FinTech Compliance: Regulations & Best Practices

- Updated: Aug 27, 2024

- 10 min

Entrepreneurs in the financial technology sector must prioritize compliance to enable their startups to grow securely while earning customers’ trust.

In this article, we’ll explore:

– What is FinTech compliance, and why is it critical?

– How is the regulatory landscape for FinTech startups evolving?

– FinTech compliance best practices that you should implement.

– Tools and strategies to manage compliance efficiently.

Let’s understand the FinTech regulatory environment to build an ethical, long-lasting business in this innovative sector.

For a competitive edge, explore the benefits of fintech and its impact on business.

What is FinTech Compliance?

Before we delve into the intricacies of financial technology regulations. Let’s first help you understand what it entails.

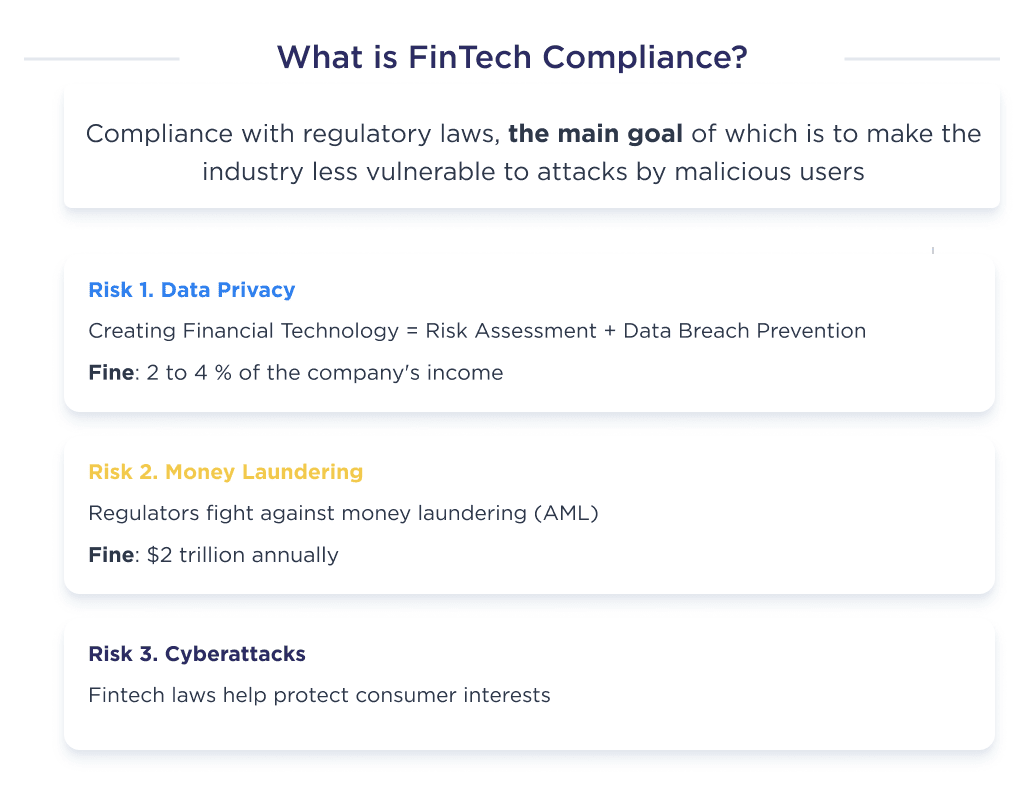

FinTech compliance means adhering to regulatory laws that guide new business models and financial technologies. These guidelines help protect consumers’ interest and investors’ capital. They also play an important role if you plan to start a fintech startup.

To plan regulatory guidelines, governmental agencies often consider a gamut of risks:

- Risk 1. Data privacy. One of the important issues in creating financial technology is risk assessment and preventing data breaches. Upon detecting a data leak, regulatory bodies may find the guilty party.In countries that are European Union members. non-compliance with anti-data-leaks may result in two to four percent of a company’s revenue as fine.

