Fintech Ecosystem Overview: What It Is and What You Should Know

- Updated: Nov 12, 2024

- 8 min

Are you an entrepreneur, FinTech founder, or an investor looking to understand the ins and outs of the FinTech ecosystem?

If so, read on to learn:

- What exactly is a FinTech ecosystem, and how does it work

- The opportunities created by the rise of FinTech

- How to leverage an ecosystem approach when building your FinTech startup

- Tips for navigating and tapping into the FinTech ecosystem

- And more!

This article breaks down the essential things you need to know about the world of financial technology, its leading players and partnerships, emerging trends, and how you can use the FinTech ecosystem to strategically grow your business.

Our recent article covers the benefits of fintech and why it’s worth paying attention to.

Transform your idea into reality with our market & product research services — contact us today!

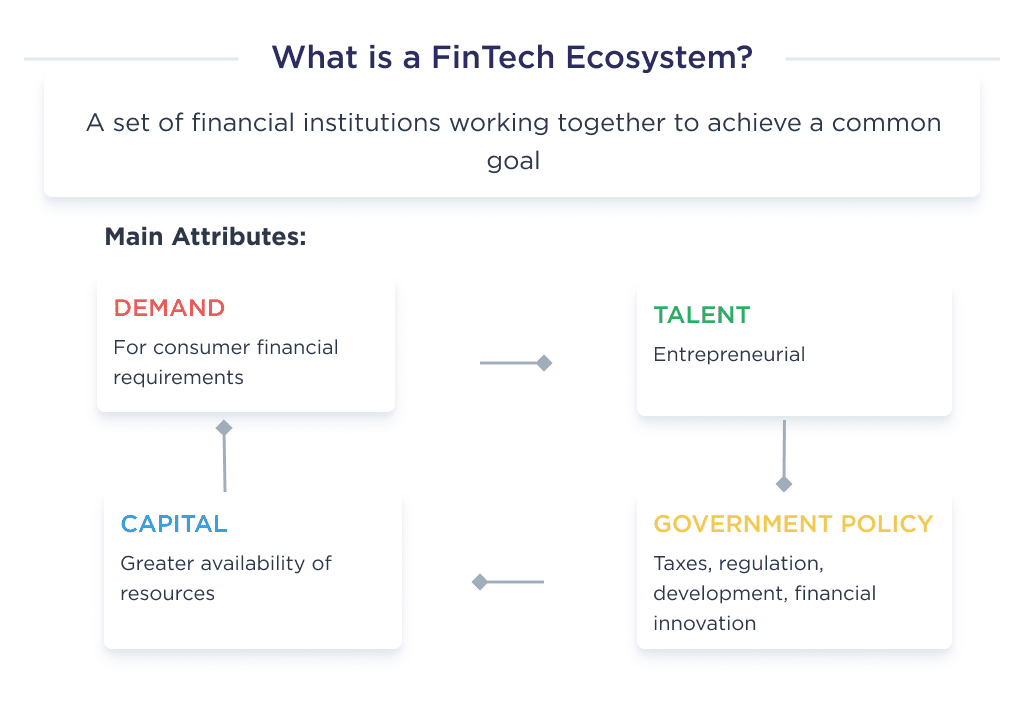

What is a FinTech Ecosystem?

A FinTech ecosystem is a concept to create a suitable environment for all types of financial technology services to synergize. They are often formed by the government, financial services companies, and startups, where every partner assists each other.

Ever since the period of FinTech 1.0, which spans from 1866 to 1913, there has always been an effort to provide a suitable infrastructure. And from experience, we can trace certain attributes to help further elucidate their meaning.

There are four core attributes of a FinTech ecosystem, and they’ll be discussed below:

| Attributes | Description |

| Demand | There should be end-client demands across financial institutions, government, and consumers. Consumer demand for financial technology is very high. The pandemic primarily influences this surge. |

| Talent | An ideal FinTech innovation ecosystem should have financial, technical services, and entrepreneurial talent. |

| Capital | This entails the availability of resources needed to commence operation without a hitch. It also covers the resources needed to pursue internal initiatives. Venture Capital investment in financial technology is currently at an all-time high. |

| Policy | This includes government policy regarding tax, regulation, and growth initiatives for the financial services industry. There should also be a presence of digital public infrastructure tailored to aid innovation in the financial services sector. |

To help you have a better understanding of the ecosystem, we’ll give you some examples of FinTech ecosystems.

If you’re looking to build a stock trading platform, our article on how to build a stock trading platform covers all the key aspects.

Three examples of InsurTech in an Ecosystem

One of the key components of today’s FinTech ecosystem is insurance.

