Insurance Claims Automation: Benefits and Best Practices

- Updated: Sep 23, 2025

- 7 min

How long does insurance claims processing take?

From one week to several months, depending on the claim complexity.

This tedious process involves paperwork, human review, and often exhausting back-and-forth communication. It can be time-consuming and result in slow turnarounds.

In the case of insurance customers, paper claims are rather frustrating and can ultimately cause trust and loyalty to degrade.

With claims processing automation, this can take as quick as a few minutes or days, depending on the claim complexity. No paperwork and minimal human intervention.

Here, we explore the benefits of claims processing automation for the insurance industry, their role in customer satisfaction, and how we implement automation in our insurance app development services to speed up claims processing.

Explore our SaaS services today

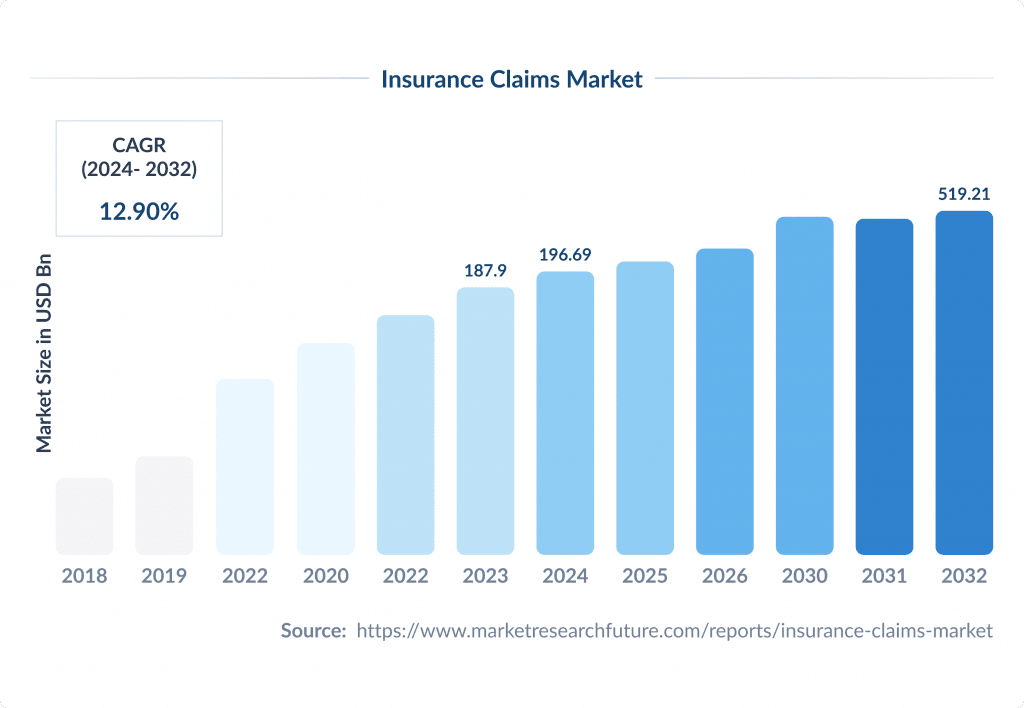

Insurance Claims Market Overview

The insurance claims market is projected to reach $519.21 by 2032, with a CAGR of around 12.90%.

Rising insurance penetration, growing awareness of insurance policies, and increasing disposable income are the key market trends highlighted in the insurance claims market report.

The increasing frequency and severity of natural disasters and accidents also influence the market.

Now, insurance companies are putting more money into technologies that help to streamline claims processing and reduce costs.

