How to Start Startup: Steps, Strategies, and Tips

- Updated: Nov 13, 2024

- 23 min

People love talking about startup failures – just look at the top Google autocomplete suggestions when you type in “how many startups.” Suggestions include how many fail, how many fail each year, etc.

But let’s talk about the flip side today. Success.

This blog post will cover exactly how to start your own startup and set it up for success from the ground up. No fancy jargon, no technical speak – just practical, actionable advice.

We’ll discuss:

- Why now is a great time to take the leap

- How to come up with and validate a solid business idea

- Tips for building an all-star founding team

- Crafting a kickass marketing strategy

- Raising funds to fuel your growth

My goal is for you to walk away fired up, equipped with a blueprint, and ready to make your startup dreams a reality.

Before we jump into the topic, here are some practical app development tips to keep your project on track and on budget.

Let’s get started!

Unlock your startup potential now — start transforming your vision into a scalable solution with our expert developers today!

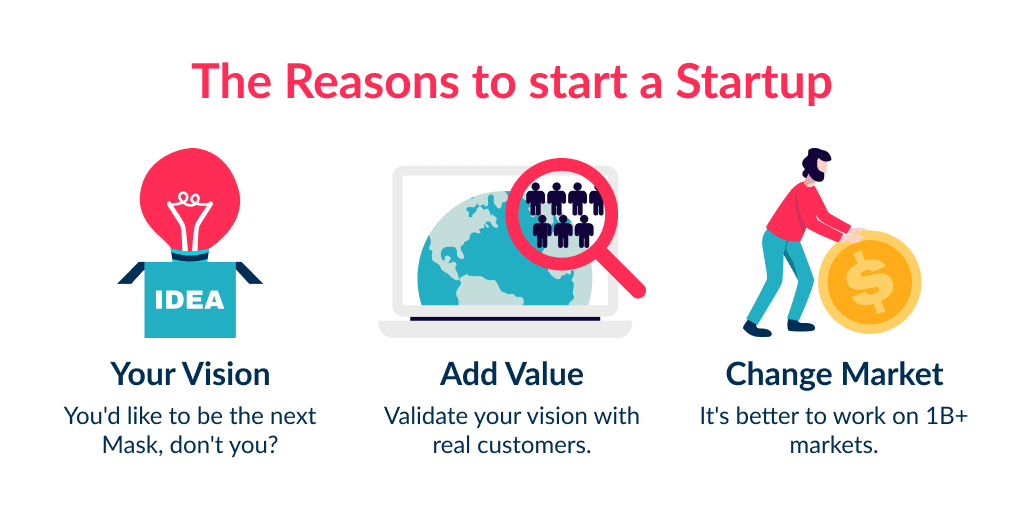

Why Start a Startup?

Some start it for money, others want to help, and some want to make a difference. There are many reasons for this:

- Elon Musk wants to change the world radically and he is still doing that.

- Jeff Bezos wanted to create an everything store, and today Amazon sells truly everything under the sky.

- Bill Gates’ Microsoft is the fruit of his vision.

- Steve Jobs started Apple because he wanted a personal computer.

Notice something?

None of the world’s most successful founders and entrepreneurs were looking to make money.

At least not directly.

They did not have a guide to build a startup and knew how to go about it.

But, they did have the motivation, a set plan, and the dedication to work for their dreams.

We have boiled down the top reasons to know how to start a tech startup company.

Passion for Innovation

Are you the next Elon Musk and looking to build a colony on Jupiter?

Visionary startups founders can be called mad geniuses.

These are the people who are always thinking of new ways to bring the company to new heights.

The motive is to create innovative products and realize ideas that others can only imagine.

By the way, if you are thinking of developing an e-learning app, make sure you check out our guide on top ed tech startups.

