Healthcare Fintech: How FinTech is Transforming the Healthcare

- Updated: Aug 27, 2024

- 8 min

Are you a serial entrepreneur, investor, or startup founder looking to create solutions for the healthcare industry?

If you answered “yes” to either of those questions, then read on.

In this article, you’ll discover:

- How FinTech is revolutionizing healthcare services

- The top FinTech startups disrupting healthcare as we know it

- Key takeaways from the most successful healthcare FinTechs

- And more!

Let’s dive right into the meat of this piece and explore how FinTech is bringing innovation to healthcare in 2025 and beyond.

Before diving into the fintech in healthcare, you can learn more about what is a startup to better understand the context.

Unlock your startup potential now — start transforming your vision into a scalable solution with our expert developers today!

How FinTech is Revolutionizing Healthcare

According to the World Health Organization, the cost of seeking healthcare expenses has driven over 100 million people into poverty.

However, FinTech is actively solving this problem by broadening financial access to reduce complex transaction costs and expedite payment processes.

From cost savings to better service, the benefits of fintech are transforming industries.

Let’s elucidate three cases in which the finance and healthcare industries are merging toward a better future.

Looking for innovation in healthcare? Here are some of the best healthcare startups leading the way.

Use Case 1: Lending in the Healthcare Sector

Healthcare lending entails getting funds for medical resources on credit. This lending program helps to cover payments for dental care, physician care, and other personal medical services.

However, FinTech for health is still nascent.

Health lending by the financial technology service industry is experiencing astronomical growth. A statistic giving credence to the importance of this tech innovation is that over 50% of US citizens use healthcare loans.

And since tech lending makes accessing credit seamless, it’s safe to assume that startups venturing into this niche will make astronomical profits.

Examples of Startups in Healthcare Lending

Numerous tech startups issue loans for healthcare seekers short of funds. Amongst the gamut of service providers, the most notable ones include:

- Arogya Finance

- Credihealth

Innovation is the key to leadership. Here’s how to win the technology race in the healthcare industry.

Let’s consider another popular use case: health wallet.

Use Case 2: Health Wallets

This is a digital wallet account created by FinTech to save up funds for health services. In the United States, health wallet savings are tax-advantaged to individuals enrolled in high deductible health plans.

While this concept is popular in many Western nations, it’s still relatively non-existent in most developing nations. Statistics from the American Economic Association show that over 60% of child mortality in developing countries can be prevented if families invest in preventive medicine.

Since health wallets help provide a means for saving towards both preventive and curative medicine, FinTech health wallets can help eliminate the problem.

Examples of Startups with Health Wallet

Some examples of tech startups championing the use of health wallets include

- Bend Financial

- Wellpay

- Medxoom

Use Case 3: Improving Healthcare Access

Access to healthcare means making timely use of personal health services to achieve the desired health outcomes. Quick healthcare payment is imperative to achieve this goal, and FinTech has been championing that through important innovations.

As it currently stands, about 50% of the world’s population still lacks access to essential healthcare services. However, fintech and healthcare providers believe that with the right synergy between FinTech and medicine, that number will reduce significantly with time.

Although much needs to be done, FinTech companies are currently making significant strides. How?

FinTech introduces new and improved digital service models to healthcare. FinTech companies are leveraging blockchain, artificial intelligence, and machine learning to eliminate gaps in the current healthcare system.

Procedures that require complex payment schemes and operations are easily accessible, and all indices show that things will keep improving toward more transparent digital financial services.

For example, FinTech, through assistive technology, has made health payments easily accessible to the disabled. Also, FinTech schemes that improve financial inclusion for the unbanked are improving the savings culture of users towards preventive medicine.

Discover other healthcare technology trends that are shaping the future of health services.

Examples of Startups Improving Access to Healthcare

- Cuesquared

- Cedar

- Explore the potential of healthcare app ideas to make a meaningful impact in healthcare.

