Trading System Software Development: A Step-by-Step Guide

- Updated: Nov 11, 2024

- 19 min

Building your own stock trading platform can be an exciting endeavor, but it also requires careful planning and consideration.

With the rise of apps like Robinhood, online trading has exploded in popularity, especially among younger audiences hoping to capitalize on market trends. However, developing a successful platform requires more than just mimicking what’s already out there.

This guide will walk you through key questions to ask yourself in the planning process:

- What type of trading platform do you want to build? Consider features that will set you apart from competitors and appeal to your target demographic.

- What technical skills and resources do you need? Building a robust, secure trading platform is complex on both the front and back end.

- How will you assemble the right development team? Specialized expertise in financial software is a must. Partners with experience in compliance and cybersecurity are also key.

- What features and functionality should you include? From basic buying/selling to more advanced analytics and automation tools – prioritize must-have elements first.

- How will you ensure regulatory compliance? There are legal requirements around accounting, reporting, handling customer funds, and more.

While market trends create an exciting growth opportunity for new trading platforms, the barrier to entry remains high.

We’ll explore all aspects of successfully developing your own platform so you can set yourself up for sustainable success in this competitive landscape.

Ready to dive in? Let’s start by figuring out exactly what type of platform makes sense for your goals.

Transform your ideas into reality with custom software tailored just for your business – contact us today!

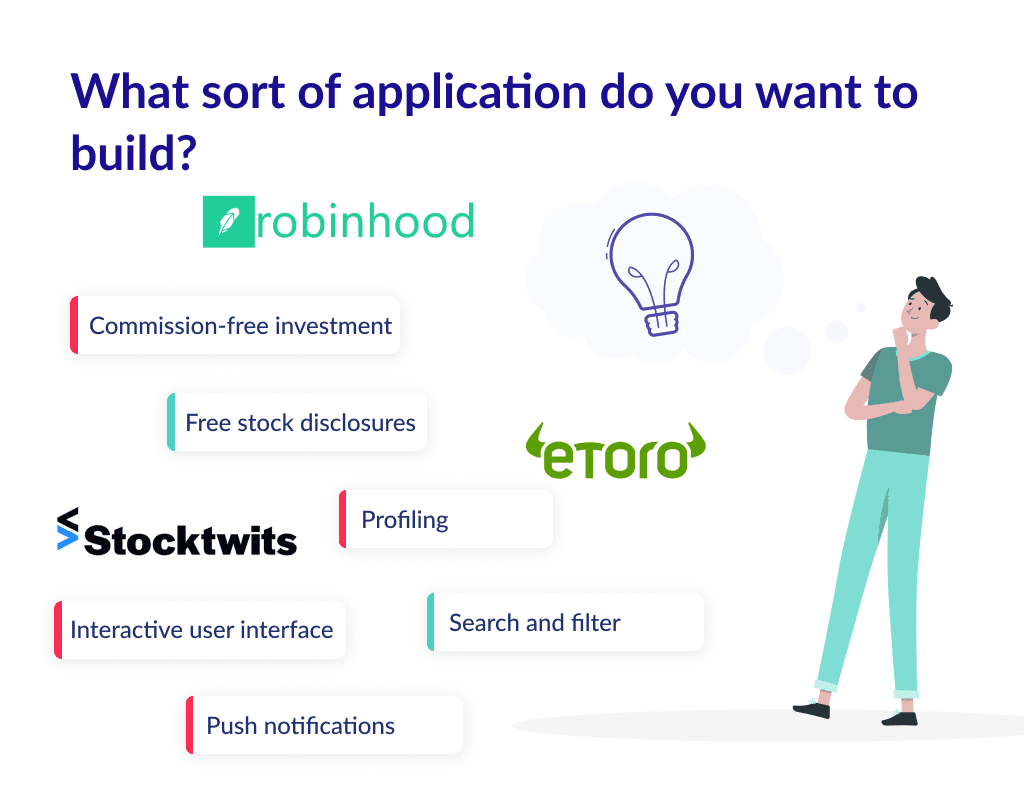

What Type of Application Do You Want to Build?

Ok, we have three role models for you here.

| Platform or Application | Features and Functions |

| Robinhood | As an online and novel online stock trading app, Robinhood helps users move their money into action. The app provides you with a global market and stocks to start trading. Apart from the standard stock trading functions, the app also helps with Options, Gold, and Cash Management. Lately, users also got the freedom to invest and trade in Cryptocurrencies. Looking at its core features will help you in knowing how to build a user-centric stock trading platform.

All these features make Robinhood a sort of case study that you should explore. It is vital to understand how this app works before you learn to create a trading platform. |

| eToro | eToro is yet another trading platform that you can imitate. Primarily eToro is a social trading platform. Resident traders and investors are sharing their secrets and strategies, e.g. mobile trading. You have the option to observe their history in trading and follow them for your portfolio. eToro also gives you access to certified CopyTraders. It represents a group of traders who are vetted by the platform and have a rich history of successful investing.

