7 Brilliant Insurance App Ideas for Startups to Launch in 2025

- Updated: Aug 27, 2024

- 9 min

The insurance industry is ripe for disruption by new app ideas that make getting coverage easier and more customized.

In this blog post, we’ll look at some promising opportunities for startups and entrepreneurs in insurtech.

We’ll cover:

- What’s driving growth and interest in new insurance apps right now

- The types of insurance app ideas that are hot with investors

- 7 specific app concepts that could be big winners in the next few years

- Key factors to consider if you want to build your own insurtech product

Let’s check out what makes insurtech such an exciting field today!

Building a startup is challenging but rewarding. This guide shows how to start a startup from scratch.

Bring your app idea to life with our expert software developers — contact us today to get started!

Why Launch a New Insurance App Now?

Many startups partner with a mobile app development company to create an InsurTech application because of an:

- Increase in global market size,

- Investments from venture capitalists into insurance-based startups,

- And an increase in the usage rate.

Let’s discuss each reason.

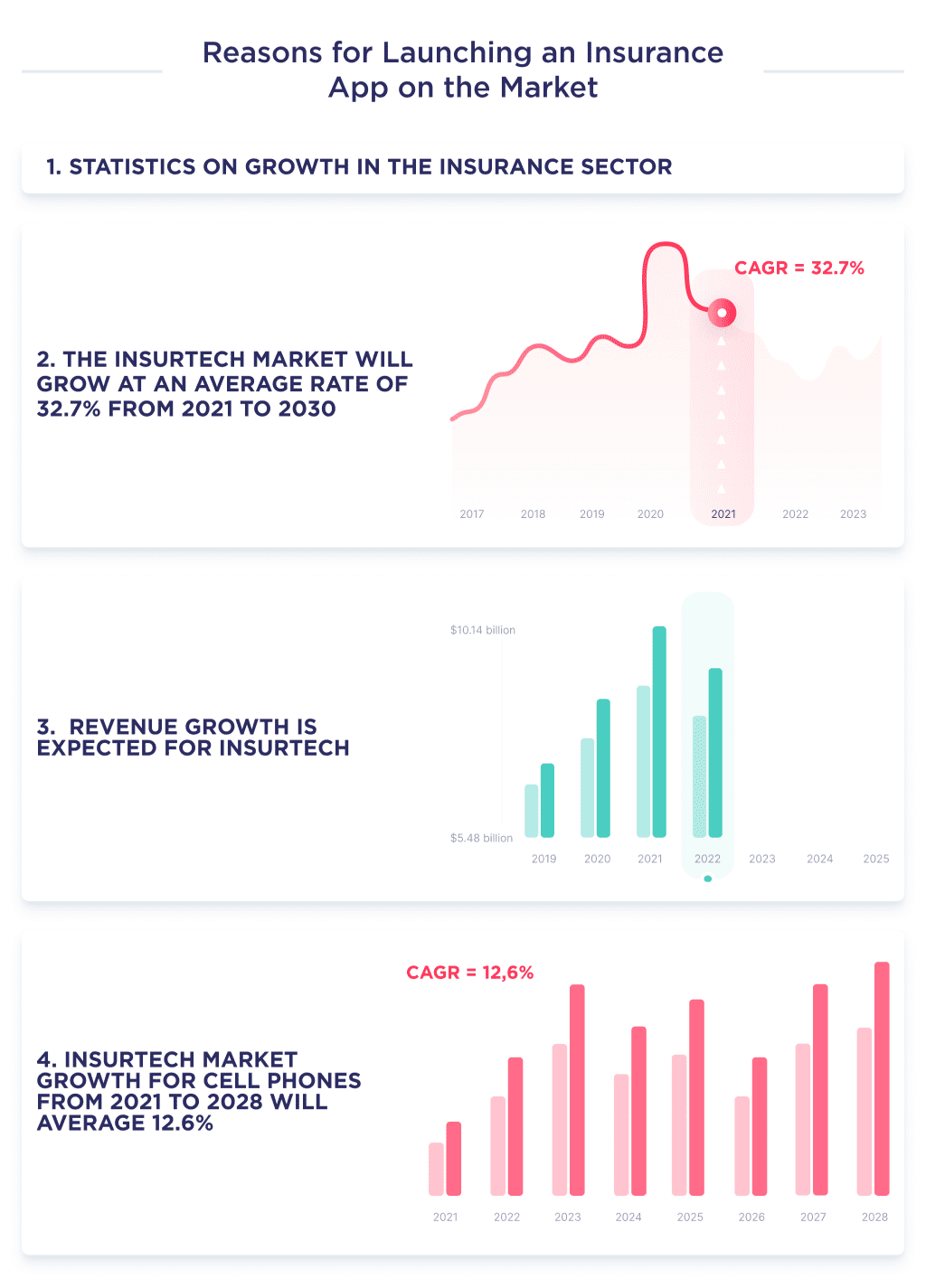

1. Growth in the Insurance Industry

Numerous growth statistics from the InsurTech space suggest that owning an app is a risky but justified move. Here are some:

- The global InsurTech market is expected to grow at a CAGR of 32.7% from 2021 to 2030;

- The revenue forecast for the InsurTech sector is expected to grow from $5.48 billion in 2019 to $10.14 billion in 2025;