- Risk 2. Money laundering. Money laundering costs corporations and government agencies over $2 trillion annually. Due to this massive loss, all countries have anti-money laundering (AML) policies. There are also regulatory bodies that synergize operation and data.

- Risk 3. Cyberattacks. Financial organizations are a hot target for nefarious individuals. And both FinTech and traditional banks are a major concern to the government. To help protect the interest of consumers, there are FinTech-centric laws. We’ll discuss some of those laws here.

Ensure full compliance with our cutting-edge FinTech app development - get started today!

Now that you know the financial technology regulations and the motivating factors. Let’s do an overview of these laws, their regulatory bodies, and the country it applies to.

Overview of FinTech Regulations

Financial technology regulations are getting tighter this 2021. Many experts predict that governments will begin to create laws to force compliance.

To understand these regulations we’ll discuss them as they pertain to 4 different regions. Regions we’ll consider include the United States, United Kingdom, Australia, and Western Europe.

FinTech Regulations in America

The United States has the largest FinTech ecosystem. And it’s a no-brainer that they also have one of the largest varieties of laws for FinTech startups.

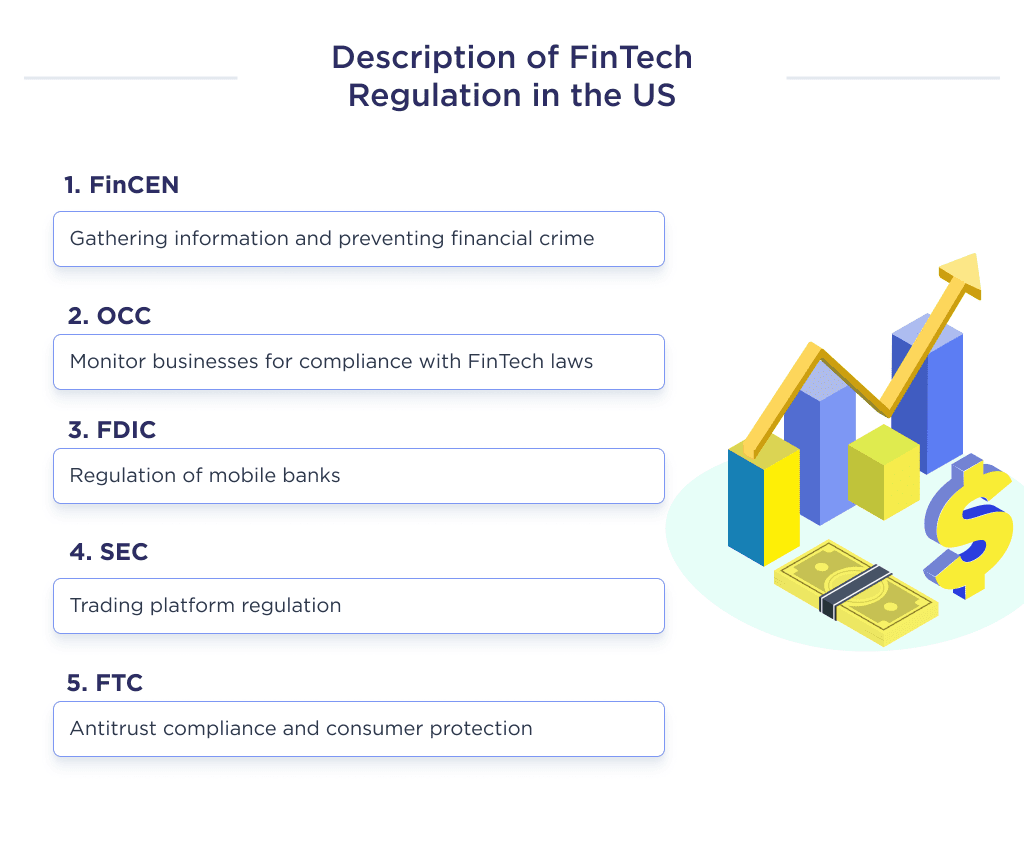

Suppose your FinTech targets the US market. Then you’ll fall under the purview of the Consumer Financial Protection Bureau (CFPB). Same with the Financial Crimes Enforcement Network (FinCEN), Office of the Comptroller of the Currency (OCC), and Commodity Futures Trading Commission (CFTC).

