FinTech App Development: Ultimate Guide for 2025

- Updated: Nov 07, 2024

- 17 min

Interested in building your own FinTech app startup? If so, you’ve come to the right place.

This comprehensive guide provides everything you need to know as an aspiring founder, investor, exec, or product manager looking to break into FinTech app development.

Here’s what we’ll cover:

- Why now is the ideal moment to develop a FinTech app

- Expected costs and considerations when building a FinTech app

- A step-by-step process for creating a FinTech app

- And much more!

By the end, you’ll understand the FinTech app landscape and market opportunities and have a blueprint for building your financial solution.

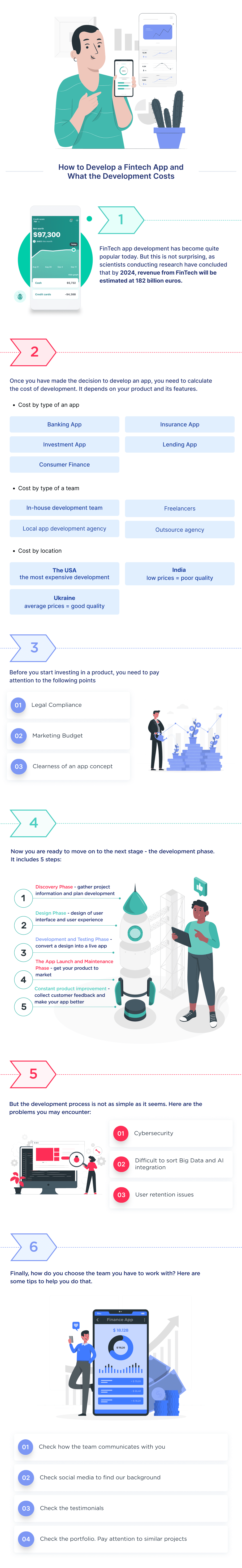

If you’re more of a visual learner, feel free to jump ahead to the infographic.

IT outsourcing can streamline your app development. Here’s a complete guide on finding the right mobile app developers.

Start your journey with our expert developers today to bring your app idea into reality!

Should You Build a Fintech App?

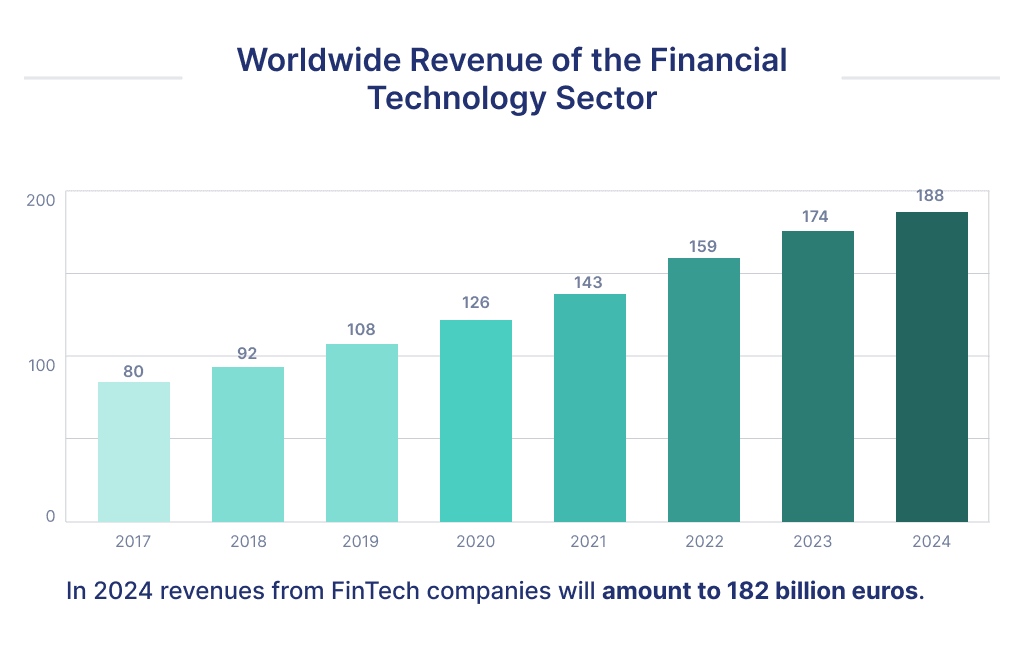

Without a doubt, FinTech apps have gained popularity over the decade. Don’t believe that? Check out this chart by Statista below:

Based on the chart above, you can deduce that the fintech market has maintained steady growth in value over the last 4-5 years.

What does this mean for your startup? The market will increase in value, which consequently creates a place for you to tap in.

Here are other statistics that support the claim that now’s your best time to own a FinTech product:

- 60% of credit unions and 49% of banks in the U.S. believe that fintech partnership is important.

- The number of digital banking users in the country is forecasted to reach almost 217 million by the end of 2025

- The number of people with neobanked accounts will grow to 34.7 million by 2025

I hope we’re on the same page now.

The next question you need to know after how to start a fintech company is how much it will cost you.

Let’s check it out.

What’s the Cost of Developing a Fintech Product?

The average cost of developing a FinTech app varies from $50,000 to $300,000+. However, the exact figure depends on a broad range of factors.

FinTech, by definition, is a broad term used to describe any technology that aids financial transactions.

The first question you’ll have if you aim to invest here is: “What’s the cost of developing a FinTech app?” Unfortunately, there is no definitive answer to this question. Here are the costs of building financial apps according to different factors:

Cost By App Type

As seen below, there are five main types of FinTech apps. Our estimate is based on the average hourly rate of $40/hour in Ukraine.

| Type of services | Example | Development time | Cost, $ |

| Mobile banking app development | Revolut | 3500 | 175,000 |

| Investment app development | Acorns | 1500 | 60,000 |

| Personal finance app development | Finch | 2000 | 80,000 |

| Insurance app development | Coalition | 2500 | 100,000 |

| Loan lending app development | ZestFinance | 2200 | 90,000 |

Let’s discuss what developing each type of app entails.