Again, it is important to look at eToro to fully understand how to build a trading platform. With cybersecurity risks on the rise, bot attack prevention has become essential for online security. |

| StockTwits | The last platform that you need to study before knowing how to create an investment and trading platform is StockTwits. Primarily StockTwits is not a trading platform. But yes, we can call it Twitter for stocks and traders. Stock Twits users can post their strategies, opinions, tips, achievements on the platform. However, for trading, a subsidiary of StockTwits, Trade App can be used. So, one platform helps users absorb knowledge, and the second one helps them capitalize it.

We are listing this application in our guide on how to create a trading platform to help you understand diversity. |

Did these platforms inspire you to make your platform?

If yes, stick with us because moving forward, we will talk about how to quickly build a trading platform. In the meantime, you can read about key FinTech trends.

How to Build a Stock Trading Platform

Every story depicting any platform’s development has two parts.

- Business

- Technical

Both of them have a symbiotic relationship.

Let’s begin with the business side of how to build a trading platform first.

The Business Side of Creating a Trading Platform

Ok, the model approach is to generate an idea and conduct idea validation.

But here, we already have a general idea.

So, before validating, it is required for you to generate more refined hypotheses.

In other words, the market is already flooded with similar platforms.

So, if you need to stand out from the herd, start by defining your value proposition.

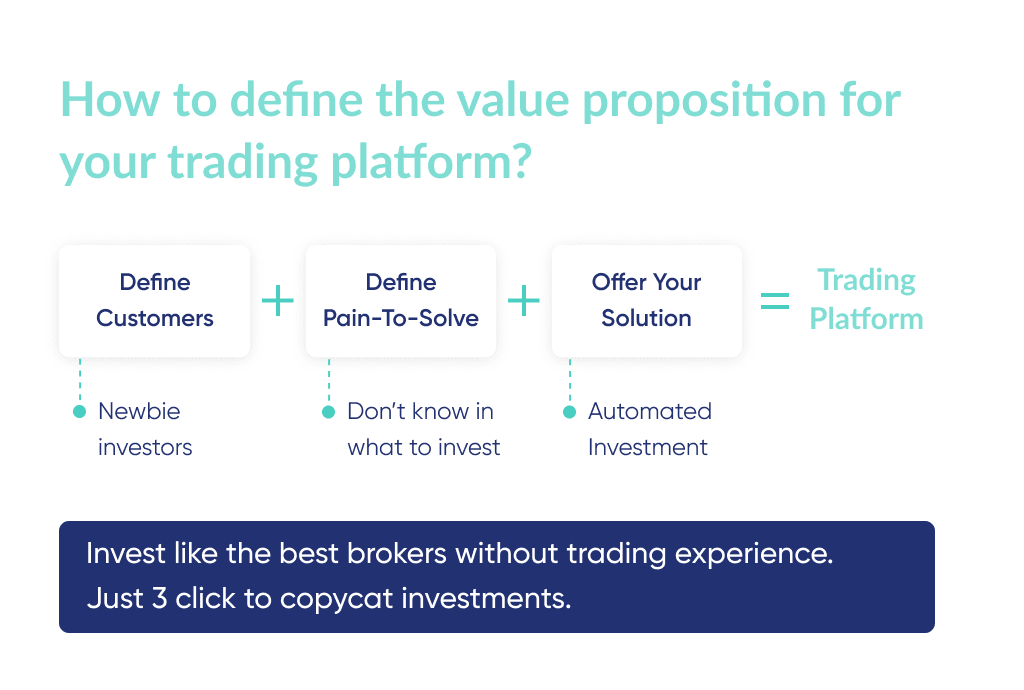

Aspect 1. Value Proposition: Who?, How?, and Why?

To build the ideal value proposition, find the answer to three questions.

- Who is your Ideal Customer?

- How will you attract them?

- Why will they use your product, or what issue will your product solve?

Yes, this is important for how to build a customer-centric trading platform.

| Aspects of Value Proposition | Why is it Important? |

| Ideal Customer | In simple terms, your ideal customer is the person whose exact needs are met by your product. The term ‘ideal customer’ can be a bit misleading. The 21st Century business landscape is not generic. Specialization and personalization is the key to success. It is imperative to identify your ideal customer base. Entrepreneurs who make the mistake of not knowing their customers end up creating the wrong product. You can make the same mistake in how to create a trading platform. How? Imagine that you do not know someone and are still sending them gifts. You cannot build a product before understanding your customers and their goals. This is the first key part of how to create a successful trading platform. Next, to build consumer persona;