Now that we’ve discussed some use cases of FinTech impacting the health sector. Let’s discuss some startups impacting the health sector.

Top 5 Innovative Healthcare FinTech Startups

The Covid-19 pandemic revealed a lot of inefficiencies in the health system. Due to these, private companies are beginning to champion a wide range of health-centric innovations.

These change champions are responsible for introducing certain benefits, such as better customer engagement, price transparency, patient financing, a fast payment system, etc.

Here’s a list of five FinTech startups introducing salient changes to healthcare:

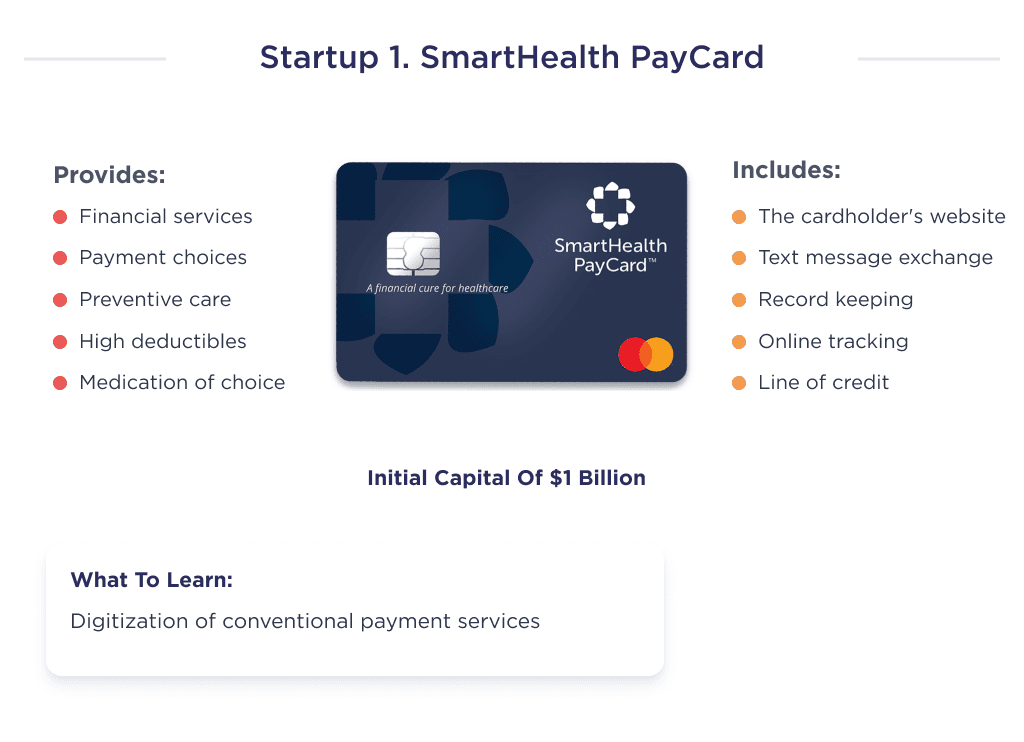

SmartHealth PayCard – Simplifying Medical Payments

This financial technology service company empowers both individuals and families with resources and solutions to simplify healthcare expenses.

The financial technology company has a SmartHealth PayCard Mastercard: a credit card that provides family members with payment choices and benefits for telehealth. It also provides copays, high deductibles, medicines, mental health preventative care, and other healthcare organizations.

The startup’s complete solution includes a cardholder website, SMS messaging, record-keeping, secure online tracking, and a credit line.

Here’s a spreadsheet depicting more details of the startup:

| Start Date | Target market | Funds Raised |

| 2019 | Smarthealth PayCard is intuitively designed for U.S.-based individuals and families. It helps them with financial solutions needed to simplify and improve their ability to pay for healthcare. | According to their page on CrunchBase, the platform has raised $1 Billion in seed funding. |

What to Learn from Smart Health Paycard

Smarthealth’s forte is its intuitiveness in digitizing ordinary payment services. Startups willing to create a similar solution should identify a niche in their target market. Then create a sophisticated product that appeals to an identified problem.