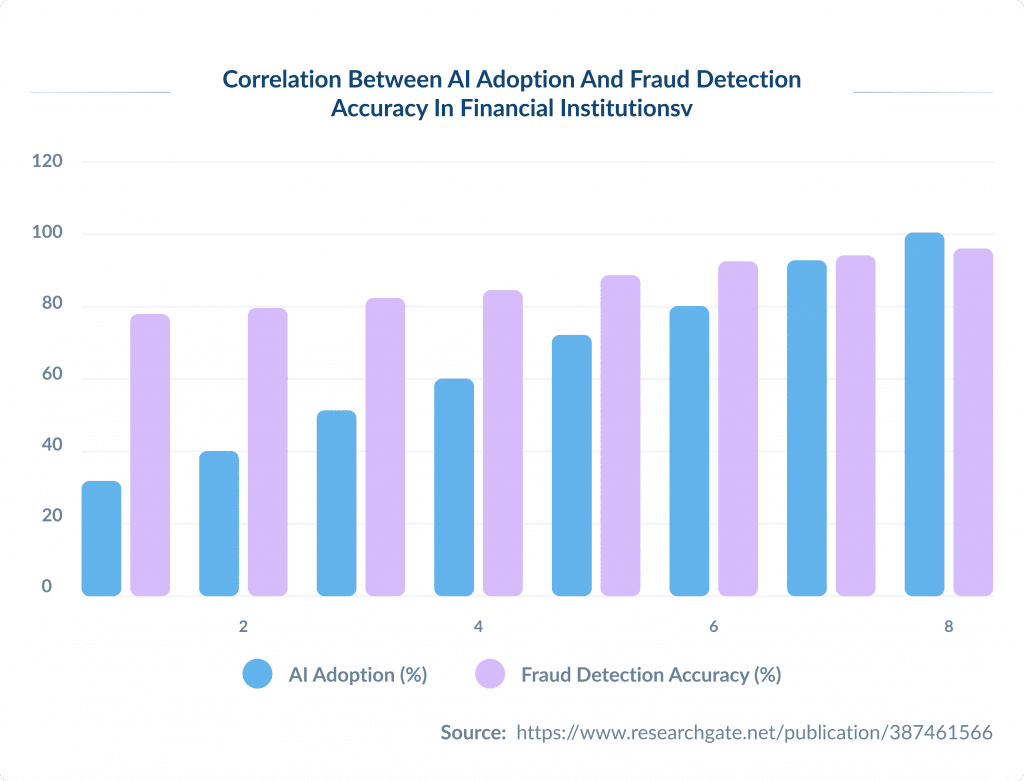

In particular, they increasingly adopt artificial intelligence (AI) and machine learning (ML) technologies.

Overall, digital transformation in insurance is changing the way claims operations are processed and settled.

These advancements enable insurers to streamline their processes, reduce operational costs, and improve customer satisfaction.

The market is also subject to an evolving regulatory landscape and compliance requirements, with stricter regulations requiring insurers to invest in compliance measures, implement robust claims management systems, and train staff on the latest regulatory requirements.

