12 Benefits of Fintech for Business and Consumers

- Updated: Nov 12, 2024

- 9 min

This article covers 12 benefits of fintech for businesses, investors, and consumers and explains why building a fintech company may be lucrative for founders.

Let’s learn how fintech can help companies improve operations, cut costs, and boost profits.

Starting strong is critical – check out these business startup tips that offer valuable insights.

Transform your ideas into reality with custom software tailored just for your business – contact us today!

Advantages of Fintech for Businesses

The global Fintech Market size was at USD 194.57 billion in 2023 and is expected to reach around USD 501.9 billion by 2032, recording a CAGR of roughly 18.9% between 2023 and 2032.

Payment automation infrastructures are becoming a major product among innovative companies with a penchant for technologically revolutionary solutions.

But what are the main attraction points of businesses to warrant such growth among FinTech solution providers?

Here are some.

1. Access to More Financial Resources

FinTech companies create algorithms and ecosystems for businesses to accept payment for trades and services in the most seamless way possible.

As such, it’s safe to conclude that FinTech innovation is one of the major growth drivers for businesses.

With their incredible intuition, enterprises and startups alike get an array of resources, distribution channels, and investment platforms.

For example, you need an electronic payment technology to purchase a product or service on the internet; thus, the crux of the e-commerce process involves an instant payment application, without which a successful transaction can’t take place.

Unlike traditional banks, the financial technology sector’s low entry threshold has made the industry an easy ground for businesses of all types to thrive.

Using open banking APIs, non-banking companies can quickly form partnerships with vendors and launch a working solution.

With an apt knowledge of creating a FinTech product, anyone can successfully own a thriving product in this niche.

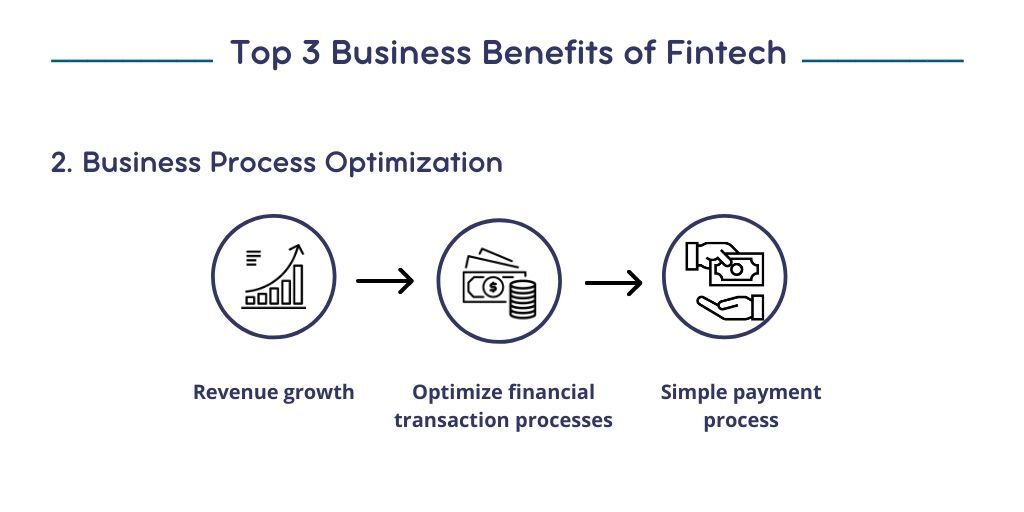

2. Optimized Business Processes

By owning a FinTech product, you’re helping to improve many organizations’ proficiency and growth by systematically streamlining financial transaction and investment processes.

Today, adopting new financial technologies does not require radical infrastructure transformation or significant investment. At low cost, businesses can adopt an easy payment process and enjoy the top-notch optimization that comes with it.

3. Improved Customer Retention

A common goal of FinTech innovators is to deliver a personalized user experience in the financial sector.

It’s the major crux of FinTech astronomical growth over the years.

A Kearney study of challenger banks corroborated this point as it shows that ease of use is a major selling point for FinTech products.