Banking app

The estimate given above includes the cost of developing a mobile banking app that includes the admin panel and client-side app.

The client-side allows users to check their transaction history, and current balance and make transfers. They can also search for nearby ATMs, send P2P payments, and schedule payments.

In this regard, you can read about the cost of developing a p2p payment app or find out more about the digital wallet app development cost.

Investment app

The price of the investment app quoted here is one that allows users to review and invest their money into numerous investment vehicles.

The app also provides users with analytics data to make more informed decisions.

Investment applications are more commonly called wealth management platforms.

Feel free to read our detailed guide about investment app development.

Consumer finance

The primary function of this finance app is to manage users’ expenses. It helps them with budgeting, business credit cards storage, digital payments management, and consumer data analytics.

But beyond that, it’s worth noting that FinTech allows you to create a startup at the intersection of eCommerce app development and financial behavior patterns.

For example, leveraging off an innovation Buy Now Pay Later via a price comparison website development.

Insurance application

InsurTech is a niche in its own right in both business and product development.

However, this niche is tightly intertwined with finance. Therefore, to specify InsurTech as a part of FinTech would be correct.

Insurance applications help customers to answer basic questions about the insurance company.

There are multiple niche-specific insurance applications, and that’s what will affect your price.

For insurance companies looking to innovate, car insurance app development is a game-changer in customer engagement.

Lending App

The price quoted in the table above is for peer-to-peer lending apps.

The app allows people with money to borrow without a government-regulated creditor.

But in addition to the type of application, the team and the region in which it is based also play a big role. Consider these options as well.

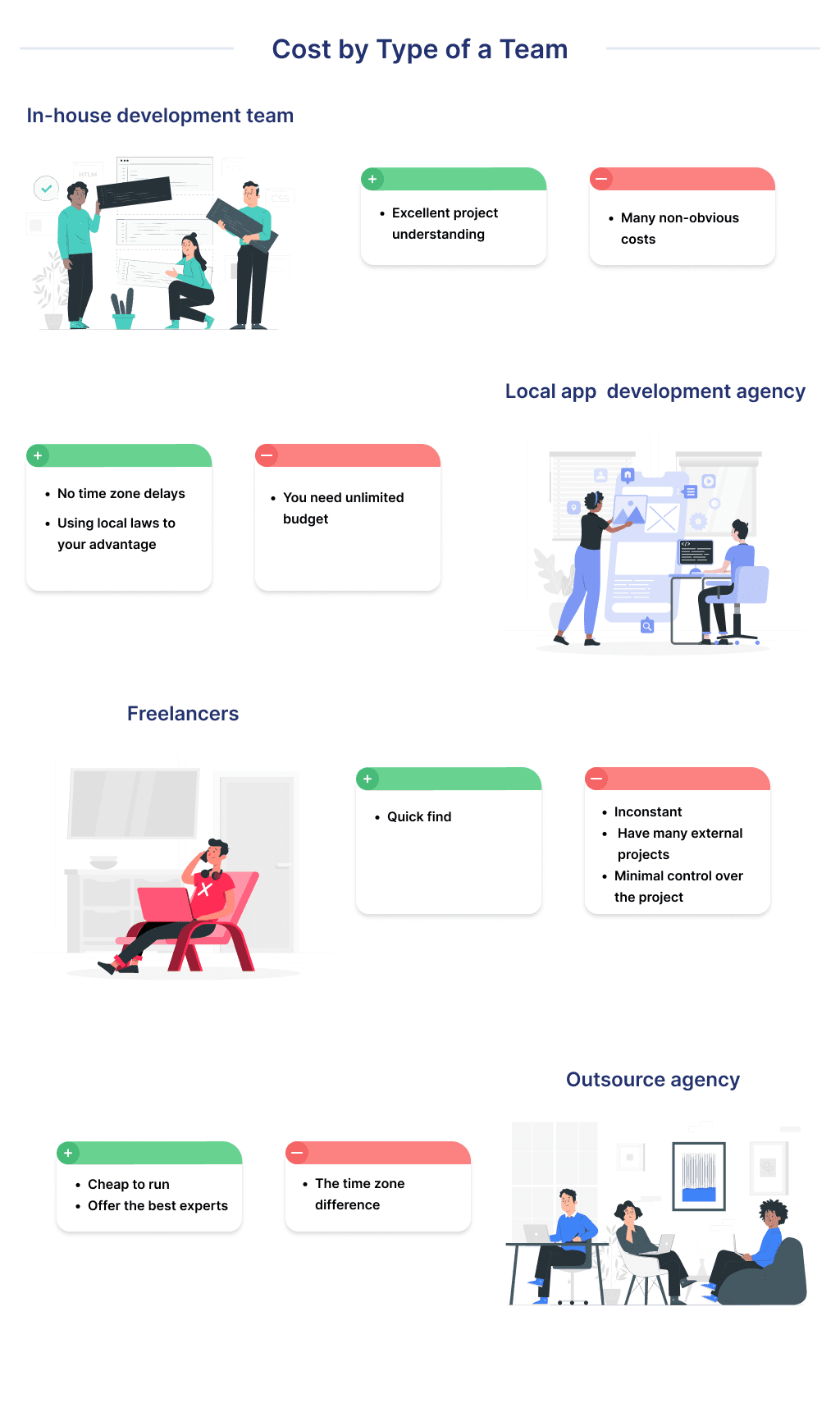

Cost By Team Type

Another important and delicate factor that determines the cost of a FinTech app is the team.

As a startup, you have a wide range of teams at your disposal. And if you’ve done a little research, you’ll discover that these options are pretty confusing as they all have their cons and pros.

To compare the options specifically, let’s take a fintech application that takes 1,000 hours to develop.

| Type of team | Cost of development |

| In-house | $90,000 |

| Local agency | $150,000 |

| Freelancers | $30,000 |

| Outsource agency | $40,000 |

However, for a FinTech app, emphasis should be placed on capacity overpricing.

The goal here should be simply to “hire the best!”

Here are the types of teams your startup can partner with:

1. In-house development team

The situation here is pretty straightforward; you post a job offer for a full-stack developer or roles you want to fill; test their knowledge of algorithms; and choose the one you like.

