8 Biggest FinTech Trends to Follow in 2025

- Updated: Nov 12, 2024

- 10 min

From cost savings to better service, the benefits of fintech are transforming industries.

Are you an investor, serial entrepreneur, or project manager interested in fintech trends?

If so, keep reading this article to dive into key fintech trends you should know.

Here’s what you’ll learn:

- The top fintech trends of 2025

- The latest fintech industry trends to watch

- The opportunities created by leading financial technology trends

- And more!

If you are thinking about creating your own fintech app, feel free to dive into fintech app development to see what it takes to create a standout financial app.

Let’s get started and discuss some exciting fintech trends shaping the industry in 2025.

Unlock your startup potential now — start transforming your vision into a scalable solution with our software developers today!

What Are the Major Fintech Trends?

The latest statistics suggest that 88% of US citizens use a FinTech product. Marking a 52% increase from 2020’s figure. It depicts that FinTech is a fast-growing sector that gives consumers great satisfaction.

The nudge in user rate is due to certain FinTech trends still making waves this year. These include;

- Increase in neo banks

- Demand for cryptographic ledger

- Custom chatbot integration

- The rise in the integration of effective FinTech APIs

The above checklist helps give a quick hint on top trends. Below is a detailed description of each.

Mobile-Only Banks

Since 2015, several alternative payment methods have emerged. One of the most successful in this endeavor is mobile-only banks. These are technology companies that offer internet-based mobile payment solutions.

And thanks to this trend, Gen Z’s and the unbanked now have an easy way to access payment processing services from their homes.

Emarketer estimates that 29 million Americans are currently using a mobile-only bank. A figure that’s expected to have increased by 7 million at the end of 2023. This increase in usage is due to the high level of innovation introduced by industry disruptors.

With this trend, startups can create a mobile-banking platform that’ll cater to all.

You can own a piece of the market share by mobile banking app development powered by a traditional bank’s API. And if you own the means, you can buy a license for your operating procedure.

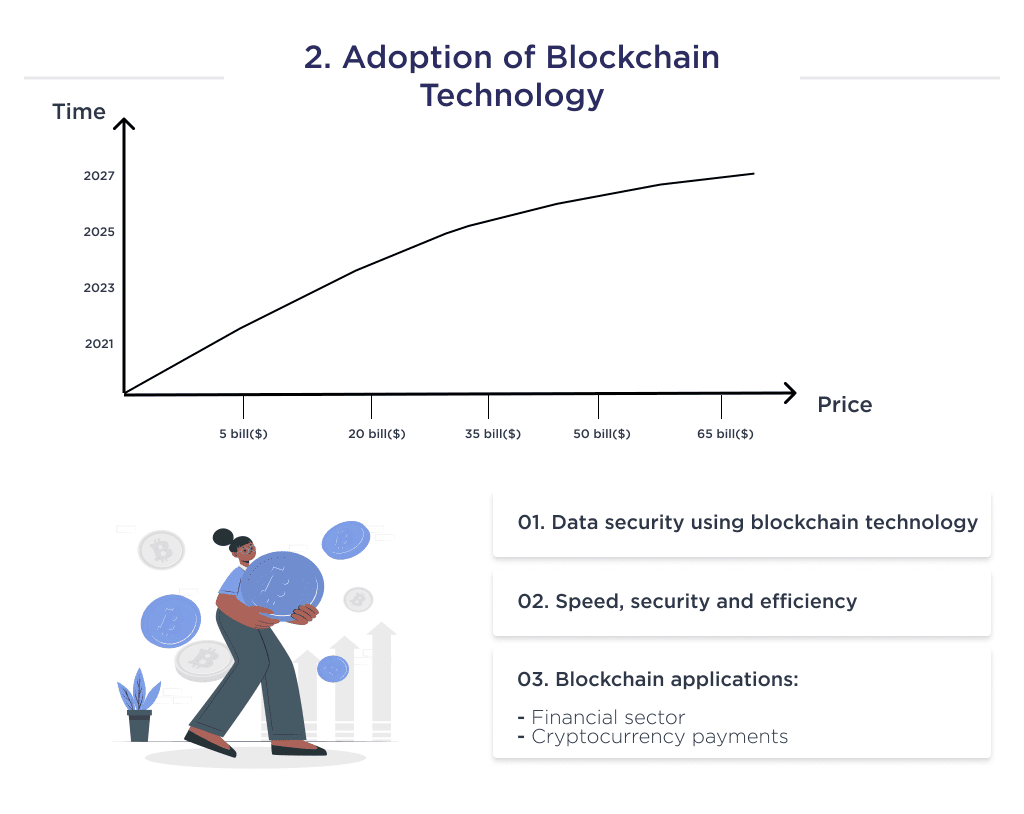

Adopting Blockchain Technology

Blockchain technology has proven to be the goose that lays the golden egg in FinTech. No wonder it’s among the top FinTech trends of the year.

