How to Outsource FinTech Application Development: A Step-by-Step Guide

- Updated: Aug 27, 2024

- 9 min

If you’re a startup founder, project leader, or serial entrepreneur looking to build a FinTech product – you’re in the right place.

With so many benefits of fintech, it’s no surprise that companies are adopting it rapidly.

This article explains everything you need to know about outsourcing FinTech app development.

We’ll cover:

- What is FinTech app development outsourcing?

- Why outsource building FinTech apps?

- How much does it cost to outsource FinTech apps?

- How to pick an outsourcing partner

- And more

All the information has been updated for 2025, so you’ll get the latest recommendations.

Also, feel free to explore these practical app development tips to keep your project on track and on budget.

If you prefer visuals over text, skip to the bonus infographic at the end.

Transform your ideas into reality with our dedicated development team — contact us today to get started!

What is Outsourcing for Fintech App Development?

Outsourcing FinTech software development stands for hiring a software development company outside your startup or business to design and develop your FinTech product.

Let’s take a closer look at the different models of outsourcing services.

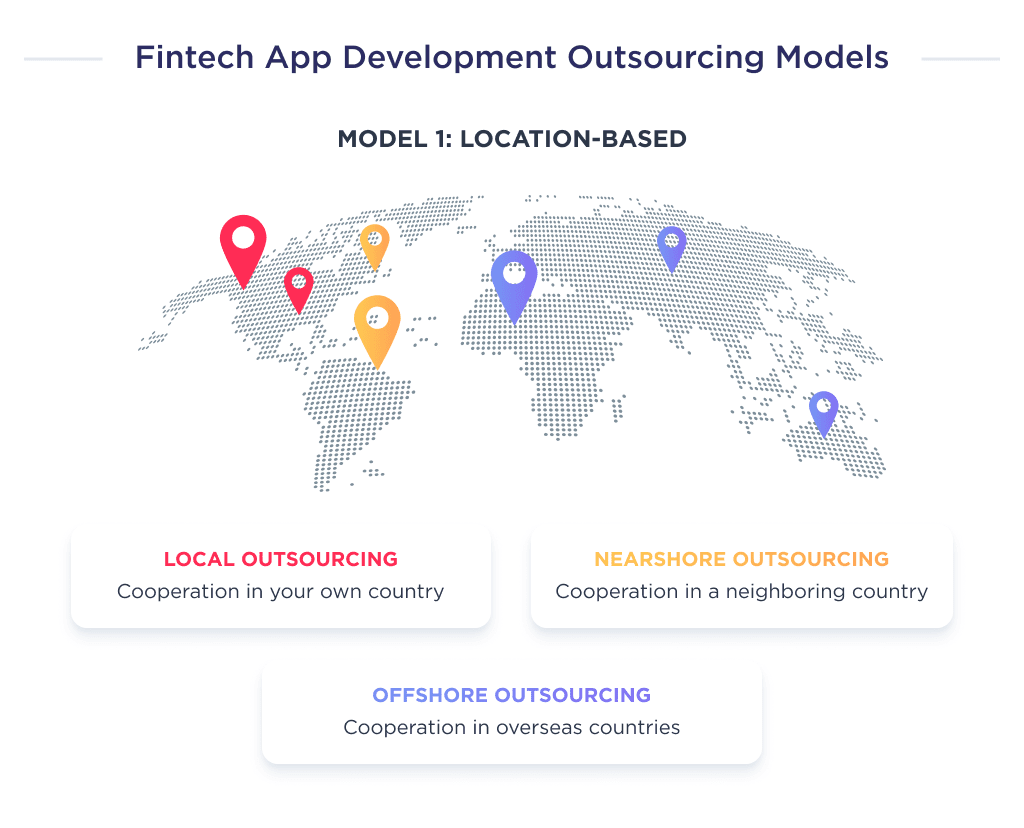

1. Location-Based Model

This outsourcing model is a very straightforward one.

As its name suggests, it entails sourcing for a FinTech app development agency in specific locations. This model focuses on your outsourced team’s proximity.

We can single out three main types in the outsourcing model.