- FinCEN gathers information about every financial transaction. It is then used the info to prevent financial crimes.

- OCC supervises businesses to ensure their activities align with FinTech laws and regulations.

- Federal deposit insurance corporations (FDIC) regulate mobile-only banks.

- Securities and exchange commissions (SEC) regulate trading platforms.

- The Federal Trade Commission (FTC) designs the regulatory framework for the financial market. It also approves new technologies for trading.

Breaking these laws comes with dire consequences. For example, refusing to report stock fraud on your online trading platform may cost you up to $775,000.

If you’re looking to build a stock trading platform, our article on how to build a stock trading platform covers all the key aspects.

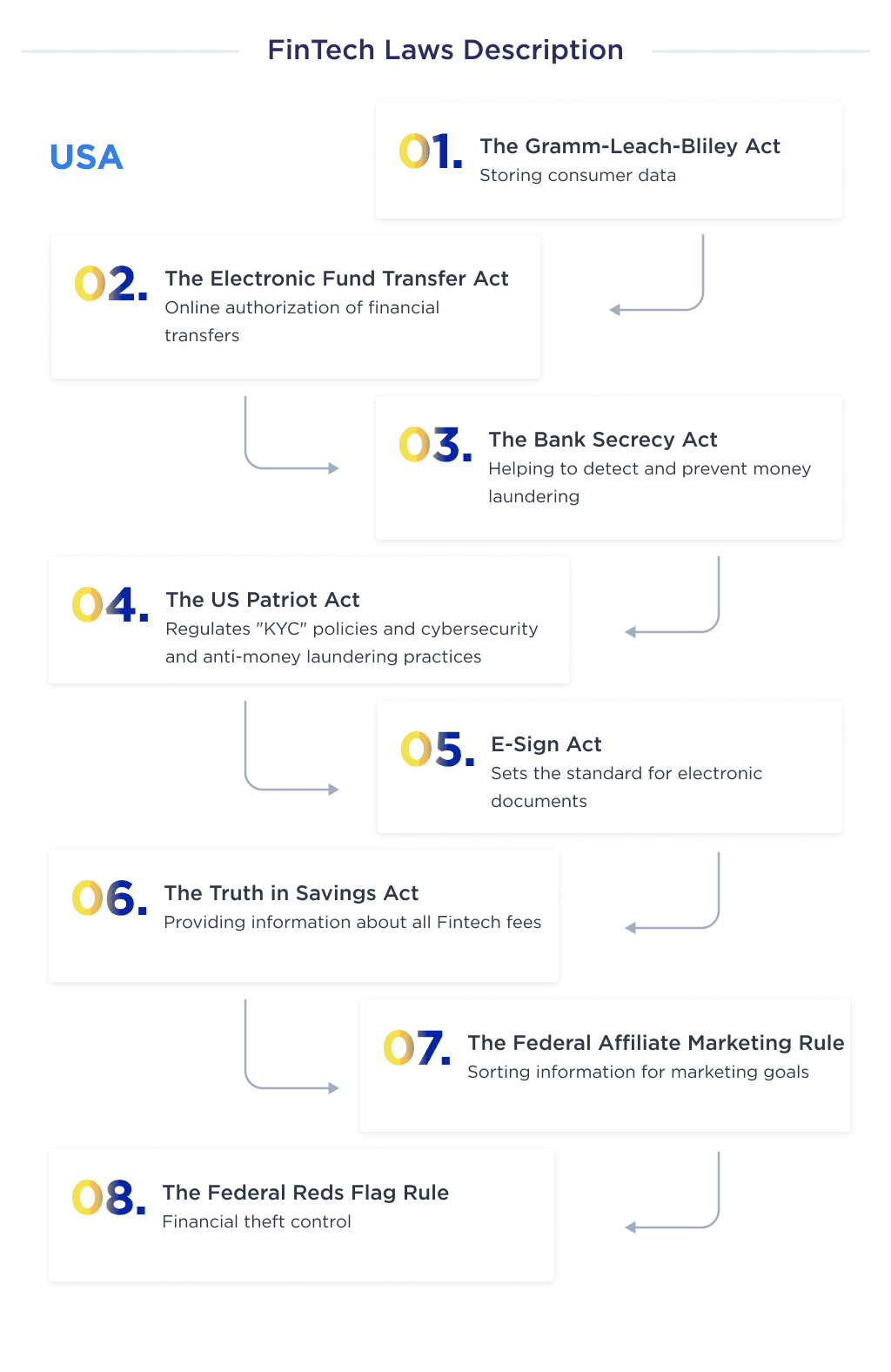

For a more encompassing exposé on FinTech laws, check out the spreadsheet below.

| Regulations | Meaning |

| The Gramm-Leach-Bliley Act | This act is the most prominent privacy law in the United States. It requires that organizations in the financial industry keep consumer data well. It also ensures that customers understand your privacy policy. |

| The Electronic Fund Transfer Act | It controls the authorization practices as it applies to financial transactions executed online. Make this the focus when developing an online payment application. |

| The Bank Secrecy Act | The United States enacted this law for AML compliance. Banking services must watch out for unusual transactions on wallets. |