At the end of this procedure, you will have a list of potential customers. Use your startup marketing strategy to reach them, and you will be surprised by the conversion rate that follows. |

| Customer Attraction or Killer Features | Customers have a variety of options when it comes to a product. But they don’t buy or use all of them. Customers will only interact with a product that they will like to interact with. And having attractive features is one of the ways to get new customers and retain existing ones. Competition analysis is integral in how to build a good stock trading platform. Basically, when you conduct a competition analysis, you identity two things;

Simply put, stay on top of your competition. Analyze their products and build something better and more customer-centric. |

| Why will the customer engage with your brand? | The cumulative answer to both the questions above will help you get the final answer. Taking this answer, you must move ahead with how to build a trading platform. This part is about knowing the value of differentiation. Your idea might be the same as others. But the way you present the solution to your customer has to be different. Marketers tend to forget that the customers are real humans and not a number of their research sheets. To make sure that they take the desired action, you have to include the human factor in every aspect. |

With the Value proposition complete, you will end up with three things.

- Relevancy

- Qualified and Verified Valuation

- Differentiation

There are millions of success stories that have started with this process.

No matter what type of application you want to build, the pre-development process is similar.

Because the process you will follow here in how to create a stock trading platform is a philosophy.

There are studies conducted by marketers and researchers to find the right mix of ingredients.

A few examples to show that creating a value proposition makes a difference.

- Tesla:

Tesla’s electric cars are the most popular across the globe.

They are expensive, no doubt.

This is the perfect fintech business model that solves many problems at once, starting with the preservation of the environment.

Added to this, Tesla cars do not need a driver.

Extended battery, aesthetics, durability, safety, etc are some other features.

We know that Tesla is not a stock trading platform.

But understand how they addressed the customer’s concerns.

Building a fintech startup? Get practical advice on how to start a fintech startup and navigate the industry.

- Uber:

Uber is following an idea that has been in existence for centuries.

Right?

Who doesn’t know about a taxi-on-hire?

And there were similar services working before Uber.

But the billion-dollar idea here is to help the customers get the taxi where they want it to be.

Look at your solution similarly working on how to build a stock and trading platform.

Uber saves time for the customers.

Feel free to check out our article on how much it costs to build an app like Uber.

- eToro:

This example completely relates to our guide on how to create an online trading platform.

The best part about eToro is that you can copy the trader’s actions.

eToro saw that even an average Joe wants to become rich overnight.

So, they gave the customer a simple way to achieve that.

Imitate the actions of successful traders and follow them for your gains.

What could be better than this?

The users are getting access to pre-vetted strategies and tactics for trading and investing.

All this only certifies that you need to listen to your customers, and they will respond.

The next leg in how to strategically build a trading platform is validation.

You need to evaluate and validate your theory that you have just formulated.

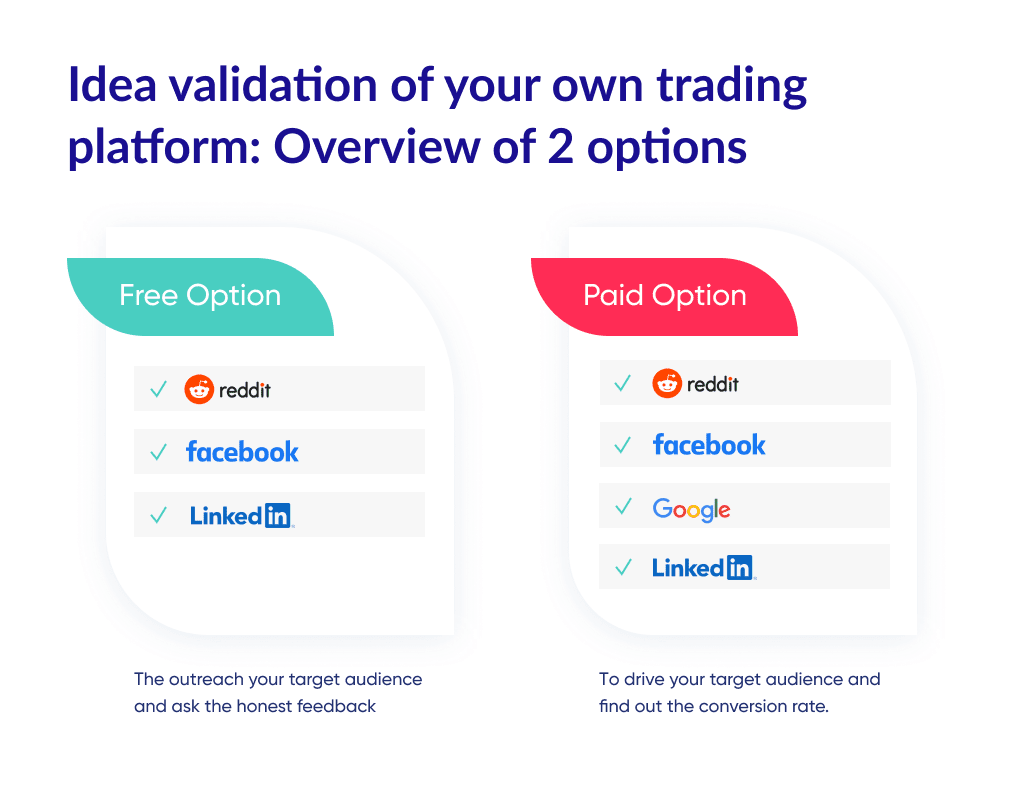

Aspect 2. Hypothesis Validation: 2 Ways-to-Go

Validation is important to ensure that you follow the right development procedure.