Looking for quality and cost balance? Here are the best countries to outsource software development.

| Type | Description |

| Local outsourcing | This model involves partnering with a development agency within your locality or country. For example, the US-based financial institution outsourcing an InsurTech project to the US-based development agency. |

| Nearshore outsourcing | This type of outsourcing involves hiring a FinTech development team within your neighboring country of operation. For example, the US-based startup outsourced its FinTech project to a Mexican agency, that provides software development services. Learn more about how to start a fintech company. |

| Offshore outsourcing | In this type, a startup hires a development agency in a non-neighboring country. A case study is the US startup outsourcing to a Ukraine-based FinTech software development company. |

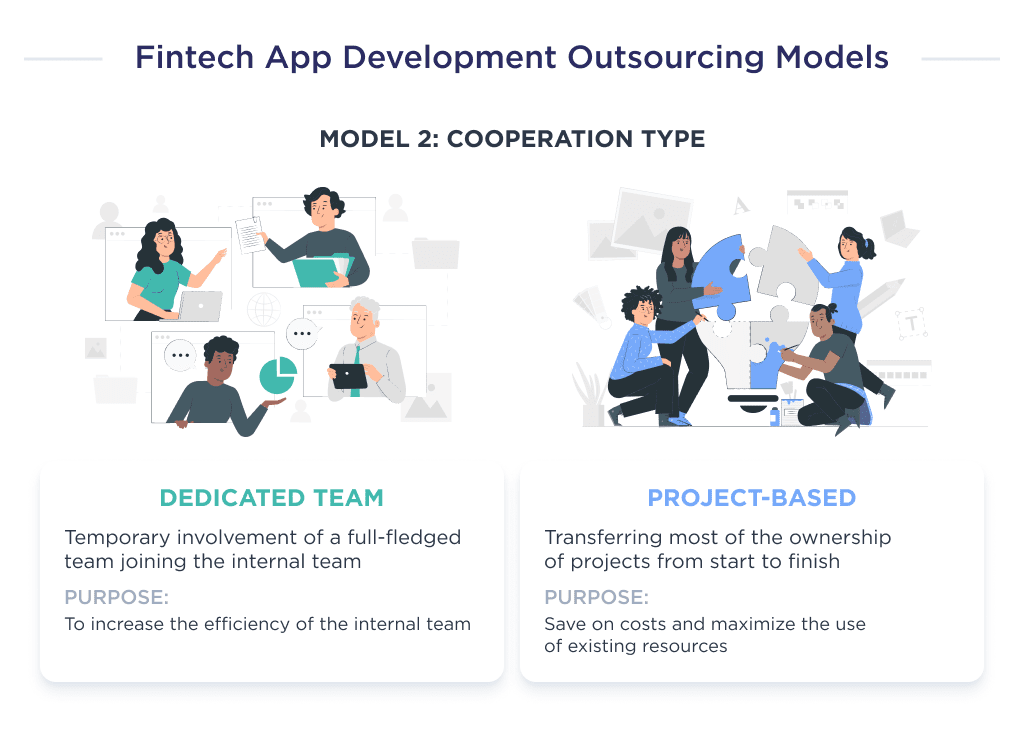

2. Cooperation Type

The cooperation type outsourcing model deals with the relationship between an outsourced software agency and a startup in the FinTech market. This model can be split into two distinct types;:

- Build a dedicated development team

- Project-based cooperation.

Check the spreadsheet below for more information.

| Type | Description |

| Dedicated team | A company expands its in-house staff by outsourcing IT specialists (usually, a few specialists at once) temporarily. This model helps a team to maximize the efficiency of an in-house team while tapping into the pool of expertise of a development agency. Check out what is IT outsourcing. |

| Project-based | In this model, the software outsourcing partner is tasked with managing the entire technical or business process per some predetermined specification. Successful apps are often the result of strong partnerships. Learn how to build one in our article on app development partnerships. |

Why Outsource Fintech Software Development?

Let’s discuss the benefits you’ll get from favoring an outsourced mobile application development company over an in-house team.