Traits of Visionary Entrepreneurs by Founder Institute:

| Attribute | What it Does? | How to Become? |

| Extroversion | Extroversion means to be talkative, assertive, and enthusiastic about everything. This helps absorb a new startup idea and get a hold of what others think. Entrepreneurs are 40% more extroverted than others. | Being an extrovert is good for your business period. And we are beginning our discussion on how to make a startup from here to help you find out your zen. So, to become an extrovert, you need to:

|

| Openness | Being open about everything lets you absorb more, and when you absorb more, you learn more. Plus, founders with this trait are more inventive and creative. On the scale of openness, the entrepreneurs are at a spot 20% higher than average. | Openness here means that the founder needs to let the ideas flow from all the directions and practice using both sides of the brain. Remember, it does not only take intelligence to start a startup. You must also know how to be creative. If intelligence was the only thing required, Einstein or Newton would have set up empires. |

| Fluid Intelligence | Intelligence may not be the only thing, but it is required. This trait helps solve problems and complete challenges. And trust us, you will face challenges in your journey. But, there is nothing that a visionary entrepreneur cannot tame. On average, entrepreneurs are 10% more intelligent than non-founders. | To completely understand how to start a start up, you need to gain fluid intelligence. And to gain this ability, be creative, don’t move away from challenges, and socialize as much as can. In other words, every experience is the grist for your mill. |

Adding Value

What venture capitalists are for a startup, a startup is for the consumers.

Startup founders that believe in giving more to the community look for ways to add value.

It can be via a product, a service, or even a by-product.

Also, adding value does not mean that you are imitating an idea. It is about improving a product and giving some better to the customer.

When you choose to add value, you must think about improving convenience, customer service, and enhancing the way of life.

Many startups are now integrating artificial intelligence in customer service to provide faster response times and personalized support. Customer service matters a lot in startups so it is important that you implement advanced customer portal software and have a proper phone system or chat system in place.

Large Market Opportunity

Well, we cannot ignore the fact that successful startups print money faster than a minting machine.

This is because they enter a market that was earlier, not at all aware of a product.

It is like they have created a new market segment.

Think about the time when Uber came out.

It may not have been the first product, but it created the space for a new market, and the rest is history.

This is the part-philosophical part-practical aspect of how to create a startup.

Here is your roadmap to building the next Uber — find out about taxi app development.

Now, let’s move on to a more detailed and technical part.

Moving on with how to make a startup, we will begin discussing the concept of an IDEA.

How to Launch a Startup

This is going to be an exciting journey.

If you have decided to become an entrepreneur, remember that failure is a part of success.

But you should not quit, albeit keep on going.

Before Alibaba, Jack Ma worked at 30 different jobs. At the time of Alibaba, he was 42.

How to start a tech startup is not only about the company.

It is about you, your idea, your vision, attitude, and the ability to learn.

First thing’s first, you must come up with an idea.

See how to find an idea for a unicorn startup with market potential and scalability.

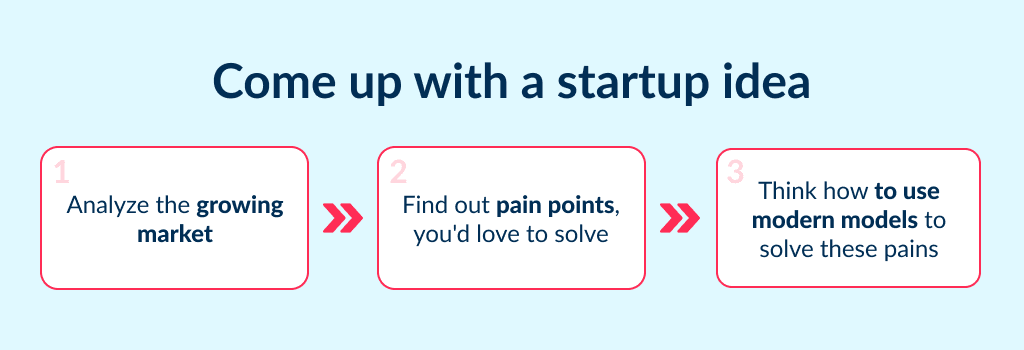

Develop an Idea

No, you do not need a brilliant idea.

To build a startup, you only need a viable idea for a unicorn startup.

