What Is Insurance Automation And How Does It Transform The Industry

- Updated: Feb 03, 2025

- 8 min

Every day, people sign up for hundreds of thousands of insurance claims.

For example, in 2021, there were approximately 4.2 auto collision insurance claims filed per 100 cars in the U.S.

With over 283 million registered cars that year, this translates to about 11.9 million auto collision claims annually, or roughly 32,600 claims each day.

With so many people filing claims and interacting with insurance services every day, it’s clear that insurance automation can make a huge difference.

As an insurance professional, you know the manual processes, inefficiencies, and complexities that can hold you back and cause delays, errors, and non-compliance.

Automating claims processing and data management can help insurance providers speed up customer onboarding, reduce the chances of human errors, and deliver a smoother user experience.

In this article, we will look at the benefits of process automation in insurance, the insurance trends driving automation, and the best process example to get it right.

We will also share an example of how we integrated AI into a safety solution and how our insurance app development services can help you grow.

Get a strategic MVP to mitigate risks.

AI in Insurance Market Overview

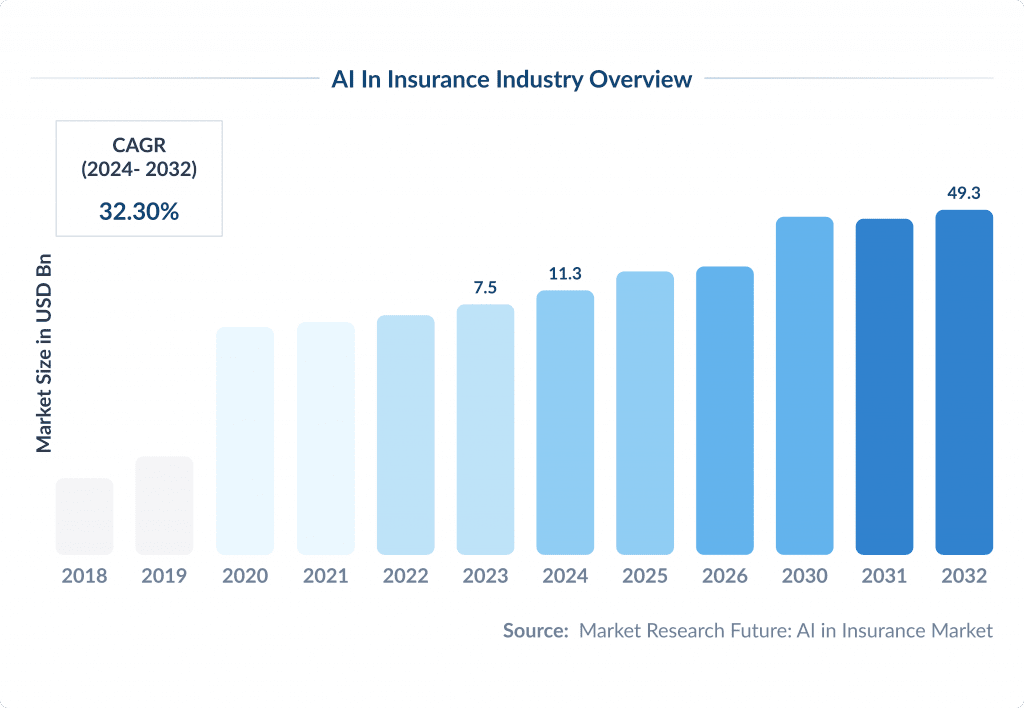

The AI usage in the insurance industry is booming.

According to the Market Research Future report, in 2023, it was $7.5 billion.

With a staggering GARG of 32.3%, the market is expected to reach $49.3 billion by 2032.

The push to automate and the globalization of the insurance industry are driving this growth.

The pandemic slowed things down in 2021, and the market shrunk to $3.1 billion.

However, it bounced back strongly and is expected to reach $40.1 billion by 2030.

Insurers adapted quickly to automation in insurance. They are using digital tools to meet changing customer needs and new regulations.

Personalized insurance is the big trend now with AI and machine learning.

Chatbots, robo-advisors, and budgeting apps are helping customers manage their finances better.