- Premiums paid to insurance companies exceeded $4.9 trillion in 2017; See 15 examples of insurance companies that dominate the industry.

- The global InsurTech market for mobile phones is expected to grow at a CAGR of 12.6% from 2021 to 2028.

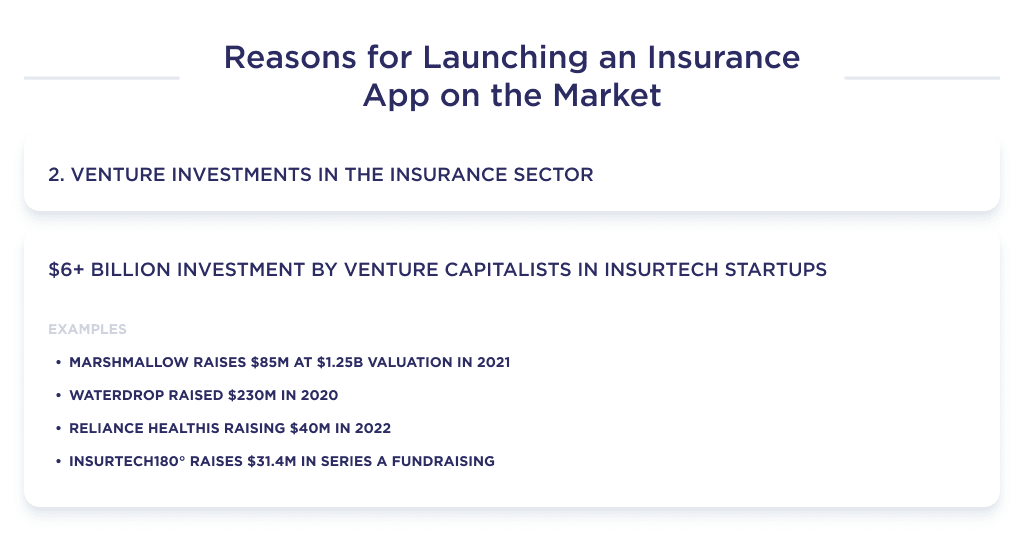

2. Venture Capital Interest

Below are some statistics suggesting that numerous InsurTech firms are getting funded, irrespective of the country where they’re domiciled:

- The VCs invested over $6 billion in US-based InsurTech startups in 2021;

- The UK’s Marshmallow raised $85M on a $1.25B valuation in 2021;

- China’s Waterdrop raised $230M for its crowdfunded, mutual aid InsurTech platform in 2020;

- InsurTech attracted 10% of investment into FinTech in 2021; Explore the fintech trends that are revolutionizing the financial sector today.

- Nigeria’s Reliance insurance startup raises $40M in 2022;

- Brazil’s InsurTech 180° raises $31.4M in its Series A fundraising round.

3. Increasing Usage Rates

The demand from users is another reason to own an InsurTech product. Here are some statistics that align with this point:

- Health insurance app installation on mobile devices rose by 36% in January 2021 alone;

- Mobile application downloads of digital-only InsurTech platforms grew by 461% over the past three years;

- 42% of Europe-based healthcare insurers have an effective app; Looking for innovation in healthcare? Here are some of the best healthcare startups leading the way.

- The percentage of motorists with an auto insurance policy in the United States has been on the increase since 1992.

The three set statistics above show that the insurance technology market is overgrowing, and VCs are also ready to fund startups in this industry.

