Top Challenges Payroll Management Software Can Solve

- Created: Aug 07, 2024

- 11 min

Efficient payroll management is crucial for any business out there.

It ensures employees are paid accurately and on time, helps maintain compliance with various tax laws and regulations, and supports overall financial stability.

A streamlined online payroll process saves small businesses time and reduces administrative burdens, allowing owners to focus on growing their businesses.

However, it is not as simple as it sounds.

Payroll management can be tedious and challenging. Many businesses, especially small ones, frequently grapple with complex regulatory requirements, errors in manual processes, data security concerns, and the need for scalability and flexibility as they grow.

These challenges can lead to compliance penalties, tax payment delays, employee dissatisfaction, and wasted time and resources.

In this article, we explore how software from reliable payroll providers can eliminate these challenges and ensure seamless payroll processing.

We're here for you!

What is Payroll Management, and Why is it Important?

When we talk about payroll management, we mean handling the nitty-gritty around your employees getting paid. It means calculating wages, filing taxes, and withholding other payments so they end up in your employees’ bank accounts on time.

You should care about payroll management because it means your employees get paid correctly and on time, which makes them happy and builds trust.

This also means you’re more tax compliant, so you won’t have to pay fines for not complying with tax laws and regulations.

Having full control means you can automate more of your processes and have the peace of mind that comes from knowing you’re doing it by the book.

Payroll is a system. Salary payment is a part of it. And if you’re using a payroll software system, you can choose a payroll technology that works for you.

Many online payroll systems allow you to track employee information through graphs or forms. Overtime is calculated based on actual hours worked and needs to be reported weekly.

A timesheet is the best place to keep hours worked and record the time and attendance of your employees.

Using a payroll software solution gets rid of a lot of constraints.

Payroll software eliminates errors and removes redundancy.

Also, some of the best payroll software solutions allow you to be tax-compliant and manage superannuation, PAYG withholding, and annual payroll tax obligations.

To address all these, we recommend an integrated technology management system that includes data collection and advanced analytics.

The system has simple rules and is designed to streamline the organization’s processes around wages, taxes, and benefits-in-kind.

A good online payroll management system should also be able to generate payroll for you.

In fact, you can even save yourself money. All these are important for a business to run smoothly, and payroll management is no different.

Payroll Software Development Market Overview

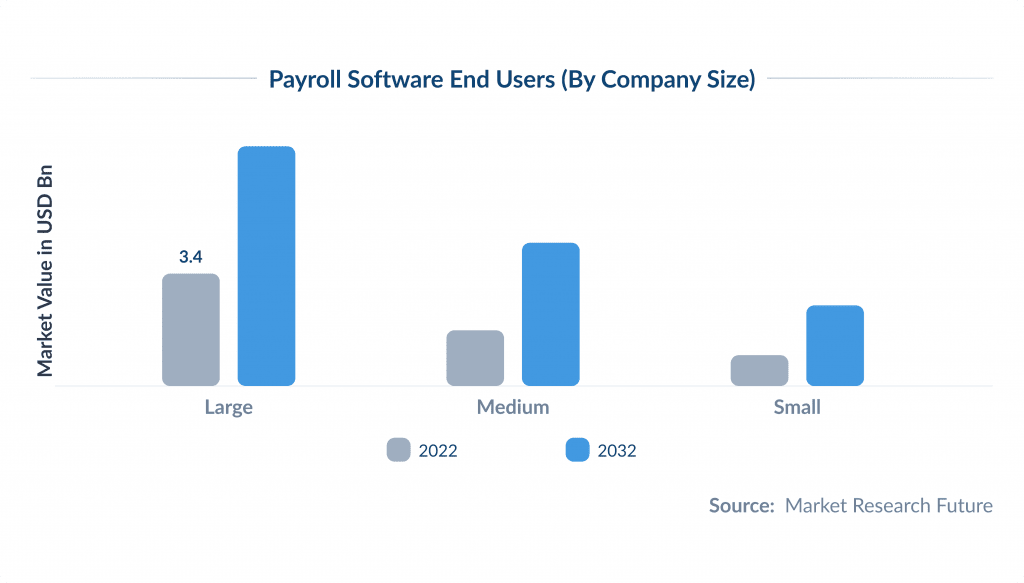

The HR payroll software market was valued at $7.3 billion in 2023.

It’s expected to grow big time, reaching $8.1 billion in 2025 and $18.9 billion by 2032. 11.2% annual growth from 2024 to 2032.

Several reasons are driving this growth.

One of them is the rise of cloud and mobile.

Businesses aiming to stay competitive are investing in cloud-based app development for enhanced scalability.

