All Services

As a fintech software development company, we provide a full range of fintech software development services, from web development to mobile banking apps, that prioritize security, scalability, and user experience.

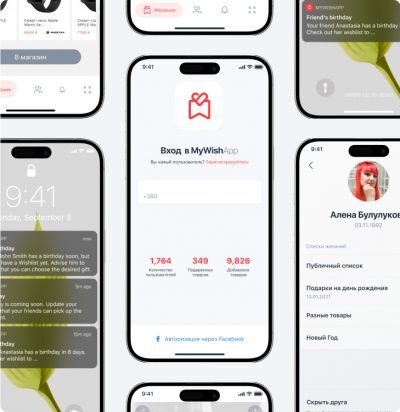

- Fintech App Development Services We create secure, user-friendly fintech applications for banking, investment, and personal finance management. Our apps are designed to offer seamless functionality, high performance, and robust security, ensuring a smooth experience for users while safeguarding their financial data. We integrate the latest features, such as real-time transactions, budgeting tools, and investment tracking.

-

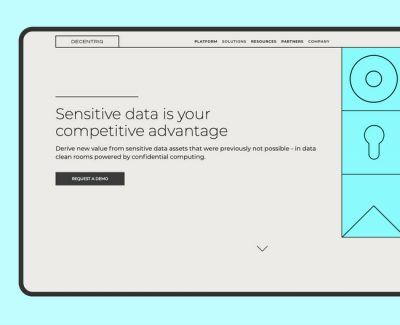

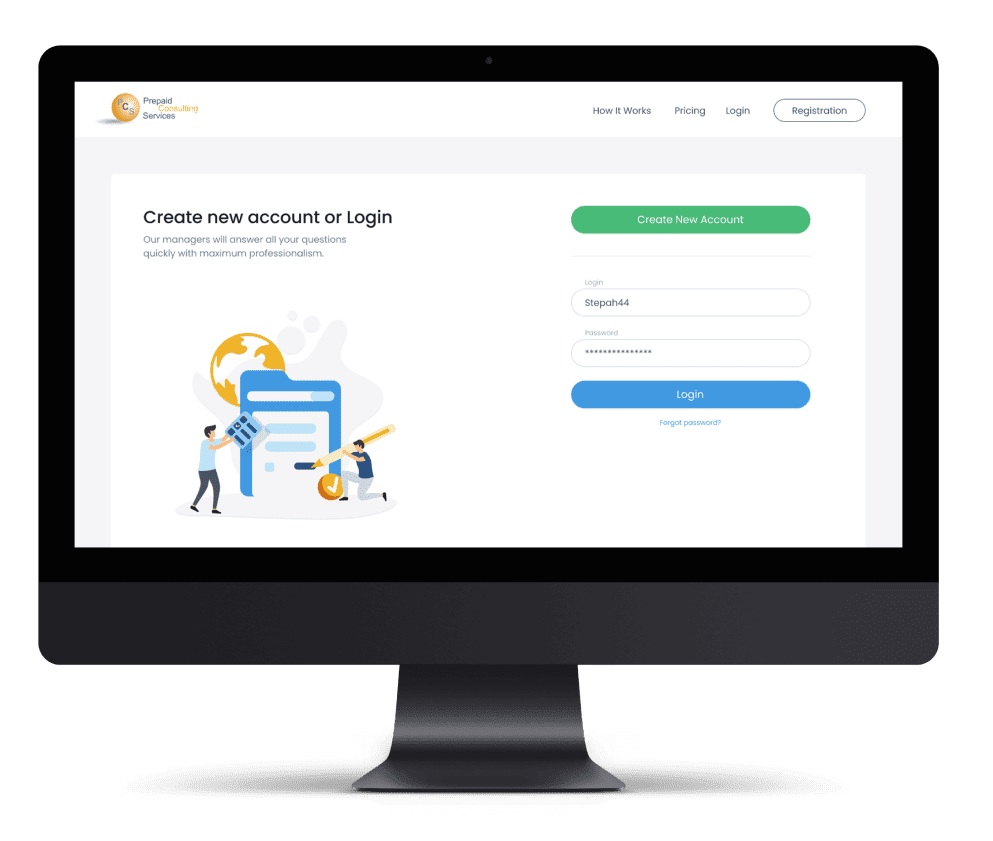

Financial Services Web Development We deliver custom websites and web applications for banks, insurance companies, and investment firms. Our solutions enhance online presence, streamline customer interactions, and improve service delivery through secure portals and automated tools. We ensure compliance with industry standards and focus on scalability to support business growth.

-

Fintech App Design Our user-centered app design focuses on creating intuitive, accessible interfaces for fintech apps. We combine clean aesthetics with easy navigation to help users manage complex financial tasks efficiently. Every design is optimized for mobile-first experiences and integrates strong security elements to foster trust with your customers.