| The US Patriot Act | This act controls the Know Your Customer (KYC) policies and other identification standards. This law ensures startups have apt cybersecurity and anti-money laundering (AML) practices. It also ensures that financial technology platforms train their workers to follow laws. |

| The Electronic Signature in Global and National Commerce Act (E-Sign Act) | This law sets the standard for electronics and signature documents. |

| The Truth in Savings Act | TILA mandates lenders, peer-to-peer platforms, and FinTech to give information on all fees. |

| The Federal Affiliate Marketing Rule | This agency guides companies on what information they can use for marketing purposes. |

| The Federal Reds Flag Rule | This law mandates financial institutions to set policies that prevent financial theft. |

This is not an exhaustive list, as you’ll need to carry out more extensive research. Furthermore, there are also laws for risk management practices. For example, biometric recognition technology laws vary from one state to another.

If you’re integrating health data to your FinTech or have a FinTech impact on health care, e.g., health insurance, or other type of healthcare starup, your product interacts with kids in a way, then extra regulations apply to your product.

As of now the United States federal system still lacks compliance programs for supervising FinTech. But steps are being made to create one. The NACHA introduced a FinTech ACT in 2019. It includes a recommendation to create a FinTech body in the US treasury department.

NACHA also recommends that the federal government create innovative offices for advisory services. And that they control the conflicting regulations that affect the sector.