Here, you have complete control over your developer’s work and regularly interface with them. In an emergency, you can easily engage them.

| Pros | Cons |

| A benefit to having developers within your ecosystem is that they’ll be very familiar with the project. Activities of third parties are restricted, so it’s more efficient to manage crises. Internet security protocols are often tighter with in-house developers than with other teams. Also, their source code belongs to your startup. This gives you 100% ownership over the project. | However, this option can be exhausting. You’ll have to pay their salary, taxes, create a workspace, cover medical licenses, etc. The recruitment process is also costly and time-consuming. |

And if you have enough to spare to hire a great team, there’s no guarantee that you’ll find one.

2. Local app development agency

Local app development agencies are software development companies based within the United States.

| Pros | Cons |

| Having local developers allow for a more interactive and engaging development process. It helps to avoid challenges surrounding time zone delays. You can easily make use of local laws to your advantage. E.g, agreements signed can be pursued within your local jurisdiction. | The cost of MVP development is really expensive. Moreover, in the long run, you need an unlimited budget to work with a local company. |

3. Freelance developers

Freelance FinTech app developers are independent contractors you can call upon for a project.

You can easily find one across social media sites and freelance platforms. They’re perfect for short-term, ASAP, irregular projects.

| Pros | Cons |

| Partnering with freelance developers can help you have deep insight into your FinTech mobile app development. However, they’re very inconsistent and usually have more than one client. Also, they can’t commit to your project for a long time. | When freelancers receive a better offer, they can drop out right in the middle of your project. You have minimal control over the project quality since they’ll write the code and test it themselves. If you lack time to monitor freelancers, then it’s best to consider another option. |

Always sign an NDA with a freelancer as they might leak sensitive information to competitors for the right price.

4. Outsource development agency

An outsource development company offers a great middle-ground between taking a risk with freelancers, an in-house team, and a local agency.

It is a type of remote team hired at a distant location. Here, a third party manages and employs the team; you’ll also provide the infrastructure they’ll need.

A software development company offers the possibility of optimally catering to your idea, irrespective of their size and technicality.

This is the best option for FinTech startups that require additional features like blockchain technology, machine learning in their mobile app development process.

Check our guide to find out more about FinTech app development outsourcing.

This method is one of the most prominent in this present day. It’s a trend in the U.S., the UK, Germany, and other major markets.

Want to build a productive remote team? This guide on high-performance remote teams shows you how.

| Pros | Cons |

| They are cheap to run. They offer an added benefit of access to top-notch professionals like senior app developers, business analysts, P.M.s, etc. These professionals are needed to build a highly technical FinTech product. e.g., building a stock trading platform. | However, the disadvantages are the time zone difference and the need to constantly monitor progress on demos or calls to the project manager. However, this is a very tentative disadvantage, because involving you as a founder is natural. |

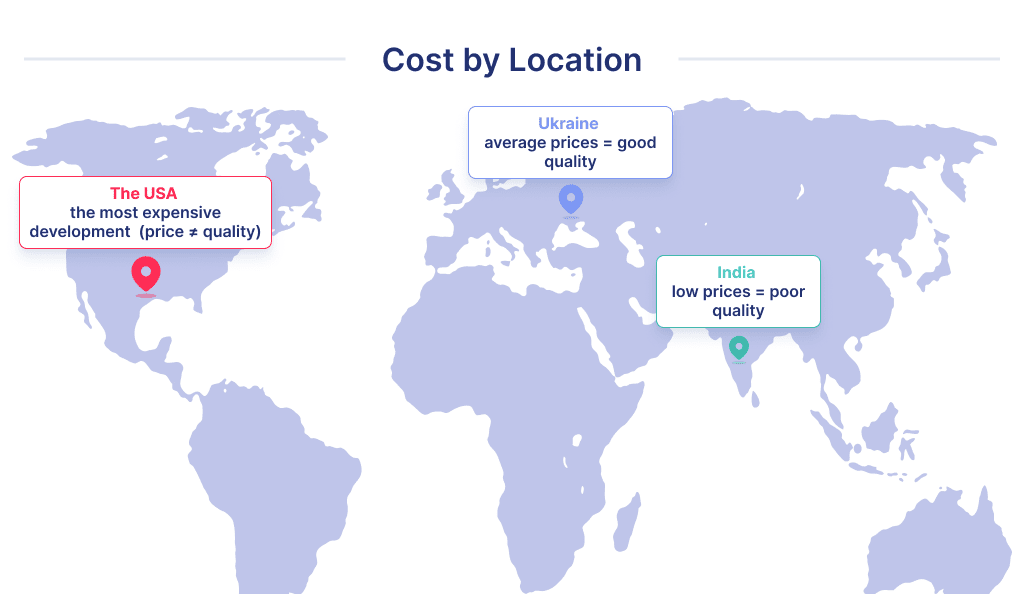

Cost Based on Location

It’s a known fact that locations affect the price of services. This is similar for FinTech software development. Generally, FinTech products built in specific areas are more expensive than those created in other locations.

Below is a graph showing the cost comparison of different FinTech apps based on location:

| Type of app | The USA, $ | Ukraine, $ | India, $ |

| Banking app | 500,000 | 175,000 | 105,000 |

| Investment app | 180,000 | 60,000 | 30,000 |

| Consumer finance | 240,000 | 80,000 | 50,000 |

| Insurance app | 300,000 | 100,000 | 75,000 |

| Lending app | 270,000 | 90,000 | 65,000 |

The table above is self-explanatory and highlights that app cost differs with location.

In the United States, the cost of developing an app is exorbitant. Ukraine has a much cheaper app development cost than the United States, but it’s still more expensive than apps built by developers based in India. Nevertheless, apps developed by companies based in India have a reputation for being poorly made.

The general perception among startup founders is that the U.S.-built apps have better quality.

This is not true, and you might just be overpaying for what you can get cheaper. Don’t believe it?

Use Outsourcing Cost Calculator to predict how much you might be overpaying for the US-based Fintech developers.

Now you have an idea of how much it costs to own a FinTech app. What else? It’s time to learn about some foundational steps.