There are two ways to validate your hypothesis.

- Do it for Free

- Use some low-cost processes

| What to do? | Benefit and Importance |

| Using Social Media for Free | It may seem a bit out of context. But social media testing is as real as conducting a survey. Until now, all that you have in terms of your platform is a rough structure. Well, we want you to use what you have and take it to social media to listen to what others have to say. However, you may get a lot of bland responses here, but the focus on the constructive responses. One way to reduce the unwanted negativity is share the idea only with a qualified and knowledgeable audience. Do not misunderstand this part of the process on how to build a trading platform with customer validation. The process for that is a bit different. Here, focus on acquiring intelligence from a like-minded community. The best part is that you can do it for free. |

| Create Ads at Lower Prices | Another way to test your hypothesis is by making a landing page. You may ask why it is important at this stage of how to build a better trading platform. We are asking you to make a landing page and follow the fake it till you make it approach. This is important for how to create a trading platform because it will help you obtain two things;

List all the features you wish to provide on the landing page. Run Facebook ads with a broad category of interests and other parameters. Again, these measures are not decisive in how to make a stock trading platform. But they do help you formulate a better idea about the final product. |

Aspect 3. Legalities [Pay Attention!]

Moving ahead with how to build a legal trading platform.

Since you will be entering into the financial domain, it is important to get legal before you begin.

In the US, the Securities and Exchange Commission takes care of the legalities associated with online trading.

Apart from the SEC, you should also register with;

- FINRA (Financial Industry Regulatory Authority)

- MSRB (Municipal Securities Rulemaking Board)

- CBOE (Chicago Board Options Exchange)

- NFA (National Futures Association)

As a founder of the platform, you need to make yourself familiar with the required rules and FinTech regulations.

Moreover, you should look at the registration and other aspects before starting the platform.

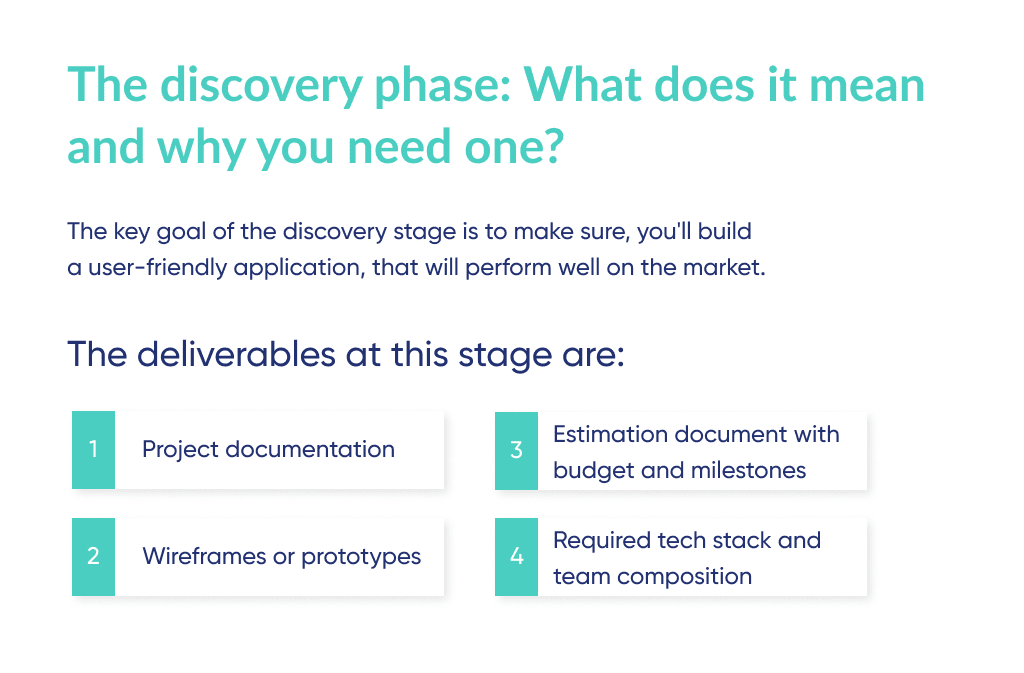

Aspect 4. The Discovery Phase of A Project

This is where the rigorous work for how to build a stock trading platform begins.