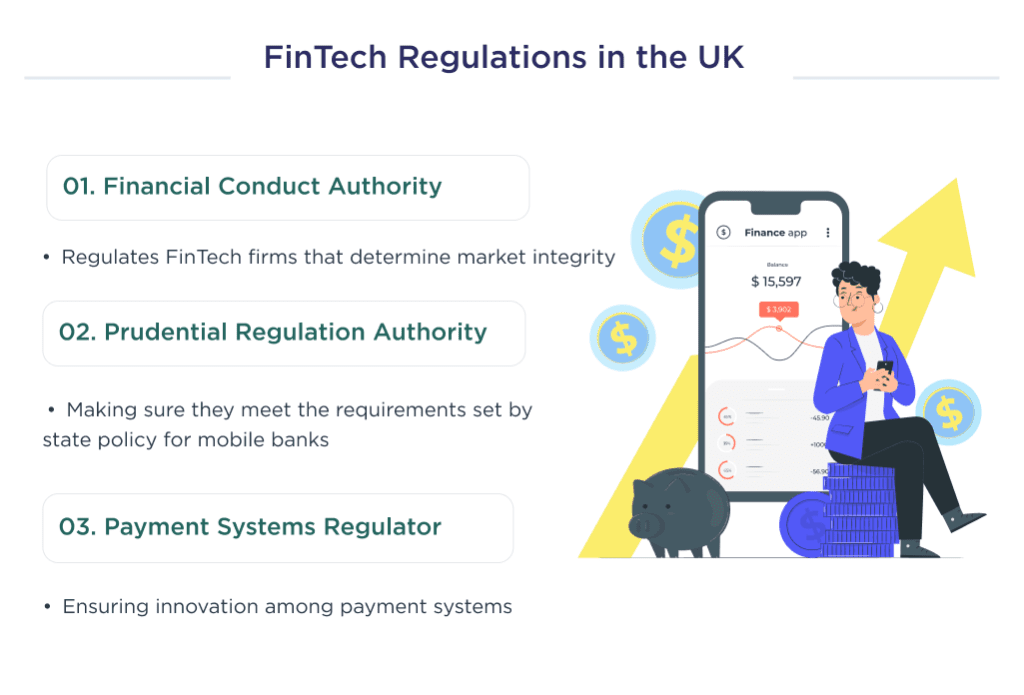

FinTech Regulations in the UK

UK Regulators are the most FinTech-friendly. Like the US, the UK has no specific legislation to protect the financial technology sector.

However, most startups in the FinTech industry handle financial transactions one way or the other. Some bank regulations are also applied to financial technology companies or may affect companies that develop banking applications.

For example, if a FinTech activity falls under the Financial Services and Markets Act 2000 (FSMA). Then they’ll have to be regulated by the Prudential Regulation Authority (PRA) or the Financial Conduct Authority (FCA).

Regulated activities are defined in the FSMA Order 2001. However, the legislation is complemented by the rules, guidance, and principles of the FCA Handbook and the PRA Rulebook.

Here’s a spreadsheet depicting the list of regulators and their regulations in the UK.

| Regulators | Task |

| Financial Conduct Authority | It’s a UK legal-backed authority that operates freely of the UK government. It regulates FinTech firms providing finance to maintain the integrity of the market. |

| Prudential Regulation Authority | This is a quasi-governmental agency that provides regulatory requirements for mobile-only banks. They also cover InsurTech platforms, crowdfunding, and investment platforms. They ensure that the operations of these FinTech providers don’t go against governmental policies. They also ensure due diligence that’ll aid an apt AML procedure |

| Payment Systems Regulator | It is an organization subset of FCA. Their role is to provide a framework to aid innovation among payment systems. They’ll also ensure that their operations align with the interest of the people. |