For example, CLARA Analytics launched software that simplifies claims using AI to analyze bills and medical records.

These tools aren’t just making insurance more efficient.

They are making insurance more customer-centric.

The McKinsey report on insurance productivity 2030 indicates that by 2030, AI-powered automation could boost productivity in insurance processes and reduce operational expenses by up to 40%.

Even more than that, this business process automation simultaneously boosts the customer experience.

So, what exactly is automation in the insurance industry, and how does it work?

Let’s explore.

What is Insurance Process Automation?

Insurance process automation is basically using advanced technologies to streamline and automate insurance-specific tasks and processes.

The advanced technologies include artificial intelligence, machine learning, and data intelligence. These software solutions help insurers automate data entry, claims processing, policy insurance, and much more.

The use of automation in insurance comes with multiple advantages, including better operational efficiency, reduced costs, enhanced customer experiences, and more.

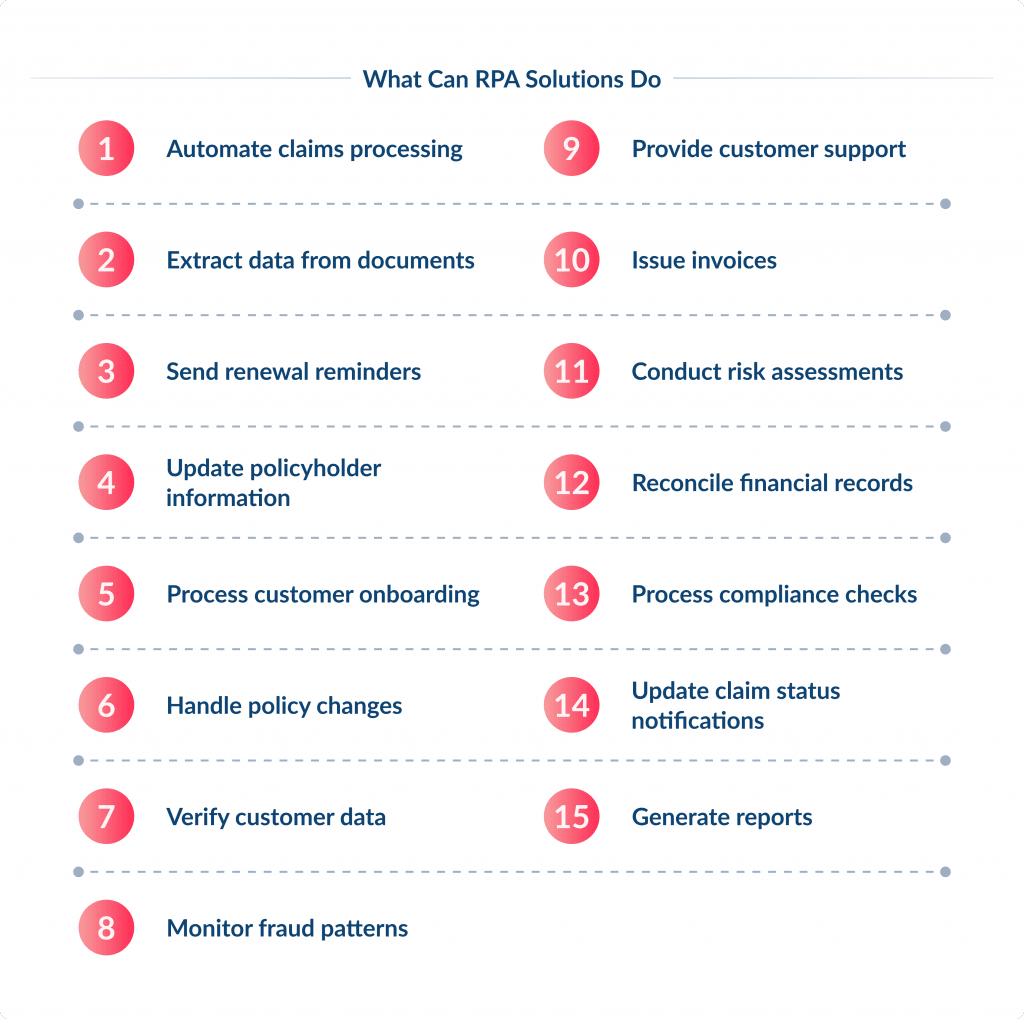

The Role of Robotic Process Automation (RPA) in Insurance

Robotic process automation is an essential part of insurance automation and one of the key trends of digital transformation in insurance.