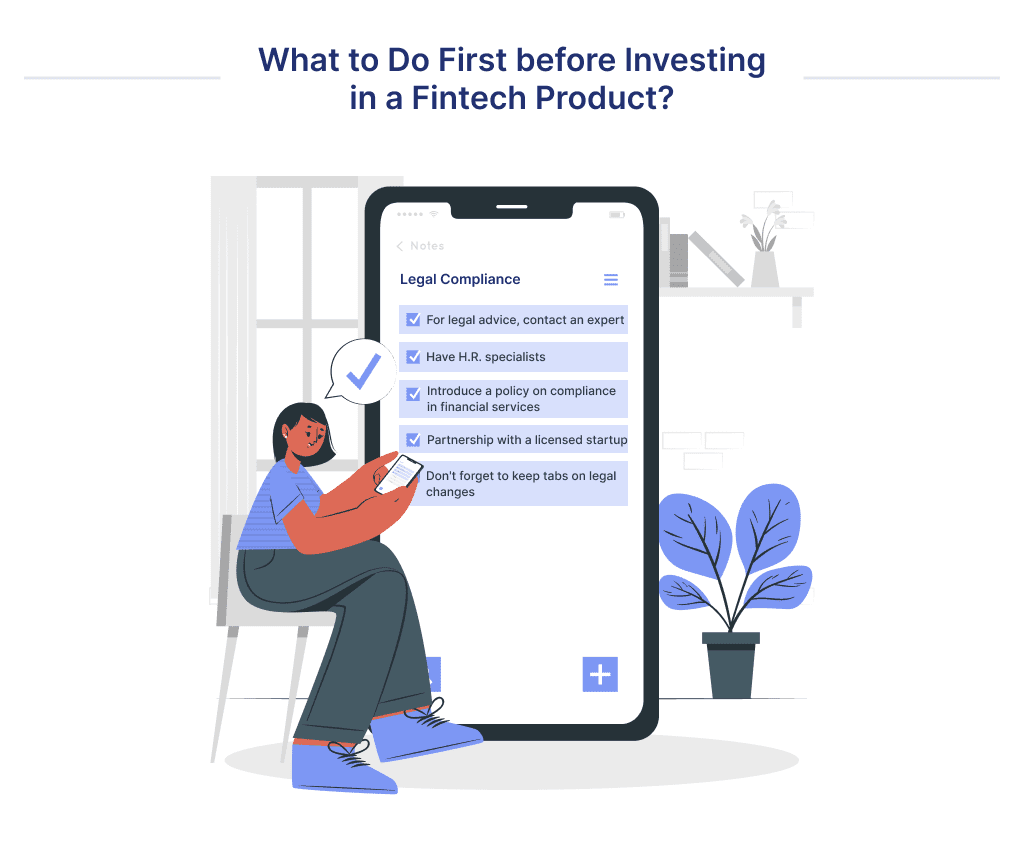

What to Consider Before Building Fintech Apps

Before investing in a FinTech product, here are some things to consider first:

Ensure Legal and Regulatory Compliance

FinTechs in the U.S. is not subjected to specific regulatory frameworks by any state or federal law.

However, the activities of FinTechs often come under the purview of some regulatory bodies.

FinTechs should do the following to comply with legal stipulations:

- Always seek legal advice from an independent legal luminary. You should do this before taking any significant step. If you’re confused about any regulatory burden, then talk to a specialist.

- Have H.R. specialists with knowledge of labor laws on deck.

- Have a policy that inculcates financial services legal compliance into your startup’s daily operations.

- Enter a partnership with a licensed startup.

- Take extra caution when developing a cryptocurrency app.

When working with a development team, a solid partnership is key. Discover more in our app development partnership guide.

Access premium design and development services for unmatched success.

FinTech laws are in flux. As such, such laws need to be considered. Be alert to their changes.

Regulations to keep tabs on including the Gramm-Leach Bliley Act, the Fair Credit Reporting Act, US Anti-money Laundering Regulations, JOBS Act, etc.

Once you pay attention to the legal stipulations here, everything should be fine. Also, don’t forget to keep tabs on legal changes.

Refusal to comply with laws can result in a hefty fine or outright license withdrawal.

Plan a Marketing Budget

It’s quite common to see startups focus on product development at the expense of marketing. This only leaves you with a great product that’s not used.

As a startup, it’s imperative that you have a marketing budget. Your marketing budget should outline all your startup needs to spend to market your FinTech application.

Your marketing budget will help you keep track of your spending. It also guides your fund’s allocation.

Talking about specific figures, the marketing budget should be 2-3 times the development budget.

For example, if you have invested $75,000 in development, your marketing budget should be $150,000 – $225,000.

Develop a Clear Concept

Clarity is important to your team. It’s imperative that your team have an apt understanding of your FinTech idea.

But what makes an app idea clear?

If you can clearly articulate what your product does, who will love it, and how much people are ready to pay for it, then you have a clear product.

To create a clear concept, do the following:

- Engage in ideation sessions with your team

- Discuss suitable functionality to include, e.g., authentication, chatbot, biometric, payment system, etc.

- Speak to your target market

- Hold conversations, both random and scheduled, with your target market

Creating a great product requires that you have a clear concept, a great marketing budget, and comply with legal obligations.

Now that you have some idea of some pre-development steps to take, let’s consider the development steps. These steps will help your startup create a high-quality FinTech application.

Starting strong is critical – check out these business startup tips that offer valuable insights.