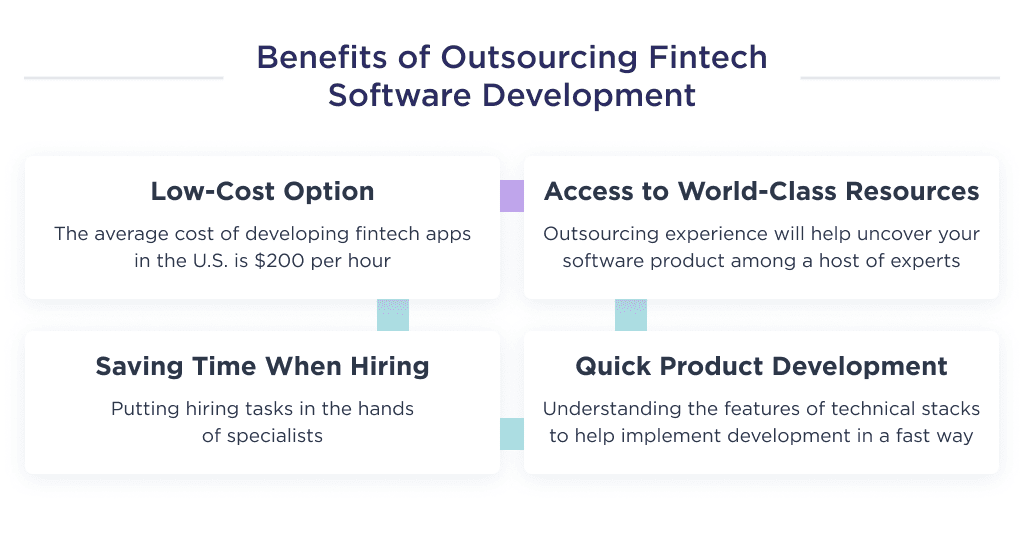

1. Reduce Costs

Outsourcing FinTech application development is, first of all, a much cheaper option than developing with a local company or creating an in-house team.

In numbers, outsourcing is 2-4 times cheaper. The exact amount of savings depends on many factors, but the main ones are the complexity of the application, the technical stack, the technical level of the developers, and the location of the team.

Thus, the average cost for FinTech application development in the U.S. is $200 per hour, while in Ukraine, it is $50.

If we consider a cheaper option of hiring an in-house team, then we have to take into account all the indirect costs, in addition to salaries: taxes, accountant services, office rent, equipment, and so on.

To estimate the difference in person, you can use an outsourcing calculator or an app development cost calculator.

2. Access World-Class Talent

As a startup, experience is key in creating a trustworthy FinTech app that can deliver on your goals.

Most software development agencies are made up of professionals with a gamut of experience creating a wide range of applications. Thus, outsourcing FinTech mobile app development opens up your startup to a variety of experts. Their expertise can then provide you with deep insight into some tips and tricks to make your software product stand out.

3. Skip Specialist Recruiting

Recruiting in-house developers is a time-consuming activity. From advertising a position to sorting out resumés, and conducting interviews, your overall time-to-market can take a year. Onboarding your team and finally gathering the required tech stacks can also take time.

Thus, it’s a time-wasting option for founders who desire quick delivery.

Deciding to outsource the FinTech development activity helps your operational procedure as you simply identify a reliable agency and agree on a price and suitable time frame.

Discover how to choose a tech stack with our expert advice.

From concept to creation – launch your marketplace with SPDLoad!

4. Accelerate Launch

Another merit of outsourcing over in-house is that the actual product development activity is very fast.

A recent survey by Deloitte shows that startups see a competitive advantage in outsourcing as it prioritizes emerging technologies and drives innovation.

Since the software solutions agency has a highly experienced team, they’ll have an apt understanding of the intricacies of adapting their tech stacks in a smarter and faster way.

From the discovery phase, all through to the app launch and maintenance, the team’s experience synergizes faster to give you desired deliverables.

Now that you know the merits of opting for an outsourcing agency, let’s help with location-based cost estimates.

Picking the right partner is crucial — here’s how to choose an app development company that fits your needs.

