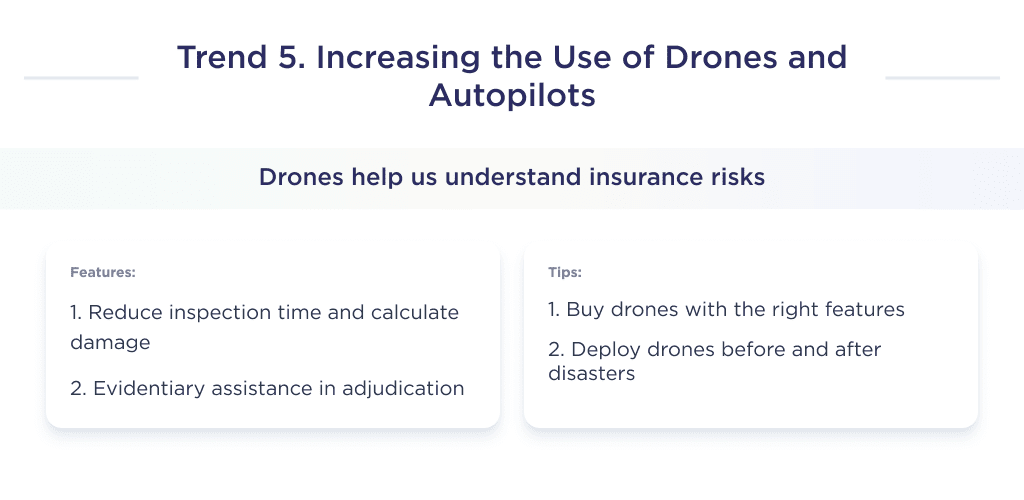

5. Drones and Autopilot Adoption

17% of drone usage in the United States is channeled at insurance inspection. This number will rise.

Experts believe that a 10% increase in drone usage by insurance companies can help the industry prevent about $32 billion in losses due to quicker fraud detection.

Drones and other unmanned aerial vehicles help to gather data, access damage and understand insurance risks. An example of an insurance company using this technology is Farmers Insurance.

This rising trend is bound to bring the following opportunities to InsurTech:

| Opportunities | Description |

| Increased evaluation time | Drones and Auto-pilot reduce inspection time to mere hours from days or weeks. When coupled with advanced AI technologies, they can calculate damages. |

| Evidence Gathering for Adjudication. | Since drones record and process information live, they can help provide evidence to support the insurer in cases of adjudication. Time-stamped proofs lead to quicker resolutions and settlements. |

Access premium design and development services for unmatched success.

Here are some tips for leveraging on this technology:

- Buy drones with the right specifications: Vertical Take-off and Landing, elevation maps, HD cameras, and infrared capabilities.

- Deploy drones before and after natural disasters in high-risk areas.

One such business model that’ll influence InsurTech is a behavior-based discount. Let’s discuss this.

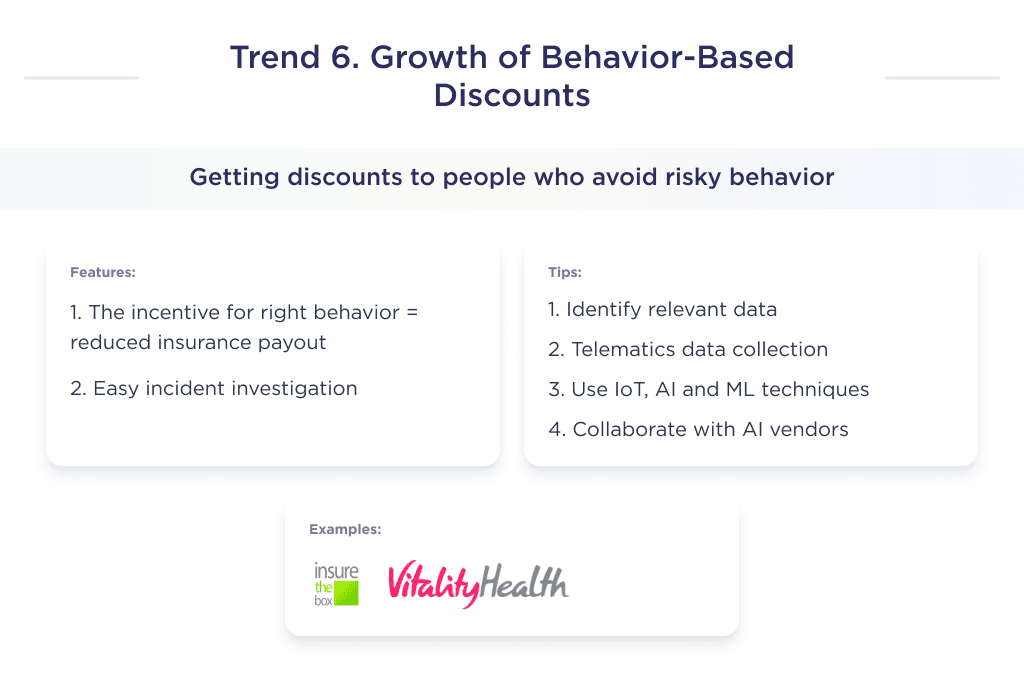

6. Behavior-Based Discounts

Behavior-based discounts provide rewards to policyholders that avoid risky behaviors. For example, QBE launched a product called Insurance Box that uses telematics to issue a DriveScore. The safer you drive, the higher your score, and the lower your premium. Individuals that drive in less congested areas and less distance also get lower premiums.