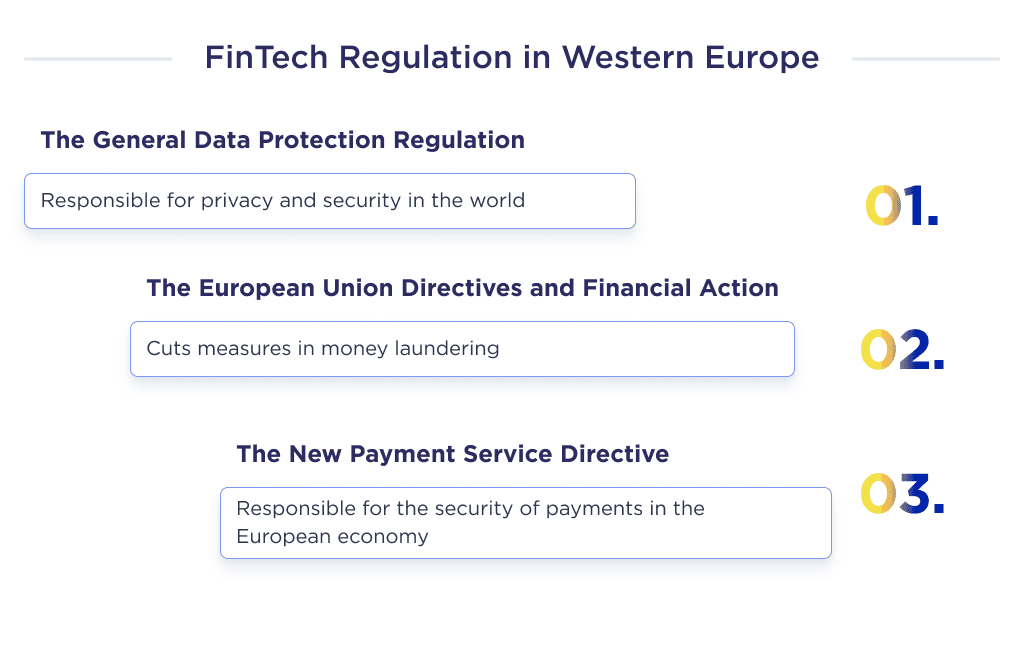

FinTech Regulation in Western Europe

A 2013 report by the European Banking Authority elucidated how 31% of the 1,500 FinTech startups that participated in a survey are not subjected to any regulation.

Thus, it’s safe to conclude that Western Europe is still largely unregulated and startups are still free to innovate in every way possible.

If you wish to operate your startup in Western Europe, it’s best to focus on country-specific financial regulations that will help you, as a fintech startup, earn. Europe has few FinTech specific regulations, which are:

| Regulations | Meaning |

| The General Data Protection Regulation | This is deemed the toughest privacy and security law in the world. It determines how organizations gather information and what they can do with it. |

| The European Union Directives and Financial Action | This proposal accentuates the imperativeness of KYC policies and data checks to stem the tide of money laundering. |

| The New Payment Service Directive | This directive aims to guarantee top-notch payment security within the European Economic Area. |