The blockchain market is going to be worth $67.4 billion by 2025. A major reason for this growth is that blockchain-verified data is secure.

With the right application of blockchain technology. You can make your product stand out in speed, security, and efficacy. Transactions with these three merits can better help organizations exchange digital information.

Startups with a penchant for blockchain technology can join this trend by;

- Creating a platform that empowers cryptocurrency payments

- Building a dApp.

- Implementing Decentralized Finance System in their FinTech product

- Creating a blockchain solution for the financial sector

- Crypto-powered payment gateway

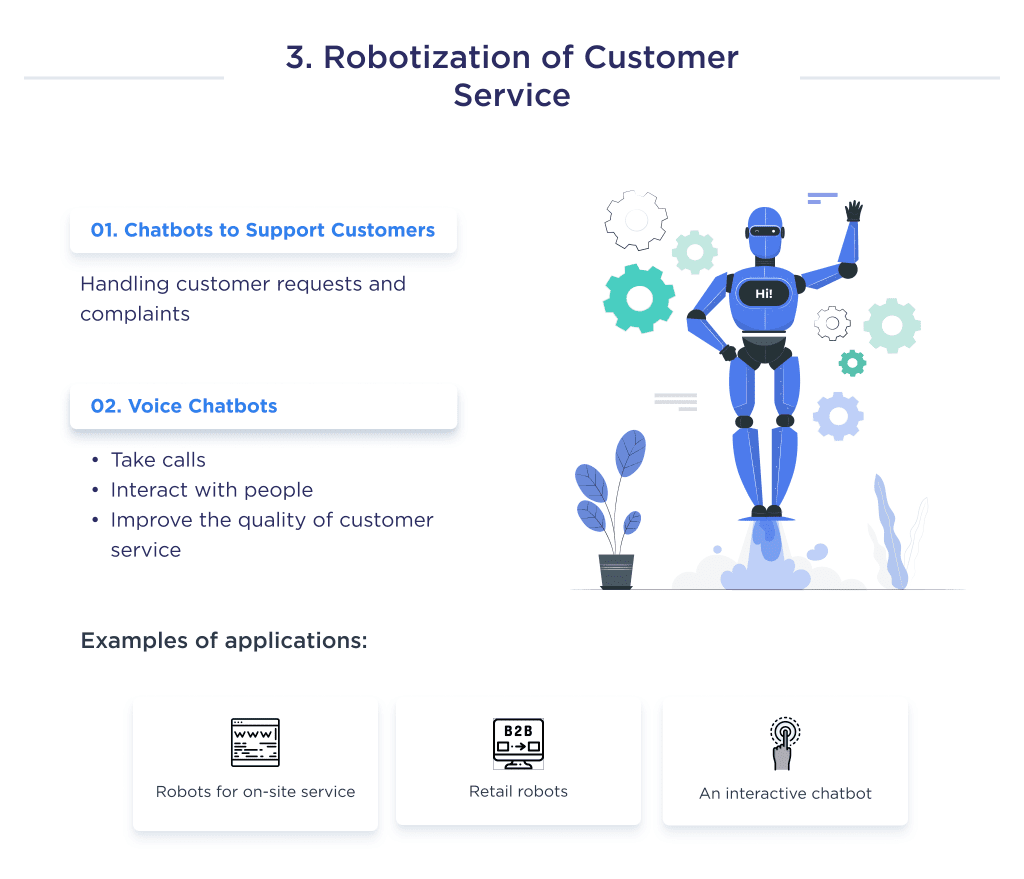

Embracing Robotics for Customer Service

Robotization is reshaping the alliance between humans and technology. Its emergence has been linked to the advancement of Artificial Intelligence (AI). Same with Machine Learning, and particularly in Conversational Artificial Intelligence.

The first robotization introduction to customer service was chatbots. Those small chat windows pop up when you browse some websites.