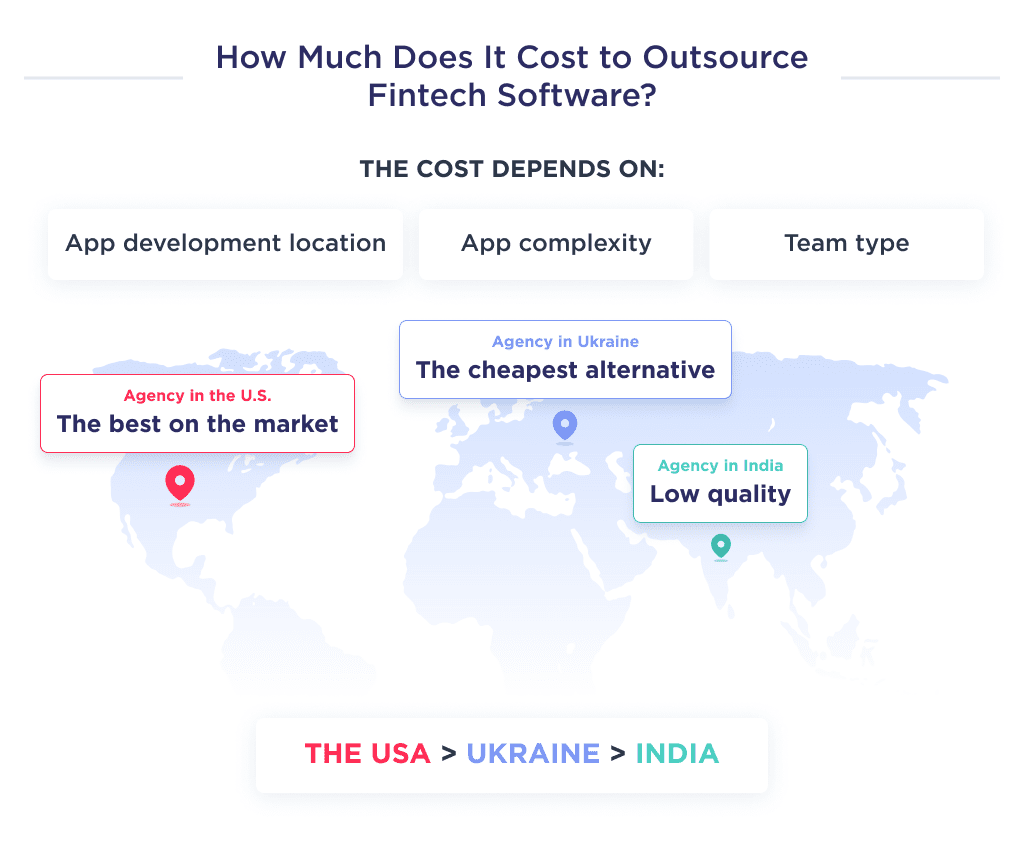

What’s the Cost to Outsource Fintech Apps?

It’s a known fact that labor laws in the FinTech industry and living standards in specific locations affect the prices of FinTech services.

This holds true even for FinTech mobile software development as creating apps through outsourced agencies based in certain parts of the world is generally more expensive than others.

Below is a spreadsheet depicting the different cost comparisons of FinTech applications based on location:

| Type of app development services | The USA, $ | Ukraine, $ | India, $ |

| Mobile banking app development | 500,000 | 125,000 | 65,000 |

| Investment app development (learn more on how to create an investment app) | 180,000 | 45,000 | 25,000 |

| Personal finance app development | 240,000 | 60,000 | 30,000 |

| Insurance app development services | 300,000 | 75,000 | 40,000 |

| Loan lending app development | 270,000 | 68,000 | 34,000 |

The price and location shown in the table above are self-explanatory that location is an important cost factor to consider before outsourcing.

The cost of developing a financial technology app in the United States can best be described as exorbitant. For most FinTech companies, a cheaper alternative is opting for a Ukrainian development team with a vibrant portfolio.

However, an even much cheaper option is contracting an Indian outsourcing development agency. A major disadvantage with India-based software developers is that their apps are often considered low quality and prone to hacks.

A popular myth among startup founders is that U.S-built apps often fare better in the market than those created elsewhere. This is not true, as you’re probably just overpaying for simple tasks.