Another example of an insurance company doing this is Vitality Health. They use connected devices, AI, and ML to track policyholders’ exercise and eating habits for risk assessment.

The more healthy your lifestyle, the lesser your premium. According to Forbes, the number of drivers getting telematics offers for behavior-based discounts increased from 32% in November 2021, to 40% in March 2023.

Here are some potential opportunities that this trend will create:

| Opportunities | Description |

| Better risk aversion among users | This business model centers around improving healthy living amongst policy hold. As such, it provides the right incentive for consumers to behave right, thereby, reducing claim payment for insured incidences. |

| Easy investigation | It’s easier to investigate incidents when there are enough data capturing technologies in the environment. In the case of car accidents, telematics information from the driving behavior tracker can provide hints on speed, acceleration, and brake intensity. For insurance companies looking to innovate, car insurance app development is a game-changer in customer engagement. |

Here are some to adopt this trend:

- Identify the relevant data you need,

- Collect telematics data from GPS, Cellular,

- Use IoT, AI, and ML to collect and analyze data,

- Partner with third-party AI providers if you lack an in-house technical team.

Another trend that’ll shape insurance in the future is blockchain technology. Let’s discuss this.

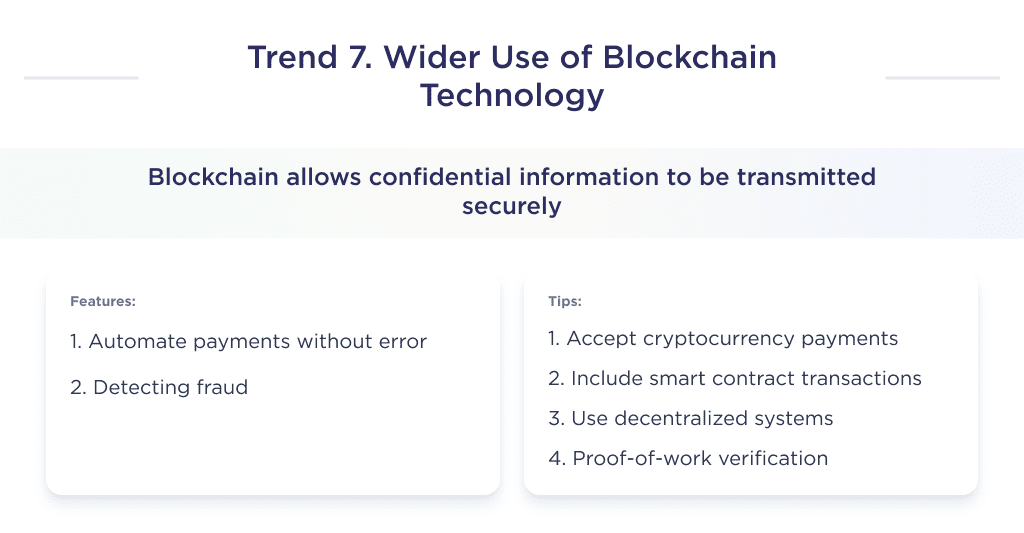

7. Blockchain Technology Implementation

The use of big data by Insurance technology companies makes it important to transfer sensitive information to stakeholders in a secure way.

Blockchain technology helps to secure data management from one point to the other without a security breach. Through its Decentralized Autonomous Organizations, blockchain can aid policy management in insurance. It can also complement cybersecurity strategies.

Its increasing use of blockchain in the insurance sector is inevitable.

For example, experts value the blockchain in the insurance market at $64.5 million in 2018 and will hit $1.3 billion by 2023, representing a CAGR of 84.9%.

This growth has fueled many opportunities, including:

| Opportunities | Description |

| Automated Transaction Execution. | Blockchain’s smart contract automates contract execution. For insurance, it can help automate claim payments without any margin of error. This is comm in life insurance. |

| Fraud Detection. | Fake claims are a primary challenge for insurance firms. For example, healthcare insurance fraud alone costs Americans over $50 billion yearly. But with blockchain technology, Insurers can verify the authenticity of a claim. Discover the best healthcare startups making a significant impact in the industry. |

Here are some tips to keying into this trend:

- Accept cryptocurrency payments,

- Use smart contract transactions,

- Use decentralized systems to manage the financial transaction,

- Secure in-app financial services with the decentralized ledger,

- Attach proof-of-work verifier to claims processes.

Now that you’ve learned a lot of Insurance tech trends that’ll shape the future, there’s more.

Discover how to choose a tech stack with our expert advice.

Ready to Build Your Own InsurTech Product?

The insurtech trends we’ve covered show no signs of slowing. They will continue pushing boundaries of what insurance can be.

For incumbents, adapting poses immense challenges with legacy systems embedded. For startups, the pace of change opens doors to reshape insurance for the better.

If you have a promising insurtech concept to validate and build, our team can bring it to life.

With insurance app development services and UX design expertise, we guide ventures from idea to launch and beyond.

Besides that, our team can handle other tasks like insurance website design or redesign.

Being a Clutch Leader in Ukraine speaks to our dedication and hard work in the software development field.

Let’s connect to explore options to start mapping your insurtech plans in this dynamic era.