Cloud based payroll software is a convenient and secure way to process company payments.

Another is the push for more automated payroll HR processes and the demand for more comprehensive and flexible software options.

These trends are helping more businesses to streamline their payroll and HR, and thus, the market is growing fast.

Given the market demand, the move to cloud and mobile, and the growth potential in HR payroll services, now is the best time to develop payroll software.

If you develop a full-service payroll solution that covers payroll taxes, automates processes, is flexible, and has comprehensive services, you’ll ride the growing market and give big value to your clients.

The HR payroll software market is hot, and it’s time for small businesses to get in.

Big companies have always been the players in this space but now the spotlight is on small and medium sized enterprises (SMEs).

This is because more and more small businesses are realizing how payroll software can make their lives easier by reducing errors and saving time.

There are also new startups, especially in emerging markets, who need payroll solutions as they grow.

As a new startup in the payroll software market, you can be a payroll provider that can service these needs by offering flexible and affordable options to SMEs.

With growing awareness and more startups, small businesses have a great chance to make their presence in the payroll software market and succeed.

Looking for inspiration for your HR software? Feel free to explore the best HR software solutions on the market.

So what are the features that can make your solution stand out in the market? Let’s find out.

Why Businesses Use Payroll Software

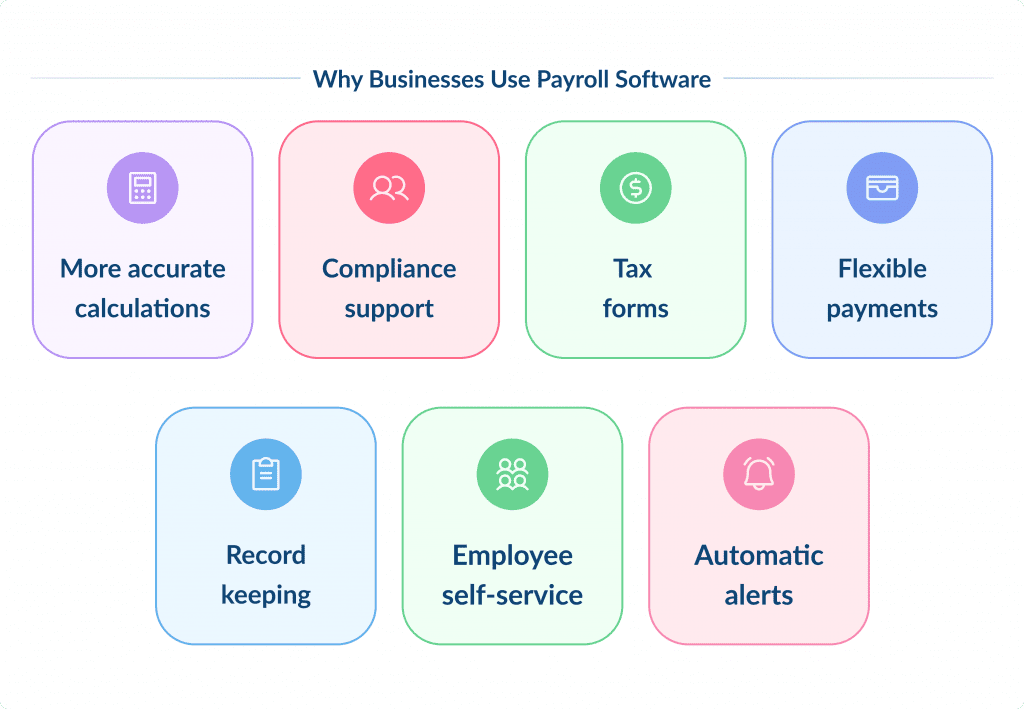

So why do businesses use payroll software instead of doing payroll themselves?

It saves them time and offers many benefits:

More accurate calculations

Automated accounting software ensures salary calculations, payroll deductions, employer taxes and other taxes are correct. Reduces human error costs.

Compliance support

Many payroll software providers notify employers of changes in employment or tax laws that may affect their business. So businesses will be compliant automatically.

This is very useful for small businesses, startups, and first-time business owners.

Tax forms

With reliable software employers can access important tax documents like Form W-4, Form W-2, Form 1099 and Form I-9 through their payroll software. It helps to stay compliant with state and federal taxes, tax season will be easier.

Flexible payments

Payroll software can accept various payment methods. Traditional paychecks, direct deposit and even pay cards.

Record keeping

Digital payroll systems create employee profiles with payroll records. These can be aggregated and downloaded to meet regulatory requirements.

