What is an Insurtech Ecosystem? +Examples & Best Practices

- Updated: Aug 27, 2024

- 7 min

The insurance industry is transforming thanks to emerging technologies and new types of partnerships.

In this article, we’ll look at the growing “InsurTech ecosystem” – how different players are interacting to drive innovation.

We’ll be covering:

- What is an InsurTech ecosystem, and how does it work?

- What opportunities are out there for startups looking to get involved?

- How can you use the ecosystem model to thrive in this industry?

- And more!

For insurance companies looking to innovate, car insurance app development is a game-changer in customer engagement.

Whether you’re an established insurance company or a scrappy startup, there are ways for you to tap into the energy and collaboration fueling much of the current innovation in this sector.

Read on to learn more!

Transform your ideas into reality with custom software tailored just for your business – contact us today!

What is an InsurTech Ecosystem?

An InsurTech ecosystem is a concept that’s designed to create a suitable environment for numerous insurance service providers so users can access more robust offerings.

The InsurTech ecosystem from experience has four main attributes. These are:

| Attributes | Description |

| Demand | Every ecosystem needs to have strong demand from users. The demand for InsurTech products rose during the pandemic. And according to Research Dive, it’s expected to have a CAGR of 29.1% from 2021 to 2028. |

| Talent | An ideal InsurTech ecosystem should have robust technical, management, and business teams. As it stands 44% of global InsurTech companies have between 1-10 employees. See 15 examples of insurance companies that dominate the industry. As such most ecosystems in this niche are managed by few, but effective talents. |

| Capital | By capital, we mean resources needed to achieve corporate aims effectively. Financially, InsurTech companies raised a total of $19.8 billion in 2021. |

| Policy | For an ecosystem to exist, there should be policies supporting its existence. In the US InsurTech sectors, for example, policies supporting startups in this niche include the Dodd-frank act, HIPAA, etc. Stay compliant and secure with these best HIPAA-compliant chat apps available today. |

For a better understanding of the ecosystem, we’ll discuss some noteworthy examples.

Three InsurTech Ecosystem Examples

Ecosystems help introduce business models like API-based insurance and microservices. They’re also vital to helping consumers get personalized insurance services. Let’s discuss three ecosystems in this niche:

1. Ping An Insurance

Ping An Insurance of China is an ideal example of an InsurTech ecosystem. Through Innovation, it sells insurance services, and also provides other ads-on like Good Doctor, a care service.

Another service it offers is Pinganfang, a real estate service, and AutoHome which organizes recreational activities.

2. BNP Paribas Cardif

Cardif insurance is another typical example of an InsurTech ecosystem. The company works primarily in the United Kingdom and the Netherlands, to provide insurance services.

Beyond insurance, they also offer other financial services like real estate credit, personal investment, and other consumer-friendly services.

3. Discovery

A South African insurer named Discovery Insurance offers its consumers an ecosystem that entails life, car, and home coverage, together with medical aid and other financial services.

By creating an ecosystem, discovery noted that its consumer base has gained significantly. For example, its health and wellness program users have 28% fewer hospital stays.

This improved its profit margin. This shows that ecosystems are beneficial to insurance businesses.

Let’s discuss more the benefits of the insurance ecosystem.

Opportunities Created by the Insurance Ecosystem

The InsurTech ecosystem opens up a number of opportunities for every business to help make your InsurTech idea stand out. Below are some benefits:

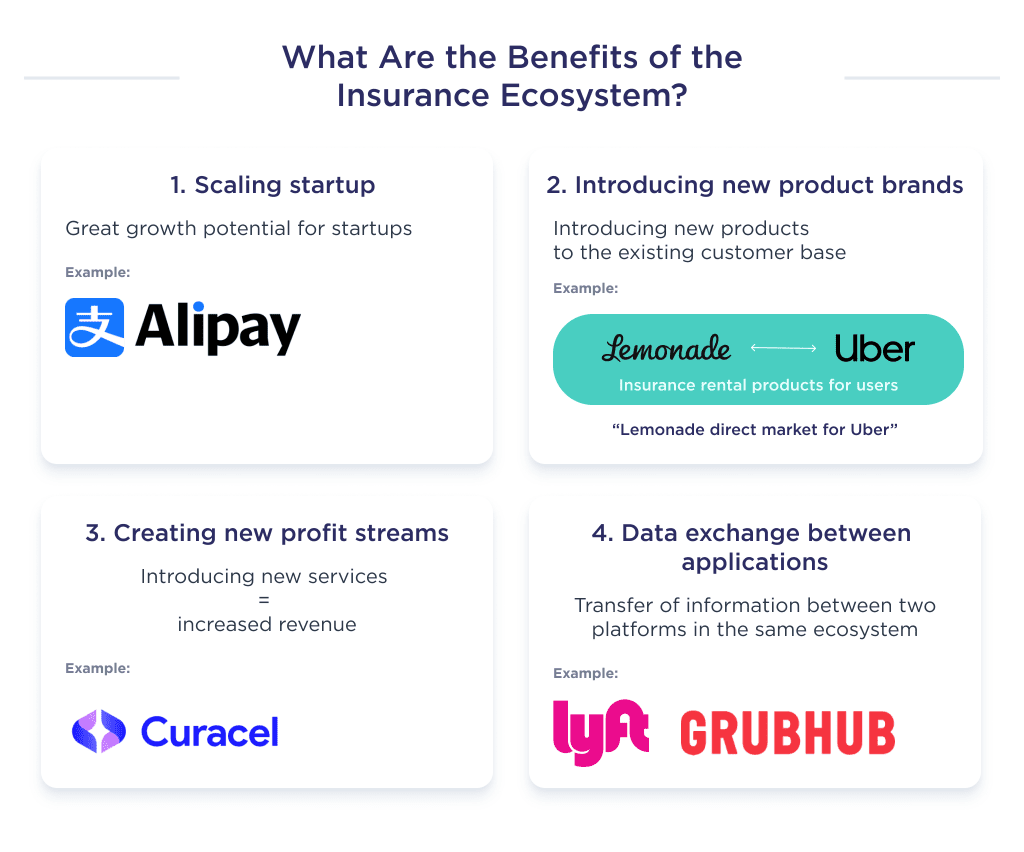

1. Unlimited Startup Scaling Potential

The InsurTech market is expected to be worth 114 billion by 2030 as it’s currently growing at 46.1% between 2022 and 2030. This shows that the growth potential is strong, and startups can benefit from this by plugging themselves into or creating an ecosystem.

One startup benefiting from this opportunity is Alipay Insurance. The Insurtech service usage gained over 5 million new users the month it launched the Alipay super app.

2. Introduction of New Products

One great benefit of InsurTech ecosystems is that they help to introduce new brands of products to an existing customer base. For example, Lemonade Insurance currently helps Uber with its product users’ rental insurance.

This provides Lemonade with a straightforward market for Uber’s 131 million app users.

3. Creation of New Revenue Streams

Ecosystems help to create new profit streams. A study conducted by Sopheon shows that adding more services to an ecosystem adds to your revenue.

Looking to calculate annual recurring revenue? This ARR calculator provides a quick and accurate estimate.

For example, Curacel, an AI-powered system for claims processing was able to seamlessly introduce its embedded insurance service to consumers within its ecosystem. Through this, it has been able to raise its revenue by 20%.

4. Cross-Application Data Exchange

Cross-application data exchange, the transfer of information between platforms within the same ecosystem plays a pivotal role for insurance companies, especially for Insurance companies leveraging generative AI.

Since ecosystems have multiple platforms that are accessed via a single one, the host determines what data is shared.

This ensures that all products get the needed data to guarantee personalized features.

For example, information from the Uber app is exchanged with Lemonade insurance, as they work together.

Another example is Lyft. It shares data with GrubHub, the insurance service in its ecosystem. This enables Grubhub users to get personalized insurance services.

Let’s discuss ways this can benefit your startup.

How to Leverage the Ecosystem Approach to Build a Startup

The Insurtech ecosystem offers multiple benefits. It provides startups opportunities to scale their products. Startups can either scale by using their internal resources or leveraging on others.

Let’s discuss these points!

Scale Using Your InsurTech Startup’s Resources

You can use your startup’s resources to scale your insurance product within an ecosystem. Statistically, this is the preferred method for 77% of organizations.