However, as the COVID-19 pandemic ranged and more people made purchases via mobile phone. Conversational AI started to grow in demand. Voice bots, a generic term encompassing all conversational robots (think of Alexa or Siri), grew in demand. Voicebot is now programmed to pick calls, interact with humans, and parse information. In fact, AI’s impact is growing rapidly, and you might want to explore these AI statistics that highlight the trends you need to know.

Today, more than 23% of customer-service websites use chatbots. Which has been helping to improve customer experience.

This relatively new field creates a new league of opportunities for consumers and startups. So much so that chatbot is the fastest growing communications channel. Robotics Customer Service solves the demand for better customer inquiries and complaints handling processes.

Startups can also benefit hugely from this field as investors’ confidence is at an all-time high.

Startups and investors willing to adopt this technology may create the following;

- An interactive chatbot

- Voicebot

- Robotic process automation (RPA)

- Retail robots

- Field service robots

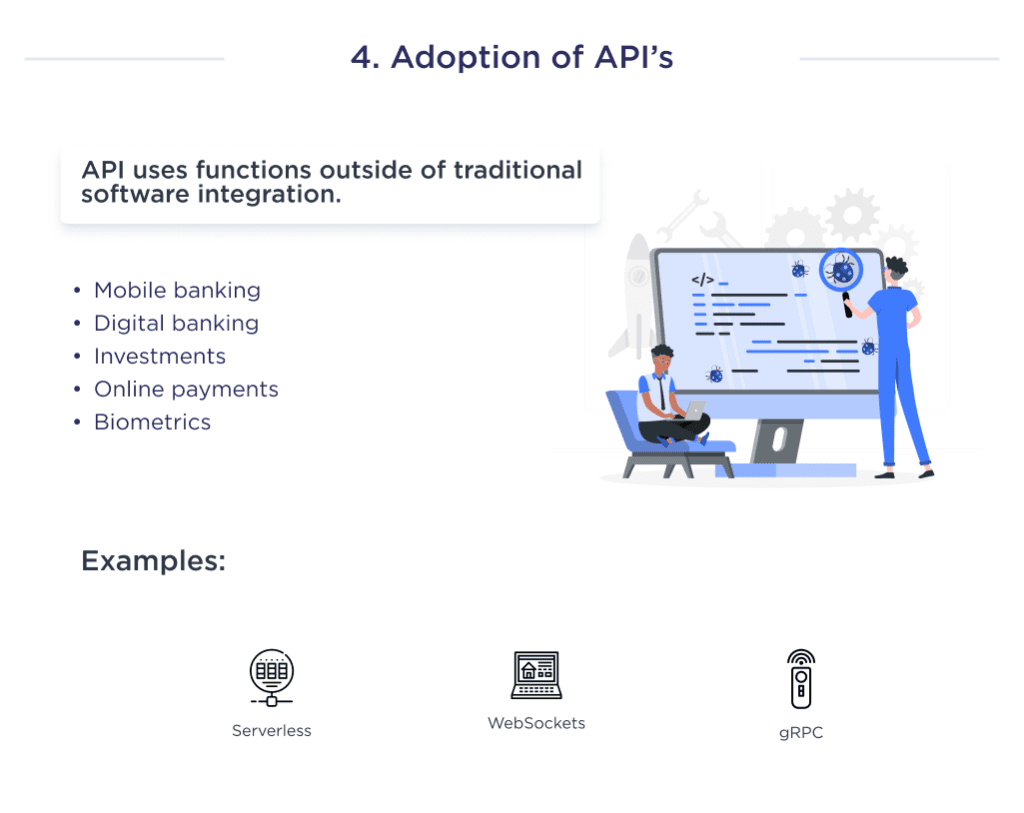

Leveraging APIs

Application Programmer Interface (API) adoption is a technology trend on the rise. Statistics show that 71% of developers have pledged to use API more this year.

According to Iddo Gino, a tech startup founder, “During the pandemic, most companies fast-tracked digital transformation. So it’s no brainer that investment in API economy and software development as a whole rose this year.”

APIs are a breakthrough for FinTech startups. For example, Stripe API enables startups to own payment infrastructure without owning some expensive licenses. Many surveys also suggest that API usage and technology this year are more varied.

REST remains the most notable standard in finance. But, there is noteworthy interest in emerging technologies. Examples include FaaS, serverless, gRPC, and WebSockets.

Startups willing to jump on this trend may do so via.

- Creating an API for licensed mobile banking infrastructure

- An API for investment

- The digital banking API infrastructure

- Insurtech enabling API

- API for contactless payment

- Biometrics API

Now that you have a detailed knowledge of the current trends let’s consider the eight latest FinTech trends.