Employee self-service

Employees can edit personal information, change deductions, submit tax withholding information, view pay statements, and more through a mobile app or computer. It’s convenient and transparent.

Automatic alerts

Many payroll systems have workflow notifications. When the software detects a data entry error, it can send an alert to the user so they can correct it before payroll is processed, so payroll runs smoothly and error-free.

So, with payroll software, business owners can save time, reduce errors, and be compliant with different tax laws. So they can focus more on growing their business and less on payroll taxes and other boring tasks.

Based on these benefits, we have listed down the must-have features of the best payroll systems for their users.

Payroll Management Software Must Haves

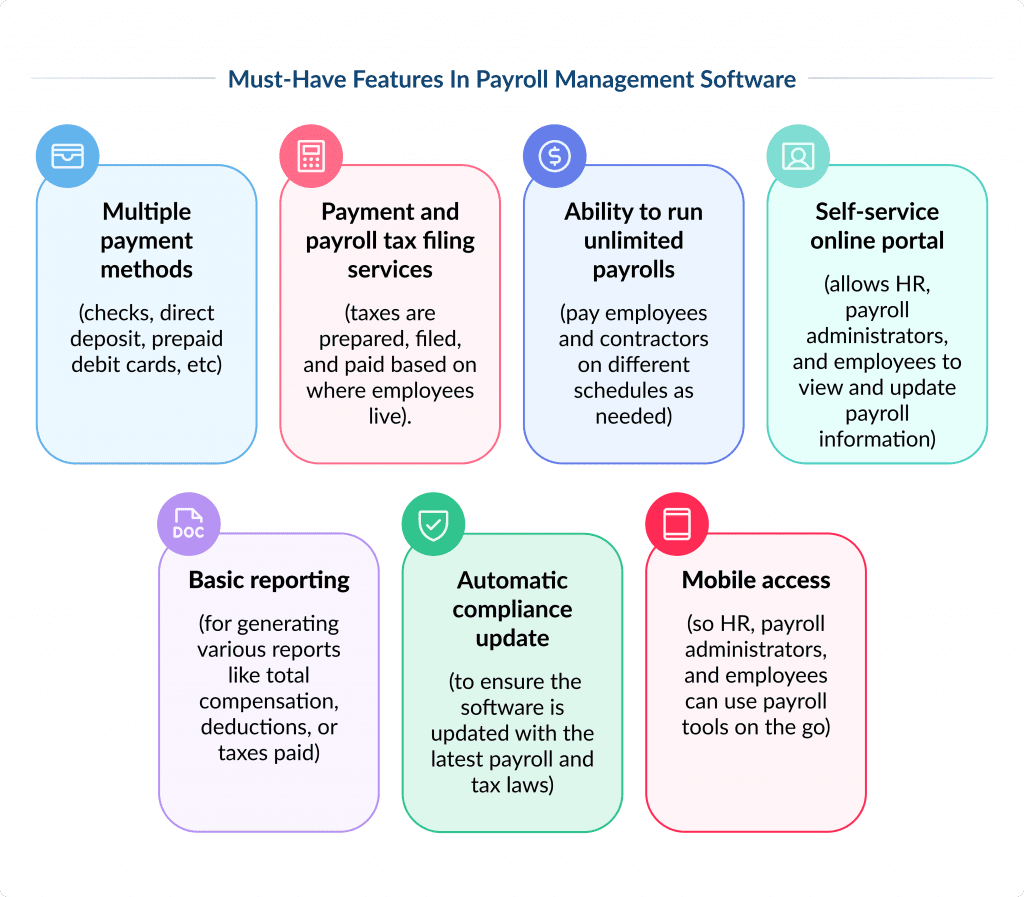

Here are the features that make payroll tools better than manually running payroll using a spreadsheet.

With multiple payment methods, payroll software offers flexibility in paying employees through paper checks, direct deposit, or prepaid debit cards.

It also handles payment and payroll tax filing services so taxes are prepared, filed, and paid based on where your employees live. This is very important for companies with employees in multiple states or countries.

Another feature is the ability to run unlimited payrolls so you can pay employees and contractors on different schedules as needed.

Also, payroll software has a self-service online portal. This feature allows HR, payroll administrators, and employees to view and update payroll information (pay period, taxes, and more).

Thinking of adding a card payment option on your website? Discover the best options for accepting card payments on your website in our step-by-step guide on how to accept card payment on-site.

Basic reporting allows for the generation of various reports like total compensation, deductions, or taxes paid within a specific period. So businesses can be informed and compliant.

Automatic compliance update is another feature to ensure the software is updated with the latest payroll and tax laws so you don’t have to.