Step-by-Step Guide to Fintech App Development

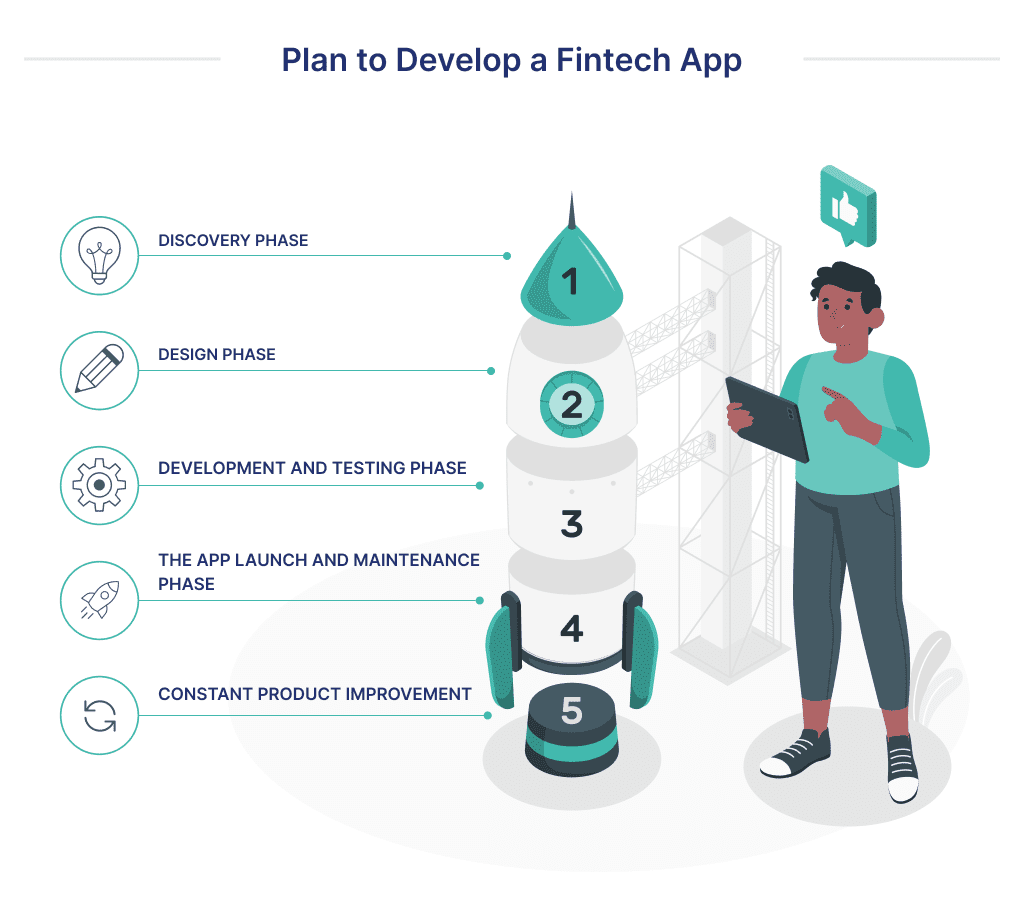

There’s no one size fits all plan to develop a FinTech app. But to help you have a better grasp of the process, we’ll focus on a step-by-step guide.

This guide should undoubtedly make the developmental process a seamless one.

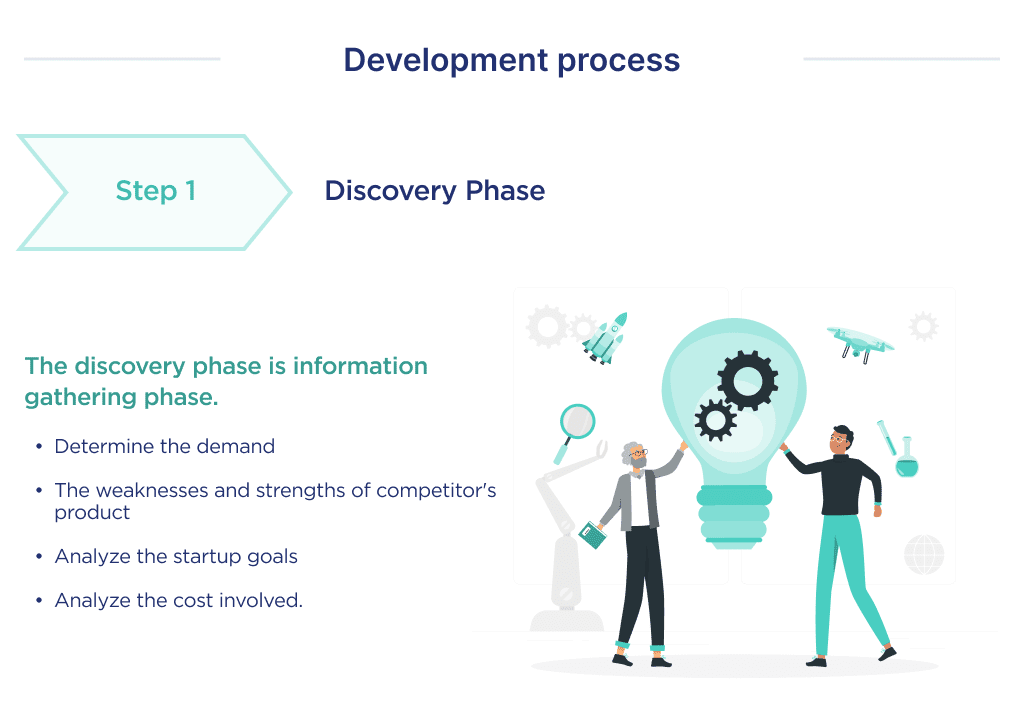

Step 1: Discovery Phase

The project discovery phase is the initial information-gathering stage of the product development.

This stage is one that helps to create an upfront analysis of the developmental processes involved.

To have a proper discovery phase and synergize all information, everyone’s hands must be on deck, from the UI/UX designer to the product manager and other partners.

This phase helps team members to have an apt understanding of what they’re developing.