In the earlier steps, we were only testing the waters.

If the answers to the steps given above in how to create a good trading platform are positive.

You can begin the project discovery phase.

Three types of research will go into the discovery phase for how to create a trading platform;

| Type of Research | Importance and Benefits |

| Market Research | Understand everything you can about the market you will be working with. Revolve your research around the market history. Check how the market treats a new entrant into the industry. Look at the past trends before moving ahead with how to build a trading platform. It is said that history teaches us about the future. So, you must closely look at the turning points in the online trading industry. Look at the things that brought a change in the tide. Observe the market response to similar platforms. Everything you do here looks like research. But, it is more of an exercise to understand what shall be done next. |

| Customer Research | In the previous sections of how to build a profitable stock trading platform, we talked about customer research. Follow the same process here. The motive is to build a complete customer profile. This will help you make the right product and select the perfect features. |

| Competition Research | Following the process we discussed earlier for competition research, add a few things here. Apart from the core features offered by your customers, you must also look for other aspects. This includes

Not to imitate anything, but the motive is to study, observe, and improvise. These aspects in how to build an online trading platform are essential. Competition analysis is also essential for creating a features list. Apart from the core features, you need to add some unique aspects too. Lastly, for how to build a user-friendly stock trading platform, check the UI/UX parameters. How good is your competition’s application in terms of design and user experience? |

These aspects may not make much sense to you.

Especially if you are too eager to launch the platform and start printing money.

However, it is very important to follow the right approach.

Because if you want to know how to build a profitable trading platform, do it the right way.

17% of startups fail because they don’t have a good business model.

What’s it going to be for you?

Until here was the first part of the discovery phase.

In the next segment of this phase in how to easily create a trading platform, we will design the work scope.

How Does All This Help? [A Quick Recap]

The Discovery workshop lets you make evidence-based decisions.

Consequently, it reduces the time required to develop the product.

Completing the discovery workshop for how to build a trading platform helps with.

- Acquiring accurate estimates

- Get higher ROI

- Create customer-centric platform

- Save time and money

- Build a better understanding with the development team.

Hence always conduct a discovery workshop to know how to create a trading platform.

This is essential to develop the right expectations for;

- Team

- Cost

- Tech stack

- Other requirements

Here is a brief on the work scope of how to create a stock trading platform.

| Scope of Work | Importance and Impact |

| Define Features List | Don’t consider this as the features list for how to build a stock trading platform. In this part, we want you to brainstorm the types of features. Always aim to build the MVP version first. Because the cost of MVP is less and the same is easy to scale. |

| Design Solutions | Here again, your task is to identify the design scope. Your application’s Fintech design depends on your research. Better research translates to customer-centric designing. Depending on your target customers, the design changes. Assuming that your target audience is the younger generation. These are the users who want to do things quickly. Plus, they are tech-savvy, and they can make out the difference between a good and bad design easily. Another design aspect in how to easily build a stock trading platform is the tools used for the same. Although we will list out the ideal technologies, you should consider listing them out here. This is important irrespective of the fact which is building the platform. |

| Competitors | Combine this task with the previous competition research activity. Besides the things you covered in the previous task, add here;

The motive is to discover everything about your competitors so that you can build a better platform. |

This was all about the business part of how to build a trading platform.

Apart from these aspects, you should also look at the monetization models.

Identify how you can earn revenue from your customers.

Take note the current platforms are not taking any commission from their users.

“Zero Commission Trading” has become the USP of several platforms in this domain.

While following the same principle, look for some other methods to earn and grow.

Let’s move on to the technical part now.

Crafting Custom Mobile Apps That Delight Users!

The Technical Side of Building a Trading Platform

By examining the business and technical aspects, we deduce the final cost estimate.

Also, you should understand one thing.

There is no one-stop solution in any sort of platform development.

Everything depends on how deep you go with the planning and development.

In other words, how far you take the research part and the technical aspects ultimately decide the cost.

If you take 500 hours to conduct the research, a business analyst will charge similarly.

On the other hand, if you take 1000 hours for development, the technical team will also charge similarly.

It is like adding more fuel to fire.

You keep on adding the fuel, and the fire will burn with progressive intensity.

Ergo, always aim to build the MVP first.

Our discussion ahead will mostly focus on the MVP version of how to easily create a trading platform.

There are four sides to it;

- Designing

- Features Identification

- Team Composition and Type

- Tech Stack

Let’s get into the details.