Crafting Custom Mobile Apps That Delight Users!

Cedar – Reducing Medical Bill Stress

Cedar is a financial technology startup that provides ways for medical groups, hospitals, and health systems to manage their patient financial ecosystem.

The solution created by this startup uses a combination of techniques in healthcare, FinTech, and ad tech to ensure providers engage patients efficiently.

The platform delivers modern intelligence to eliminate collection challenges, improve billing effectiveness, and ensure patients get an apt user experience.

| Start Date | Target Market | Funds Raised |

| 2016 | The startup targets hospitals, medical groups, and health systems that elevate the end-to-end patient experience. | Cedar has raised a net sum of $351 million. Their most recent funding was raised on March 9, 2021. |

What to Learn from Cedar

Through a robust platform, Cedar Pay personalizes the experience for every patient, leading to a better business-to-customer relationship and better results.

Startups that copy Cedar’s business model must first invest extensively in creating platforms that appeal to business owners and their customers.

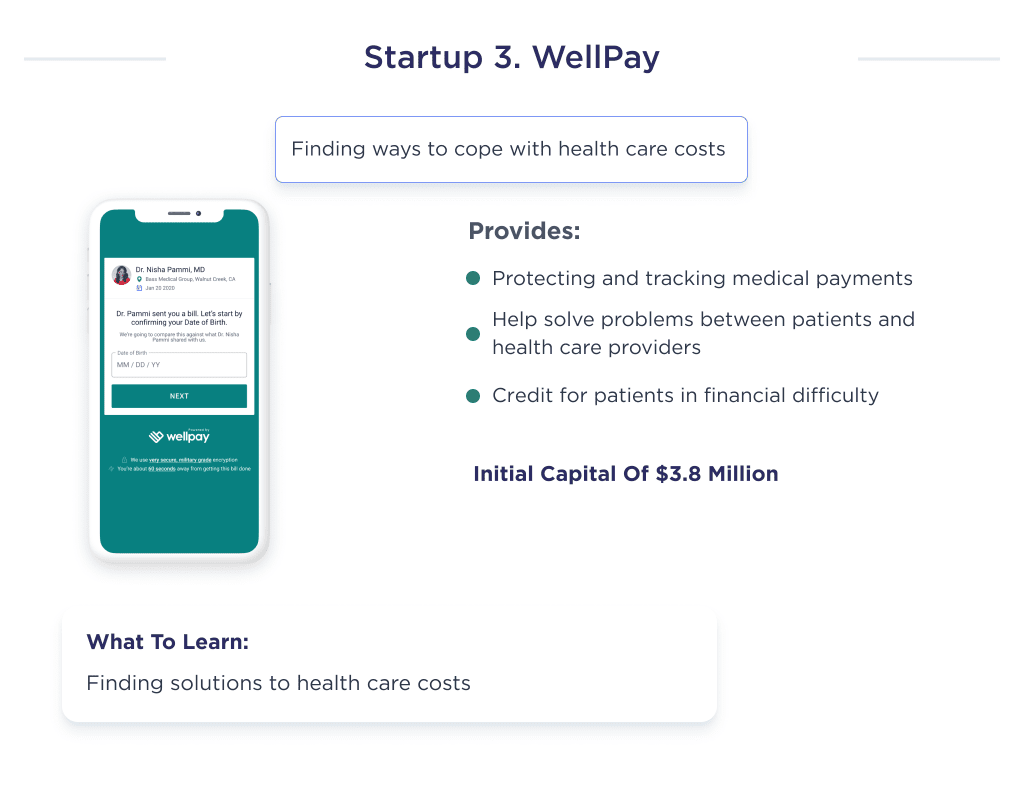

WellPay – Paying Bills Interest-Free

WellPay is a financial technology solution provider with the aim of building solutions that allow consumers to deal with rising healthcare costs.