RPA is focused on automating repetitive, rule-based tasks using bots or software.

For example:

- Processing claims

- Extracting data from forms

- Sending automated policy renewal reminders

RPA solutions can eliminate manual processes and do much more than that. These bots can be trained to handle more complex tasks and even make decisions.

For instance, RPA bots can be used in analytics, automated insurance underwriting, claims processing, and other activities.

Insurance claims automation best practices help to detect fraud and accelerate processing times.

Even though RPA is limited to predefined processes and doesn’t involve decision-making beyond its programming, the capability of these bots increases with the advancements in technology.

As RPA bots have already proven themselves as cost-saving and efficiency-boosting solutions, their adoption will only rise in the future.

McKinsey’s report on the value of robotic process automation highlights that case studies have shown up to a 20a0% increase in ROI within the first year of RPA deployment in financial services.

Given this incredible growth, the RPA bots can deliver the same, if not better, results in the insurance industry, too.

What are the Benefits of RPA in Insurance?

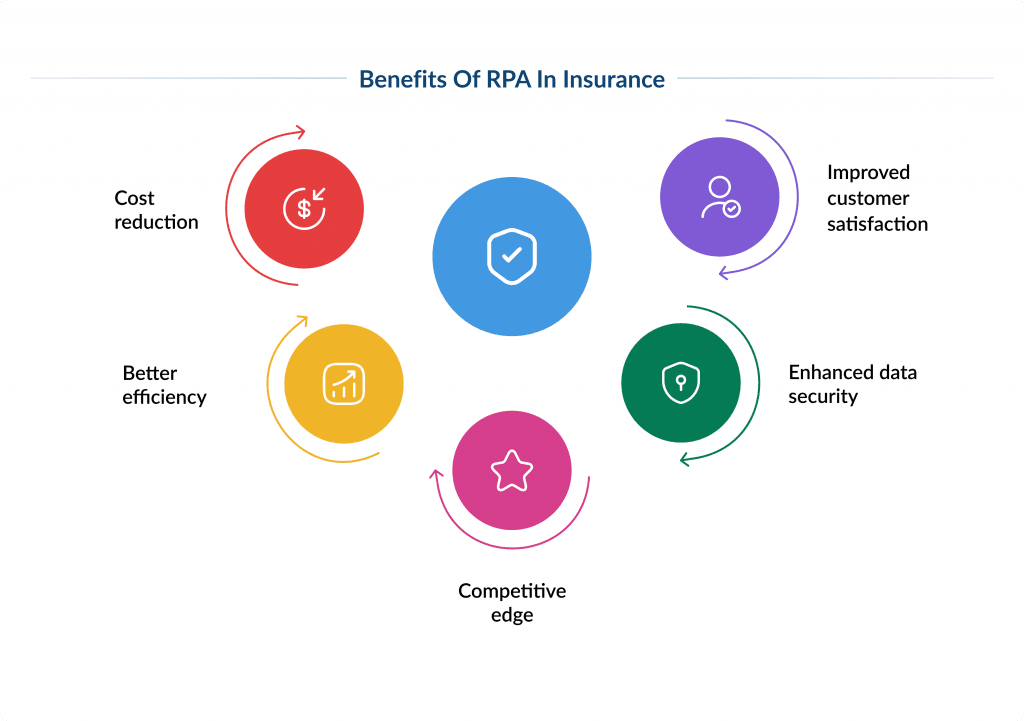

RPA brings many business benefits to the insurtech ecosystem:

Cost Reduction

RPA in insurance eliminates or reduces many manual, non-value-added tasks.

When using RPA bots to eliminate errors and reduce time spent performing these tasks, insurers can save costs and be more efficient.