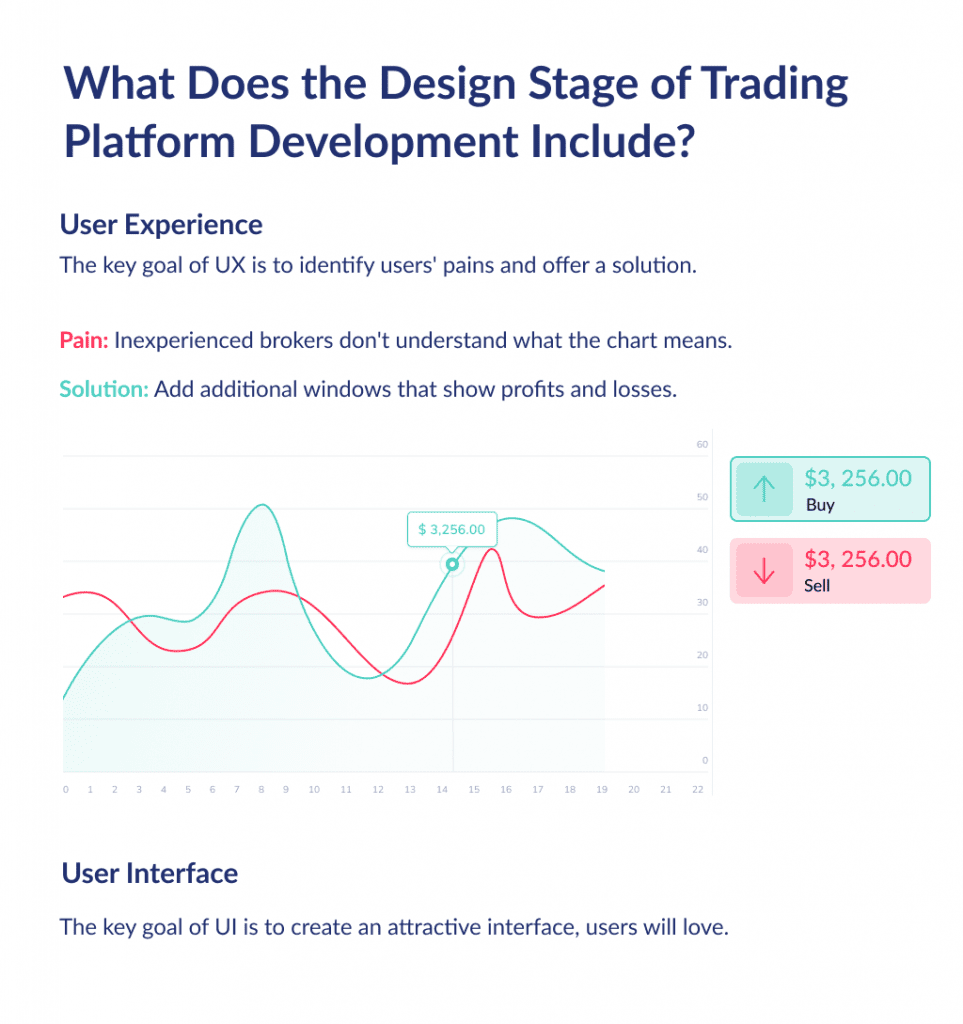

1. The Design Part of How to Build a User-Friendly Trading Platform

An application’s design is pivotal to its success.

Experience designers already know the pitfalls they shall avoid.

In 2023, 218 billion applications were downloaded.

Moreover, the 71% churn rate in 2013 added with a 12% retention rate of 2023 poses a big challenge to the designers and developers.

The design is pivotal to this mission.

So, there are two things you need to ensure while designing the platform.

The first one is User Experience.

Your users are here to earn money in the simplest way without working too much.

This directly implies that you need to help them in terms of;

- Features

- Speed

- Engagement

Hence, it is imperative to build a user-centric design.

In no case should you leave your users hanging or thinking?

Everything has to be in front of their eyes and easy to reach.

Even a simple thing as “too far buy now button from the thumb” can lead to abandonment.

So, you can only imagine how important design is in how to create a trading platform.

The second thing is User Interface: hybrid or native.

Depending on your user base, you have to make this choice.

Do you need to make the platform for iOS and Android users or target only a single OS?

Because your choice here will impact how to build a stock and trading platform.

Building for a native platform can be costly.

But it will provide the best user experience.

Hybrid development is cost-effective and fast.

However, you may have to compromise with the user experience to some extent.

If you decide to build an iOS app, this guide on the best iOS app development tools covers everything from prototyping to testing.