Read on to know the process of getting a viable idea.

| What to do | How to do it? |

| Analyze the growing markets | You need a business plan. And understanding the market is the first step in creating a business plan. A startup market analysis requires 8 do-follow steps:

|

| Research How to Make it Better | Reiterating the fact that you must not focus on how to start a tech startup company with a completely new idea. For that, you require to develop some new technology or use an existing tech in your novel manner to disrupt the market. If not this, then you are most probably entering the market with a product which is already there. Do you know how to make charts and graphics? If no, then start learning. Competitor analysis is imperative to develop a market-fit product. Start by self-evaluation:

Always remember that the customers are not looking for the same solution. They already have a solution. Now they need something better. Always include real-world evidence solutions in your market research. The market size of collecting this kind of business evidence is estimated to reach up to $1.8 billion by 2026. Lastly, to get an accurate answer to how to start a startup company, including your product’s economic, social, and cultural impact in the research. |

| Imbibe Successful Models for Other Problems | According to startups.com, it takes around four years minimum to build a startup. How to do that will depend on case to case. So, when you are thinking of an idea, always keep this in mind. It will help you finalize how to start a tech startup company. This is a game where perseverance and determination pay off more than your bank balance. While creating an idea for your startup, do not hesitate to leverage other development models into your business. Indeed, we are not asking you to imitate, but if some organization is already progressing with a model and fits with your business, imbibe it. |

| New Solution > Old Problem | Whatever idea you create, always ensure that it is better than the existing version. If you are copying your competitor’s word for word, you have already lost. Hear this, in the 1950s, the average period of an S&P 500 company to stay on the index was 60 years. Today, this time has come down to 20 years. Strange, right? If only these companies would understand the power of the customer perspective and innovate. And here you are, looking for answers to how to make a startup company from scratch by cloning. No, such an idea will only face the dust. In other words, identify your competitive advantage, innovate, procreate, and enhance. |

After much research and analysis, you finally have the idea that it can disrupt the market.

Your idea and the first step in how to start a growing startup is now underway.

Getting an idea for your startup is great, but before we talk about the development and team-building part, let’s validate the concept.

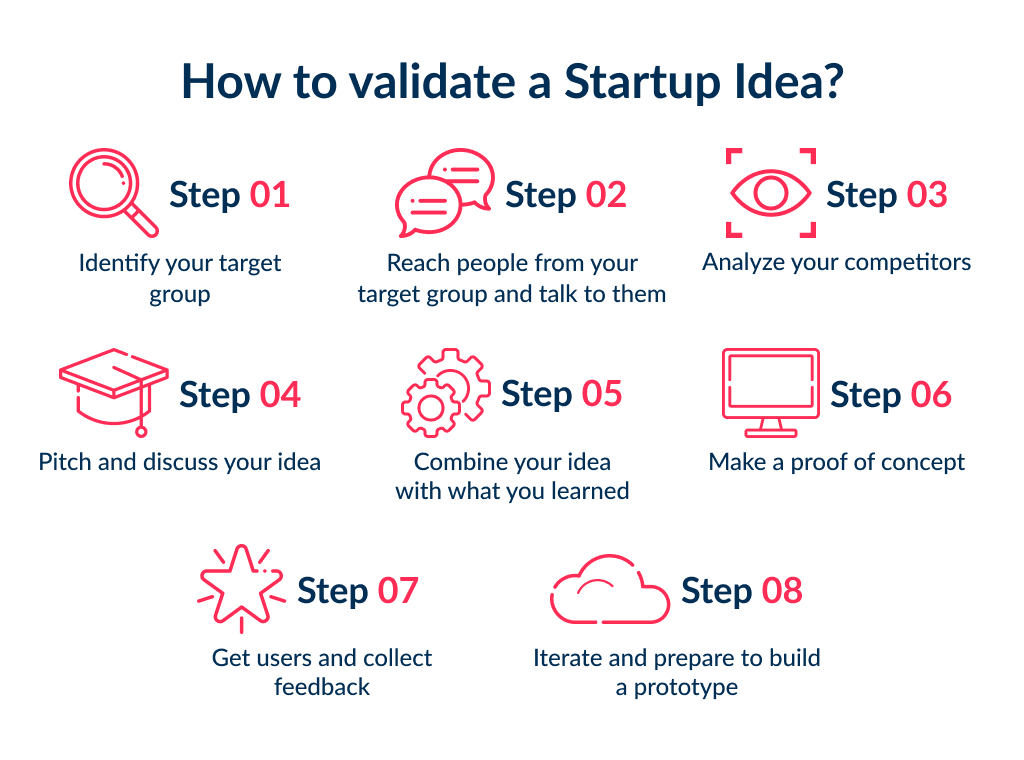

Validate Your Idea for Success

Before we move ahead, take note that idea validation and idea generation are different.