By adopting some generic and industry-specific FinTech products, businesses can give their customers a more impressive purchasing experience, thus leading to a much better customer retention rate.

Aside from improving customer retention through convenience and speed, FinTech also provides customers with personalized experiences through AI and Big Data service.

This helps businesses to offer services and products to clients through their past purchases and financial standing.

Beyond businesses, FinTech also has an impressive gamut of benefits for consumers. Let’s elucidate further on this.

Benefits of Fintech for Consumers

With a FinTech usage rate of over 63% among US-based consumers, it’s safe to conclude that financial technology has a highly appealing effect on the average citizenry.

This interest surge has been traced to the top-notch user experience customers derive from using FinTech payment and investment tools that allow fintech startups to profit.

But what exactly are the benefits that consumers derive from using a FinTech product? Here are three notable ones;

1. Secure, Personalized, User-Friendly Services

Financial safety is the major forté of e-payment services. This is because FinTech minimizes the risk of loss and physical theft.

Although the technology is still prone to cyber theft, the probability of such theft can be reduced to its barest minimum with the adoption of modern cybersecurity intermediaries.

For example, to develop a fintech app, you need to learn the laws and implement security measures like security service edge to protect your app from hacking.

Real-time money tracking, whether for domestic or international payments, helps to improve transparency.

Blockchain and other new technologies using distributed ledgers ensure that transactions are immutable and timestamped.

Also, Big Data, machine learning, and artificial intelligence guarantee that products and investment outcomes are more personalized to fit the innate desire of consumers.

With the right mind-map and UX design, FinTech guarantees better user-friendliness and improved financial connectivity compared to other traditional financial solutions.

With cybersecurity risks on the rise, bot attack prevention has become essential for online security.

2. Access to Complex Offerings with Robo or Human Advisors

Financial technology helps to simplify access to complex FinTech services like real-time budget tracking, financial counseling, etc.

A perfect example of how it does that is through Robo advisors and non-contact human advisors.

As it stands, $1.4 billion worth of assets is currently being managed by Robo advisors, with the figure expected to reach $2.8 billion by 2025. This signifies a CAGR of 19%.

The growth in patronage signifies a steady increase in demand for this technology.

Patronage of non-contact human advisors has also sky-rocketed as evidence reveals that millennials tend to have a penchant for human advisors.

The Covid-19 pandemic has also led to a rise in FinTech platforms for financial education.

See how you can make a difference in learning with these EdTech startup ideas.

3. More Convenient Access to Credit

Experts believe that the digital lending sub-sector of the economy is expected to grow at a CAGR of 16.7% over the next five years, an apt reflection of consumers’ demand for FinTech-facilitated loans.

This demand is basically on the premise that FinTech startups like Branch offer credit facilities to a pool of lenders through a seamless process.

The characteristic quick application-to-disbursement period gives the platform’s users a top-notch user experience.

FinTech offers credit to individuals with poor credit ratings and consumers who are not deemed credit-worthy.

Beyond this, they also meet customers’ expectations for increased speed and convenience (e.g., documentation transfer, online applications) and provide information and convenience on loan extensions (borrower identification, terms, pricing).

However, to tap into this benefit as your startup’s selling point, for example, loan lending app development, it’s best to focus on a specific segment in the consumer market.

Haven discussed the pros of FinTech to consumers.

Let’s open up on the benefits for investors.

Benefits of Fintech for Investors

The FinTech industry includes a mixture of startups and revolutionary offerings from industry titans.

Fintech startups attracted over $14B in VC funding in Q1 2023. This is far from 2021 levels but more than the last two quarters.

The major inspiration for this bullish investment drive can be anchored on a gamut of benefits investors get from purchasing stocks in FinTech. Below are some of those advantages.

If you’re looking to build a stock trading platform, our article on how to build a stock trading platform covers all the key aspects.

Find the best TypeScript developers for your project.