Better Efficiency

RPA in insurance can reduce cycle time, especially for complex, long processes like claims and underwriting.

These processes require lots of information from customers and are often plagued with missing information and slow turn around times, especially if paper based.

RPA speeds up information gathering and centralizes data in a digital file that can be easily accessed. So significant cycle time reduction can be achieved with RPA in insurance.

Competitive Edge

RPA in the insurance industry offers a competitive advantage.

Using AI and machine learning algorithms allows companies to level up their decision-making and identify opportunities for growth.

This is because RPA bots can analyze more data faster than humans. So, analytics can be used to uncover new opportunities or bottlenecks in business processes.

Enhanced Data Security

Insurance is a highly regulated industry, and regulations change all the time.

It can be complicated to keep employees trained and up to date with the latest insurtech compliance regulations, and even harder to make sure they comply with all of them.

This is when RPA in insurance comes into play.

With RPA bots, insurers can stay compliant and eliminate the risks of fines, reputational damages, and other possible consequences of non-compliance.

Improved Customer Satisfaction

RPA connects traditional insurance systems to improve customer experience and operational efficiencies.

Specifically, RPA platforms can process actions down to the mouse and keyboard level. They can also integrate with lower-level systems through application programming interfaces (APIs).

Businesses can use API connectors when building their RPA workflows for end-to-end automation.

RPA solutions can do the following:

- Copy and paste data across applications

- Calculate data to create reports

- Open emails, gather data and move it into a core system

- Leverage artificial intelligence (AI) add-ons to extend bot capabilities

- Work with workflow automation, rules engines and other components for fully automatic processing

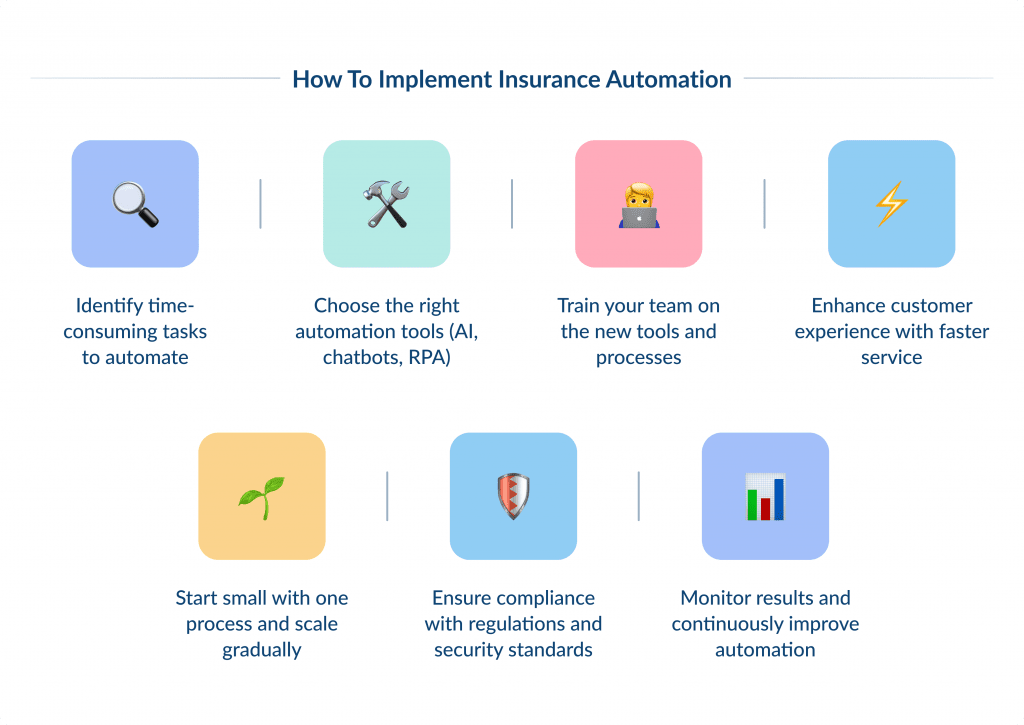

How to Implement Insurance Automation

If you’re looking to bring automation into your insurance business, it’s all about simplifying the complex and saving time — for both your team and your customers.