In the latter, you get an idea and test the waters.

You identify whether the answer to the question of how to start a good startup with this idea is positive.

Why do we validate an idea? Is it important in how to start a tech startup company?

Two reasons:

- Know that if the product is the right fit for the time and the market.

- To identify the chances of selling and recognizing the buyers in the process.

Not everyone will buy your product, and one product cannot serve everyone.

Even the drinking water has thousands of brands, all with their unique identity.

Fuel your startup's growth with tailored mobile apps.

Idea validation is the core step.

Several MVP tools and its auxiliary aspects contribute to its completion.

The journey of an entrepreneur is very interesting and taxing, but it is satisfying and rewarding.

The core motive of idea validation in how to make a startup is checking how far can your idea run.

There is nothing more important than knowing this.

So, let’s take a detailed look at what goes under idea validation.

Because if you do it carefully, you will get honest feedback, which will lead to the launch of your startup on the right terms.

That is why pay attention.

| Steps | Description |

| Get Customer Feedback | There are multiple ways to get the feedback for your idea. Go talk to your friends and family. Put forth a situation and ask them what they would like to have to solve it. Identify the gaps that you can fill with your product. This will help you in creating a features list for the MVP. Don’t stop here. And don’t fixate on your idea. If the need arises, be ready both mentally and monetarily to make the changes. Use the internet. Basically, the idea validation process has four aspects:

We have already covered points 1 and 2 in the above sections of how to start a startup business guide. The feedback aspect covers the point 3. This is all a part of the feasibility study. Now getting feedback from the web is convoluted. It involves playing with all sorts of toys at once and then collating the entire pool of data to get your answer. The best tools for a feasibility study or feedback, both user-generated and data-based, include:

Also, use online data analysis tools to work faster and get better accuracy. But until then, Fake it ‘til you make it. Start with conducting online surveys, sending emails, and interviewing people. With these things, you will have to extend an arm out and reach the people. In the next step of how to validate and start a startup, we will see another method. |

| Landing Pages and Advertisements | After surveys, you can also use a landing page or a one-page website to create a data pool of interested potential customers. Landing pages and advertisements are connected. You post ads on platforms like Facebook about your product and see how many people have visited the landing page to know more about the product. Add good CTAs to inspire the users to engage more and give feedback. Here, it is all about A/B testing the product and identifying its market fitness. There is a flood of tools in the market that can help you create landing pages and connect them with email marketing. Again, collect the data to read the market’s pulse. |

| Prototypes, Proof of Concept, and MVP | Do not create all of them when you are still learning how to create a startup. Start with one and if the need arises, move to the other. But, if you have got your answer, do not waste resources on the other. Hit the waters.

As the name suggests, here you are not focusing on building the actual product or even the MVP. It is all about gathering proof for your concept. You think this way: I have an app idea and built a plan for its development and deployment. That is great. But before deployment, do you have everything in favor of your product or not? That is PoC for you. However, the USP of this method is that it also includes the technical part of the development. If it’s an application, you will also have to list the SDK and other technologies required.

After PoC, start making the outlay of the product and decide how it will look. These are the things that you might use for your advertisements. Prototypes include dealing with the UI/UX part of the development. It also helps in identifying the features and making heat maps according to the customer’s preferences. The best part about the prototype is that it is a PROTOTYPE. There is no rule saying that you have to stick to the prototype. It can change as many times as you want. But the changes must occur by keeping the end-user in mind. We would recommend knowing about the Wizard of Oz prototyping. This is an integral part of any new product development and receives an honest, detailed, and actionable review.