WellPay recently launched the beta version of its platform to provide personalized healthcare service delivery for Covid-19 patients. It’s expected to carry out a full-scale product rollout later this year.

This FinTech platform’s crux is a machine learning algorithm that enables patients to secure and keep track of pending medical payments.

The platform then negotiates and facilitates disputes between patients and healthcare providers, if any. It also provides zero-interest rate credit to financially distressed users.

Summarily, Wellpay helps manage healthcare bills and smoothens operations between healthcare providers and patients.

Let’s help you with a spreadsheet of more valuable information about this startup:

| Start date | Target Market | Funds Raised |

| 2019 | This solution is targeted at healthcare providers. It helps them streamline and give accurate billing statements to patients. | The company has raised $3.8 million in seed funding. |

What to Learn from Wellpay

Wellpay understands that costs and transparency are among the biggest problems facing healthcare. Thus, through niche marketing, the company is helping healthcare providers solve that problem.

As a startup, you can learn from the problem-solving approach of Wellpay and imbibe the founders’ attitude of diligence.

MedXoom – Affordable Medications Without Insurance

Medxoom is a FinTech startup that helps organizations and employees save money on healthcare costs through pricing, payment & mobile CRM solutions. The financial technology company introduces comparative shopping, CRM, and unified billing to healthcare.

If you’re interested in how to build CRM from scratch, our guide will give you all the tools and insights you need.

The Atlanta-based startup helps to bend healthcare costs by recommending platform members to cost-efficient medical organizations. Beyond this, it also offers users financing options, powerful payment features, an integrated net due to payment, and a payment card.

Medxoom employs a wide range of strategies to help members and employers save on health costs. Among the methods used are reference-based pricing, member steerage, direct provider contract, etc.

The FinTech organization is backed by leading venture funds TTV capital and Las Olas Venture Capital.

| Start Date | Target Market | Funds Raised |

| 2018 | Medxoom’s target market is mainly corporate organizations and their employees. | Medxoom has raised $11.3 million in total funding. |

What to Learn from Medxoom

Medxoom focuses on answering a specific question in the health sector: how much will it cost? They’ve stayed through to this and have provided the most suitable answers obtainable to their users. Their determination and focus once again show the efficacy of niche marketing.

If you’re looking to build a stock trading platform, our article on how to build a stock trading platform covers all the key aspects.

Gem – Boosting Health Savings Accounts

Gem is a blockchain-centric startup that creates digital financial solutions for healthcare businesses. The company mainly focuses on helping health professionals to create a fully functional blockchain environment for data storage.

Beyond this, the platform also helps prove sensitive information without divulging its details to the inquirer.

Need to know more about Gem? Check the spreadsheet below:

| Start Date | Target Market | Funds Raised |

| 2017 | Gems’ target market is hospitals and other health-related institutions looking for a secure way to store patient data. | According to their Crunchbase page, the total funding amount raised by the company is $148 million. |

From concept to creation – launch your marketplace with SPDLoad!

What to Learn From Gem?

Gem emerged on this list primarily due to the company’s management vision of creating a consumer-centric solution.

Every product the company has worked on seems to guarantee top-notch consumer data security. This consumer-centrism is partly due to the co-founder, Steven Bartel’s experience working for Dropbox.

Learn more about how to find a co-founder for your startup.

If you are thinking about creating your own fintech app, feel free to dive into fintech app development to see what it takes to create a standout financial app.

Want to Build Your Own FinTech Healthcare Startup?

If you are thinking of developing an app that will solve healthcare financing challenges or have an idea for a healthcare fintech startup but need an expert app development partner to turn your vision into reality, we can help.

Our experienced developers and designers have worked with leading healthcare companies and startups to build secure, user-friendly products.

We provide reliable, scalable development services if you need an app, responsive web platform, or integrated backend infrastructure.

Contact us for a free consultation on how to start a fintech company. We will do our best to assess your needs and provide recommendations tailored to your idea.