But where do you start? Let me break it down.

First, think about the tasks that slow you down.

For example, processing claims or reviewing policy documents can take hours when done manually. These are perfect candidates for automation.

AI tools can now scan, extract, and organize data from documents much faster than any human could.

Next, you’ll need the right tools.

Automation isn’t one-size-fits-all, so start with what matters most to your business.

For example, chatbots are great for handling simple customer questions like “What’s my policy coverage?” or “How do I file a claim?”

At the same time, RPA bots can handle repetitive tasks, for example, sending out renewal reminders, updating databases, or extracting data from forms.

You also need to remember about the team training. Make sure you educate your employees on how these new tools work and what tasks they can delegate to virtual assistants.

Emphasize that automation is a way to make their life a little bit easier and save time on tasks that matter the most.

For instance, instead of spending hours inputting data, they can focus on higher-value tasks like building relationships with clients.

Another interesting thing is that insurance automation can make life easier for your customers, too.

Imagine someone filing a claim for a car accident. Instead of waiting days to hear back, an AI system could process their information almost instantly and get the ball rolling. That’s the kind of experience people remember — and appreciate.

Start small. Maybe you automate one process, like policy renewals, and see how it goes.

After you get used to the automation of this process, you can delegate another area to automation, like fraud detection or underwriting.

Monitor the outcomes and tweak things as needed.

And don’t forget about compliance. Automation doesn’t mean you get to ignore industry regulations or data privacy laws. Make sure everything you set up is secure and follows the insurance industry regulations.

In the end, insurance automation is not solely a cost-saver. It is an instrument that allows businesses to create better experiences for both insurers and their clients.

Implement it wisely, and you’ll see the power of automation.

How AI Can Tackle Insurance Challenges: A Case Study

Advanced industries like semiconductor manufacturing and data centers face various safety risks every day.

For insurers in this area, the job goes to spotting issues. They need to juggle endless tasks: filling out reports, analyzing trends, and ensuring regulatory compliance.

These tasks are exhausting, time-consuming, and, frankly, not always efficient.

Their consultants were overwhelmed as they spent more time on paperwork than on making workplaces safer.

Meanwhile, managers struggled to keep up with scattered data. It was hard to see the bigger picture or act quickly when problems arose.

They needed a better way to work.

They contacted us to build an advanced web platform that could improve their daily activities and make them more effective.

Our team utilized AI to automate repetitive tasks and streamline their operations.

Here is how we utilized AI to power their solution:

Implemented AI for Reporting

Manual reporting was a big bottleneck. Consultants had to spend hours compiling observations and filling out daily reports.

To fix this our developers integrated ChatGPT to pre-fill reports based on previous data. This reduced time spent on paperwork by hours.

And the AI helped consultants with safety related questions and provided predictive insights so they could identify hazards before they became critical.

What’s Changed?

This wasn’t just a new tool — it changed how the team worked.

Instead of being bogged down with reports, consultants could focus on making the workplace safer.

AI-driven insights reduced human error, and nothing got missed.

Predictive analytics meant they could stop problems before they even started.

This is what AI can do in other industries like insurance.

Automate claim forms, spot risks before they happen, or give your team a dashboard that makes sense of all the data.

Same principles: save time, reduce errors, and make better decisions.

Feel free to read the full story of safety solution development to see the other challenges we’ve tackled.

Including complex safety requirements, data visualization, user-friendly insurance app design, and more.

Explore our app development services today

Conclusion and Next Steps

Insurance automation is transforming the insurance industry. It enables companies to be more efficient, save time on repetitive tasks, reduce operational costs, and enhance customer experiences.

If your insurance company is ready to get started with your automation journey, you need a reliable partner who can help you identify the tasks and business processes that can be automated and select the right technology and tools to automate them.

SpdLoad is here to help you out with intelligent automation for your insurance business.

We have been creating software solutions for the insurance industry for over a decade, and we know how to ensure robust security, comply with regulations, and ensure top-notch functionality.

With our efficiency-forward approach to insurance app development, you can transform your operations, enhance customer satisfaction, and secure a competitive edge.