Let’s move on to a review of the best insurance app development ideas.

7 Hot Insurance App Ideas for 2025

These ideas overview results from market and trend analysis and venture capitalists’ feedback.

You’ll find a description, demand analysis, key insights, and examples for each app idea.

Let’s take a closer look at each of them.

Access premium design and development services for unmatched success.

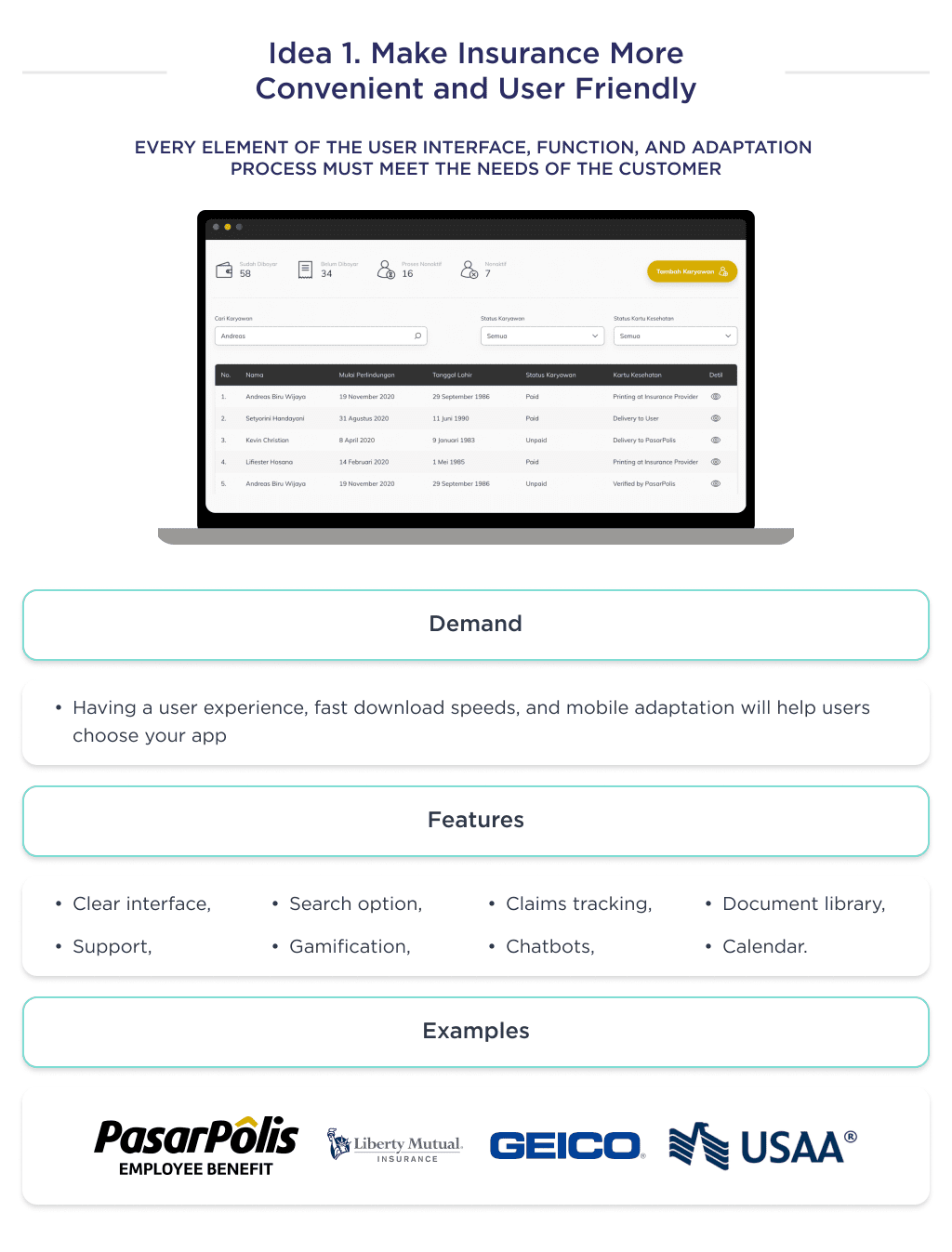

1. Streamline the User Experience

This idea may seem somewhat “trivial” to you. Perhaps it is.

However, this does not change the fact that a user-friendly product is still better than just a product.

So let’s start with that and then move on to more specific things.