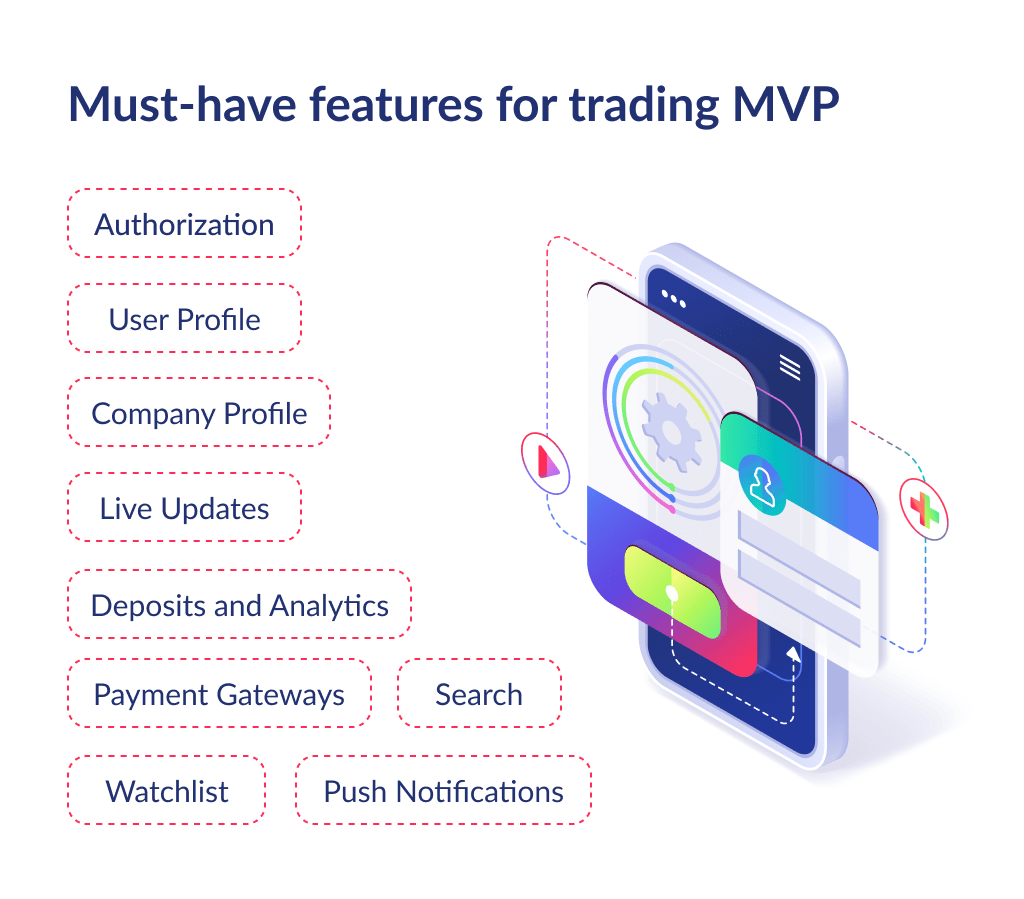

2. The Define MVP Features Part of How to Build a Trading Platform

Your features play a major role in the cost.

More features mean more hours required to build them.

However, you must add the core features that will get your MVP version of the platform rolling.

Here are the features you need to add.

| Feature | Importance |

| Sign Up and Sign In | Ensure that you have one-click signup and sign in. Reduce the time and steps required by users to start using the platform. |

| User Profile | In how to easily build a trading platform, success depends on functionality. Giving the option to create a dedicated user profile is pertinent from various aspects.

|

| Company Profile | Even the companies listing their IPOs on your platform should have a profile. It will allow the users to vet them before investing. |

| Live Updates | Trading is data-driven. Real-time updates help users get a clear picture of the market. |

| Deposits and Analytics | Ensure that your users are able to see their deposit history. Also, build in-built functions to help them see their past trading performance. This is essential in how to build a stock trading platform. As if the users can study their previous transactions, they can plan the future ones with better knowledge. |

| Payment Gateways | Allow the users to pay via multiple payment options. At no time should they feel at a lack of payment options. Because if a user abandons the app once, it is next to impossible for them to use it again. This point should also be taken into account when developing an application for online payments. |

| Watchlist | Another user-friendly aspect in how to build a trading app is a watchlist. Allow your users to select the stocks they wish to follow and keep an eye on. |

| Search | Everyone should be able to search for a particular stock and company easily. |

| Push Notifications | Every user must receive personalized push notifications. It can be when their chosen stock performs or lags. Or when a new company is about to run its IPO. For the leaders, send notifications when someone follows them. |

These are the features that are a must for every type of platform.

However, if you want to add other functionalities, it can be done.

Note that adding these features will add to the overall work and cost.

So, in how to build a trading platform, MVP version, these features are not essential.

| Additional Features | Importance |

| Newsfeed | A news feed section will help users stay updated with the social side of trading. It will help users engage with each other. Traders can share their insights, trading hacks, and success measures. |

| Portfolio of Other Traders | By adding portfolios of other traders, you can help users to imitate their actions. |

| Sorting and Filtering | Add filters for better engagement. Examples include;

Also, allow them to sort the stocks as per their preference. |

| Synchronization | Even if the user is trading through different devices, they should have full sync between them. Any transaction or activity indulged on any one platform shall be reflected on others. |

Access premium design and development services for unmatched success.

These are the advanced features.

You may not need them for the MVP version.

But if you are seeking answers for how to build an advanced trading platform, these features must be added.