The discovery phase includes the following aspects:

| Aspect | Description |

| Market Analysis | A small business statistic released by CB insights suggests that 14% of businesses fail because of poor market analysis. Market analysis helps you identify if your FinTech product is needed. It also helps to identify who needs your product and what they’re ready to pay for it. Without a good KYC (know your customers) plan, your marketing strategy will simply be a guessing game. Your marketing analysis should be carried out to know if your idea is viable or not. |

| Competitor Analysis | Competition is responsible for 26.4% of business failures. This stat can be scary for small startups just entering the financial sector. As such, competitor research is very vital. This will help you understand their product and know what works for them. It’s a crucial but easily overlooked phase of project discovery. A top competitor to watch out for includes Apple. |

| Your target audience | Since you’re making a FinTech app, you need to understand your target audience. Your target audience is the category of people that you’re making your FinTech product for. They’re going to use your product more than any category. Thus, it’s imperative that you know them. To know if your product will be acceptable to your target audience, create an MVP. The MVP gives your audience pre-launched access to your product. Better put, it’s a product sample (learn more about what is MVP in software development). |

| Know your startup goals | Setting your business goals is another crucial phase. Your startup can’t succeed in the FinTech space without a clear goal. According to CB insights, losing focus is responsible for 13% of business failures. Be clear about your goal of creating the product. Analyze the goal. Stick to it. |

| Cost Analysis | 44% of businesses fail due to financial constraints. Startups should properly analyze the cost involved. Doing this helps you to know if you have enough to see the product to profitability. There’s nothing you can do without enough cash. If you find yourself in a financially undesirable situation, that might be time to speak with your investors. |

As a founder, the benefit you’ll be getting from carrying out the project discovery phase include:

- Overall cost reduction

- Better risk management

- Idea validation

- Hire a reliable and professional team

- A clear goal in mind

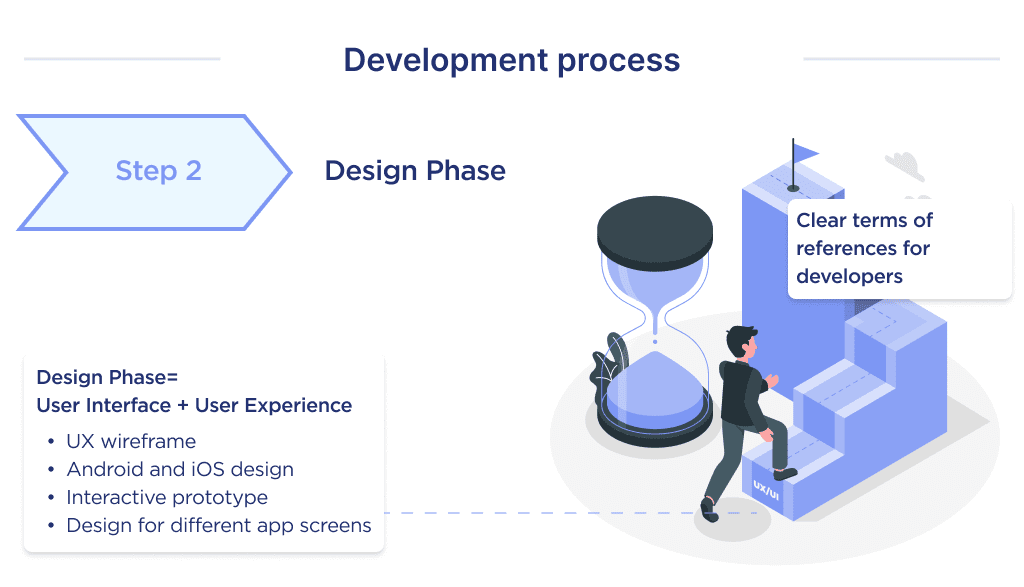

Step 2: Design Phase

The next step is the design phase. The design phase of your FinTech project deals with transforming your idea into a form that the software developer implements.

We won’t talk much about how to properly design a FinTech application, as this is a rather subjective question in terms of User Interface.

Rather, you need to understand the role of this stage in the overall development process.

The app design process is where your User Interface and User Experience are conceived until there’s a blueprint for a developer to build on.

This stage is a bit more fluid than others, as outputs from this phase often require a redesign of the app.

However, it’s a very creative process and the foundational technical process for creating your FinTech application.

Before you can begin the design phase, you must complete the first step. This is important as you’ll need to apply some information from the discovery phase.

For example, the charted User Experience from the discovery phase will be applied here.

When this phase ends, you should have the following:

- A full UX wireframe

- Design for different app screens for optimal responsiveness

- Separate Android and iOS designs or a single cross-platform version of the app

- Have an interactive prototype

Your design phase should end with a clear summary that you can send to developers.

The design should be both attractive and practical. Feel free to find out more in our guide about FinTech app design.