A user-friendly InsurTech product makes it easy for users to purchase premiums, make monthly payments, cancel coverage, and perform other in-app features on the go.

An average user should be able to decode what each button stands for and achieve the desired activity without requesting help.

Let’s consider some critical insights to having a User Experience-focused app:

| Factors to Consider | Description |

| Demand | The customer experience of an app is crucial to having the platform thrive. Here are statistics supporting that:

|

| Key Insights | The needs of your target users should be the focus of your app. Every UI element, feature, and onboarding process should cater to their needs. If you’re not aware of their needs, then begin by asking the following questions: Why should they use your app? What problem does your app solve? Use these answers to map your development workflow. Take life insurance app development ideas, for example. People use it to provide financial security for loved ones in their demise. Centering your app experience around this helps to keep users happy and engaged. Generic UX enabling features that should be in your app are:

Insurance broker apps should have a documents library, an in-app broker’s calendar, and other helpful features. Also, ensure your app is accessible to all smartphones. |

| Example | Here are some user-friendly apps: |

Another top-notch app idea to consider is a car insurance app for delivery drivers.

Let’s describe what this entails.

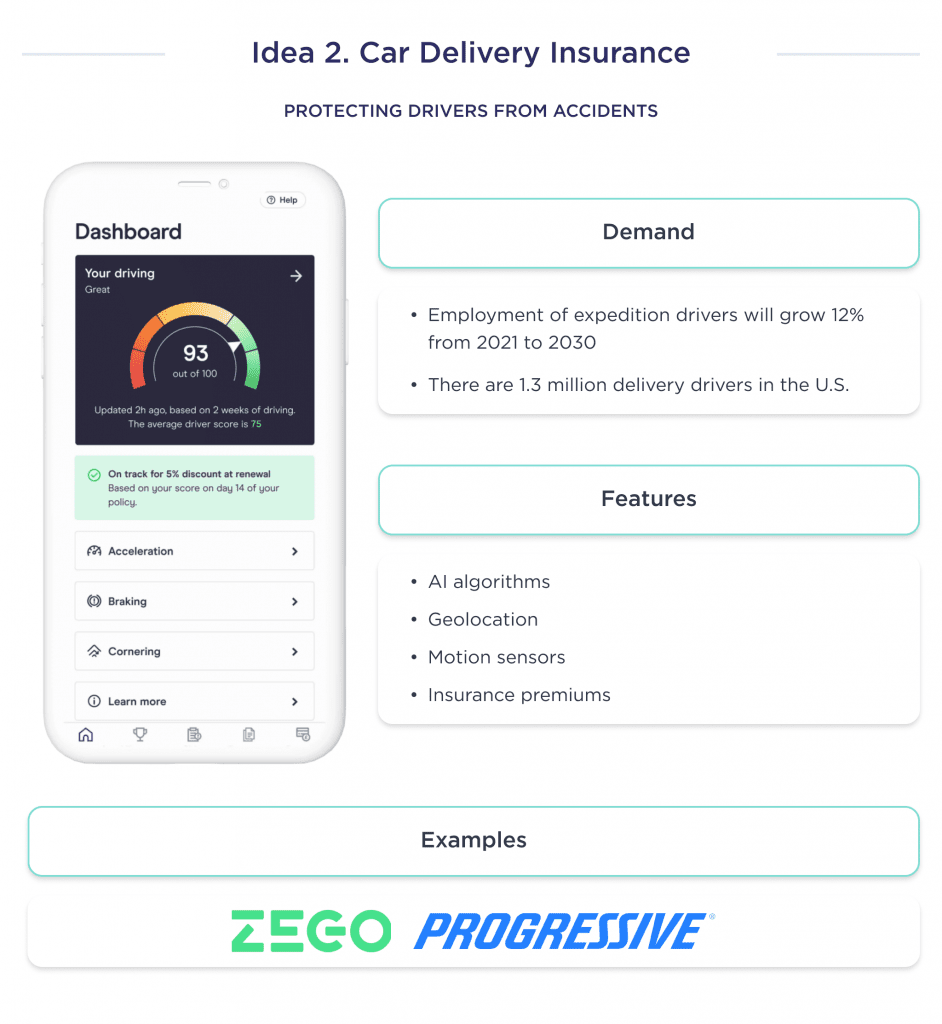

2. Car Delivery Insurance

This insurance service protects drivers from accidents and unforeseen losses when using their vehicles for delivery purposes.