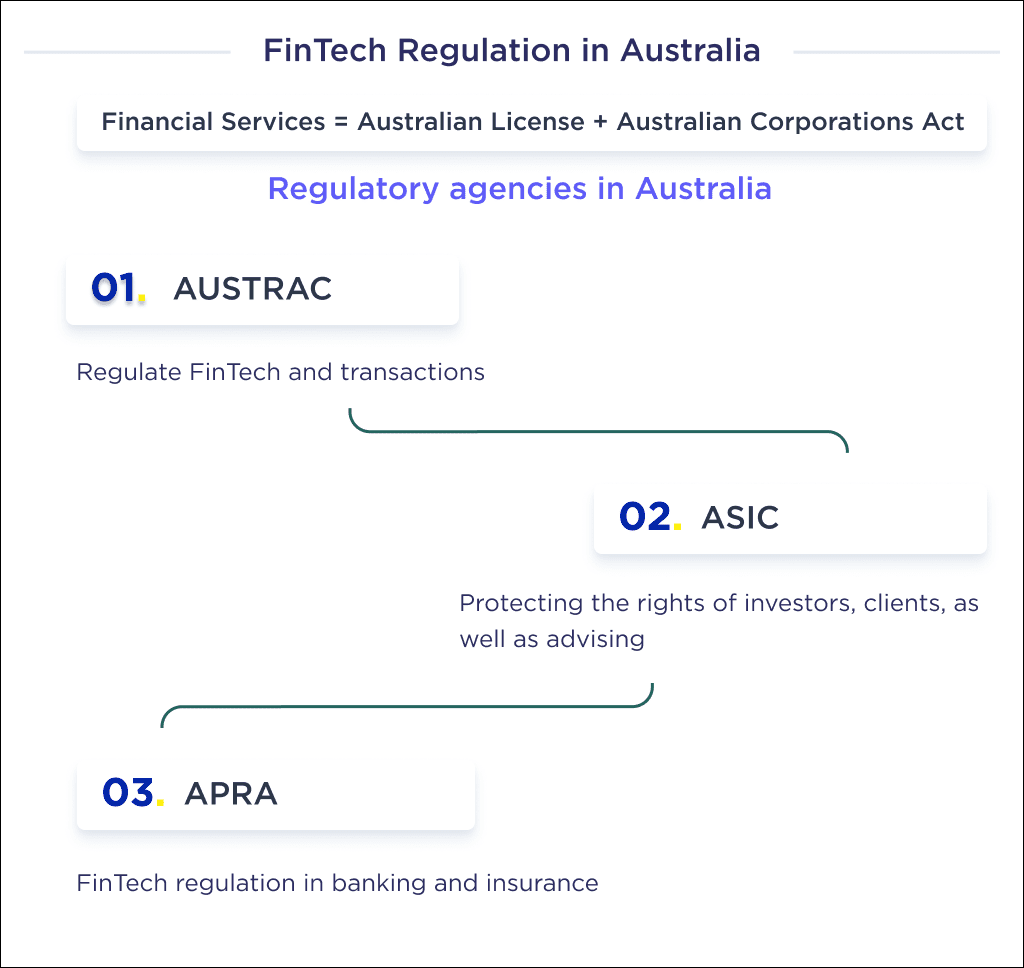

FinTech Regulation in Australia

FinTech businesses undertaking any financial services in Australia must hold an Australian financial service license or get a direct exemption from owning one. The law empowering this is the Corporation Act of Australia.

This law covers your FinTech startup if you’re willing to:

- Create a financial product that offers financial advice

- Provide a template for selling a financial product

- Operate registered schemes

- Provide custodial or depository services

Generally, the regulatory environment in Australia is one with many regulations. But they’re quite easy to understand – unlike other regions mentioned earlier.

Here’s a concise spreadsheet of Australia’s regulators and the laws they regulate.

| Regulators | Task |

| The Australian Transactions Reports and Analysis Center (AUSTRAC) | They regulate FinTech in general and transactions that occur on the internet. For example, AUSTRAC regulates cryptocurrencies. It does this by ensuring that exchange platforms report transaction participants’ identities. |

| The Australian Securities and Investments Commission | This national regulator protects both investors and customers. Beyond enforcing laws, they also offer regulatory advice for FinTech establishing in Australia. |

| The Australian Prudential Regulation Authority | This law also regulates FinTech into banking and insurance activities. |

Note. Watch out for state-level laws, as some states have laws safeguarding their interests.

This guide to bot attack prevention covers methods to keep bots from disrupting your online services.

With an apt overview of FinTech laws in different regions of the world. Let’s help your sacrosanct futuristic details.

Future FinTech Compliance and Regulation

The future is highly promising for FinTech startups. But it also brings more exposure to tighter regulations, sanctions, and legal bottlenecks.