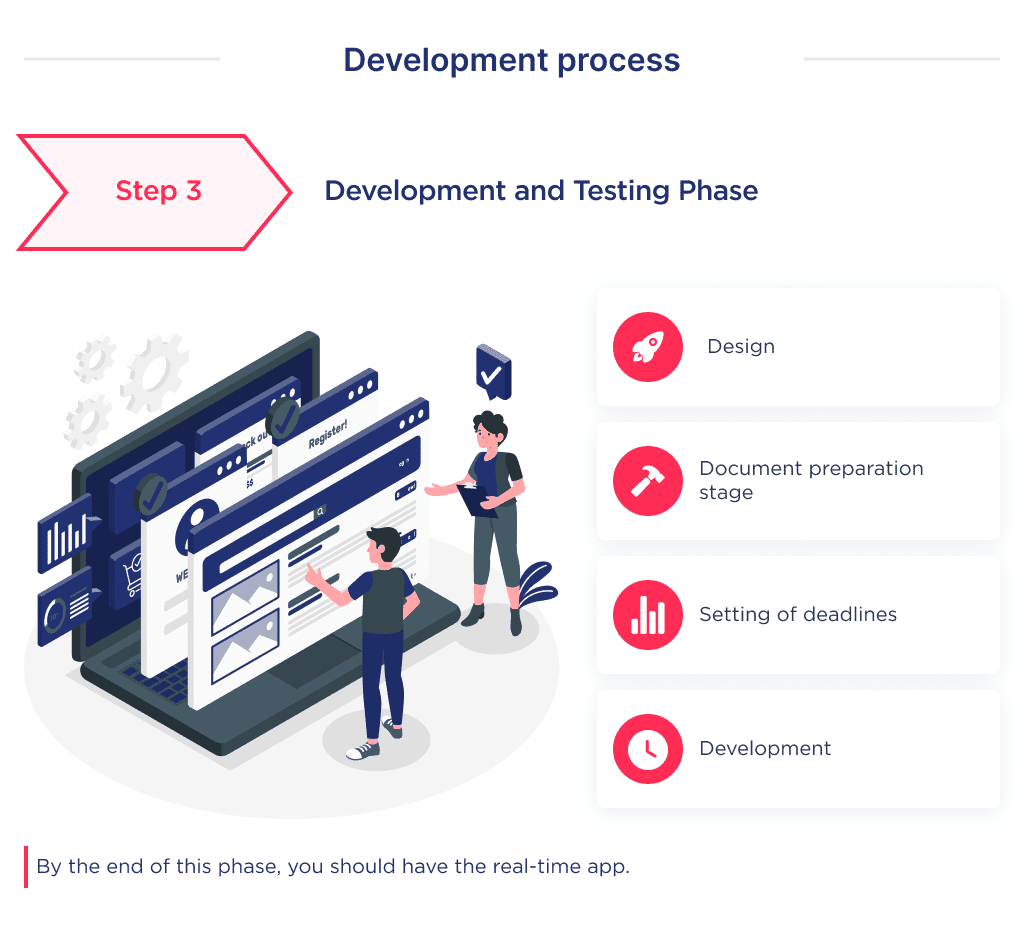

Step 3: Development and Testing Phase

Now that you have a design, what’s next?

This phase involves turning the design into a live app.

The design stage should have provided the wireframe showing all app screens and their connection.

In some cases, there may be an interactive prototype to provide you with a sense of how using the app feels.

To properly keep tabs on the app development, set milestones with strict deadlines. For example, you can set deadlines for the completion of specific features.

By the end of this phase, you as a founder should have the real-time app. The app, on completion, is then tested among a selected sample in your target market. Needed adjustments are forwarded to the developmental team for a rework.

Find the best TypeScript developers for your project.

For a typical FinTech platform, about eight professionals will work on your application. They are:

- Project manager

- Business analyst

- CTO

- Backend developer

- Frontend developer

- Mobile developer

- UI/UX designer

- Markup developer

- Quality assurance tester

When building your FinTech, a typical technology stack you’ll need includes:

- Server: AWS or Vultr

- Backend: Node.js

- Frontend: Vue.js or Nuxt.js

- Mobile: Swift, Java, or React Native

- 3rd party integrations: Yodlee, Trulioo, Firebase, Paypal, or Stripe, and others based on your requirements.

Discover how to choose a tech stack with our expert advice.

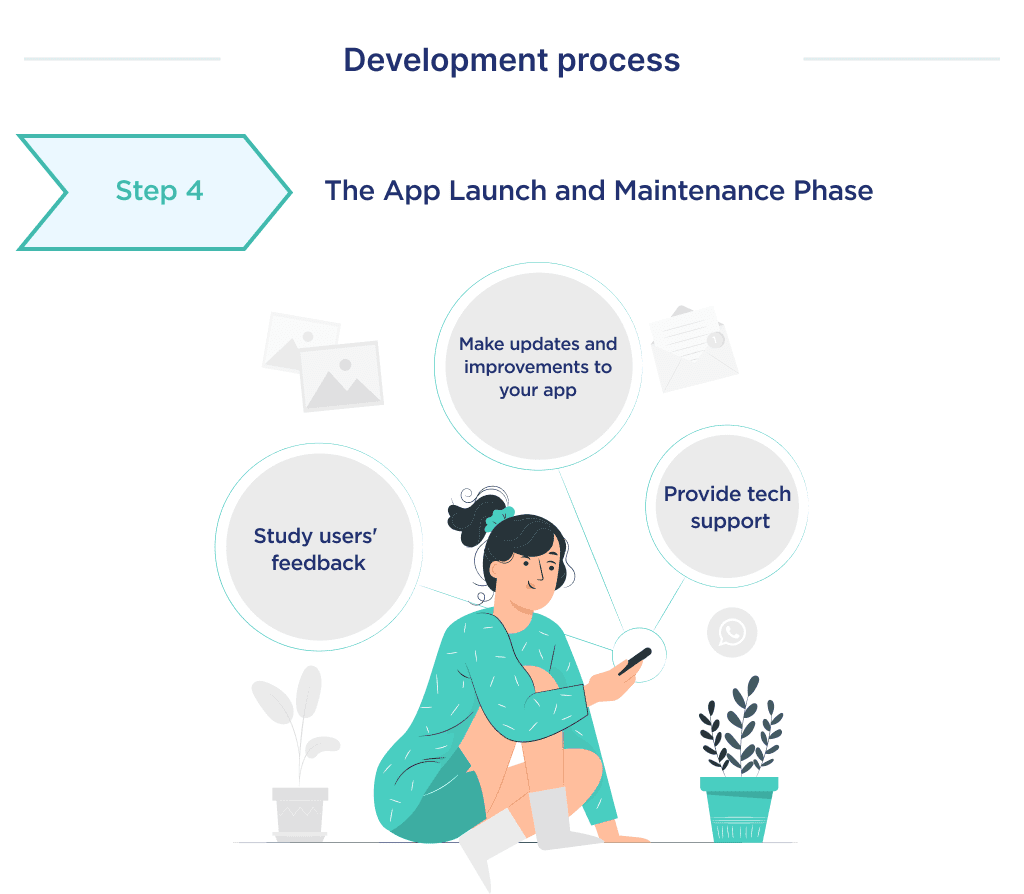

Step 4: Launch and Maintenance

Your mobile application development is not complete without releasing your product to the market. Product launch is an integral process of development.

However, soon after launching your app, you should begin to study users’ feedback.

Also, take relevant steps to make necessary updates and improvements. Provide the needed tech support for your FinTech solution.

This, too, is a rather tricky budgeting issue. After all, it needs to be thought through at the planning stage, as it is a kind of hidden cost.

The budget for support is %25 of your total development budget. So, if your application costs $75,000, the maintaining will cost $19,000 per year.

What goal should you set here? First, ensure that a lot of people use your solution. This is because the more people use it, the more your feedback. And the more feedback you get, the better the improvement you can make.

Whether you created a cross-platform, iOS, or Android app, your maintenance spending will be similar. These include:

- App upgrade

- New features

- Analytics and monitoring

- Feature extension

- Enhancement

- Support & maintenance

If you’re planning to build an app, these detailed guides on Android app development costs and iOS app development costs will help you navigate the financial aspects.