At the end of the entire process, you will lay your hands on the MVP. MVP is vital if you want to understand how to start a tech startup company. This is the step when you capitalize on all the previous research, market understanding, customer profiling, and features inclusion. But, this part of how to make a startup company comes only after identifying the core features of your product. Without that, do not create the MVP, as it will not deliver the true value. Plus, you will not get the accurate cost of MVP. Developing an MVP will also help you secure funding (more on this later). It gives the potential users a chance to use the product, test it, and review it. So, this also helps you fine-tune your product as you grow and gain more traction. Not only startups, but even the more established companies like Sony thrive on constant product updates. Case in point, the previous version of the Sony AS 7 III did not have a flip screen and an HDMI port. But, they added it in the upgraded version because the customers and fans demanded it. Similarly, you are building a startup, and your only hope is to accept the product by the users. Ergo, listen to the feedback, implement the changes, and then you will have a minimum viable product in your hands. |

Got the point?

Now that is how you identify the product viability before you start a tech startup company.

Ok, the product or solution is ready to disrupt the market.

But who is going to build everything? Can you do it alone?

Of course not. And even if you do, you should not do everything alone.

This means that you need to hire some people.

Build Your Team

Consider getting two teams;

- Founders team

- Operational team

Founders

The founders team is not a necessity. If you think that you can do it alone, ignore this.

Most of the time, founders look for their co-founders because of their lack of experience and knowledge in the field.

One of the founders can be from a non-technical background, while the other can be from a tech background.

The tech and non-tech duo work for the benefit of the organizations.

The dual partnership alone gets you the answers to how to make a startup company easily.

Three things are imperative for an epic founder’s team.

| Pointers | They Matter Because |

| How Many are Enough | 2 is the magic word. Having two founders is better from almost every perspective.

Sometimes, three can also work, especially if you have a large scale production or it is too technical. But anything more than three is calling for chaos. It can lead to frequent clashes and indecisiveness. Especially in how to start a tech startup company, 2 founders will be great. |

| Kind of Team | Steve Blank is a veteran Silicon Valley Entrepreneur. He says that to build a team utilize the Business Model Canvas. This is a concept that contains nine crucial aspects of every business. So, if you can paint your business into this model, you will get an overview of the responsibilities and layout of the project. From here, you can get yourself a team. Thinking about offshore development? This guide explains how to hire an offshore dedicated development team. |

| Extra Traits | Education and Experience are not the deciding factors. They might come under eligibility. But to get yourself a founding team, look for communication, respect, trust, adaptiveness, and diversity. To identify the understanding and communication levels, use the DISC test. It gives a better picture. |

Want to build a strong founding team? Start by learning how to find a technical co-founder.

Operations Staff

Understand that more than 50% of startups fail due to bad teams.

Not focusing on the failure part, understand that 50% of the startups do not fail due to a bad team.

This means that they have a great team, to begin with.

Here are the traits of a successful startup team and how to build it, by HBR.

- Product Knowledge

- Industry-relevant skills

- Soft Skills

- Work Experience

The same HBR report also cites that,

“Startup Teams showcasing high experience, but low passion are weaker on the whole.”

That’s it. You have another one-line answer to how to start a start up.

So, don’t drool on experience and academic qualifications. Most of the startup founders are not after money.

The same goes for the team.

You need to look for developers and designers in the beginning.

Well, before you start choosing the developers, make sure to look at our guide on:

These guides target two vital aspects of how to start a startup.

Make sure to follow them.

Before we move ahead with the marketing plan development in how to start a tech startup company, remember.

A passionate team that believes in the product is much better than a group of students coming straight out from the IVY league and don’t understand compassion.