If you’re interested in using this popular route, ways to do that include

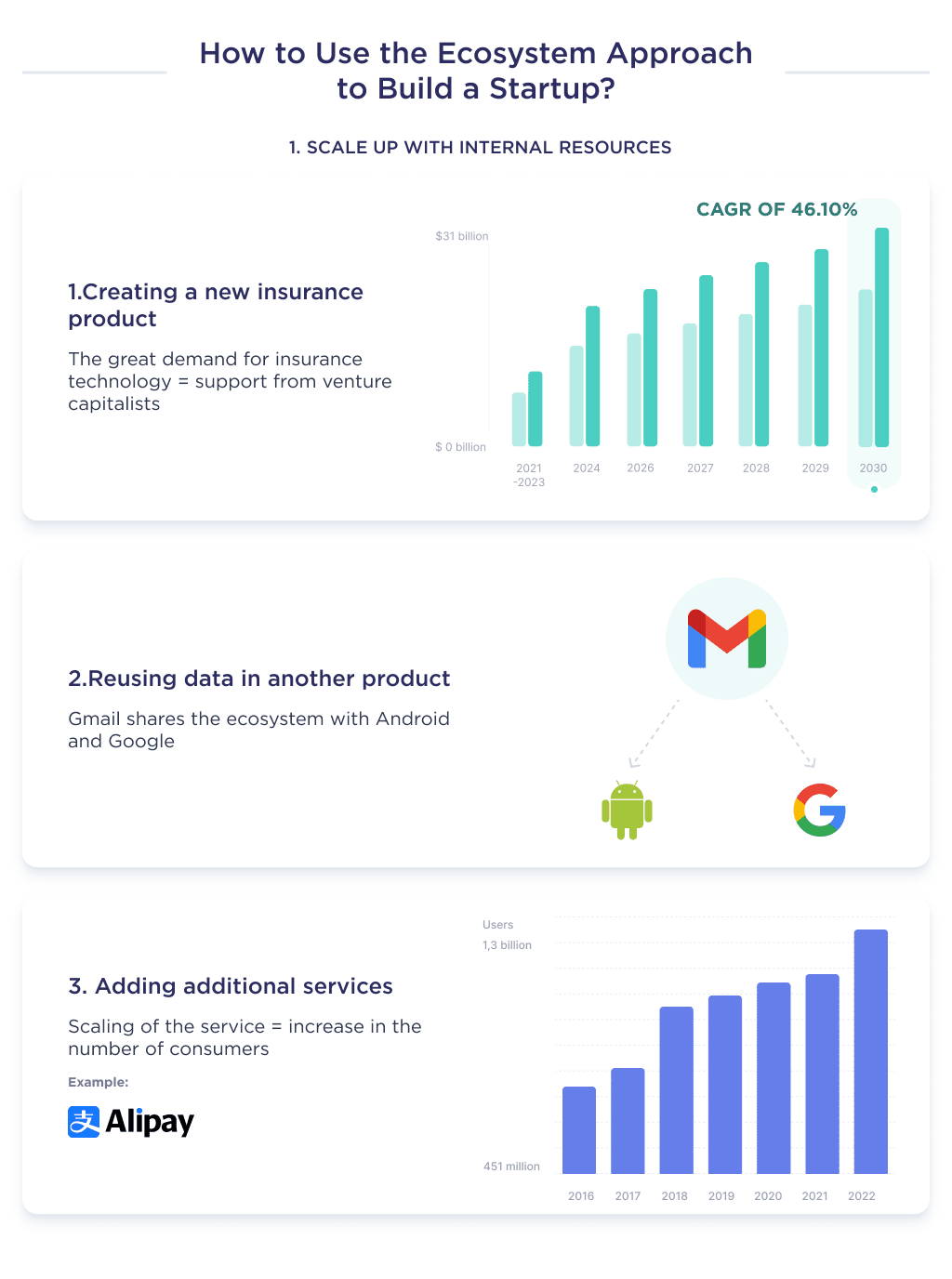

1. Fundraise and Create a New Insurance Product

The demand for InsurTech products is infinite. How? The global InsurTech market is expected to grow at a CAGR of 46.10% from 2021 to 2030. Also, health insurance alone is expected to reach $31 billion by 2030.

By creating an InsurTech product, you stand a chance to benefit from that growth.

On the fundraising side, VCs have shown interest in funding InsurTechsolutions, and statistics are showing that. One such is that the number of InsurTech funding deals increased by 21% from 2021 to 2022.

Also worthy of note is that VCs around the globe raised a total of $10.5 billion within the first 10 months of 2021.

Thus, there’s enough demand for insurance technology, and VCs are ready to back them. A sure way to get started is by creating your own insurance application. Learn more about insurance app development services.

Fuel your startup's growth with tailored mobile apps.

2. Re-use Data within your Reach

A great way to have a leap start is via adopting data from one application within your ecosystem and reusing it in your InsurTech product.

For example: although Gmail was launched in 2008, it had 1.5 billion users in 2009.

This quick growth happened because it shares an ecosystem with Android and Google, enabling it to grow by reusing data from both platforms.