InsurTech can be singled out as a separate area: in fact, this industry is created at the intersection of FinTech innovations and traditional insurance. That’s why we’ll look at examples from InsurTech in this article.

Ecosystems help to build InsurTech platforms through microservices and APIs. They also assist InsurTechs in offering solutions that fit insurers, as ecosystem relationships are customizable to consumers’ goals.

Example 1: Uber

Through innovation, Uber’s connectivity and market share are moving rapidly, so much so that they’ve encompassed food delivery, ride-sharing, Uber Eats, and car rentals in their ecosystem.

However, to operate as a partner in any of those sectors, it’s mandatory to own an insurance policy.

For insurance companies looking to innovate, car insurance app development is a game-changer in customer engagement.

Example 2: Grab

Grab offers its people a super-app for mobility reasons and an encompassing insurance policy. This policy doesn’t just offer travel coverage; they also offer ride insurance with $100,000 of coverage for accidents and vouchers if your ride arrives late.

Example 3: SoFi

SoFi has a financial market ecosystem that encompasses the insurance industry. In 2020 alone, SoFi has set up relationships with Lemonade for renter or homeowners insurance, Ladder Life for life insurance, and Root insurance for automobiles. As of now, SoFi has over 2.5 million customers, and it plans to extend its insurance partnership to all within the system.

Upon helping you have a better understanding of what a FinTech solution hub entails, let’s help you understand the benefits that are derivable from them.

How Does the FinTech Ecosystem Create Opportunities?

The FinTech ecosystem opens up a gamut of opportunities to all parties involved. However, since this article is tailored for startup founders, investors and entrepreneurs, we’ll only focus on the opportunities therein for startups.

Below are the pros of the FinTech ecosystem.

Benefit 1: Limitless Startup Scaling Potential

The FinTech sector in the US is growing at a CAGR of 8.4%, and it’s expected to continue till 2025. This growth depicts the potential in the FinTech sector, and creating a vibrant ecosystem can help startups beat that growth.

An example to follow: through creating an ecosystem, China’s WeChat grew from 160 million users in 2012 to 1.2 billion users in 2021. This figure is poised to rise over the next few decades as the company expands outside mainland China.

Benefit 2: Introduction of Innovative Products

Another great benefit of the FinTech industry ecosystem is that it helps to introduce new products to an existing customer base.

An example of a startup doing this is Lemonade Insurance, as they currently have an ecosystem with Uber, helping them offer their rental insurance to automobile renters. This singular ecosystem introduces their product to Uber’s 93 million users.

Amazon also created its insurance through a partnership with JP Morgan.

Benefit 3: Generation of New Revenue Streams

Owning an ecosystem inspires you to create new products, leading to new profit streams. A study conducted by Sopheon shows that increasing a product catalog increases a startup’s profitability.

Benefit 4: Cross-Application Data Exchange

Cross-app data exchange refers to data synchronization between two platforms with the same account. Since an ecosystem has multiple platforms within a single ecosystem and is controlled by a primary platform, they seamlessly exchange data.

This makes all products within the ecosystem enjoy top-notch user-friendliness, as there is more data to personalize products to users.

For example, data gotten by Uber is shared with an insurance platform called Lemonade since they share a FinTech hub.

This helps users get a better-personalized service for their car rental insurance through Big Data analysis. In Lyft’s partnership with GrubHub, the ride-booking company shares its data to guarantee users a more personalized service with Grubhub.

Let’s discuss how your startup can get these benefits.

How to Leverage the Ecosystem Approach to Build a Startup

The financial technology ecosystem offers every stakeholder multiple benefits. For startups, it offers them an opportunity to scale. Based on all the benefits of Fintech, you can use either scale by leveraging other startups’ products or using your internal resources.

Let’s discuss these two points in detail.

From concept to creation – launch your marketplace with SPDLoad!

Scale Using Your Startup’s Internal Resources

An organic way to scale your FinTech is using your organization’s resources. This is the most common growth strategy for most startups, as 77% of financial technology organizations focus on internal growth.