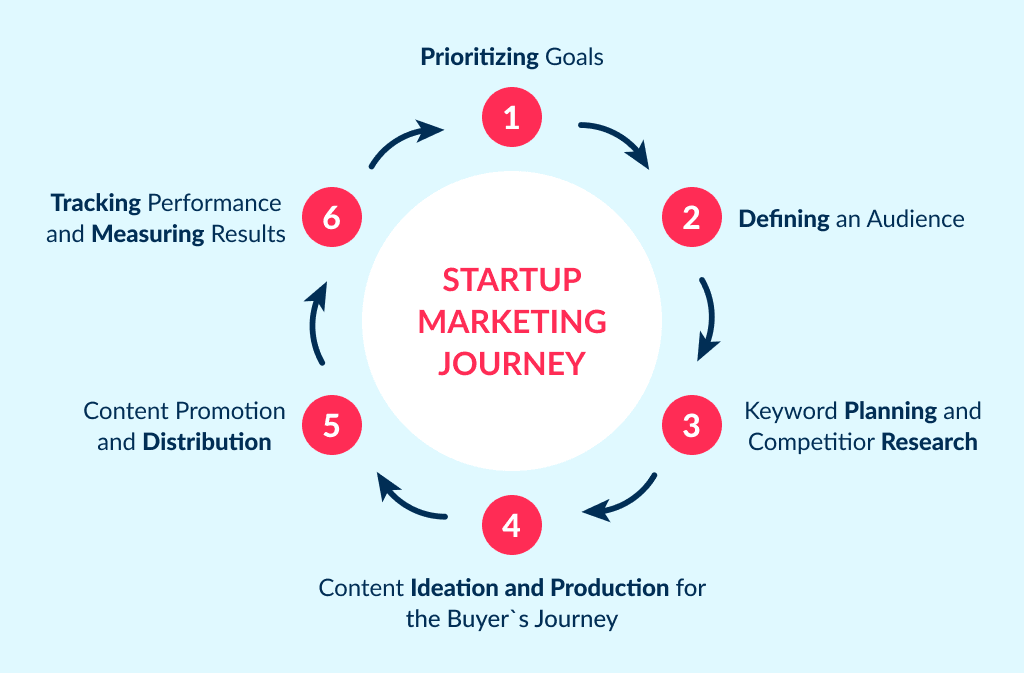

Create a Marketing Plan

It is time to let the world know of your startup’s presence and here’s how to start with the marketing.

It is possible that by this time, you are already more cautious about your spending.

Product development takes a lot of toll on the finances.

Well, a great way to compensate is to bring paying customers ASAP.

And that is where marketing comes in.

Here we are not talking about setting up landing pages or a couple of adverts on Facebook.

This is the real deal.

You may have to work tirelessly and take care of more than one thing at a time.

Work to let people know about your product.

If you are looking for ways to elevate your email strategy, our email marketing for startups tips are here to help you communicate effectively with your audience.

| What to do | But, How? |

| Make them Aware and Drive Traffic | Start by making people aware of your product. If anybody doesn’t know, how can they buy or subscribe? So, initially, your campaigns should only talk about the product and what it means for the people. For this, you can choose one or more than one of these methods.

Ready to build the next big social platform? Learn how to create an app like Instagram. Use the appropriate methods to drive traffic to your product. These things also depend greatly on the customers. For instance, Tinder wanted to attract and convert the local customers. To achieve this, they planned parties in California. The people attending must have Tinder installed on the phone. And just like that, Tinder’s user base grew by 15000 accounts in one night. So, go where the customers are. If they are global, run campaigns that connect the global user to your product. Segregate the audience and then target them. Here are the top 12 places to find your customers as per the Founders Institute. Create your own Tinder-style app. Discover everything you need to know about how to make an app like Tinder. For advertisers looking to maximize exposure, our CPM calculator helps manage costs while reaching more people. |

| Get Customer Feedback | Directly or indirectly, every type of awareness campaign is about getting customer feedback. Sometimes, the feedback will not be verbal. Haven’t you heard, actions speak more than words. That is why set up measurement tools. Get the metrics and understand them. Know what it means by:

And so on… Tracking customer retention is essential, and churn rate calculator can help measure your customer loyalty. For verbal feedback, you already have the questionnaires made for the surveys. Modify them to include the product information and ask the users how they would engage with your product. It is about knowing what your customers want. All of us have seen the one guide that talks about why startups fail. Without looking at reasons in here, understand that nothing works in a vacuum. The real reason for a startup’s failure is not one. Rather it is a combination of more than one factor. And it is not immediate. One of the reasons can trigger the sinking drop. But something must have been building up in the shadows that gradually brings everything down. So, take care of all the aspects and work accordingly. |

| Convert Them | Conversion follows awareness. Whatever data you have gathered from the awareness campaigns, use that to convert. Conversion means that you need to ace various sorts of marketing methods.