Now that you have a cost estimate of FinTech app development. Let’s discuss the steps needed to decide on the right outsourcing agency.

How to Pick the Right Outsourcing Partner

The procedures for choosing the right outsourcing service are somewhat elusive. As a newbie, your outsourcing process should adhere to this checklist:

- Identify your goals

- Check the internet for an agency with extensive digital footprints

- Check through their portfolio and read reviews

- Share your idea with the development agency

- Discuss on modalities of the project

- Organize a test task

- Finalize the deal

However, this is a pretty succinct checklist. So we’ll help you with a descriptive guide of a step-by-step procedure that’s easy to follow.

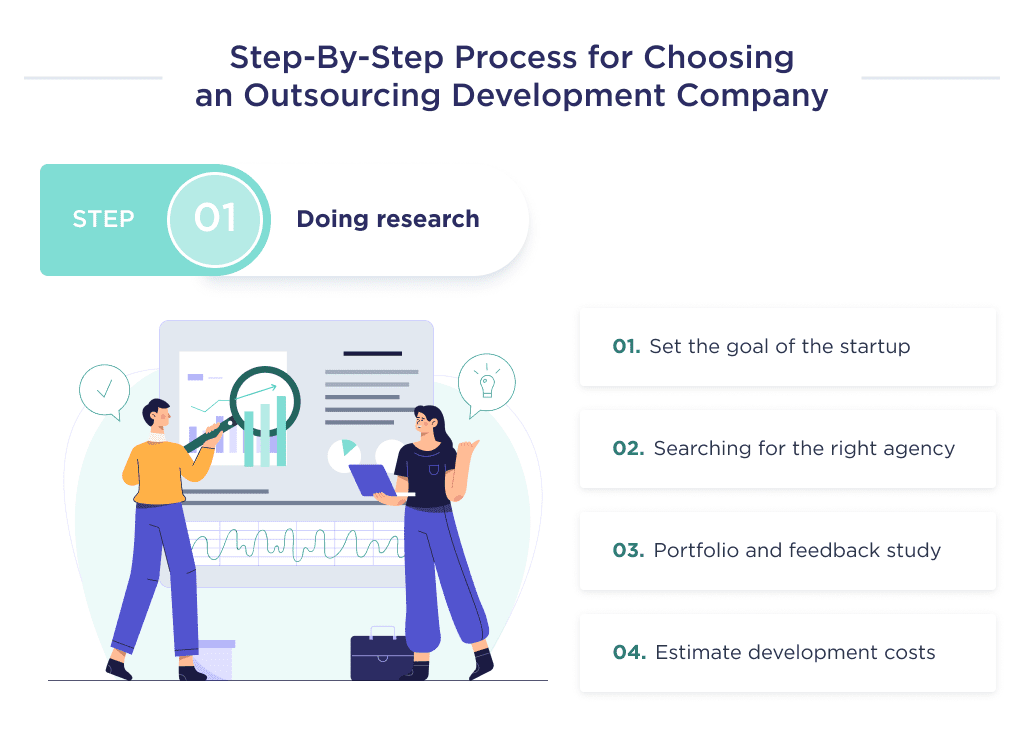

Step 1: Do Your Homework

Devote extensive time to researching the right agency for application development before you decide. Even when you feel certain, you must carry out much deeper research by reading reviews and checking the authenticity of those reviews.

Center your research on the following:

1. Your Startup’s Goal

Extensive research without a clear goal in mind is synonymous with embarking on a journey without a destination. FinTech companies can discuss with in-house decision-makers of your startup and create a checklist of expected goals you want the FinTech application to achieve.

2. Search for the Desired Development Agency

Your startup’s goal helps to guide your search intent. For example, if the platform you’re developing requires cryptocurrency, then be sure to streamline your search to a development service provider with knowledge of blockchain.

There are many ways to search: you can do this on a reliable search engine platform like Google, find an agency from listings, leverage the networking power of LinkedIn, or surf through freelance platforms.

3. Have a Cost Estimate in Mind

We’ve given an estimate of the cost of outsourcing FinTech app development in one of the sections above. For more information, read these articles. “app design cost,” “cost of MVP development,” and “how much does it cost to build an app.” The cost estimate will guide what you offer during the actual negotiation phase.