The coverage is only active within the period where you’re moving from one location to the other, intending to make a delivery.

Below are some facts about this idea.

| Factors to Consider | Description |

| Demand | The basis for growth in-car delivery insurance is due to the rise in the patronage of delivery services. Here are some statistics on the industry:

|

| Key Insights | To develop a car insurance application that stands out, combine AI automation & algorithms, with motion sensors and Geolocation APIs. These features help your app analyze driving behaviors, therefore helping you customize premiums per policyholder. You can also offer ads-on travel insurance policy for inter-state deliveries. |

| Example | Common examples of car delivery insurance apps are: |

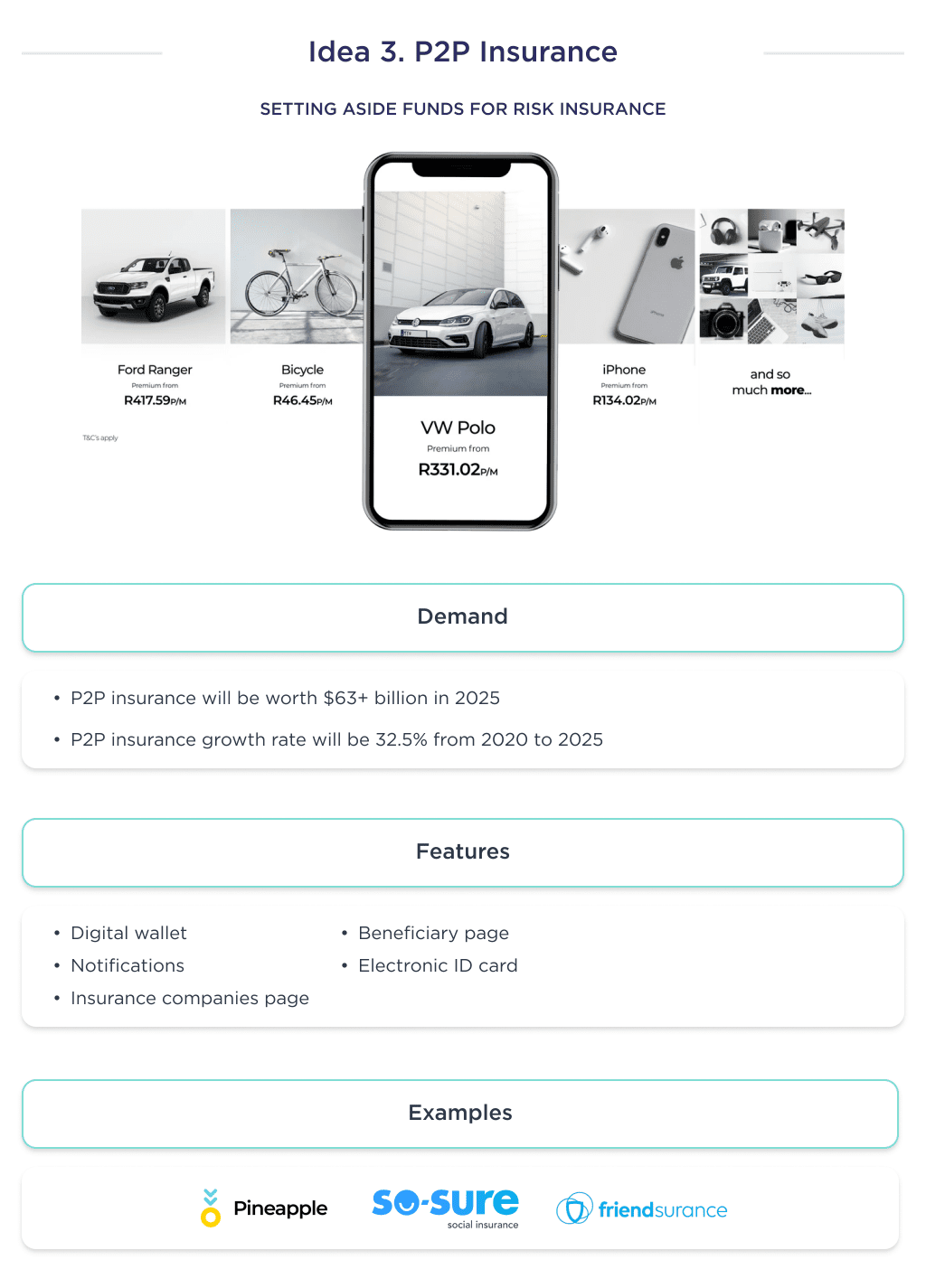

3. Peer-to-Peer Insurance

P2P Insurance, also regarded as social insurance, is a risk-sharing network of people, where all group members set some funds aside to insure against a risk.