And mobile access so HR, payroll administrators, and employees can use payroll tools on the go.

Employees can view their pay history and pay stubs through a mobile app, making payroll software more convenient and efficient.

Payroll Challenges Small Businesses Face

Payroll can be a real pain for small businesses, with errors, paperwork, and complicated regulations.

It’s easy to feel overwhelmed and worried about making costly mistakes. Let’s see the common payroll challenges your target audience may face.

Compliance

In general, compliance gets harder, not easier.

New laws and changes to existing ones come up every year. During the pandemic, new regulations were introduced to address the massive changes happening in the workplace. Even business growth brings new and different rules. There are over 180 federal labor laws alone that apply to different businesses.

Payroll compliance is more complex, it covers laws like Fair Labor Standards Act (FLSA) which is about wages and overtime and Family and Medical Leave Act (FMLA) which is about unpaid leave among many others that applies to contract workers.

Businesses need legal expertise and attention to detail to avoid penalties and be payroll and HR compliant. This adds more work to payroll staff, making their jobs even more challenging.

Time-Consuming Processes

One of the reasons payroll can be more time-consuming and complicated than it should be is that many businesses still use manual processes, using spreadsheets, and outdated payroll software with limited features.

If company staff is familiar with toggling through multiple spreadsheets and software programs this can increase the risk of errors which requires more time to fix.

Data Security and Privacy

Every day, it seems like there’s a new data breach, and businesses can’t run a payroll system without handling sensitive data like bank account and social security numbers, home addresses, and pay rates.

This exposure puts your business at risk.

For example, in 2023, a major retailer had a data breach that compromised the personal information of thousands of employees, including their payroll details. This incident highlighted the need for robust security.

To protect your business, you need to have clear privacy policies and a secure environment for payroll records.

Implementing internal controls over who can access sensitive pay-related information is a must. This will protect your business and employees from data breaches.

Learn about the most impactful cybersecurity trends to safeguard sensitive data and prevent breaches.

Multiple Payroll Input Sources

Another payroll challenge is dealing with incompatible systems.

For example companies uses one software for employee records, another for leave, a different system for time tracking and another for requisitions or employee benefits. Juggling between these different systems is a nightmare and can lead to errors and wasted time.

Getting an HRMS software from a reliable payroll provider that integrates all these functions can simplify processes. Less time to input data and track information means a business is more efficient and cost effective in the long run.

Explore our HR development services today!

Custom Payroll Management Software Can Fix These Issues

Custom payroll management software can turn these tasks into a breeze.

Let’s get into how custom solutions can solve common payroll problems and make your payroll process simpler and more reliable.

Compliance with Regulations

Custom payroll software ensures your business is compliant with changing laws by having automated updates.

Imagine never having to worry about new tax laws—your software does it for you. This not only avoids huge fines but also saves you from legal troubles.

With built-in compliance features the software ensures all payroll processes follow local, state and federal regulations. It generates necessary reports and files documents on time, takes the compliance stress out.

So you can focus on running your business without the hassle of keeping up with legal requirements.

Accuracy and Fewer Errors

Accuracy is key in payroll, and custom software automates calculations.

Imagine never having to manually calculate overtime, deductions or bonuses again. The software does it all, eliminates human error. Plus integrated data validation checks catch any discrepancies before payroll is processed so everything is correct.

This not only reduces errors but also saves you time to fix them.

By automating these processes, you can be sure your payroll is accurate and reliable and you and your employees are happy.

Time-Consuming Tasks

Payroll tasks are time-consuming, but custom software simplifies things by automating repetitive tasks.

Imagine tax calculations and direct deposits are automated, freeing up hours a week.

Centralized data management means all your payroll information is in one place so you can access and update employee records.

This speeds up the entire payroll process and reduces errors. Automating these tasks allows HR teams to focus on strategic activities and be more productive and efficient.

Data Security and Privacy

Employee information is sensitive, and custom payroll software secures it with advanced encryption and access controls.

Imagine it as a digital fortress that guards sensitive data from unauthorized access and cyber threats. Regular security updates ensure the software is always ahead of potential vulnerabilities.

For example the software applies the latest security patches automatically, your data is safe. Your employees will trust your payroll software more because it prioritizes data security.

Scalability and Flexibility

As your business grows, so do your payroll needs.

Custom payroll software grows with you, scalable and flexible.

Imagine starting with basic payroll functions and adding more complex features like health benefits management and performance tracking as you grow.

The software can handle more data and users with ease, so it’s with you at every stage of growth. This flexibility makes it a smart investment for businesses of all sizes so you can adapt to changing needs without missing a beat.