If you decide to build an iOS app, this guide on the best iOS app development tools covers everything from prototyping to testing.

Step 5: Continuous Improvement

FinTech is a competitive sector. To stay above competitors, you should endeavor to come up with intuitive ideas regularly. Religiously improve your product.

Even when all seems perfect, always be open to new ideas and be ready to integrate better APIs when needed. When you do this, you’ll find yourself going through the entire developmental process at one point or the other.

Data synchronization is a critical process in FinTech to ensure seamless and real-time alignment of data across various systems, enabling accurate and up-to-date information for enhanced financial services and customer experiences.

Challenges in Fintech Development

Just like other tech processes, the product development process has its own challenges. Here are the common challenges you’ll likely face in product development:

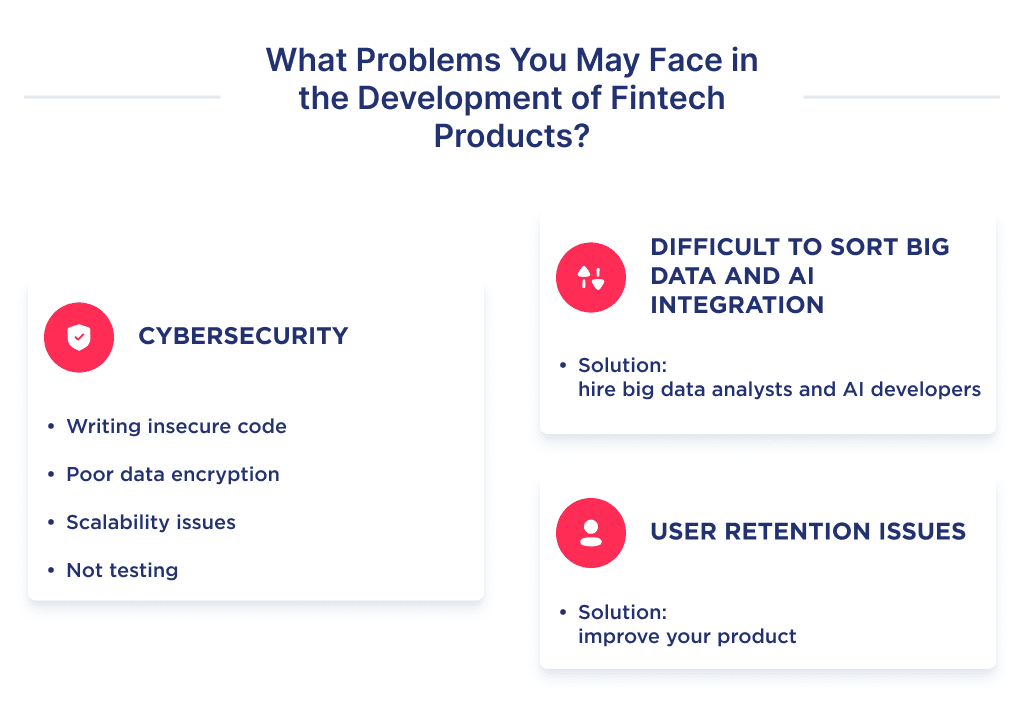

Cybersecurity Risks

Among financial institutions, data security is paramount.

And a single data breach, e.g., a leak in the details of bank accounts is enough to knock your product out of the market. In fact, a breach can mark the end of your startup.

Some common sources of cybersecurity issues here include:

- Writing insecure code

- Poor use of data encryption

- Scalability issues

- Not testing the app

With cybersecurity risks on the rise, bot attack prevention has become essential for online security.

Integrating Big Data and AI

Big Data and Artificial Intelligence are at the core of most FinTech processes. However, they can pose a challenge during app development. How?

Since Big data for A.I. is gathered from numerous sources, it is often difficult to sort them. This may in turn make the app development process challenging to developers.

The only way out of this problem is to hire big data analysts and A.I. developers. This sounds like a trite (or even useless) answer. But believe us, many founders have no idea what it means to work with datasets or how to train neural networks.

With them in your team composition, you should minimize the occurrence of this problem.

Improving User Retention

User retention is when customers continuously use your FinTech product. Quite often, a great marketing campaign makes people download an application. However, a poor product will lead to user retention issues.

There is no single recipe for user retention, nor are there products with 100% retention.

It is a field for experimentation and testing improvements.

This applies to product work: design updates, adding or changing functionality. It is also about working with the business model or the economy of attracting customers.

Always work on improving your product. It’s also imperative that you work on customer feedback ASAP.

Tips for Choosing a Fintech Development Team

A development team plays a key role in the success of a good FinTech solution. A wrong team can mess up your great idea.

Let’s get started on some tips for choosing a great FinTech team:

- Expertise. Before you settle for an app development team, consider their understanding of app development and past jobs. Creating a profitable FinTech app goes beyond product development; understanding the market is also crucial. Only opt for a team with both technical and business analysis of the creation process.

- Successful FinTech built. Other than expertise, pay attention to their FinTech application success rate. The chances are high that your FinTech product will be effective if they have a good record of achieving that.

- Project Portfolio. Any team can claim to be the best. However, a project portfolio helps you to separate the best from the worst. A project portfolio is evidence of knowledge and experience.

- Social media evidence of professionalism. Social media tend to reveal one’s expertise. Check what people are saying and watch out for comments from past clients.

Want Fintech Industry Help?

After reading this guide, you likely see the potential in creating your own FinTech product.

However, with complex regulations and data security needs, bringing a FinTech app to market presents real challenges.

Our team of experts has launched dozens of successful FinTech apps. We navigate regulations, ensure bank-level security, and design for maximum engagement.

Before you dive into FinTech development, schedule a free consultation.

We’ll review your product concept, discuss potential obstacles, and map out a plan tailored to your startup’s needs and budget. With the right guidance, your FinTech dreams can become reality.

Bonus Infographic

Here you’ll find a summary of our in-depth guide. Learn the highlights of how to develop a FinTech app in 2025.