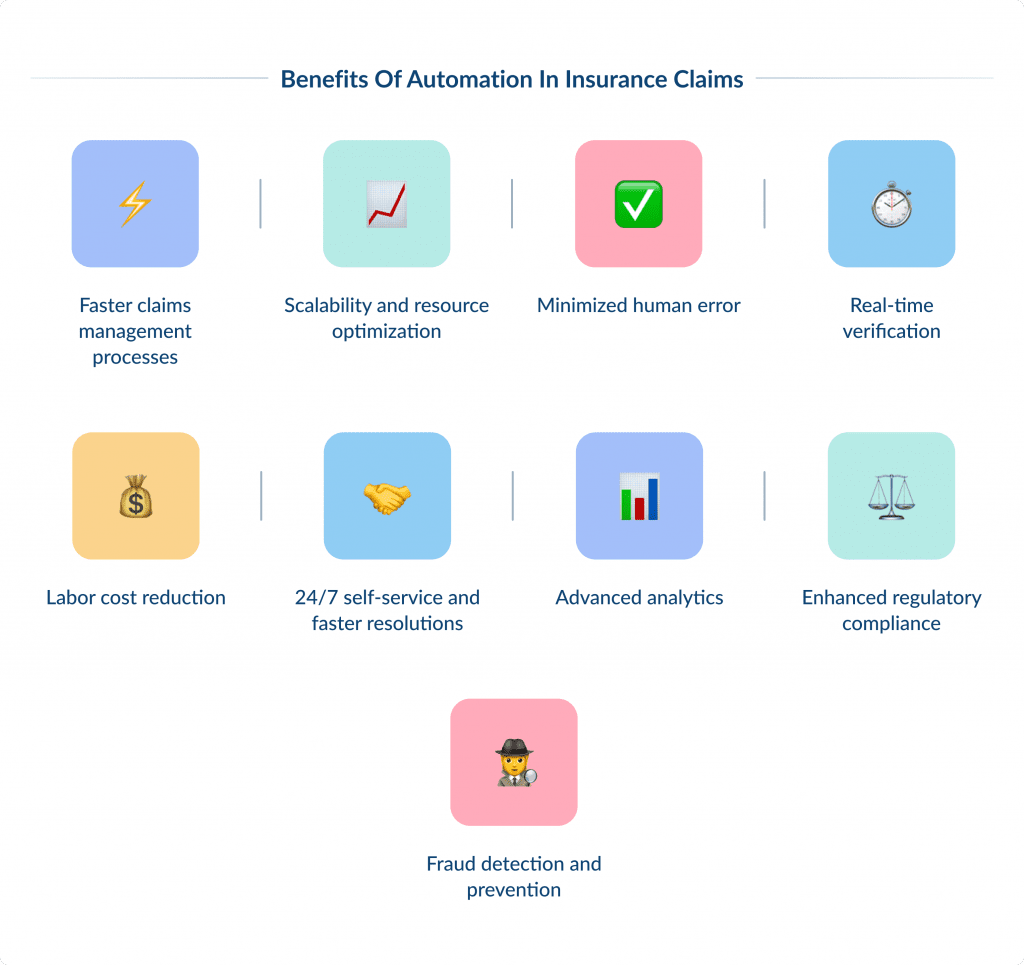

Benefits of Automation In Insurance Claims

The use of technology to process insurance claims, among other insurtech trends, has transformed the insurance industry.

It has made things more efficient, reduced costs and made customers happier.

Here are the main benefits of this new approach:

- Faster claims management processes

- Scalability and resource optimization

- Minimized human error

- Real-time verification

- Labor cost reduction

- 24/7 self-service and faster resolutions

- Advanced analytics

- Enhanced regulatory compliance

- Fraud detection and prevention

With automated claims adoption, insurers are not only streamlining operations but also positioning themselves as agile, customer-centric leaders in a competitive marketplace.

Technologies such as AI and RPA will continue to redefine the claims process, with predictions of 50% automation adoption by 2030.