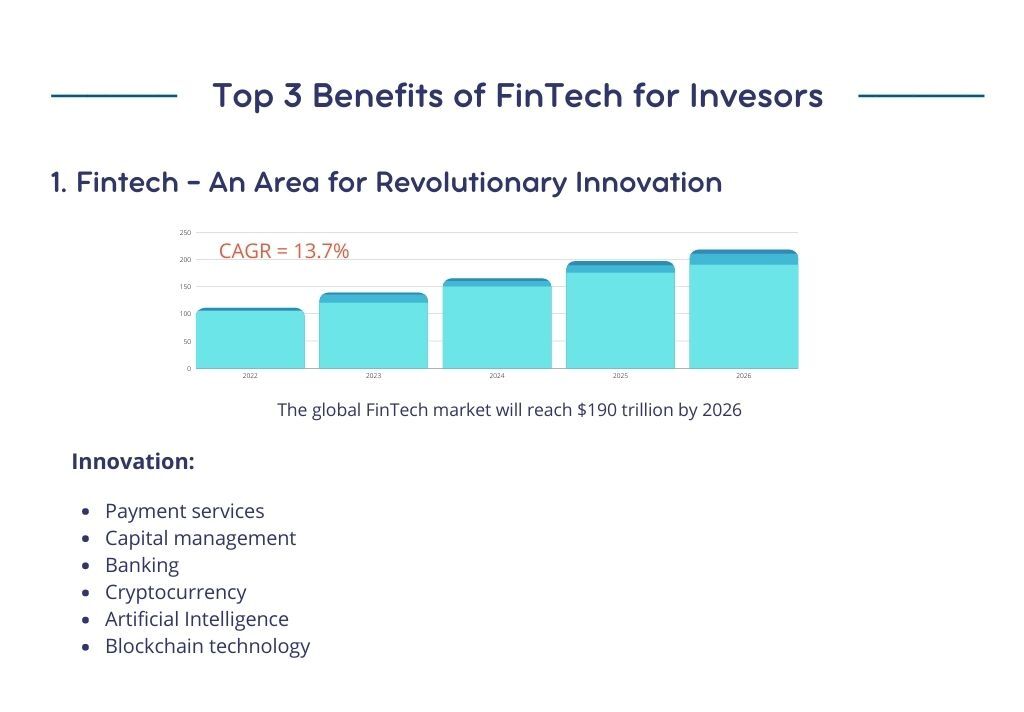

1. Disruptive Innovations

The FinTech sector is projected to be worth over $206.76 billion in 2026.

One factor at the forefront of this impressive valuation is the level of disruptive innovations being introduced to the industry.

The area of technology where FinTech is currently championing innovation include payment services, wealth management, banking, and more.

Bitcoin and other cryptocurrencies, which are major discussion points in the finance world, are also a part of their innovative invention.

Through tools like Artificial Intelligence, blockchain technology, and Big Data, FinTech software engineers can apply top-notch innovation to develop more disruptive solutions and create valuable ideas for fintech startups.

Investors with a penchant for investing in a highly disruptive product will undoubtedly have a field day sorting through a gamut of sophisticated solutions in FinTech.

2. Chance to Invest Early in Future Unicorns

Every investor aims to own a significant share of the next unicorn startup.

There’s no faster way to achieve this aim than investing in a FinTech company. Why?

The FinTech sector is currently growing at a CAGR of 13.7%, and the global FinTech market is poised to get $190 billion of investment in 2025.

With this impressive growth, the valuation of FinTech startups is expected to be worth a significant sum in years to come, and owning a piece of the sector now guarantees you a seamless way to become a part of a noteworthy organization in years to come.

There is already a degree of interest in FinTech from the investment community and tech giants like Intel, Salesforce, Google, and many more.

Traditional finance houses also embrace FinTech solutions to fend off competitors and establish a vibrant distribution channel.