It offers users the added benefit of keeping premiums where no claim is paid.

Below are some key points and examples of P2P insurance.

| Factors to Consider | Description |

| Demand | The market readiness for P2P is huge, and statistics from multiple organizations depict that. Here are some:

|

| Key Insights | P2P insurance is not a novel concept but a technological adoption of model mutual insurance. P2P insurance apps increase the speed and ease with which consumers purchase premiums. For example, Lemonade, a P2P InsurTech platform, helps users get premium quotes in less than 3 mins. If you want to create an insurance app, you’ll need the following features:

You can include other functionality that suits the intricacy of your idea. |

| Example | Some examples of P2P apps are:

|

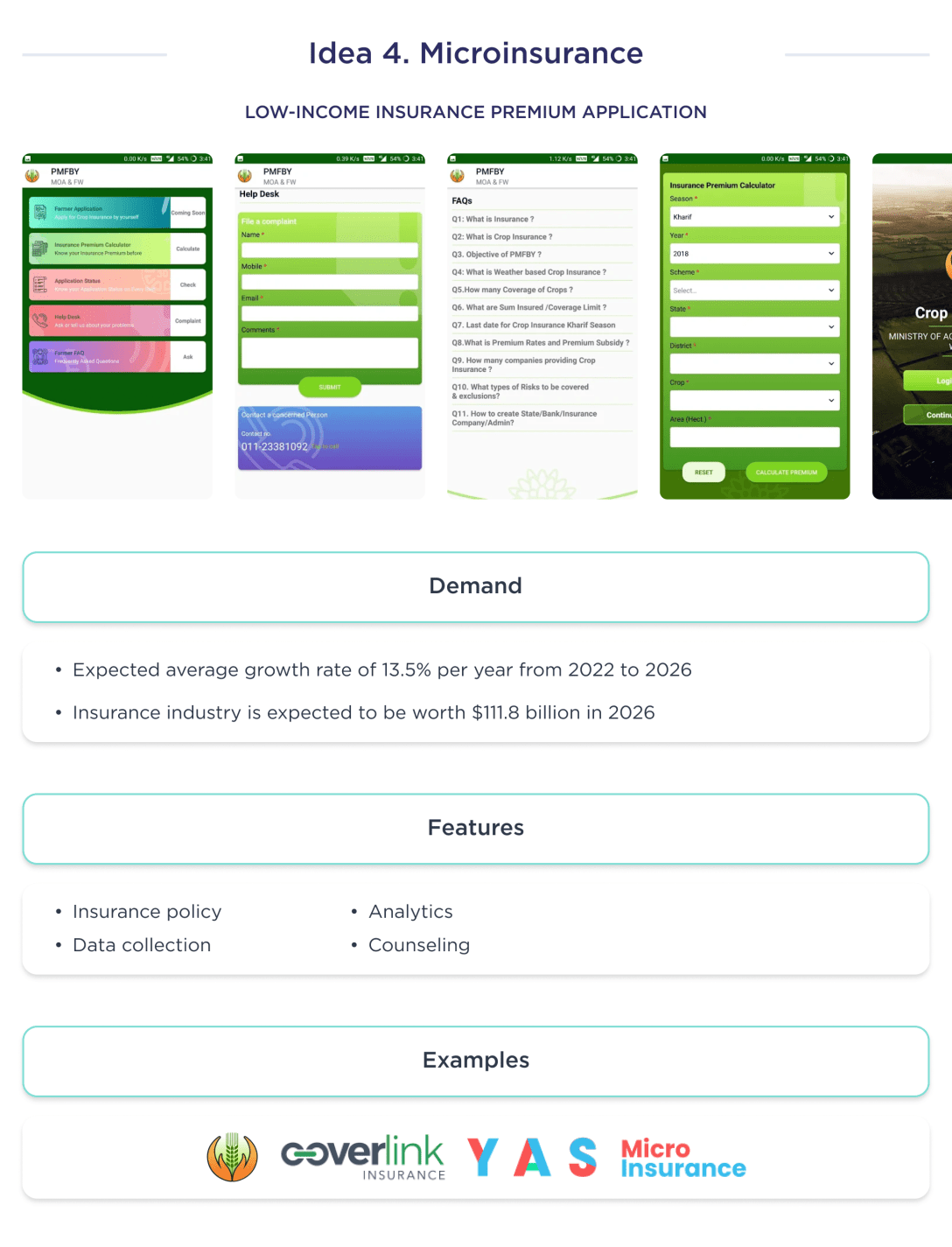

4. Microinsurance

Microinsurance entails offering insurance premiums for low-income individuals against numerous perils in exchange for cheap premiums per their income and risks.

Below are some points to note.

| Factors to Consider | Description |

| Demand | These statistics show that having this insurance plan can be a profitable move:

|

| Key Insights | Microinsurance functions on the basis of the concept of risk pooling. Designing a solution according to this concept is not an easy task. You will need to develop customized insurance policies that suit your target users. You need data collection and analytics capabilities as well as a long-term marketing plan. You can also offer a free in-app consultation to properly convince potential customers. It’s best to combine this idea with P2P and other cost-effective insurance models to achieve an optimal customer experience. Looking to stand out in the insurance industry? Create intuitive, secure, and engaging interfaces. Here’s your guide to insurance app design. |