There is a wide range of ways to scale internally, these include:

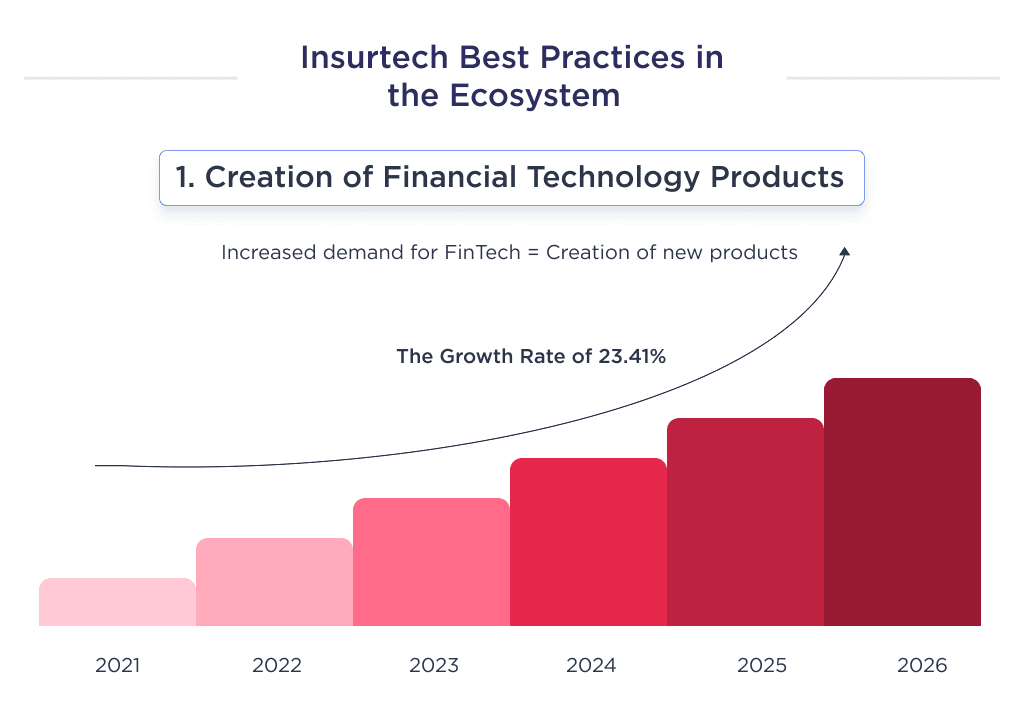

1. Creating new Financial Technology Products

The prospect of FinTech services is infinite. The global FinTech market is going to be worth a staggering $324 billion in 2025, representing a 23.41% CAGR between 2021 to 2025.

This growth is mainly fueled by an increase in demand for FinTech products. You can tap into this demand increase by creating additional products as a startup, using ideas for fintech startups.

2. Add New Features

A great way to use the ecosystem approach to scale is to add new features to your product. For example, developing a basic digital banking app to a super-app will significantly increase your consumer base, as well as make a fintech breakthrough in the banking industry

An example of FinTech that grew with this model is Alipay. The tech giant grew from 451 million users in 2016 as a mono-product to over 900 million users in 2019.

Scale Through Partners’ Products

Creating an ecosystem that includes third-parties products can help accelerate your growth journey through overcoming scaling challenges. It does this by raising your profile and providing market credibility. It can also help unlock a customer segment loyal to your partners.

This is particularly effective, as 57% of organizations use partnerships to acquire new customers. Another statistic shows that 44% of startups use alliances to get new innovations, ideas, and insights. Additionally, a study by Business Insider report shows that 87% of FinTech partnerships result in effective ecosystem cost management.

From the statistics above, it’s evident enough that this is an effective approach. However, it can be dicey if you lack the expertise and regulatory laws. Also, you must choose the right company to partner with and not just the product.

For example, if you own an InsurTech company that provides only auto-insurance, and you want to scale to other insurance sub-sectors, then you should partner with an insurance company with clientele in numerous subsectors. The larger the insurance sector covered, the better.