What are the 8 Hottest Fintech Trends for 2025?

The FinTech space is astronomically innovating new technologies. This leads to an ever-dynamic trend in both its technical and business growth.

Want to be a part of some of FinTech’s latest trends? Here is a checklist of the latest.

- Heightened regulatory requirements.

- Point of purchase credit facility

- The appearance of government-issued cryptocurrency

- FinTech partnership across the board

- The appearance of embedded finance

- The rise of the FinTech ecosystem

Let’s elucidate better on each point raised.

From concept to creation – launch your marketplace with SPDLoad!

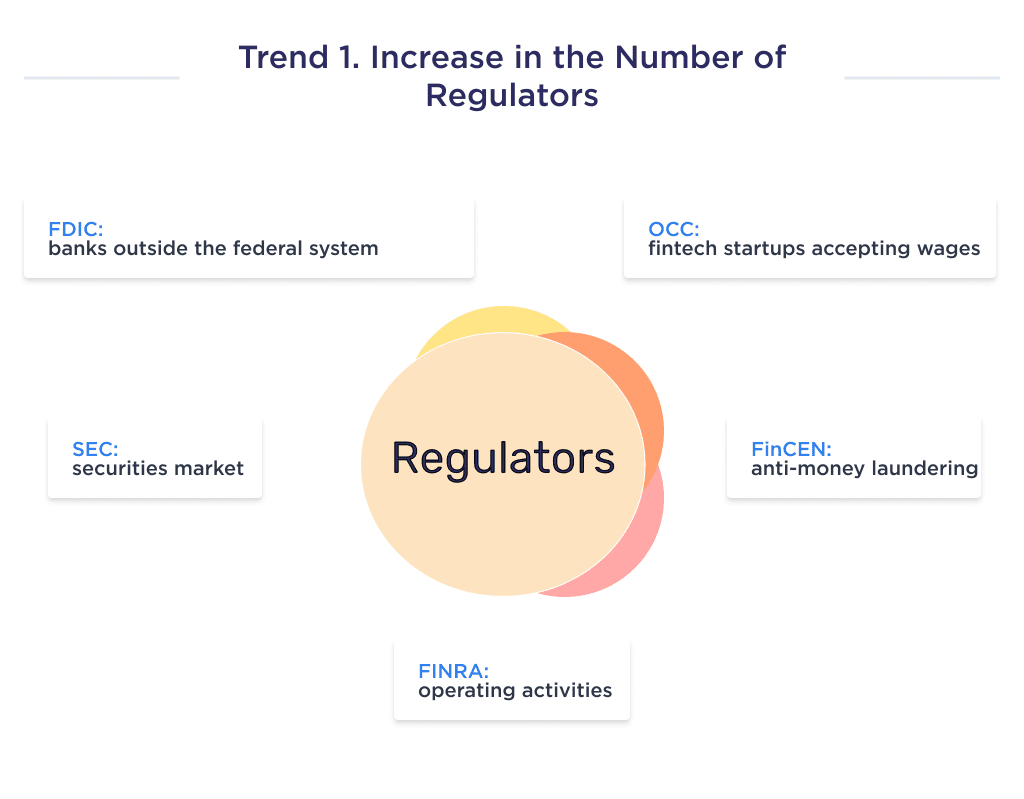

Tighter Regulations

Governmental agencies are beginning to introduce more regulations to FinTech. Fueled by the rise of risky assets investments, such as cryptocurrencies.

Choosing the best crypto exchanges for Canada could be complicated especially in 2023. Being Canadian, I personally was struggling to find a proper exchange for trading crypto that properly operates in Canada and is safe.

However, most countries don’t have a single legal framework that regulates FinTech. Instead, startups are regulated by different authorities depending on the size and nature of their business.

For example, the main financial regulators in the UK are Prudential Regulatory Authority (PRA) and Financial Conduct Authority (FCA). FinTechs that accept deposits send funds, perform peer-to-peer lending, and enable investments must adhere to their stipulations.

However, there have been efforts to synergize these regulatory agencies for the FinTech sector. Beyond these, most governments also plan to increase regulations to catch up with increasing innovations.