| Example | Common examples of microinsurance apps are:

|

From concept to creation – launch your marketplace with SPDLoad!

5. Blockchain-Based Insurance

Blockchain-based insurance platforms offer coverage via InsurTech apps where claims submission, payment, and data protection are automated on the blockchain network.

See how insurance automation is changing the game.

Let’s provide you with some insight into this idea.

| Factors to Consider | Description |

| Demand | Just like other sectors, there’s a high demand for blockchain in insurance. Here are some statistics that prove this:

|

| Key Insights | Blockchain improves efficiency, transparency, and security in the insurance sector. It also eliminates certain data-gathering practices by insurance agents. Distributed Ledger Technology helps InsurTech platforms to boost cybersecurity protocols, speed payment time, and streamline claims processing via insurance claims automation. It’s important to use a knowledgeable software development company as blockchain implementation is very technical. |

| Example | Common examples of apps in this niche are:

|

6. Pay-as-You-Go Insurance

This is also called pay-per-mile insurance. Here, Insurance companies charge per mile or hour driven. They also require policyholders to pay a very small amount to cover against theft or damage when the car is parked. Users can change or cancel the policy at a prompt.

| Factors to Consider | Description |

| Demand | PAYG insurance services are in high demand, and statistics can prove that:

|

| Key Insights | This type of insurance falls uses telematics to track driving behavior and uses their risk level to determine pricing on premiums. It’s particularly suited to low-income risk-free earners as it offers them low premiums. |

| Examples | Examples of PAYG InsurTech apps are:

|

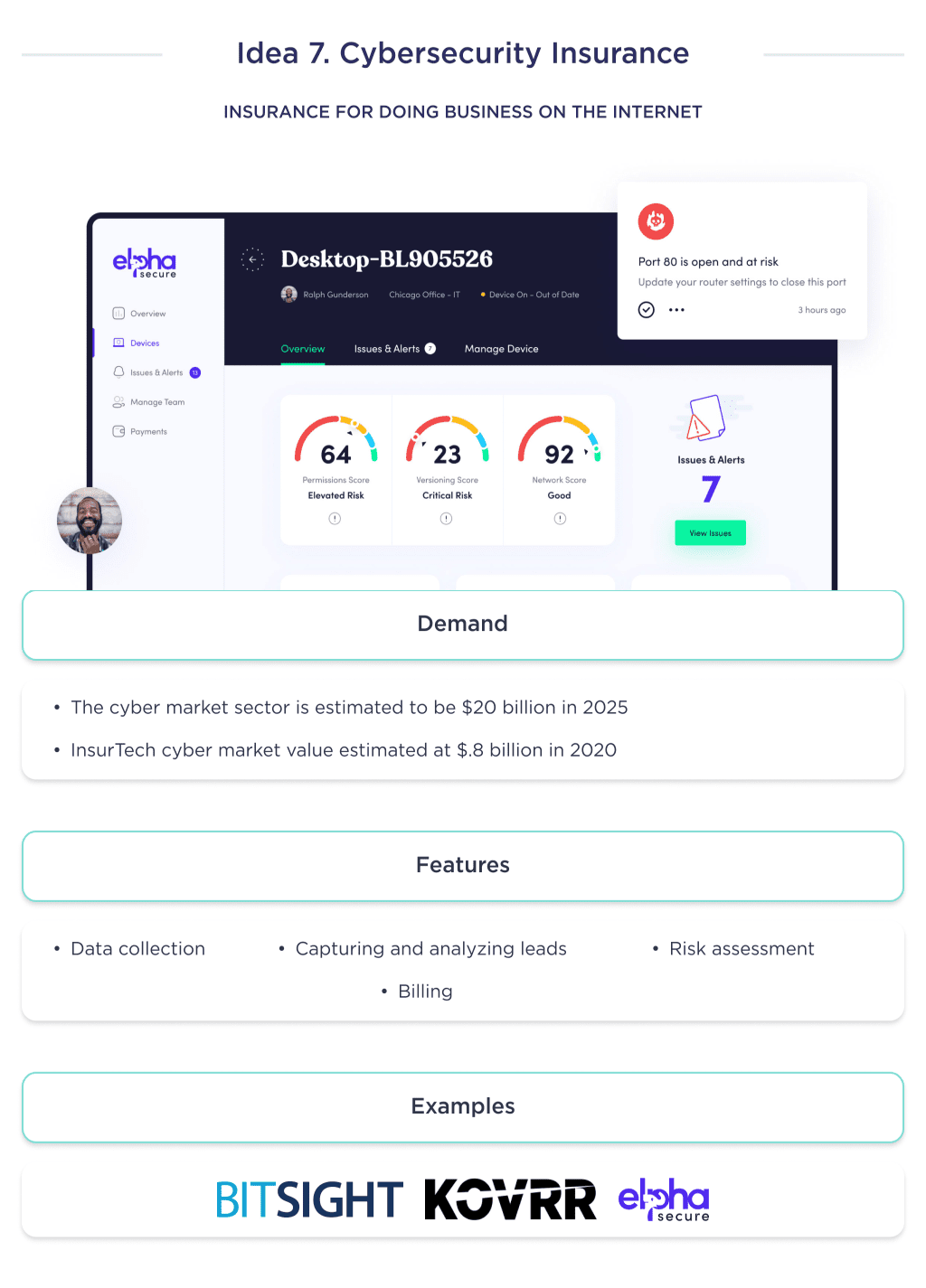

7. Cybersecurity Insurance

Cybersecurity insurance is a type of policy that an individual can purchase to reduce judgment liability that’s attached to doing business online.

By paying premiums at the stipulated time, the individual transfers some of the risks to the insurance service provider.

| Factors to Consider | Description |

| Demand | Although cybersecurity coverage is a new InsurTech niche, the demand for the service has been very strong. Here are some statistics that prove that:

|

| Key Insights | Ransomware happens every eight minutes. Thus, it’s imperative to appropriately access ransomware risks before billing prospective clients. A major challenge with cyber insurance is that underwriters have little data to calculate premiums and risk models. Little research has been done into gathering real-time data on cybersecurity risks. Except for the use of technologies like IoT, and AI in lead capture and analysis. |

| Example | Successful platforms to take a cue from are:

|

Building a fintech startup? Get practical advice on how to start a fintech startup and navigate the industry.

Ready to Build Your InsurTech Product?

There’s no shortage of promising insurance app ideas worth pursuing in the years ahead. From microinsurance to pay-as-you-go models, investors are pumped about the potential in insurtech.

Feel free to explore more ideas in our article discussing digital transformation in insurance.

If you want to capitalize on this opportunity with your own insurance app, the team at SpdLoad can help. We’re experts in building, launching, and scaling digital products.

Discover how to take your business worldwide with these 6 tips to help your startup gain global recognition.

Whether you need an MVP to validate your concept or want to add advanced features like AI down the line, we’ve got you covered. From adoption rates to market growth, our article on AI statistics covers everything you need to know.

Our agile approach means we can get your app to market quickly and adjust as needed based on real customer feedback.

Contact us today to discuss your insurance app idea. We’ll assess your concept, provide advice to maximize success and give you a personalized quote for the build.

Being a Clutch Leader in Ukraine speaks to our dedication and hard work in the software development field.