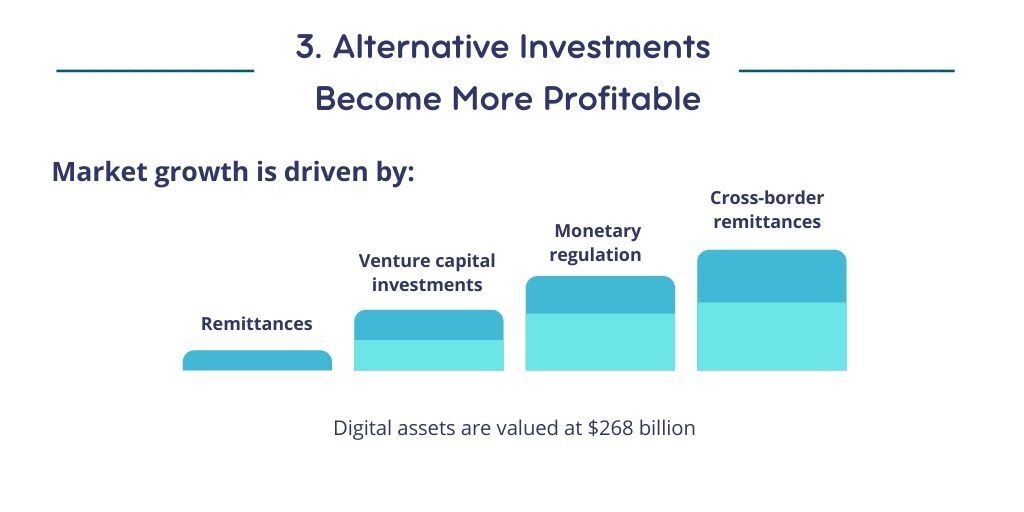

3. Rise of Profitable Alternative Investments

The industry has afforded investors avenues to grow their assets via various strategies.

The alternative investment industry, especially digital assets, is continuously growing.

To date, the digital asset economy is estimated to be worth $300 billion, with an all-time high of $744 billion in late 2018. An analysis report by Prance Gold Holdings shows that the “major drivers of market growth are high remittances, transparency of distributed ledger technology, growth in venture capital investments, monetary regulations fluctuations, and cross-border remittances.

Benefits for Fintech Founders

FinTech has been deemed a primary conveyer of the astronomical growth that alternative investment has enjoyed in this century.

Anyone can now invest in derivatives, futures, and the forex market.

All that’s needed is a FinTech investment platform, an internet source, and investment funds on a digital wallet, credit card, or any other mobile payment solution.

Other than investors, founders also benefit from starting a FinTech startup.

Below are some advantages of FinTech for innovators.

From concept to creation – launch your marketplace with SPDLoad!