Custom Payroll Software Development: Examples and Case Studies

Here are a few examples of payroll software development we did. These are the projects we did recently. Hope you find it helpful.

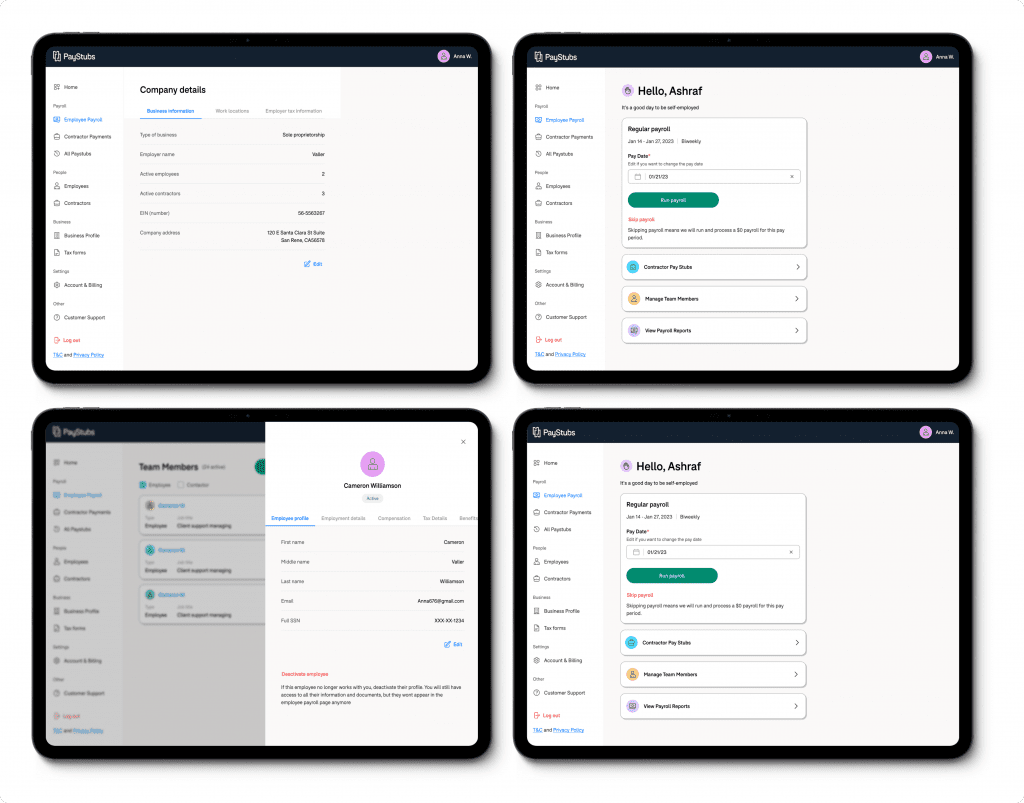

The first project is a custom payroll platform.

The client approached us to build a user-friendly and visually appealing payroll solution. The project took one year and involved a team of six people, including React developers and a UX/UI designer. Our task was to develop the front end and integrate it with the existing backend.

Get the details on the cost to hire a React.js developer and what factors can influence rates.

Communication with the backend team was key to maintaining functionality and user experience.

As a part of our digital design services, we designed an intuitive interface so the platform is easy to process payroll, manage tax payments and do other activities.

The result was a full payroll system with banking features, payment calendars, employee accounting, and tax applications. We developed web and mobile versions so users have flexibility and convenience.

Another project in this space was working with a payroll services platform.

The client chose us as their dedicated offshore outsourcing partner to develop new software products, create an application to enhance payroll and tax payments and support existing systems.

This platform simplifies employee payments, calculates salaries, withholds taxes, and complies with regulations.

Employees can access their pay stubs online, and employers can get detailed payroll reports.

Using React, we further improved the product by adding advanced tax algorithms and real-time pay stub generation.

This project shows that we can deliver efficient and user-friendly payroll solutions and that we value collaboration and modern technology in custom payroll development.

Discover the benefits of IT outsourcing and why it’s popular for scaling tech needs.

Conclusion

Managing payroll comes with its fair share of headaches, from keeping up with changing regulations to reducing errors and handling time-consuming tasks.

Tailored payroll software effectively addresses these challenges.

It automates updates, improves accuracy, streamlines processes, and enhances data security.

Overall, this type of software makes employee information easily accessible and offers the flexibility to grow with your business.

Are you thinking of developing your own payroll software? Our team at Spdload can help!

Let’s get in touch and see how we can collaborate to create a secure, reliable, and profitable system with automated tax payments, time tracking, employee self-service, and other advanced features.