FinTech Regulatory Bodies and their Regulations for the United States Include.

| Regulator | Regulation Object |

| Federal Deposit Insurance Corporation (FDIC) | Banks that don’t fall within the purview of the Federal Reserve System. For example, banks like Revolut. |

| (OCC) Office of the Comptroller of the Currency | This body regulates the activities of FinTech startups that accept paychecks and deposits. |

| Securities and Exchange Commission (SEC) | They regulate the securities market. This includes all exchanges, dealers, brokers; mutual funds; and investment advisors. An example of FinTech that comes under this regulatory body is Robinhood. |

| Financial Industry Regulatory Authority (FINRA) | This body helps to protect investors and regulates business operating activities. Including crowdfunding platforms like Crowdfunder. |

| Financial Crimes Enforcement Network (FinCEN) | This regulatory body ensures that all US-based FinTech follow anti-money laundering regulations. Every company receiving, transferring, and receiving payments must adhere to this regulation. |

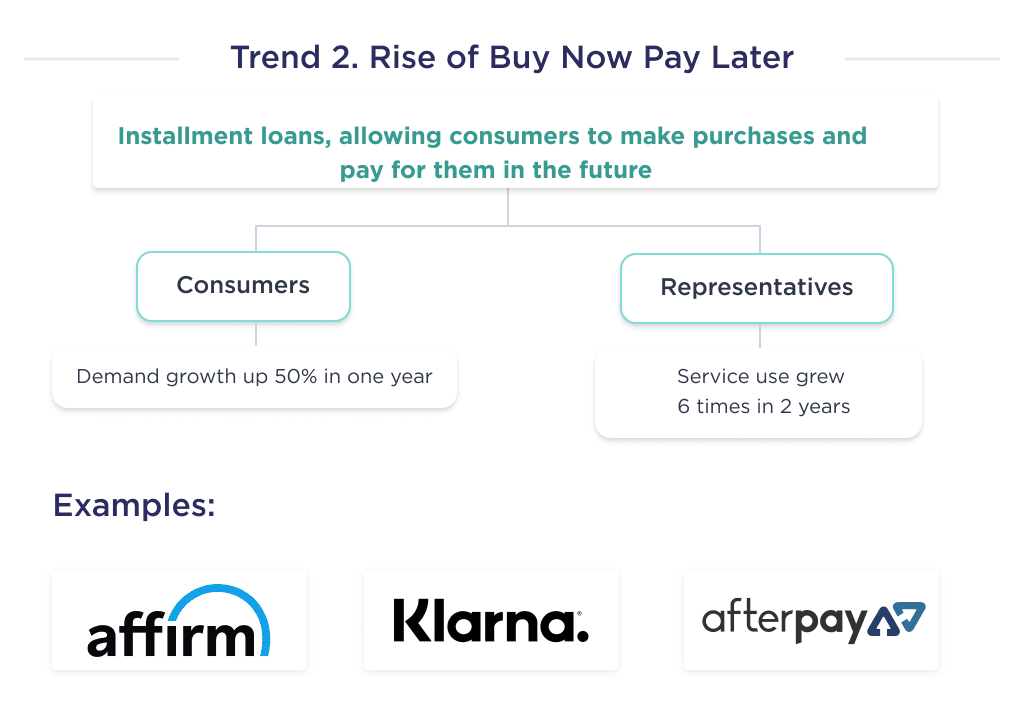

Expansion of Buy Now, Pay Later (BNPL)

BNPL is a FinTech creation that allows consumers to buy a product and make payments later. Consumers can get this intermediary at e-commerce checkout and at point-of-sale.

Due to the intuitiveness of the solution, it has received immense interest amongst buyers. For example, a study shows that 55.8% of consumers have used a buy now pay later service in 2021, up from 37.65% in 2020 – an increase of over 50% in a single year. Also, the percentage of Gen Z’s using autonomous BNPL has grown 6x from 6% in 2019 to 36% in 2021.

There’s no doubt that this initiative is rife. And with the right business model, any innovative FinTech startup can thrive therein.

Willing to launch your real-time BNPL product for small businesses? Examples of companies to the model are Affirm, Klarna, and Afterpay.

Discover eCommerce startup ideas that fit the latest trends and customer demands.

Rise of Central Bank Digital Currencies (CBDCs)

The sweeping presence of cryptocurrency created by private individuals has put many central banks on their toes. The reality check for them is that non-state entities can create alternatives to fiat currencies сreating a problem for regulators. In order to get things under control again, central banks have started creating their own e-currencies to rival to stem this tide.

Although the first CBDC, Avant smart card system, was created by the Bank of Finland in the 1990s. it wasn’t until 2021 that the trend began to generate some buzz. Three decades after the first Central Bank, Digital Currency, nine countries have now fully launched the concept.