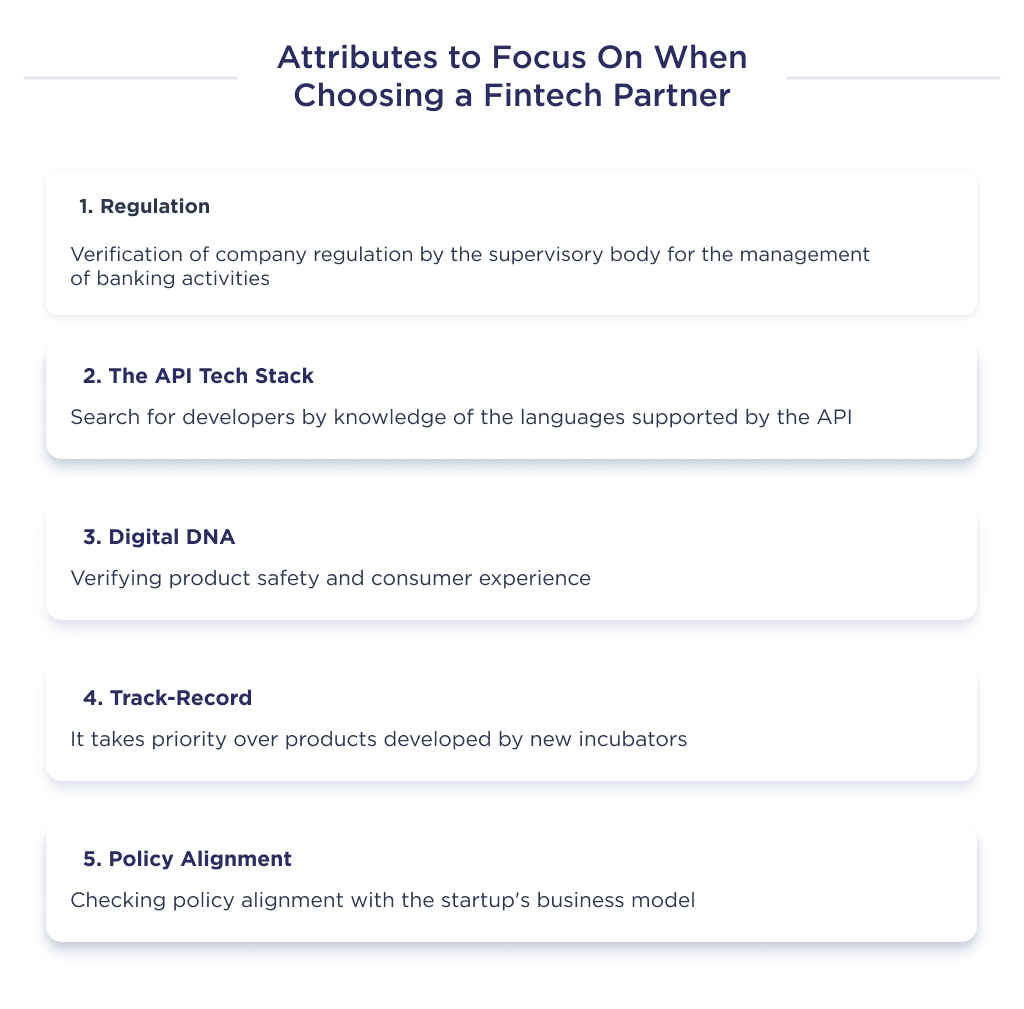

Attributes to Consider in a Suitable FinTech Startup Partner

Before choosing a product from a provider to scale up with, consider the following:

| Attributes | Description |

| Regulation | The regulatory framework of the financial sector in every market differs. Thus, you should ensure that the product you want to scale with aligns with the regulation in your target market, i.e. check for FinTech compliance Also, asset management and open banking have the most stringent regulation. Thus, you should double-check if your company’s operation is regulated by wealth management and traditional banking supervisory body. For more information, read this article on FinTech regulations. |

| The API tech stack | Ascertain that there’s a match between the coding skills of your developers and the languages the API supports. Discover how to choose a tech stack with our expert advice. |

| Digital DNA | Before adding a product to your ecosystem, check out its digital DNA. This helps you determine how secure it is and consumers’ user experience. |

| Track-record | You should favor products with a track record over one developed by new incubators. |

| Policy alignment | All startups have policies. Thus, you should check that their policy aligns with your business model. |

Building a fintech startup? Get practical advice on how to start a fintech startup and navigate the industry.

Examples of partners to help your FinTech scale include:

- Telcos. FinTech companies partner telcos for USSD integration and offline mobile banking.

- Traditional financial institution. Early-stage startups may partner with banks for financial and data support, for example, to develop an application for online payments

- Ecommerce platform. To bring digital transformation, faster e-commerce transactions, and improved customer experience to e-commerce. Discover eCommerce startup ideas that fit the latest trends and customer demands.

- Brokerage company. FinTech, with a desire to access the capital market, needs a brokerage company in its ecosystem.

Now that you have an overview of FinTech ecosystem, you should learn more about FinTech.

Crafting Custom Mobile Apps That Delight Users!

Want to Build a FinTech Startup?

The FinTech ecosystem allows companies to scale, innovate, and generate revenue through strategic partnerships.

Looking to collaborate effectively? Our guide on app development partnerships explains what to consider.

Our experts build custom FinTech solutions for you, utilizing the complex web of platforms and integrations available, including:

- Intuitive mobile/web apps

- Seamless third-party integrations

- Banking and trading platforms

- Secure infrastructure

Contact us to create tailored FinTech software that taps the full potential of this ecosystem.

If you are thinking about creating your own fintech app, feel free to dive into fintech app development to see what it takes to create a standout financial app.