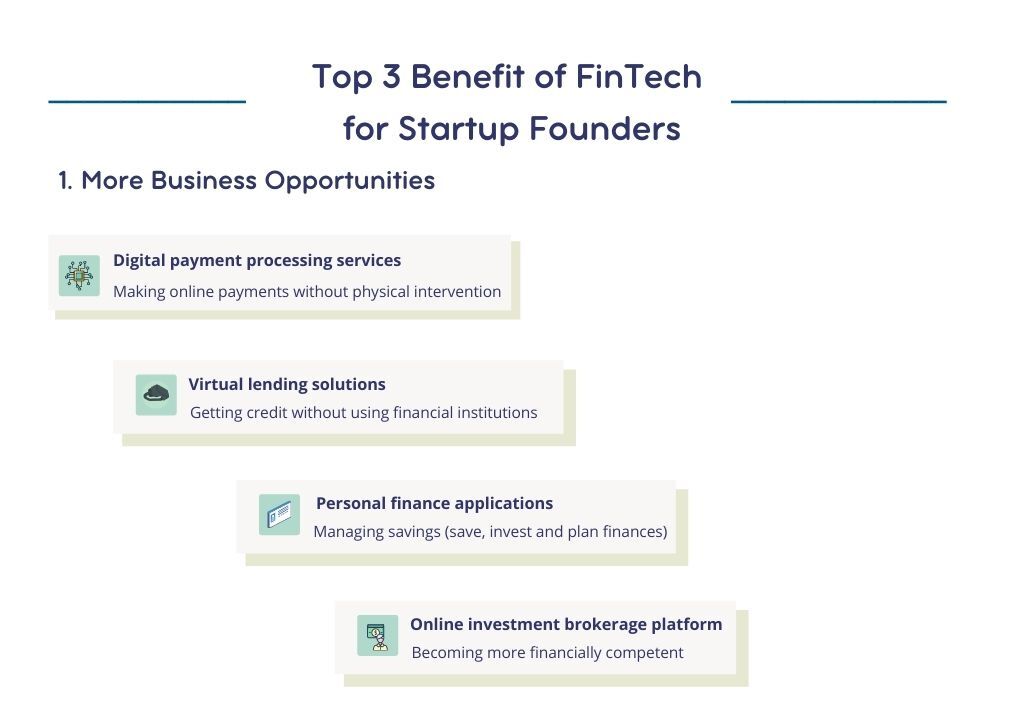

1. New Business Opportunities

Numerous exciting FinTech business opportunities empower you to unleash your inner creativity as a FinTech founder.

So many financial problems still require solutions, and with the right eureka moment, you can craft a noteworthy solution to the problem.

Amongst the tens of business opportunities in FinTech, the most noteworthy ones include:

- Digital payment processing services

This business model includes online payment solutions that enable consumers to process transactions on mobile devices without the need for physical money exchange.

With a basic bank account or peer-to-peer payment method, you can make money transfers to personalities and small businesses.

- Virtual lending solutions

Principally, online lending platforms work as an alternative to traditional loan marketplaces, e.g., banks.

These virtual lenders are FinTech firms that provide consumers with financial products to guarantee a seamless avenue of obtaining credit without visiting a traditional financial institution.

Therefore, as a startup option, you can benefit from mobile banking app development to create apps that help customers save time and effort.

- Personal finance applications

Personal finance apps help users save, invest, and plan their finances from their digital devices.

Some highly sophisticated solutions may further improve customer experience by introducing functionalities to help navigate savings and aid retirement preparation, thus reducing financial mistakes through mobile technology.

- Online investment brokerage platform

Essentially, this entails offering investment brokerage, regulatory, and monitoring services via the internet.

Irrespective of your preferred choice, your objective should center on helping consumers achieve their financial goals, build financial confidence, lower transaction cost, and commit fewer mistakes.

2. Bigger Investments

Investment in FinTech has grown rapidly since 2010 and has been higher in countries with better regulations and more capacity for innovation.

This shows that investors’ confidence in the sector is very high, and a noteworthy innovation is bound to get much-needed financial support.

It’s also worthy of note that there’s no limit to the amount founders can raise in a single investment round.

This is a noteworthy example to depict the extent of funding that’s available for FinTech companies.

3. InsurTech Driving Transformation

The entire FinTech industry is booming at an unprecedented rate.

However, a noteworthy shining light in the beaming industry is Insurtech.

Despite the fact that InsurTech is a separate industry, it is often seen as a branch of FinTech.

Insurtech, as the name implies, entails the use of artificial intelligence and Big Data to process a person’s medical and criminal records whenever legally permitted.

It also checks out open social media information, credit history, and other information to reduce the startup’s risk and suggest the most beneficial option to an Insurance policy buyer.

This sector is particularly considered a founders’ paradise for those searching for an industry that can guarantee quick growth.

How?

At a mindblowing CAGR of 42.35%, experts believe that Insurtech will easily spin out to be the next gigantic FinTech sub-sector over the next six years.

That’s why insurance app development services are now more popular than ever.

For insurance companies looking to innovate, car insurance app development is a game-changer in customer engagement.

Want to Develop a Fintech Product?

Fintech benefits businesses, investors, consumers, and entrepreneurs. As it rapidly transforms finance, these advantages will grow. Lean into this wave by leveraging fintech to boost your organization.

If you’re ready to build a fintech product, we can help. Our experienced software and app developers craft custom, game-changing solutions.

Let’s connect to explore how fintech can supercharge your ambitions and potential. The next unicorn can be yours!

Wondering about the cost of hiring a software developer? We break down what you need to know.