These are the web-based methods and more conducive for a country-wide and global audience. Discover how to take your business worldwide with these 6 tips to help your startup gain global recognition. For a local audience, you can also try;

But, the engagement with these may differ and even disappoint sometimes. Always remember these three things;

|

| Value and Virality | Again, very few startups founders are after money when they launch their venture. The focus is on building value. And that is the key to how to build a successful startup. Have you ever thought that any restaurant that serves the best food in the town does not go out of business? Why is that? Yes, because they serve good food. When the product is good, people pay It seems strange, but it’s true. Look at Apple. People line up to buy the new iPhone. Why? Because they provide value as no one else does, and it pays. Use the right marketing channels to create virality for your product and generate authentic, honest, and reliable value. |

When you have everything, the money will start to flow in.

You generate cash regularly and consistently.

And money is one of the things that you always have to be smart about when learning how to ideally start a startup.

Iterate to Achieve Product-Market Fit

Crappy software and solutions bloat the market.

The real bummer is that companies spend billions of dollars on these products.

- 2019 – $229 Billion

- 2023 – $500 Billion (Expected)

Some of these products might be lacking in more than one way.

Their lack is your opportunity.

We focus on analyzing the customers, their pain points, and the problems they face with current products.

You might have already considered everything.

If you did, GREAT!

But it does not stop here.

We need you to iterate the process until and unless you deliver what the customers want.

Because that is the way to build a startup and under how to attract the customers.

| What to Do | Why? | Does it Matter? |

| Hypothesis to Test | By now, your product should have gained the required audience. Understand that you cannot stick to one product. Update constantly. For this, always create a hypothesis for your product and test it. Here’s how to test the hypothesis:

| Yes, to a great extent. Testing the hypothesis means that you understand what your customer wants. You run an ad about a potential new feature and record its response. If the response is good, you can add it. If the response is not good, drop it. |

| Metrics and Analytics | Data is crucial to truly understand how to make a startup. You gain metrics from all the online marketing channels. Every single figure that you include in your campaign is essential and has a role to play. In other words, these figures are the representatives of your audience’s concerns. So, get the metrics, record them, and analyze them. These steps are the repetition of what you did earlier. But now, you have some data in the background and have a better understanding of the target market. | It matters to a great extent. While learning how to smarlty start a startup business, you need to understand the customer. Without that, you are only shooting blind arrows and hoping that it hits the bullseye. So, if you want to do it right, record the metrics, analyze them, and implement the changes. |

All set?

Just a couple of things more in how to start a startup, and then we part ways.

You may have some money, but you need a lot of money for your startup.

Let’s know how to get that.

Funding

Funding should not be your first step. It has to be the last.

The reason being, investors need to see some data.

If you are an entrepreneur, you must have seen the show Shark Tank.

Notice how, almost every time, the sharks ask for numbers, sales, network, customers, ROI, etc.

Explore our SaaS services today

Because they want to know whether the product has gained any traction or not.

That is why, as a founder, you might have to finance the initial stages yourself to secure a better chance of getting the funds.

Read our guide on how to get investors for a startup.