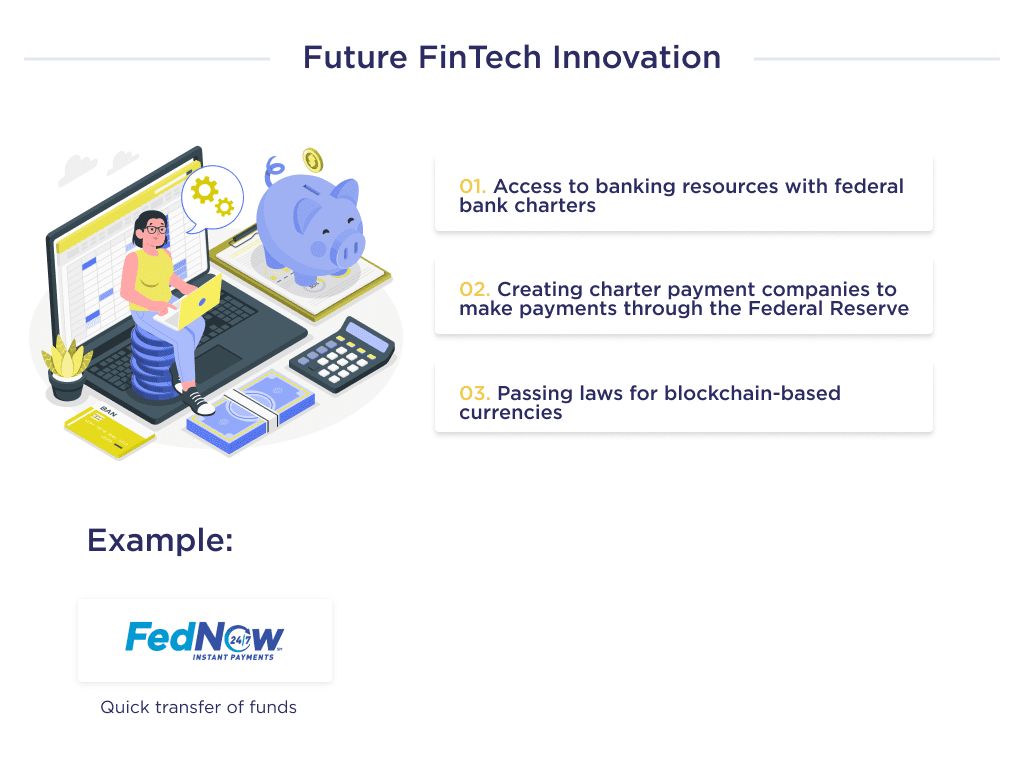

Future FinTech Innovation

The US federal reserve announced a different way for FinTech startups and banks to make faster payments. Experts believe that this new service called FedNow will enable quick funds transfer.

However, the ABA lobbied to remove FinTech startups from the deal as they do not have federal banking charters. This opposition shows that FinTech may have to own more licenses before having access to banking resources in the future.

As a response, OCC regulatory authority plans to introduce Special Purpose National Bank Charter Payment Companies. It’s designed to help give chartered companies the ability to clear payments through the Federal Reserve System. It is also expected that new laws will be created for blockchain-built currencies.

Emerging FinTech Compliance Standards

FinTechs are now dabbling into some core financial processes. Although the technicalities of these requirements do not constrain most startups. It’s sacrosanct that you take steps to ensure a more conforming platform.

For example, a FinTech company was recently fined $2.5 million. This fine is for not structuring its loan in a way that allows consumers to build their credit scores. This isn’t much of a surprise as compliance standards in FinTech are held to the barest minimum.

To apply for a loan from a traditional bank, you’ll have to submit many documents to fulfill the stipulations of anti-money laundering acts. For example, you’ll need to do this to get a SBA business loan.

But most P2P lending technology platforms don’t require that.

All this will change as FinTech will come under increased scrutiny from agencies.

Explore our SaaS services today

Navigating FinTech Compliance as a Startup

Newbies in this sector will be overwhelmed with geographically-dependent regulations. These regulations need the knowledge to prevent you from falling on the wrong side of the law.

The ideal way to address this challenge is by hiring a consultant. Hiring a compliance team in itself is a hectic task, but not having one may even lead to a business shutdown.

Let’s help you with the options to hire a compliance team.

Building an Effective Compliance Team

You can hire a compliance team by bringing one from outside or by outsourcing your entire compliance process to a FinTech compliance startup.

Let’s help you with what each entails.

Hire a Compliance Expert

Hiring a compliance expert entails employing one as an employee of your organization. Opting for this option gives you more interactive communication with your expert. It also gives them an experiential understanding of your FinTech’s ecosystem.

This is a great choice for a startup handling large volumes of consumer data.

| Pros | Cons |

|

|

Outsource your Compliance Duties

If you’re a new startup or one that’s particular about keeping your expenses small. Then app development partnership might be the most suitable option.

By outsourcing your compliance duties you’re asking a third party to ensure that your startup aligns with regulations.

But as beneficial as this method is for startups, it also has its distinguishing pros and cons.

| Pros | Cons |

|

|

That’s not all financial technology development entails. You should dig deeper to broaden your knowledge.

Save time on research with this list of the best IT outsourcing companies for quality service and reliability.

Staying on Top of Changing FinTech Compliance

As FinTech continues to evolve, regulations will adapt to safely foster innovation while protecting consumers.

Partnering with an experienced technology provider can ensure you build and launch compliant, cutting-edge products.

Our team designs, builds, and supports compliant FinTech apps and platforms. We stay on top of the latest regulations across North America, the UK, the EU, and beyond.

If you are thinking about creating your own fintech app, feel free to dive into fintech app development to see what it takes to create a standout financial app.

Contact us today to schedule a free consultation. Let’s build the future of FinTech together.

If you’re entering the SaaS world, these best SaaS startup ideas are worth exploring.