3. Scale your Services

Adding more services to your ecosystem helps you benefit from this approach. For example, a delivery insurance solution in an e-commerce app can significantly increase consumers.

Alipay’s consumer base increased from about 451 million users in 2016 to more than 1.3 billion users in 2023. Simply by scaling their services to include new features and products.

All the methods described above can help you scale with your product. An alternative is scaling using solutions developed by other companies. Let’s discuss this.

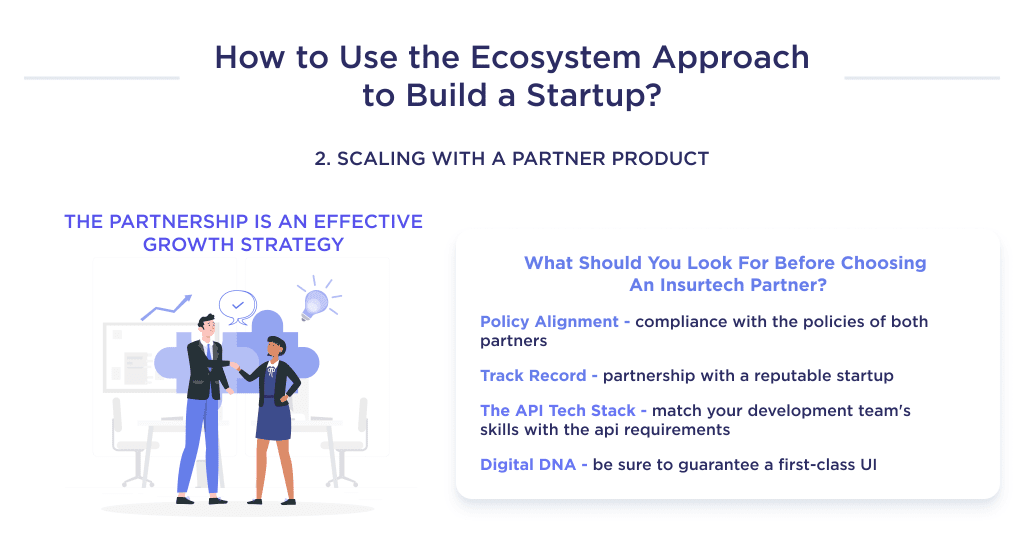

Scale Through a Partner Product

An effective way to accelerate growth is by including third-party solutions. It does this by improving your market credibility.

It’s estimated that over 57% of companies acquire customers via partnership. Another study highlights that nearly half of startups get insights and ideas from third parties.

The statistics above provide proof that partnership is an effective growth strategy. However, it’s important to vet third-party companies and products. Also, watch out for regulatory laws.

Ensure your partnership is complementary. For example, if your startup offers home insurance, then partnering with a mortgage loan provider is great.

Things to Consider Before Choose an InsurTech Partner

Consider the following before you choose a third-party partner:

| Attributes | Description |

| Policy Alignment | Insurance is a highly regulated sector. As such, ensure that your complaint team ensures that policies by both partners align. For example, gambling is illegal in several countries, as such, partnerships between InsurTech and casinos are tricky. |

| Track record | Consider partnering with a reputable startup over one by a less-experienced one. For example, rather than partner with an unknown digital bank startup. Consider more reputable neobanks such as revolut and the likes. This is because a data breach on one solution within an ecosystem can affect others, due to information sharing. |

| The API tech stack | Ensures that API requirements from the third-party solution align with your development team’s coding skills. For example, you shouldn’t partner with a tech product that requires API integration in Golang if you lack a developer that can code in the language. Discover how to choose a tech stack with our expert advice. |

| Digital DNA | Before you include the product in your ecosystem, first vet its digital DNA. Check for loopholes within its software architecture. Also, ensure its codes guarantee a top-notch user experience. |

Upon having an overview of the Insurtech ecosystem, you’re probably interested in digging deeper.

Want to Develop Your Own Product?

In summary, the InsurTech ecosystem presents immense opportunities for innovation. However, seizing this opportunity requires bringing compelling insurance app ideas to market.

If you want to launch a high-performing digital insurance product, the technical experts at SpdLoad can help turn your concept into reality.

Being a Clutch Leader in Ukraine speaks to our dedication and hard work in the software development field.

Our engineers and designers specialize in building successful insurance solutions.

Contact us for a free consultation today to make your product a success story within the thriving InsurTech space.

When working with a development team, a solid partnership is key. Discover more in our app development partnership guide.