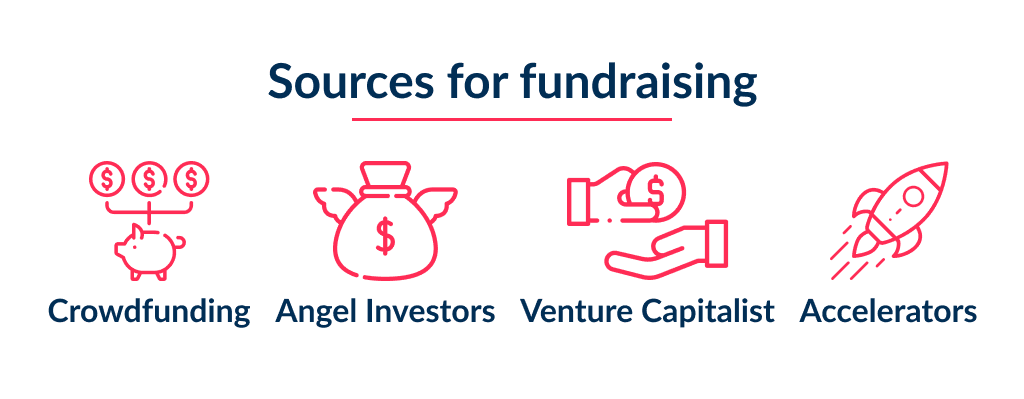

Funding Sources

| Source | Description |

| Crowdfunding | Crowdfunding channels like Kickstarter, GoFundMe, and others help founders get money from the actual users. Not only the investors here are potential buyers, but they are also sources of free advertisements. Therefore, put your product out there for the small investors to see and complete how to perfectly start a startup. Planning a crowdfunding platform? Learn what goes into crowdfunding website development. |

| Angel Investors | The name is enough. Angel Investors come to your rescue like an angel and fund the entire project single-handedly. They might reel in one of their friends too. The benefit with angel investors is these are the people who can say, “been there, done that.” Most of these investors were once looking for the answers to how to start a tech startup company. They were successful, and now they have tons of money from their last venture. Since the angel investors are more relatable, they will understand you better and look at the founder more than the money. But, you must study and pitch your investor accordingly. In any case, be true, honest, and realistic. |

| Venture Capitalist | These are the big guns. They invest heavily, and once they do, your startup will certainly get a lot of attention. But reaching and attracting them is easier said than done. Plus, the Venture capitalists part comes later in the journey. Probably after 3 to 4 years. So, let’s focus on sustaining for four years first. |

| Accelerators | The last method you must know how to get funds and create a startup are accelerators. Accelerators are not only great for getting funds. But they also help with:

|

Funds are in! Awesome.

Now the only question remains with how to start a tech startup company: how much does everything costs.

How Much Does It Cost to Build a Startup?

Everything depends on your needs and requirements.

Due to the open-source technological innovations, the total cost to start an app or other kind of startup has reduced.

So, the final cost will depend on what sources you will use to build your product.

Moving on, there are two types of costs One-time and Recurring.

The one-time costs include:

- Licenses and permits

- Registration and incorporation

- One-time payment of software

You can also save money on legal fees by starting an LLC. As the first step, you need to learn how to start an LLC.

Other things like rent of the property and infrastructure can be avoided initially.

You can either choose to work from a coworking space that has the rent but no infrastructure cost.

Or work from home.

LLC costs have an annual fee but there are some frequently recurring expenses that you need to keep an eye on.

These are:

- Marketing

- Salaries

- Website maintenance

- Repayments

- Development costs

For the initial years, all these expenses may pinch. But when you start getting the results, it will feel good.

Ready to Develop Your Own Startup?

Starting a successful, scalable startup is no easy feat. As exhilarating as the journey can be, the process is undoubtedly demanding.

When the pressure ramps up, know you don’t have to go it alone. Lean on the expertise of a dedicated startup consultant like SpdLoad.

With over a decade of experience fueling startup success stories, our team can provide invaluable guidance on:

- Validating and optimizing your big idea

- Crafting an MVP that attracts investors

- Assembling a dream team

- Creating buzz and driving early traction

- And more

We don’t just develop innovative products. We develop founders, giving you the insights and confidence to turn your vision into reality.

Successful apps are often the result of strong partnerships. Learn how to build one in our article on app development partnerships.

Our collaborative, transparent approach focuses on understanding you and your users first. This allows us to bring products to market that deliver real value fast.

Let’s connect to explore how our startup consultants can amplify your success.

Startups often overlook branding — but a strong strategy can set you apart. Here’s how to develop a brand strategy.