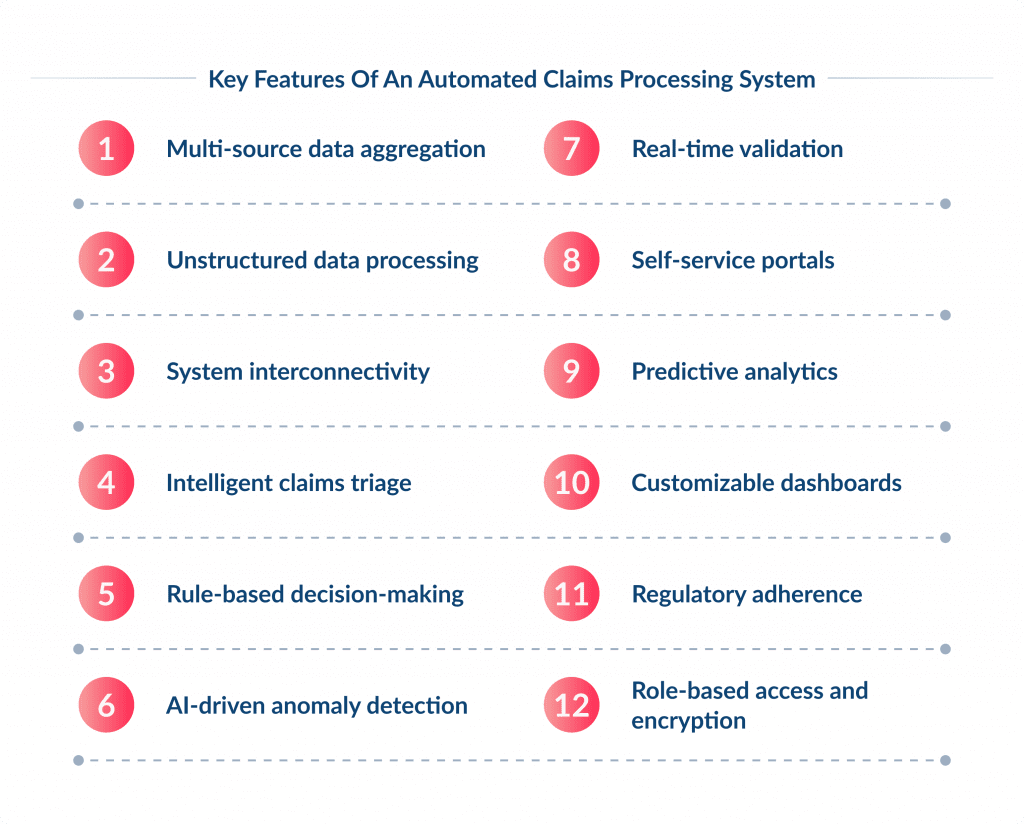

Key Features of an Automated Claims Processing System

- Multi-source data aggregation allows to automatically collect claims from digital portals, emails, phone calls, and IoT devices.

- Unstructured data processing is used to extract insights from medical reports, photos, videos, and text using AI-powered tools like Natural language processing (NLP) for document analysis and OCR. Learn more about natural language processing development.

- System interconnectivity features can integrate the insurance system with CRM, policy administration, billing, and third-party databases for real-time data flow and centralized access.

- Intelligent claims triage helps to prioritize claims by complexity using AI, routing simple cases for instant settlement and complex ones to specialists.

- Rule-based decision-making is used to apply predefined criteria for approvals/rejections, with RPA handling routine decisions.

- AI-driven anomaly detection capability allows to analyze historical data and cross-reference with fraud databases to flag suspicious patterns.

- Real-time validation is used to verify claims against policy terms, third-party sources (e.g., police reports), and compliance standards.

- Self-service portals enable claimants to submit documents, track progress, and receive updates 24/7 via mobile apps or web portals. Explore more about insurance web portal development.

- Predictive analytics enables forecasting claim costs and risks using historical data, IoT inputs, and external factors (e.g., natural disasters).

- Customizable dashboards are handy in monitoring KPIs like claim volume, settlement time, and loss ratios in real time.

- Regulatory adherence allows companies to automatically enforce standards like GDPR, HIPAA, and NAIC, with audit trails for transparency.

- Role-based access and encryption features are essential to protect sensitive data with multi-factor authentication and end-to-end encryption.

Manual vs Automated Claims Processing

What is wrong with traditional claims processing?

Insurance companies have been using the manual method for centuries, so the main reason why you need automation is simply because the manual method is outdated.

It is time-consuming for both insurers and clients.

Submitting claims and supporting documentation is just the beginning of the process, after which claims handlers and other staff have the tedious task of manually handling and processing the pile of documents.

It is also prone to errors and delays. Misplaced or lost documents can lead to longer processing times – and frustrated policyholders.

In addition, the paper-based process often requires multiple touch points and manual handoffs between different departments and individuals.

This can lead to miscommunication, duplication of effort, and a lack of visibility into the entire claims process.

Ultimately, this inefficiency can result in higher costs for you and a poor experience for your customers.

Let’s compare manual claims processing with automated claims processing.

| Feature | Manual claims processing | Automated claims processing |

|---|---|---|

| Processing speed | Slow, takes days or weeks | Fast, often completed in minutes |

| Accuracy | Prone to human errors | High accuracy with AI and algorithms |

| Cost | High labor costs | Lower costs due to reduced manpower |

| Scalability | Limited, requires more staff for higher volume | Easily scalable to handle large claim volumes |

| Fraud detection | Relies on manual reviews, less effective | AI-powered fraud detection improves security |

| Customer experience | Longer wait times, frustrating for customers | Faster approvals improve customer satisfaction |

| Compliance & audits | Requires manual tracking, higher risk of non-compliance | Automated tracking ensures regulatory compliance |

| Data management | Paper-based or fragmented digital records | Centralized digital records with easy access |

Manual claims processing has been the go-to method for years, but it comes with drawbacks — long wait times, higher costs, and a greater chance of errors.

Automation changes the game as it speeds up approvals, reduces mistakes, and makes the whole process smoother for both insurers and customers.

With AI-powered fraud detection and built-in compliance tracking, automated systems not only save time but also add an extra layer of security.