More Fintech Partnerships

The crux of FinTech creation, scaling up, and deployment entails identifying the right partners and engaging them. Banks now perceive FinTech as partners needed to achieve goals. For example, 84% of financial institutions in a survey showed interest in partnering with FinTech over the next three years. Instead of the 40% currently partnering with one.

An example of such a partnership is Affirm and Cross River Bank. Affirm has been making waves with its BNPL program. But it’s Cross River Bank that actually sponsors the entire credit.

For the bank to build its BNPL program would have been a challenge. At the same time, Affirm needs a huge financial muscle to have a BNPL program of such magnitude. This synergy is definitely a win-win situation for both.

FinTech Partnerships also have loads of benefits for tech startups. It’ll open them up to a greater pool of resources. They can also benefit from the experience pool of their partner, thus, ensuring they operate without infringing the law.

Growth of Embedded Finance

Embedded finance is when non-financial companies offer their customers access to financial solutions through tech platforms. Embedded finance is a trend that more and more businesses are embracing.

Everyone uses embedded finance without realizing it. How? In booking an Uber ride, a customer can pay for the driver’s service from the application. That’s embedded finance because there’s no need to involve a third-party financial institution for a successful transaction.

The pandemic led to a 40% increase in online shoppers, making the eCommerce industry more vibrant. This, in turn, led to a renewed drive by online retailers to find solutions to attract more consumers to their platforms.

Although this solution grew astronomically at the pandemic’s peak, it’s expected to keep growing as the years go by.

Acceleration of Open Banking

Open banking is also called “open bank data.” This practice entails providing third-party service providers access to financial data through APIs.

The banking industry faced some noteworthy challenges throughout 2020. And the most significant emanating from Covid-19 inspired restrictions. This restriction marked the rise of open banking as financial institutions began to seek more ways to offer banking services.

Crafting Custom Mobile Apps That Delight Users!

Since banking was moving online and challenger banks were making waves. Traditional financial institutions saw an opportunity by providing financial data to these banks. Banks now share more financial data with platforms, making banking more user-friendly.

Now that 25% of millennials and gen-Zs use challenger banks, it’s undoubtedly a great business model for expanding into new frontiers.

Startups willing to benefit from this trend can create their mobile banking product. And seek resources from traditional banks.

Emergence of Super-Apps

A super-app is a mobile application with a wide range of services. It’s an all-encompassing self-contained communication and commerce platform. And it’s sometimes robust enough to support all aspects of commercial and personal life.

China is considered the birthplace of super-app, with the first one being the social media giant WeChat. As the name depicts, it’s used primarily for messaging. It also has a payment system used by vending machines, shops, local transit systems, and vendors. WeChat hosts apps or “Mini-Programs” that provide a way to book a service and hail a ride. The list goes on. It is expected WeChat users in China will exceed a billion users by 2025.

As a startup, creating a Super app gives you lots of benefits, albeit it also has some disadvantages. Some advantages to making your application a super app entails:

- Big data gathering

- Low relative developmental cost

- Easy and fast onboarding

Any platform can easily be made a super-app. However, it’s best to acquire a large audience with your product and gradually add other features to make the solution more encompassing.

If you are thinking of creating a brand new messaging solution, check out this guide on how to create a messaging app step by step.

Development of Financial Services Ecosystems

Inextricably linked to other FinTech trends is the rise of ecosystems. Digital ecosystems in 2021 are best described as distributed, and adaptive. They’re also open socio-technical systems with sustainability, scalability, and self-organization properties.

Examples are MasterCard enterprise partnership, Apple ecosystem, etc.

According to the World Bank, 70% of new value created in the economy over the next ten years will be based on digitally-enabled platforms. This shows that the business model is here to stay, and startups with a flair for growth should start adopting it.

Building a fintech startup? Get practical advice on how to start a fintech startup and navigate the industry.

Want to Build Your FinTech Product?

Partnering with the right software development company is crucial to building cutting-edge fintech products capable of capitalizing on these trends.

Looking to collaborate effectively? Our guide on app development partnerships explains what to consider.

Our expert fintech developers and designers at SpdLoad stay on top of the latest IT trends to build custom platforms, apps, and solutions that help future-proof your business.

Contact us today for a free consultation on leveraging custom software, apps, and emerging financial technologies.

The future of fintech is bright – let’s lead the way!

If you’re looking to build a stock trading platform, our article on how to build a stock trading platform covers all the key aspects.