Ensure that the agency’s pricing model is fair and will translate into a healthy ROI, although this can be difficult to achieve for someone new e that partners with a U.S.-based development team. As such, it’s best to broaden your horizon by outsourcing to a non-U.S.-based software team.

Once you’ve done the required research, you can now move to the next step.

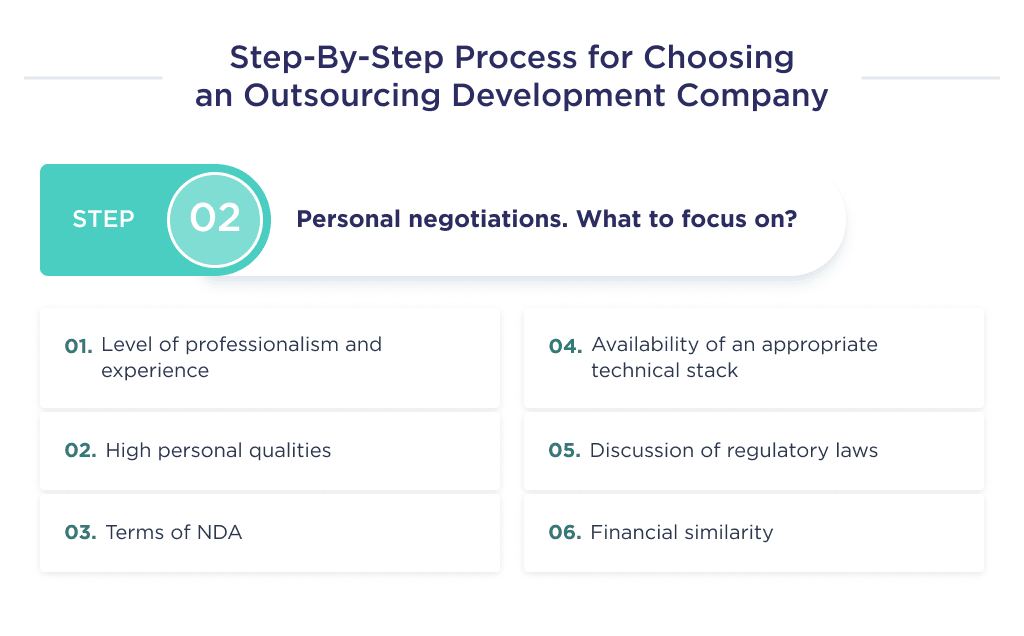

Step 2: Meet in Person

As a founder, you must commit a great deal of time to hold briefs with your team. Doing this allows you to effectively communicate your ideas and also helps to guide your opinion of them.

While negotiating, use agile methodologies to judge how the personal synergies are firing or misfiring. Find answers to the following questions:

- Do the development agency’s representatives appear professional and knowledgeable?

- Do they seem easy to work with?

- Do they show an attitude of concern and care over your startup?

- Are they polite and respectful?

- Do they agree to an NDA?

- Do they have the right tech stacks in their ecosystem of tools?

- Do they have a quality assurance expert of repute?

- How do they plan to satisfy regulatory laws binding the financial industry?

Find the best TypeScript developers for your project.

Ideally, organizations are often at their best behavior while “courting” a new customer, so an area of hiccup now is usually a sign of impending problems. You should also be wary of agencies that are “too accommodating,” as it may be a false act to win your trust.

Engage your soft skills here and use initial meetings as a litmus test for determining if they’ll be effective in creating an apt synergy with your FinTech startup.