Now that we are done with the features let’s move to the next part.

3. Required Team

Your research, design, and development team must comprise the following members.

- Project Manager

- Business Analyst

- UX/UI Designer

- Backend Developer

- Frontend Developer

- QA Tester

- DevOps (discover which DevOps trends are set to impact the future of software development).

4. Tech Stack

Choosing the right tech stack is the next important question in how to build a trading platform.

A tech stack represents the collection of technologies required to build the platform.

Here is what we recommend you to use for your development.

| Task | Technology Required |

| Project Requirements | G-Suite |

| Design and Prototype | Figma |

| Hosting | AWS |

| Backend Development | Node.js |

| Frontend Development | React.Js |

| DevOps | Jenkins, Docker |

This was all about the tech stack required in how to build a stock trading platform.

Now we are left with the cost of how to create a trading platform.

Estimating the cost is a bit complicated.

The Cost of Developing a Trading Platform

Focus on this part of the guide as it is vital.

There are two segments of the development part that influence the cost.

- Features, designing, and all the aspects we have discussed above.

- The team you choose for development.

While we have gone through the first segment.

Let’s talk about the team now.

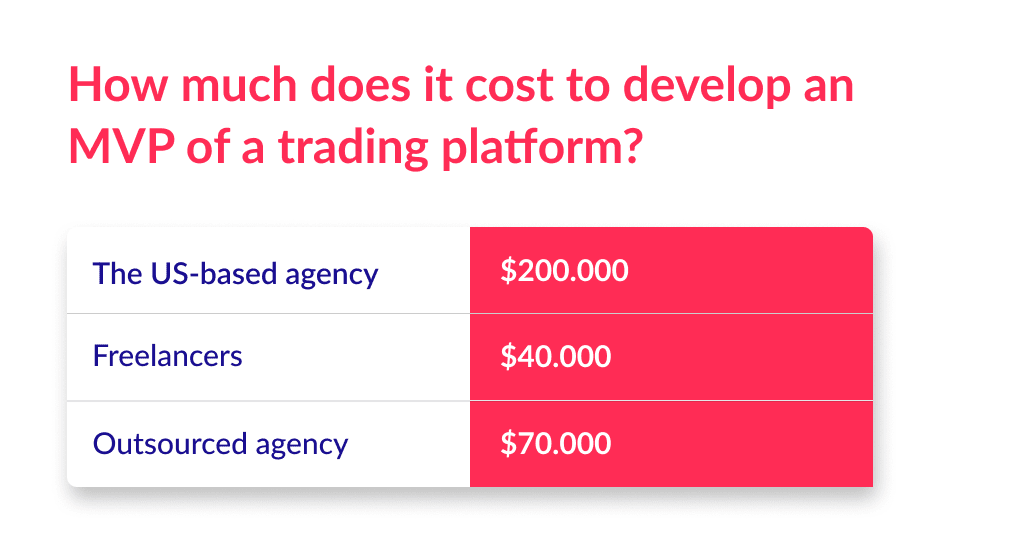

You have the option to choose from three kinds of team compositions.

| Type of Team | Pros and Cons |

| Local US Agency | A local US agency is your neighborhood development team with in-house experts. Hiring them may seem like the best option, especially if you want a quality product. However, be prepared to spend a fortune. Because US development agencies charge between $125 to $150 per hour. The MVP development of the trading platform would take around 1500 hours. The total cost will be about $200,000+. Pros:

Cons:

|

| Freelancers | Freelance developers charge as low as $25 per hour. Yes, the cost is optimal, around $37,500+. But, there is no guarantee of product quality. Managing freelancers is a painstaking task. Moreover, there can be gaps in communication. Pros:

Cons:

|

| Outsource to an Agency in Ukraine | Outsourcing the development is the best option for how to build a trading platform. Agencies in Ukraine have extensive expertise in development. It is easy to find excellent agencies that provide high-quality products at cost-effective prices. The average cost charged by them is $40/hour. So, a 1500-hour+ MVP project will cost around $70,000+. Save time on research with this list of the best IT outsourcing companies for quality service and reliability. Pros:

Cons:

|

This means that hiring an agency out of Ukraine is your best way forward.

Along with the optimal cost of development, you will get an expert team for your project.

So, that is the answer to how to build a trading platform.

Ready to Create Your Own Trading App?

With so many benefits of fintech, it’s no surprise that companies are adopting it rapidly.

Are you looking to develop a robust yet user-friendly stock trading platform? It’s not an easy task, but with the right software development partner, your unique platform vision can become a reality.

Our team of industry experts has experience in building custom trading systems for both enterprise organizations and fintech innovators. We take care of all design and engineering aspects, allowing you to focus on your core business.

Contact us for a free consultation where we assess your goals, budget, target users, and more to create a high-performance solution tailored to your needs.

Let’s build something transformative!