As the demand for faster, hassle-free claims processing grows, automation is quickly becoming the smarter, more reliable choice.

Best Practices for Insurance Claims Automation

Moving to an automated claims system can significantly improve the operational efficiency of your organization.

However, to maximize the benefits of automation, it’s important to follow certain best practices.

Here are a few steps to implement claims processing automation to enhance claims processing.

Step 1. Set Clear Objectives

First, you need to define clear and specific goals you want to achieve with claims processing automation.

These can be reducing processing time by 30% or cutting operational costs by 25%.

This way, you will align automation with measurable outcomes.

You want to start with high-impact workflows (e.g., FNOL or fraudulent claims detection) to demonstrate quick wins and build momentum.

Step 2. Determine the Processes and Workflows to be Automated

Instead of trying to overhaul every process from the FNOL to claim settlement in one go, prioritize the processes that need to be automated first.

This approach will help maintain buy-in and demonstrate value quickly.

To assess processes, consider their:

- Business impact

- Process maturity

- Process complexity

To automate effectively, analyze the existing claims process to identify bottlenecks and inefficiencies.

Here’s what you can evaluate:

- Data collection: Are claims manually entered, or is there an existing digital system?

- Decision points: Which steps require human intervention?

- Fraud detection: How are suspicious claims flagged today?

- Payment processing: How long does it take for an approved claim to be paid?

This assessment helps determine which areas will benefit most from automation.

At this point, you need to remember that some workflows may have to be reimagined before introducing the automation.

Step 3: Evaluate Potential Risks

Implementing claims processing automation, like any other automation effort, comes with certain risks that need to be identified and addressed.

Those risks include:

- Security and privacyPoor security measures can lead to data breaches, identity theft, or compliance violations (e.g., HIPAA, GDPR).

- Fairness and transparencyAI-driven claims processing must be free of bias to avoid unfair claim approvals or denials.

- Safety and performancePoorly trained AI or incorrect data inputs can lead to false claim approvals or denials.

- Third-party risksMany insurers rely on third-party automation providers (RPA, AI, cloud solutions, APIs).If vendors lack security measures, data leaks or system failures could occur.

The specific risks depend on the solution chosen for claims processing automation.

Compile a list of potential solutions and assess their vulnerabilities and risks one by one.

Step 4: Determine Functional and Technical Requirements

Will a SaaS product meet the company’s automated claims processing needs? Or is bespoke development in order?

Which technologies are best equipped for automating the selected workflows?

What applications should the automation solution integrate with?

Consider all these questions, then translate those needs into requirements falling into one of these two categories: functional and technical requirements.

Functional requirements are the features users should have access to as a result of automation. For example, customers seeing and validating prefilled fields in the FNOL form is a functional requirement

Technical requirements describe how the automation solution should be built, what technologies should be used, and what integrations should be available.

For instance, it may have to be compatible with a 20-year-old legacy system or support REST API calls.

Step 5: Start with a Pilot Project

Any automation effort should start with a proof-of-concept.

It allows for promptly demonstrating value and improving or maintaining buy-in, for example.

It also helps determine whether key assumptions about the automated processes are valid.

Based on the pilot project’s results, decision-makers can choose to:

- Proceed with automation on a larger scale

- Improve or change the solution and do another iteration of the pilot project to test it

- Roll out and track progress

While most automation leaders opt for large changes to processes instead of incremental improvements, that doesn’t mean that the rolled-out solution should be carved in stone.

The iterative approach to polishing off the solution is still an effective way to ensure automation sets the company on a trajectory to meet the set goals.

To that end, insurers should keep track of the KPIs and user feedback after the rollout.

Based on the collected information and the type of solution, decision-makers may need to rethink or redevelop certain automation processes or account for previously overlooked scenarios.

Conclusion

Claims processing automation offers numerous benefits and opportunities for insurance companies.

These include faster claims processing, reduced chances of human errors, cost savings, better regulatory compliance, increased customer satisfaction, and much more.

However, the process of claims management automation can be challenging for companies that have relied on manual document processing.

If you are looking for a development team that can help you leverage the power of automation in insurance, feel free to contact us.

You can hire AI developers from our team to create custom solutions that will be tailored to your current business processes and goals.