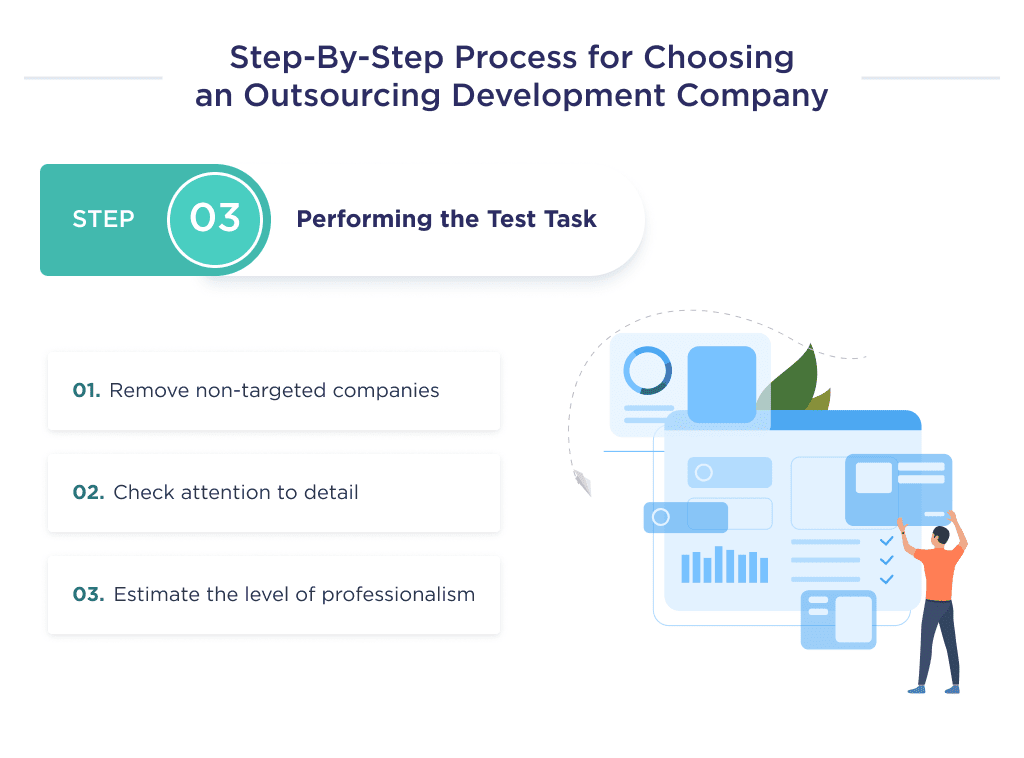

Step 3: Assign a Test Project

When it comes to deciding on which of your prospects is a perfect team for your FinTech project, it’s quite easy to mess things up since every software development agency will attempt to prove to be a good technical partner with an outstanding tech stack.

Sometimes spotting the right partner is outrightly unachievable, except you’re a knowledgeable tech expert. To solve this problem, you can filter prospective outsourcing agencies by giving them a test task.

It’s imperative that you only test their knowledge about the project’s intricacies. For example, if your project is highly dependent on IoT and big data, be sure to determine their capacity on these technologies.

Also, rather than sign a contract to develop a fully functionality-packed crypto lending platform, the test task of a mini-website for the platform gives you a hint of the teams’ attention to detail. A bolder move will be a contract for the development of the MVP of a crypto trading application.

If you’re looking to build a stock trading platform, our article on how to build a stock trading platform covers all the key aspects.

However, you don’t need a test task if the team has the following:

- A verifiable portfolio with noteworthy projects

- Genuine reviews on the clutch. Here’s an example of a review after collaboration with SpdLoad team

- No compelling or justifying reason to doubt their expertise

Now that you have an apt understanding of outsourcing FinTech application development, let’s help you with a shortcut to one of the most reliable mobile app development companies.

Outsourcing companies only accept paid test tasks as they’ll have to commit a great deal of time and resources to even the smallest task.

Have a Fintech Idea?

There you have it – everything you need to know about outsourcing FinTech app development.

Ready to transform your startup with an intuitive FinTech MVP? Our team can design, develop, and deliver results fast.

Being a Clutch Leader in Ukraine speaks to our dedication and hard work in the software development field.

Check out our portfolio and reviews on Clutch. Our expertise in building successful FinTech apps for startups speaks for itself.

Have a concept you want to bring to life?

Get in touch for a free consultation on your product vision. We’ll scope out features, timelines, and costs to kickstart the process.

The cost of developing an app can vary widely. Get a clear idea of what to expect with our guide to app development costs.

Bonus Infographic

Here you will find a summary of our detailed guide. Learn the basics of the FinTech application development outsourcing process.